Research into Digital Vehicle Key: Bluetooth Key Installations Soared by 244% in the First Seven Months of 2020

Our Digital Vehicle Key Industry Report, 2020 sorts out current digital key solutions and development trends.

In an era of intelligent vehicles, key is a new digital trait and has been not like what it used to be. Terminals like smartphones, smart watches and smart bracelets become carriers of vehicle keys, making people’s lives more convenient and creating more room for digital car life.

1. The less than 5% installation leaves space for rapid adoption

Digital key has three technology routes: Bluetooth Low Energy (BLE), Near Field Communication (NFC) and Ultra-wideband (UWB). Yet the overall installation is below 5%. Among them Bluetooth key finds broader application.

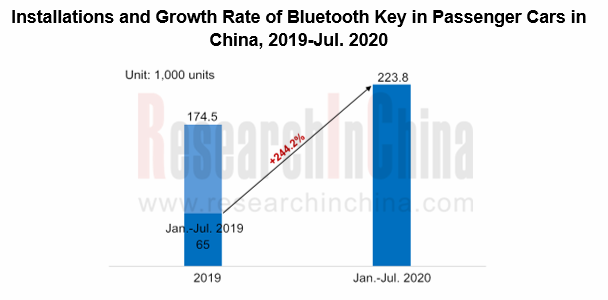

In the first seven months of 2020, Bluetooth key was mounted on roughly 220,000 passenger cars in China, a like-for-like spurt of 244%, with an installation rate of 3.3%, 1.6 percentage points higher than that in the prior-year period. Despite low installation in both volume and rate, Bluetooth key is roaring ahead.

Apart from car lock/unlock and start-up capabilities, digital key enables personalized settings (e.g., seats, music and ID account), key sharing, vehicle trajectory record, and delivery to car. In future digital key will be an individualized element for cars and arouse much imagination.

2. Digital key is so beloved by Chinese automakers

In China, local automakers more willingly embrace digital key. In Bluetooth key’s case, there were a total of 14 passenger car brands using such a key in China between January and July in 2020, including 10 homegrown ones with a combined 70% share in installation.

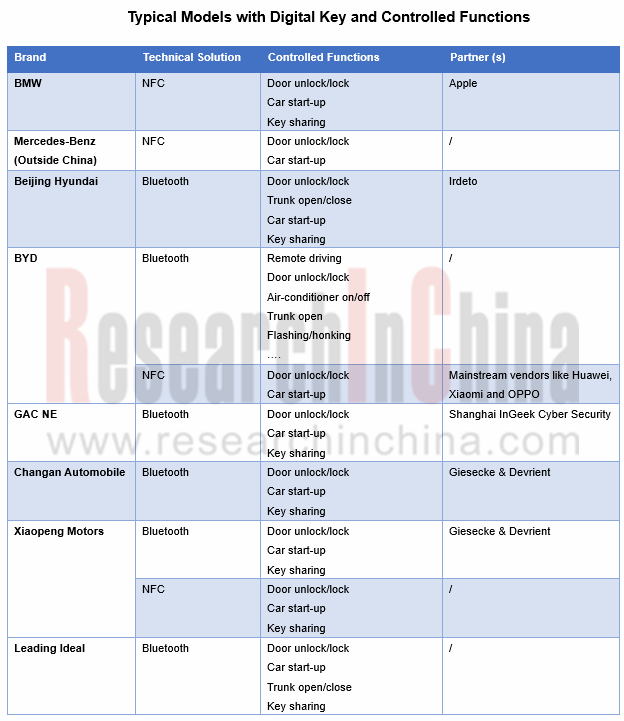

In 2014, BYD first introduced smartphone Bluetooth-based digital key which can lock and unlock cars without network. GAC NE, Xiaopeng Motors, Geely and Changan Automobile followed and rolled out Bluetooth or NFC-based key.

In April 2019, GAC NE unveiled its Bluetooth key-enabled car models -- AION.LX and AION.S. The key solution is co-developed by GAC NE and Shanghai InGeek Cyber Security Co., Ltd..

In September 2019, Xiaopeng Motors released a Bluetooth-based “financial-grade secure digital car key” (the identity authentication technology is developed with Alipay, with security performance subject to financial-grade standards of the Internet Finance Authentication Alliance (IFAA)).

In December 2019, BYD DiLink and Huawei Wallet jointly launched smartphone NFC-based car key.

Joint venture brands also followed suit. In particular, BMW and Beijing Hyundai, among others have stepped up efforts in digital key field in 2020, and plan adoption in full range of their future models.

In July 2020, BMW’s models began to be equipped with Apple CarKey, a NFC-based key solution.

In September 2020, the full family of new vehicles under Beijing Hyundai was outfitted with Irdeto Keystone, a Bluetooth key solution.

3. Established Tier1 suppliers and information security firms flock into the field

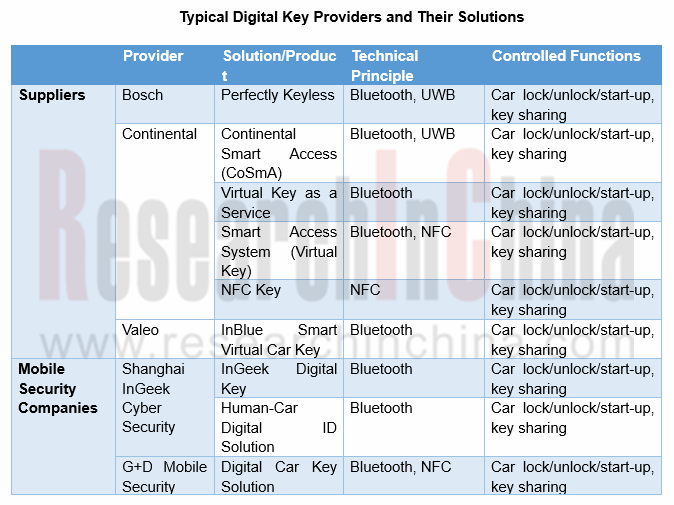

On the strength of technical expertise in common key, Tier1 suppliers like Bosch, Continental and Valeo have made a natural foray into digital key field.

In 2016, Valeo introduced InBlue, a smart virtual car key designed for shared mobility and fleet management and compatible with both Android and Apple phones.

In 2017, Bosch rolled out Perfectly Keyless, a digital key solution with which users can unlock, start or lock their cars via smartphone APP.

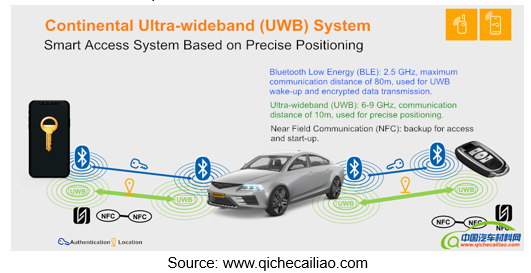

In August 2020, Continental launched new-generation CoSmA digital key based on ultra-wideband (UWB) technology. The system allows the car to be unlocked and the engine to be started without having to interact with the smartphone. It also enables remote control over the car via smartphone.

While bringing diversified and convenient experience to users, digital key poses a non-trivial security problem. Hacking at any links such as identity authentication, encryption algorithms, key storage, and data packet transmission will lead to a crash of the entire digital vehicle key security system. As a result, internet firms that are rooted in cyber security find vehicle information security a way to enter OEMs’ partnership system. Examples include foreign companies like Giesecke & Devrient (G+D) and Irdeto and Chinese peers such as Shanghai InGeek Cyber Security Co., Ltd. and Sichuan Zhongwang Safety and Environmental Protection Technology Consulting Co., Ltd..

4. BLE+NFC+UWB integrated solutions will come to the fore in future

In current stage, the three digital key solutions (BLE, NFC and UWB) can lock, unlock and start cars independently. Integrating them into one terminal (e.g., smartphone and smart wearable device) will hold the trend. In an integrated solution, BLE, NFC and UWB work together but also play their own part in different scenarios: BLE used for vehicle wake-up and transmission authorization, UWB for locating where the user is after wake-up, and NFC as an alternative solution for car unlock and start-up in the case that mobile phone runs out of power.

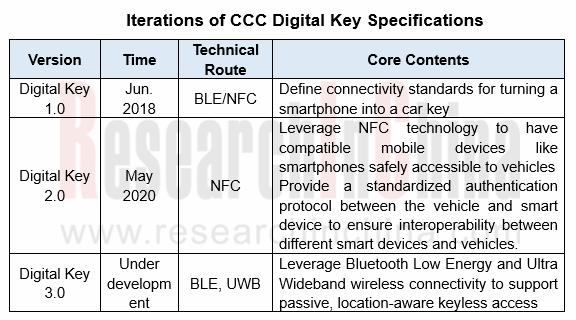

Car Connectivity Consortium (CCC) is dedicated to cross-industry collaboration in developing global standards and solutions for smartphone and in-vehicle connectivity. The Board of Directors of CCC comes from Apple, BMW, GM, Honda, Hyundai, LG, Panasonic, Samsung and Volkswagen.

In May 2020, CCC announced rollout of Digital Key Release 2.0 specification.

As below are capabilities enabled by Digital Key Release 2.0:

- Security and privacy equivalent to physical keys;

- Interoperability and user experience consistency across mobile devices and vehicles;

- Vehicle access, start, mobilization, and more;

- Owner pairing and key sharing with friends, with standard or custom entitlement profiles;

- Support for mobile devices in Battery Low Mode, where normal device operation is disabled.

The next generation of Digital Key, the Release 3.0 specification, is under development. It will leverage Bluetooth Low Energy and Ultra Wideband wireless connectivity to support passive, location-aware keyless access, providing vehicle owners with more convenience and new features.

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...

China Passenger Car HUD Industry Report, 2025

ResearchInChina released the "China Passenger Car HUD Industry Report, 2025", which sorts out the HUD installation situation, the dynamics of upstream, midstream and downstream manufacturers in the HU...

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2025 – Chinese Companies

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2025 – Chinese Companies

Research on Domestic ADAS Tier 1 Suppliers: Seven Development Trends in the Era of Assisted Driving 2.0

In the ...

Automotive ADAS Camera Report, 2025

①In terms of the amount of installed data, installations of side-view cameras maintain a growth rate of over 90%From January to May 2025, ADAS cameras (statistical scope: front-view, side-view, surrou...

Body (Zone) Domain Controller and Chip Industry Research Report,2025

Body (Zone) Domain Research: ZCU Installation Exceeds 2 Million Units, Evolving Towards a "Plug-and-Play" Modular Platform

The body (zone) domain covers BCM (Body Control Module), BDC (Body Dom...

Automotive Cockpit Domain Controller Research Report, 2025

Cockpit domain controller research: three cockpit domain controller architectures for AI Three layout solutions for cockpit domain controllers for deep AI empowerment

As intelligent cockpit tran...

China Passenger Car Electronic Control Suspension Industry Research Report, 2025

Electronic control suspension research: air springs evolve from single chamber to dual chambers, CDC evolves from single valve to dual valves

ResearchInChina released "China Passenger Car Elect...

Automotive XR Industry Report, 2025

Automotive XR industry research: automotive XR application is still in its infancy, and some OEMs have already made forward-looking layout

The Automotive XR Industry Report, 2025, re...

Intelligent Driving Simulation and World Model Research Report, 2025

1. The world model brings innovation to intelligent driving simulation

In the advancement towards L3 and higher-level autonomous driving, the development of end-to-end technology has raised higher re...

Autonomous Driving Map (HD/LD/SD MAP, Online Reconstruction, Real-time Generative Map) Industry Report 2025

Research on Autonomous Driving Maps: Evolve from Recording the Past to Previewing the Future with "Real-time Generative Maps"

"Mapless NOA" has become the mainstream solution for autonomous driving s...