Launch of Autonomous Driving Remains to Use Mature Chassis-by-wire Technology

Chassis-by-wire makes it feasible to remove accelerator pedal, brake pedal and steering wheel, whose maturity has a bearing on autonomous driving implementations.

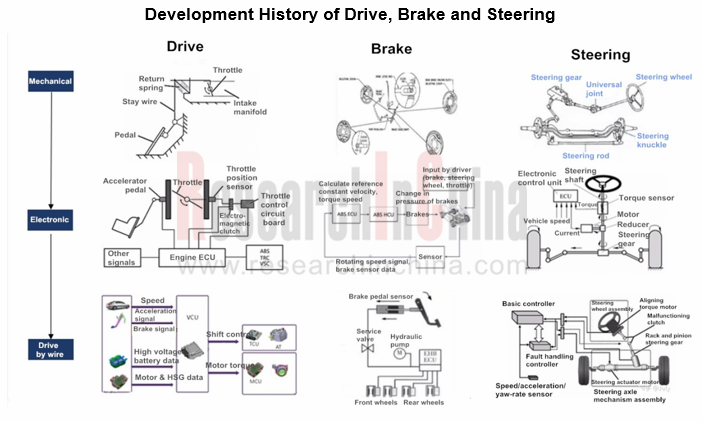

Critical elements of chassis by wire include: throttle by wire, gear shift by wire, suspension by wire, steering by wire and brake by wire. Wherein, drive, brake and steering are deemed as the crucial factors to vehicle travel.

Throttle by wire has been the first option for passenger cars, especially ACC/TCS-enabled vehicles for which such throttle has been a standard configuration. Promotion of drive by wire and steering by wire has suffered a setback due to a combination of factors such as poor user experience than conventional mechanical system for early immature technology, and difficulty in sorting out who is responsible, a result that drive by wire technology refers to regulation and control on the actuator by ECU. In recent years, boom of intelligent connected vehicles has invigorated drive-by-wire technology.

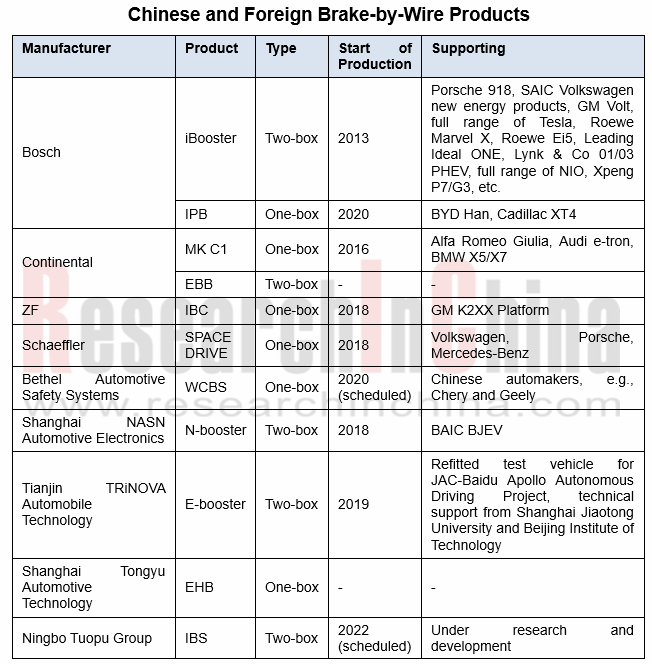

Brake by wire: Bosch, Continental and ZF leads the pack, while Chinese companies like Bethel Automotive Safety Systems Co., Ltd., Shanghai NASN Automotive Electronics Co., Ltd. and Ningbo Tuopu Group are chasing hard.

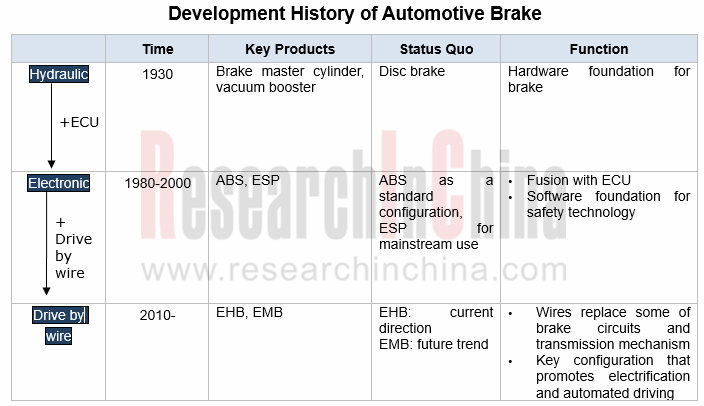

Over a century, automotive brake system has evolved from the mechanical to the hydraulic and then to the electronic (ABS/ESC). For L3 autonomy and above, responsive time of brake system is of paramount importance. Faster response of brake by wire ensures safe autonomous driving.

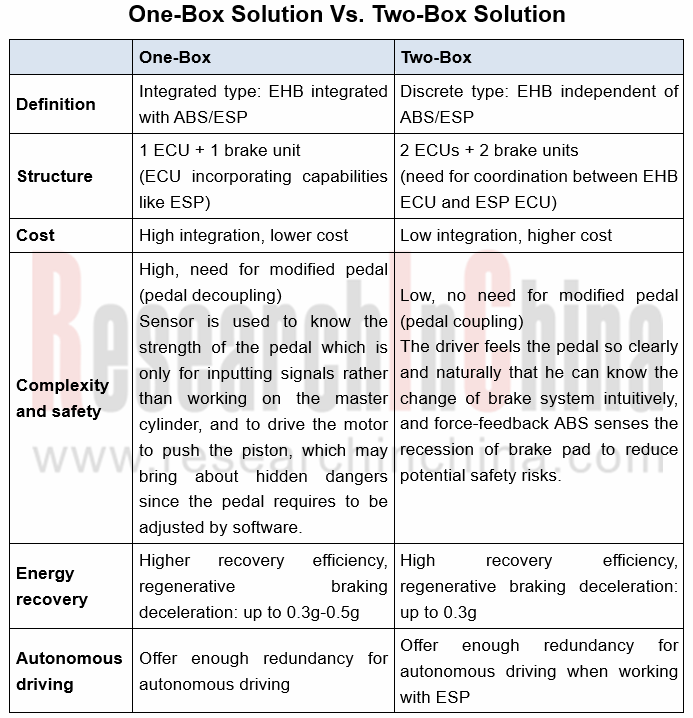

Brake-by-wire system is bifurcated into two types: Electro Hydraulic Brake (EHB) and Electro Mechanical Brake (EMB). EHB is split into One-Box and Two-Box solutions based on whether it is integrated with ABS/ESP or not.

One-box solution already prevails:

- One-box solution with fusion of ESP into EHB is based on mass production of mature ESP. Considering performance and cost, Bosch, Continental and ZF are doubling down on One-box products.

- Chinese suppliers with first-mover advantage are expected to replace foreign brands. Bethel Automotive Safety Systems Co., Ltd., the first to have developed One-box products in China, plans to spawn WCBS products in 2020, close to the SOP time of its foreign peers like Bosch. Its WCBS integrated with dual control EPB is more cost-effective.

Steering by wire: intelligence spurs the industry but commercialization is hindered

So far only Infiniti has had steering-by-wire solution for mass production since its advent. In 2014, Infiniti Q50 packing steering-by-wire solution offered by KYB made a debut. Yet, in July 2016, Dongfeng Motor and Nissan recalled 6,840 units of Infiniti Q50 and China-made Infiniti Q50L in all because of potential safety risks posed by steering by wire. In current stage, Infiniti has four models carrying Direct Adaptive Steering? (DAS) solutions all from KYB.

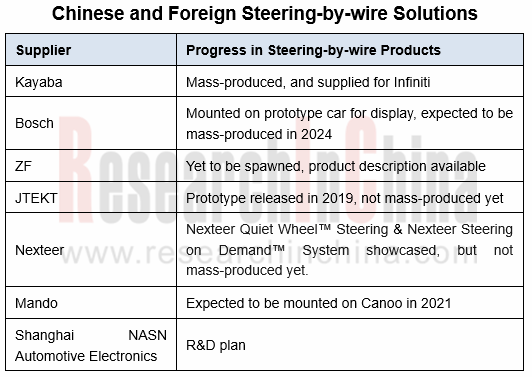

On a global view, international tycoons like Bosch, ZF, JTEKT, NSK and Nexteer boast mature steering by wire technologies and products but they still hit a bottleneck in commercialization.

In 2020, the mass production of L3 autonomous vehicles is to quicken commercial use of drive-by-wire systems. Foreign companies with an early layout in China will have first-mover advantage. Throughout the Chinese market, very few local players have made a difference in drive by wire technology, with small business scale, but the importance of drive-by-wire chassis makes them an enticement to capital and giants. In 2019, Shanghai NASN Automotive Electronics Co., Ltd. raised funds of RMB400 million. It is alleged that Huawei will set foot in drive by wire field.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...