Chinese Brand Telematics Research: Telematics system installation rate is close to 50%

In 2020, the Chinese OEMs are scrambling to ever faster iterate infotainment systems and add new features, which have been first available to new mass-produced cars:

- In June, VENUS, SAIC Roewe’s new infotainment system mounted on Roewe RX5 PLUS, was launched on market, offering new functions such as voice cloning, Alipay applet and car-home interconnection.

- In June, BEIJING-X7 equipped with BAIC’s Magic Box system was rolled out, with capabilities like face recognition, home interconnection, and AR navigation.

- In July, BYD Han with BYD DiLink3.0 went on sale. The system features a 15.6-inch rotating center console screen and the "Littlie Di" voice icon;

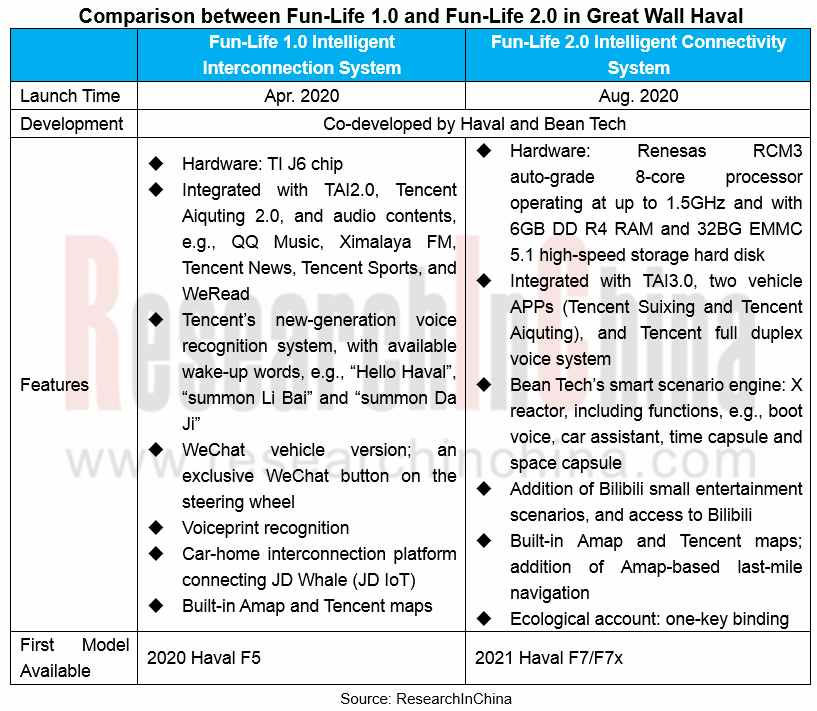

- In August, HAVAL Fun-Life 2.0 integrated with Tencent Auto Intelligence 3.0 (TAI 3.0) was first seen in HAVAL F7;

- In October, Chery i-Connect@Lion4.0 system was launched with Tiggo 8PLUS, and new functions such as “Xiaoqi” intelligent assistant and voiceprint recognition were added;

- In November, ORA ES11 (pre-sold in September), an electric car running ORA Smart-café? OS, was to become available on market.

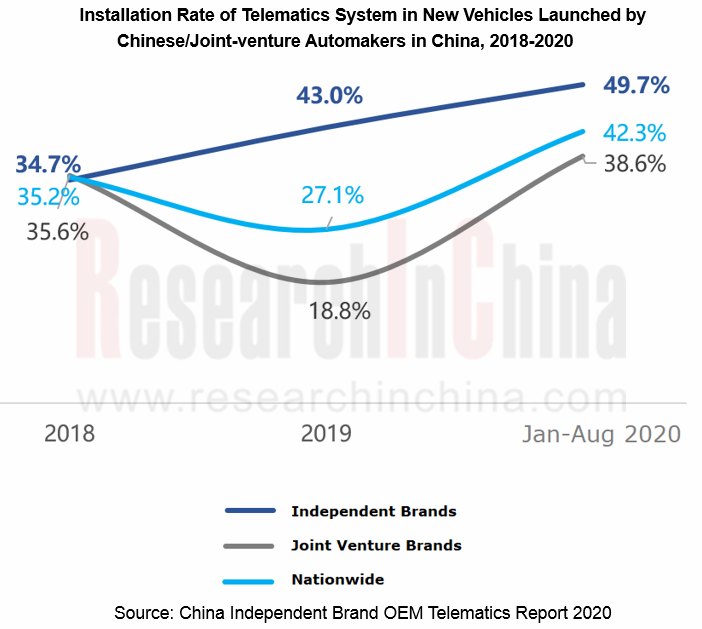

From January to August 2020, a total of 4.43 million new vehicles in China were equipped with Telematics system from January to August 2020, a like-for-like increase of 4.0%, of which 1.75 million units were Chinese brand vehicles, down by 4.8% from the prior-year period. Yet homegrown brands led in penetration and saw a rate of up to 49.7% in the first eight months of 2020, up 9.2 percentage points over the same period of last year, according to the statistics of ResearchInChina. This indicates that Chinese brands have begun to include Telematics system in standard configuration of their new vehicles.

The GKUI automotive intelligent system co-created by Geely and ECARX has been iteratively and functionally updated. As of July 2020, it has attracted more than 2 million users and been available to 40 models.

GKUI is a custom-made onboard system based on the Android system, having been iterated twice. The E01 SoC for GKUI 19 is defined by ECARX and designed by MediaTek. It uses a 64-bit quad core Central Processing Unit (CPU) that combines with dedicated Graphics Processing Unit (GPU) to support 1080p HD dual-screen display and a 4G modem. With AI Cloud, super voice, control interaction, versatile ID and other capabilities, GKUI 19 has been first available to 2020 Geely Boyue PRO. The E02 SoC with built-in 8-core CPU and independent neural processing unit (NPU) is expected to be mounted on vehicles in late 2020 or early 2021.

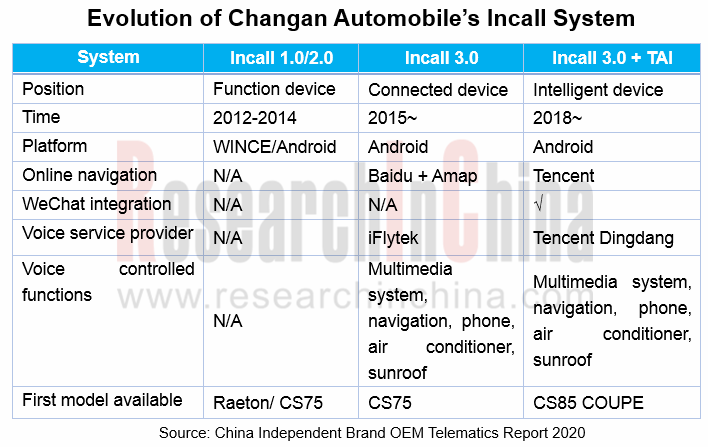

Incall, Changan Automobile's telematics information system has undergone two generations of upgrade: the first generation was iterated to 3.0 and the second generation fuses with TAI. In 2018, Changan Automobile established the joint venture "Phoenix Auto Intelligence" with Tencent to provide a telematics development platform and big data analysis. At present, new models, such as CS85 COUPE, UNI-T and CS75 PLUS, have started installation of the TAI-integrated Incall system. Among them, UNI-T, which was launched in June 2020, carries the latest UNI Life automotive intelligent interaction system whose underlying layer is Incall and which uses AI chip of Horizon Robotics and integrates with a range of interaction capabilities, e.g., WeChat vehicle version, Tencent Map vehicle version, Tencent Dingdang voice interaction system, face recognition, and Tencent Aiquting.

Great Wall Haval features two telematics systems: Hi-Life intelligent interconnection system and Fun-Life intelligent connectivity system. Of which, Fun-Life system is co-developed by Haval and Bean Tech, going through two iterations. Fun-Life 1.0 packing TAI 2.0 system, was first applied to 2020 Haval F5 and rolled out to the market in April 2020; the TAI3.0-integrated Fun-Life 2.0 was first found in 2021 Haval F7/F7x launched in late August 2020.

Chinese brand telematics is expected to be headed in following directions:

1. At present, the installation of telematics in new Chinese brand vehicles approximates 50%. Telematics is expected to become a standard configuration in over 100,000 models in future.

2. Chinese brands keep ahead of others by leveraging abundant ecosystem resources of internet giants like BAT (Baidu, Alibaba and Tencent). Examples include Banma Zhixing co-built by SAIC and Alibaba, Fun-Life system developed by Great Wall Motor together with Tencent, and i-Connect@Lion 4.0 Chery designed in harness with Baidu.

3. Since the outbreak of COVID-19, foreign brands have expedited deployments in telematics. In April 2020, SAIC Volkswagen announced an intelligent telematics system, and partnered with TAI, Amap, JD, Alibaba Cloud and China Mobile to strengthen localization. In July 2020, Dongfeng Nissan updated Nissan Connect system and launched the “Intelligent Connectivity Future” plan. In July 2020, BMW and Tencent formed a digital partnership to promote application of “Tencent Mini Scenarios” and WeChat vehicle version in BMW cars.

4. For functions, navigation, voice assistant, and entertainment ecosystem have become the standard configuration of new cars. All OEMs are enriching infotainment with capabilities such as large/multi-screen/jilt display, WeChat vehicle version, voice personalization/virtual image, onboard KTV, Douyin, car-home interconnection, fleet build-up and applets, as well as mobility services (refueling/washing/insurance). In future, ever more smartphone functions will be incorporated to in-vehicle infotainment system.

5. Advances have been made in the availability of 5G telematics technology in Chinese brand vehicle models. For example, Huawei 5G technology is used in production models like GAC Aion V (launched in Jun. 2020), BYD Han (launched in Jul. 2020), Roewe MARVEL R (presale in Sept. 2020), and BAIC BJEV ARCFOX αT (launched in Oct. 2020). In April 2020, Huawei initiated the “5G Automotive Ecosystem”, with 18 automaker members including FAW Group (FAW Hongqi, FAW Besturn, FAW Jiefang), Changan Automobile, Dongfeng Motor (Dongfeng Passenger Vehicle and Dongfeng Xiaokang), SAIC Group (SAIC Motor Passenger Vehicle and SAIC GM Wuling), GAC Group (GAC NE), BAIC BJEV, BYD, Great Wall Motor, Chery, JAC, Yutong Bus, SERES, NAVECO and T3 Mobility.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...