Automotive Cockpit SoC Technology and Application Research Report, 2020

Cockpit SoC Supports More Displays, Beefs up AI, and Improves Functional Safety

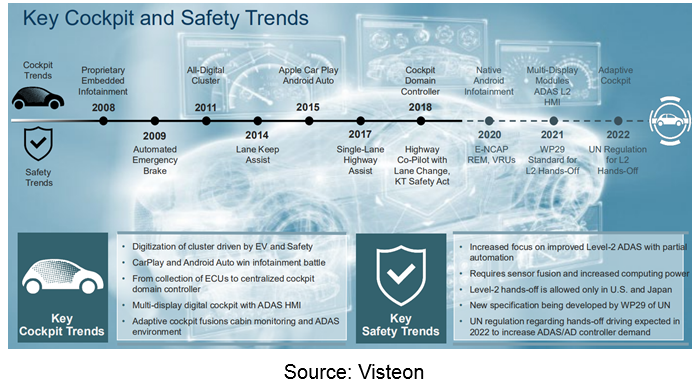

Intelligent vehicle E/E architecture ushers in a period of intra-domain integration to trans-domain convergence and to central computer from the distributed one.

For cockpit domain, the intra-domain integration calls for powerful cockpit SoC which caters to the current cockpits’ needs to support more displays, enable more AI features and fuse with ADAS, have safer functionality, among others.

Support for More Displays

Against the trend of one core enabling multiple screens, it remains a decisive factor to being chosen by the user that how many displays a cockpit SoC can support. The third-generation Qualcomm Snapdragon cockpit SoC based on versatile CPU and GPU is an enabler for as many as six to eight displays.

Samsung Exynos Auto V9 processor is in favor of up to six in-vehicle screens and twelve cameras synchronously, which has been already found in Audi smart cockpits.

Designed for smart cockpit, SemiDrive X9 series unveiled by Nanjing Semidrive Technology Co., Ltd in 2020 support eight FHD displays and twelve cameras.

At CES2020, NXP showcased its multi-display solution supporting as many as 11 screens that are enabled by dual i.MX 8QuadMax.

Support for AI

Undoubtedly, NVIDIA stays ahead of its peers as concerns support for AI. NVIDIA rolled out CUDA in 2007 and had the idea of fostering an ecosystem via CUDA then, which is helpful to both hardware sales and its superiority in software as well as to user loyalty. Despite its cockpit SoC gets a clear edge in deep learning, NVIDIA enjoys not big a share in the cockpit processor market because of its automotive business focus on autonomous driving chips.

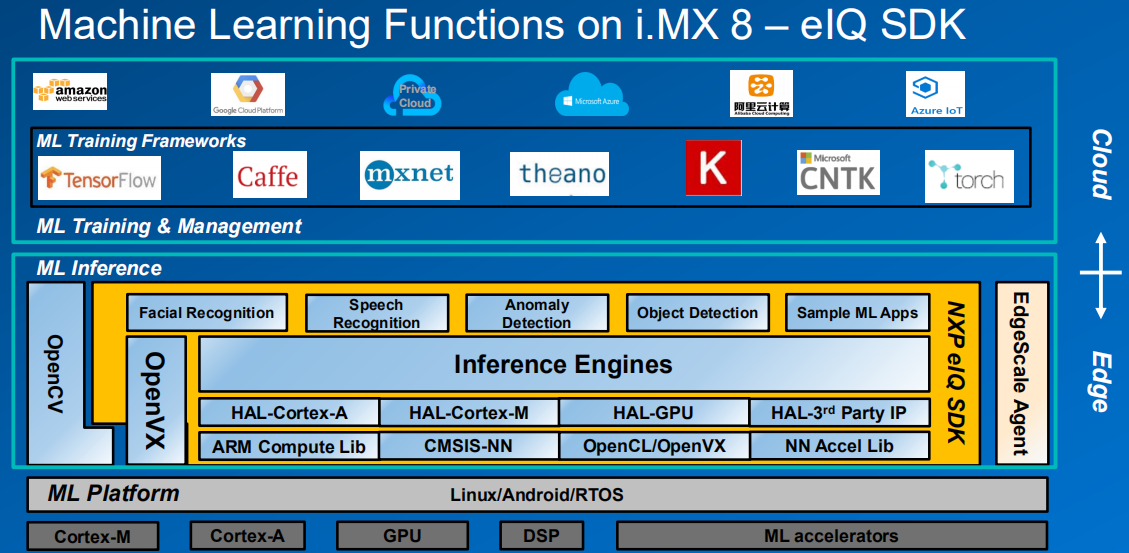

Through acquisition of Freescale, NXP is in possession of a machine learning expert team, i.e., CogniVue, an image recognition IP development team (acquired by Freescale in September 2015) based in Ottawa, Canada. NXP’s eIQ automated deep learning (DL) toolkit enables the developer to introduce DL algorithms to application programs, and meets the strict automotive standards.

Apart from its efforts in nurturing AI capabilities, NXP has been paying attention to AI defects. Deep learning employs probabilities to recognize objects and the results are inexplicable, which is disastrous to cars with a high demanding on safety. NXP has been studying a method called “explicable AI (xAI)” that extends the machine learning reasoning and probability computing capabilities through addition of more rational and humanlike decision-making methods and extra deterministic dimensions, and that combines all merits of AI with reasoning mechanism to imitate human reaction.

Fusion with ADAS for Higher Functional Safety

Some ADAS features like surround view parking, pedestrian and obstacle recognition tend to be integrated in the cockpit domain, needing the cockpit SoC to consider ADAS related capabilities.

R-Car H3, for example, gets largely utilized in cockpit and can also cope with complex functions such as obstacle detection, driver status recognition, danger prediction and avoidance.

More and more smart cockpits are added with HUD, especially the latest AR-HUD integrated with ADAS, delivering capabilities like following distance warning, line press warning, traffic lights monitoring, ahead-of-time lane change, pedestrian warning, road mark display, lane departure warning, obstacles ahead, and driver status monitoring.

There will be higher requirements on functional safety once cockpit SoC is added with some ADAS features, which will, beyond doubt, pose greater challenge to the cockpit SoC suppliers.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...