Cloud service platform (cloud platform for short) can be interpreted as a scalable platform delivering basic services, middleware, data services, and software services to users over the Internet. Cloud platform is divided into: IaaS (Infrastructure as a Service), PaaS (Platform-as-a-Service), and SaaS (Software-as-a-Service). It is also classified into public cloud, private cloud and hybrid cloud types.

The public cloud platforms incorporate AWS, Microsoft Azure, Alibaba Cloud, Tencent Cloud, Huawei Cloud and Baidu Cloud. There are a large number of private cloud platform providers such as open-source Openstack and varying Openstack-based platforms. Non-open source providers include VMware, Zstack, etc.

Vehicle, infrastructure, cloud and network are crucial elements of cooperative vehicle infrastructure system (CVIS) industry chain. This report highlights the “cloud” link, with emphasis on OEM-centric automotive cloud platform services. With supplier’s cloud platforms as a foundation, OEMs build their own cloud platforms such as marketing & after-sale cloud platform, manufacturing & supply chain cloud platform, telematics cloud platform, autonomous driving cloud platform, simulation cloud platform and HD map cloud platform.

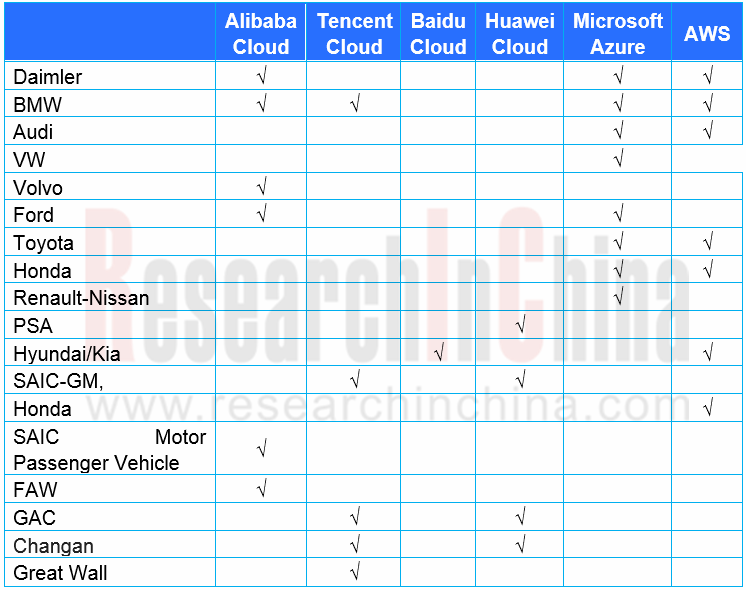

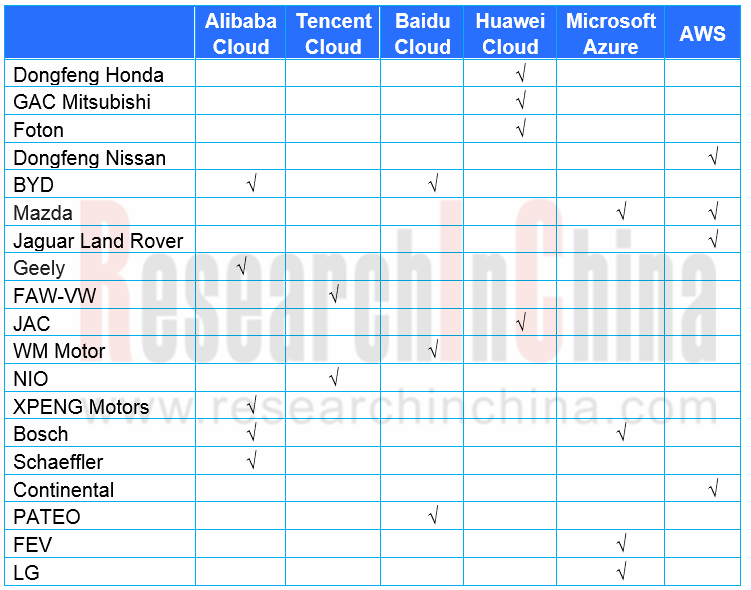

Viewed from the tables above, AWS, Microsoft Azure, Alibaba Cloud, and Tencent Cloud are the first choice of OEMs and Tier1 suppliers. Huawei Cloud and Baidu Cloud are the rising stars. Of both top ten OEMs and top ten Tier1 suppliers that once adopted Amazon Web Services (AWS), more turn to Microsoft Azure as Amazon starts developing and testing autonomous vehicles.

Quite a few OEMs stand on more than one cloud platforms. For instance, Volkswagen Automotive Cloud (vehicles, customers and services) uses Microsoft’s technology, while Volkswagen Industrial Cloud (manufacturing and supply chain management) utilizes Amazon’s.

Telematics cloud platform is among the first automotive cloud platforms already in wide use. In 2017, Microsoft released the Microsoft Connected Vehicle Platform (MCVP), an Azure-based connected automotive platform which has won support from many Tier1 suppliers. The automotive cloud service platform Huawei introduced in 2020 defines more features otherwise: autonomous driving, HD map, battery safety, OTA, V2X and “three powers” (motor, battery and ECU).

From above it can be clearly seen that IT giants post handsome cloud platform revenues at astounding growth rates, amid the booming demand from automotive sector for cloud services, which is fueled by the following:

(1) Enhancement of automaker’s production management, marketing activities and internal management, and digital revolution and synergy of related industry chains.

(2) Digitalization of the process of automakers’ development, design, test, and validation of software and hardware, and remote R&D teams’ cloud synergy and cloud-based simulation (such as cloud service for firmware simulation).

(3) Digitalization and CASE (Connected, Autonomous, Shared, and Electrified) of automotive products. This means software-defined vehicles, capabilities (e.g., connectivity, navigation, parking, entertainment and payment), and transition from a functional vehicle into an intelligent one cannot be achieved without the support of digitalized process and tools, and cloud services.

(4) Building of the telematics platform for automakers, and the connection, service and operation platform among the four -- car users, automotive products, Internet digital ecosystems, and automakers and their industry chains, providing real-time online mobile interconnected third-space services such as navigation, entertainment and payment, for better user driving experience.

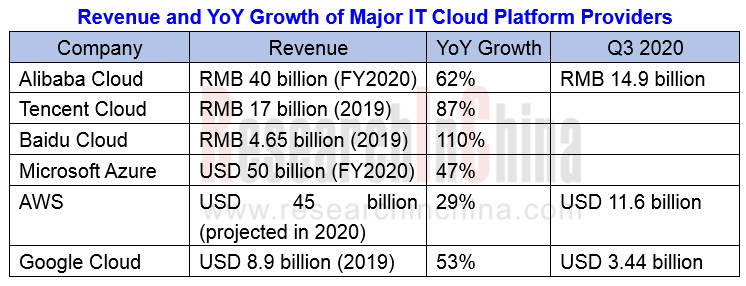

(5) As ADAS/AD gains popularity and gets updated, AVs will generate 4TB data per day, which prompts a surging demand for cloud platform space.

So BAT and Huawei lavish on automotive cloud platform involving operating system, simulation system, telematics system, autonomous driving software, and creation of software and application service ecosystem, considering it is the biggest source of their revenues after all.

OEMs always want to take hold of vehicle data. Currently, leading cloud platform solutions have reserved data ownership of OEMs. For instance, AWS platform retains full ownership of data, while providing functions like machine learning, and special solutions for connectivity and AVs to help OEMs freely create unique brand experience.

Quite a few OEMs set up their own cloud platform subsidiaries and big data centers. Take SAIC Cloud Computing Center as an example. The facility had a 6 or 7-person team, one data center and 5 or 6 cabinets at start and provided just basic cloud storage and IaaS environment. After evolution into Shanghai FinShine Technology Co., Ltd. in 2017, it now boasts a team with 150 talents, three data centers (Shanghai, Nanjing and Zhengzhou) and hundreds of cabinets, and adds software and platform services such as SaaS and PaaS. Up to now the company has owned more than 4,000 cloud hosts, over 10,000 virtual machines or containers, and 30PB storage space.

Companies like SAIC investing heavily in cloud platform still need help from IT tycoons. For example, in 2018, Alibaba Cloud and SAIC together released a hybrid cloud computing service platform for automotive R&D simulation: SSCC (SAIC Simulation Computing Cloud).

To reduce unit costs, IT giants not only build large-scale cloud platforms, but also enable AI algorithms and sundry tool chains and independently develop AI chips. Baidu Cloud, for example, has been a leader in autonomous driving cloud platform field by resorting to competitive DuerOS, Carlife, simulation platform, HD map, autonomous driving algorithms and Kunlun AI chip. OEM’s cloud platform business cannot live without the help of IT firms.

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...

China Passenger Car HUD Industry Report, 2025

ResearchInChina released the "China Passenger Car HUD Industry Report, 2025", which sorts out the HUD installation situation, the dynamics of upstream, midstream and downstream manufacturers in the HU...

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2025 – Chinese Companies

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2025 – Chinese Companies

Research on Domestic ADAS Tier 1 Suppliers: Seven Development Trends in the Era of Assisted Driving 2.0

In the ...

Automotive ADAS Camera Report, 2025

①In terms of the amount of installed data, installations of side-view cameras maintain a growth rate of over 90%From January to May 2025, ADAS cameras (statistical scope: front-view, side-view, surrou...

Body (Zone) Domain Controller and Chip Industry Research Report,2025

Body (Zone) Domain Research: ZCU Installation Exceeds 2 Million Units, Evolving Towards a "Plug-and-Play" Modular Platform

The body (zone) domain covers BCM (Body Control Module), BDC (Body Dom...

Automotive Cockpit Domain Controller Research Report, 2025

Cockpit domain controller research: three cockpit domain controller architectures for AI Three layout solutions for cockpit domain controllers for deep AI empowerment

As intelligent cockpit tran...

China Passenger Car Electronic Control Suspension Industry Research Report, 2025

Electronic control suspension research: air springs evolve from single chamber to dual chambers, CDC evolves from single valve to dual valves

ResearchInChina released "China Passenger Car Elect...

Automotive XR Industry Report, 2025

Automotive XR industry research: automotive XR application is still in its infancy, and some OEMs have already made forward-looking layout

The Automotive XR Industry Report, 2025, re...

Intelligent Driving Simulation and World Model Research Report, 2025

1. The world model brings innovation to intelligent driving simulation

In the advancement towards L3 and higher-level autonomous driving, the development of end-to-end technology has raised higher re...

Autonomous Driving Map (HD/LD/SD MAP, Online Reconstruction, Real-time Generative Map) Industry Report 2025

Research on Autonomous Driving Maps: Evolve from Recording the Past to Previewing the Future with "Real-time Generative Maps"

"Mapless NOA" has become the mainstream solution for autonomous driving s...