Fuel Cell Research: FCV is Expected to Boom over the Next Decade

In our recent report Global and China Fuel Cell Industry Report, 2020, we analyze the advances and tendencies of fuel cell industry in China and beyond.

Hydrogen, as an efficient clean energy of strategic importance, is drawing widespread attention, and it is in the upswing. Hydrogen fuel cell which is efficient to convert fuel energy with low noise and zero emission, finds broad application in automobiles, ships and trains as well as stationary power plants.

Fuel cell has been such a concern of governments and companies worldwide that have lavished ever more on research and development, demonstration and commercial application. It is noteworthy that hydrogen and fuel cell have already been commercialized in some sectors, among which automobile makes the best of them. Through the lens of life cycle of automobile industry, ICE vehicle has matured, and traditional automakers, however, have quickened their pace of transformation weighed by the thriving new energy vehicle industry, and some leading automakers has been sparing no efforts in the development and application of hydrogen fuel cell vehicles.

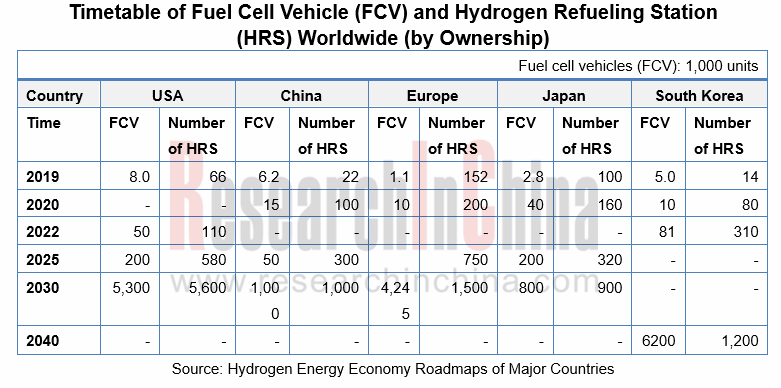

Status Quo and Planning of Global Fuel Cell Vehicle Industry

Globally, major countries are scrambling to mobilize enormous resources for the development of hydrogen fuel cell vehicles, hoping to take the lead in future competition in energy. For the moment, Japan, South Korea and China are the top three hefty investors in the fuel cell vehicle industry. The typical automakers, Toyota and Hyundai, stay ahead of their peers in production of fuel cell passenger cars, hydrogen buses and logistics vehicles. The discouragement from the Trump Administration in recent two years has hindered development of fuel cell vehicle in the US, but California as the biggest single market of fuel cell passenger cars is still a colossus in the whole industry. Europe has developed fuel cells from an early start, with traditional automakers like Mercedes-Benz and Tier1 suppliers such as Bosch all having forayed into the fuel cell vehicle field.

China is Close to Its Leading Peers in Fuel Cell System and Engine

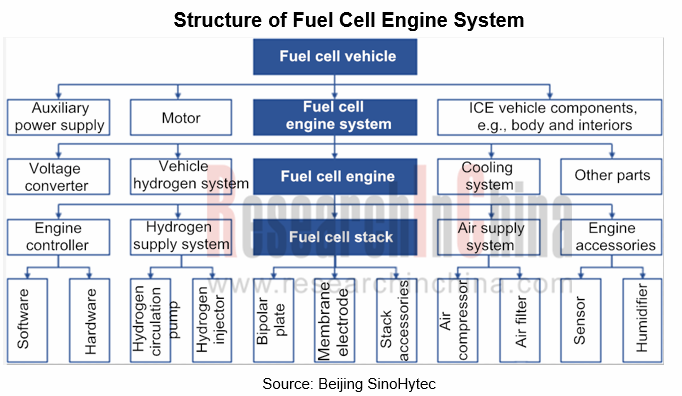

Fuel cell engine system is comprised of fuel cell engine, voltage converter (DC/DC) and vehicle hydrogen system, of which fuel cell engine packs such core components as stack, engine controller, hydrogen supply system and air supply system.

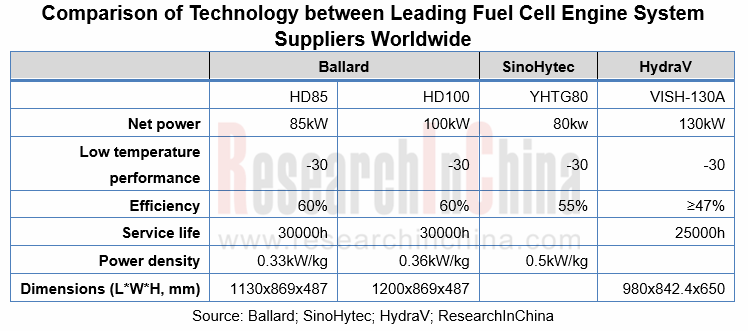

At present, China has come near to global leaders in fuel cell system and engine. In terms of fuel cell engine technology, fuel cell vehicles have been mature enough to be commercialized, with service life of fuel cells for commercial vehicles longer than 20,000 hours, meeting basic needs of vehicles for running; China’s hydrogen fuel cell engine system leads the world in several parameters, e.g., power density. Notably, on July 21, 2020, VISH-130A, a fuel cell engine of Wuhan HydraV Fuel Cell Technologies Co., Ltd. (under Vision Group), passed the certification of China Automotive Technology and Research Center Co., Ltd. (CATARC) and China National Accreditation Service for Conformity Assessment (CNAS), with stack power up to 145kW and engine system net output of 130kW. VISH-130A boasts the maximum power among hydrogen fuel cell engines having been certified by the CNAS so far.

China Remains Weak in Core Components and Materials of Fuel Cell with Heavy Dependence on the Imported

Although with the world’s advanced fuel cell engine technology, China still has weak foundation in supply chain of fuel cell engine system, having yet to build a mature components supply system. The country still needs to import most of core components and key materials including catalyst, proton exchange membrane and carbon paper, and falls far behind its foreign counterparts in technologies from membrane electrode and bipolar plate to air compressor and hydrogen circulation pump. Chinese companies still need breakthroughs in basic materials, core technologies and key components, especially in commercialization of key parts like membrane electrode.

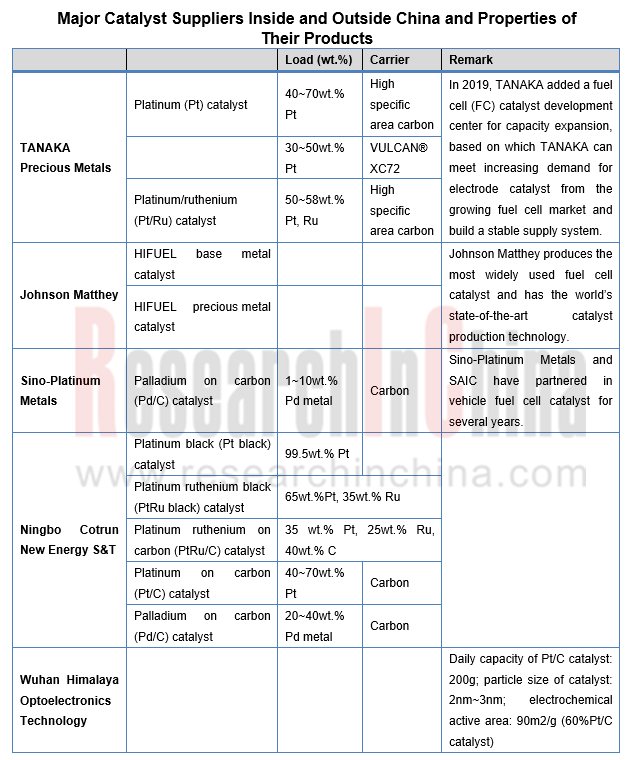

Fuel cell catalyst: it should perform very well in properties such as activity, stability and durability and could develop into a commercial product mature enough to be mass-produced only after long-term application. Now in China, catalyst verified abroad is the first option, mainly low platinum loading catalyst with high quality and high activity; homemade catalyst test is under way at the same time.

In the global fuel cell catalyst market, Toyota uses subsidiaries’ catalyst for fuel cell vehicles; Hyundai chooses fuel cell catalyst of a local producer (acquired by Umicore) in South Korea; Honda’s catalyst for fuel cell vehicles is supplied by TANAKA Precious Metals; Chinese fuel cell vehicles use catalyst from TANAKA Precious Metals and Johnson Matthey.

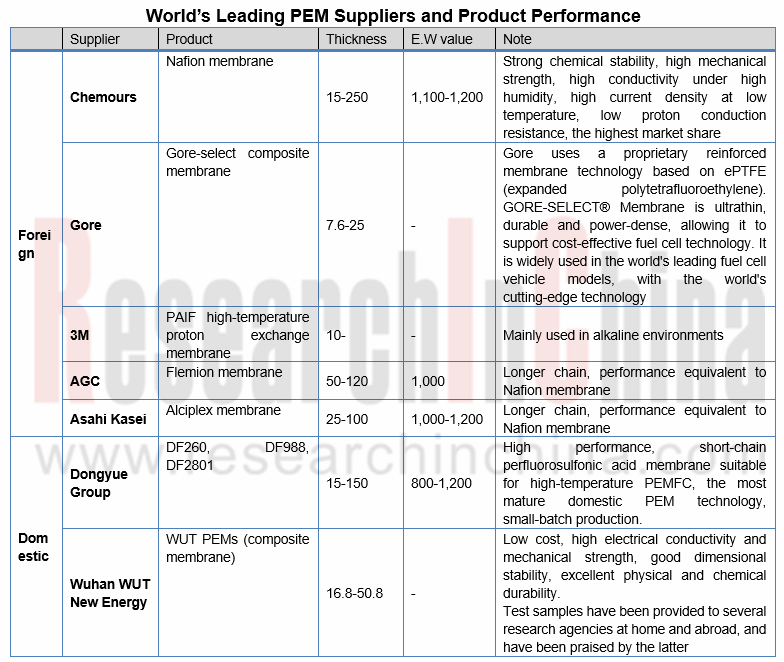

Proton exchange membrane (PEM) is the core component of a proton exchange membrane fuel cell, accounting for 30% of the entire fuel cell stack cost; and its quality determines the lifespan of the fuel cell. PEM basically transmits protons, ensure the passage of protons, and intercept electrons, hydrogen molecules, water molecules, etc., guaranteeing the performance and service life of the stack.

Concerning proton conductivity or stability, perfluorosulfuric acid membrane is the best option for the current automotive proton exchange membrane. Dongyue Group is the sole Chinese enterprise that has realized the industrialization of perfluorinated ion exchange resin, perfluorosulfonic acid proton membrane and ETFE and that can compete with foreign companies Gore and Chemours in proton exchange membrane.

Moreover, fuel cell carbon paper/powder is totally dependent on imports. Carbon powder is cheap and may well be completely imported, but from a technical point of view, the inadequate technical research on carbon materials and the weak foundation will have implications for entire research equipment of the fuel cell system in China.

In recent years, there have emerged a number of suppliers of core fuel cell components in China, but they are still heavily reliant on exports, and their technical level of core components needs improving.

China's fuel cell vehicle promotion: commercial vehicles go first

In the promotion of fuel cell vehicles in China, fuel cell commercial vehicles take precedence over the rest, due to a combination of factors such as fuel cell technology, cost, and infrastructure of hydrogen refueling stations. 100 models of fuel cell commercial vehicles are among the fuel cell vehicles listed in the Catalog of Recommended Road Vehicles released by the Ministry of Industry and Information Technology of China in 2019 but no fuel cell passenger car is on the list. Over the past five years, only SAIC, Chery and BAIC have showed fuel cell passenger cars, most of which were still prototypes, except a SAIC Roewe 750 car that was licensed in Weifang city of Shandong in April 2020. According to fuel cell vehicle promotion programs across China, buses, logistics vehicles, and special vehicles prevail but passenger cars are not taken seriously.

As concerns development route of fuel cell vehicles, foreign countries adopt the strategy of developing commercial vehicles and passenger cars in sync while China prioritizes commercial vehicles over passenger cars. In the next three or five years, fuel cell systems will be massively used in commercial heavy-duty and logistics vehicles in China, and passenger car will be an obscure corner still.

Product support programs of key suppliers of fuel cell components mirror China’s strategy of “commercial vehicles first, passenger car second”. SinoHytec's flagship product, hydrogen fuel cell engine system, targets commercial vehicle manufacturers who are early entrants in the fuel cell vehicle market, including Shenlong Bus, Beiqi Foton, Yutong Bus, Zhongtong Bus and Geely Commercial Vehicle.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...