Research into Automotive Display: 10-Billion-Yuan Automotive Display Market Is Thriving.

In this report, those are analyzed and studied such as the market size, installation rate, display technology, development trends and suppliers of automotive displays (incl. cluster display, center console display, etc.).

The Center Console Display Shipments Rank First, and the Installation Rates of Rearview Mirror Displays, Rear Seat Entertainment Displays and Vehicle Control Displays Continue to Grow.

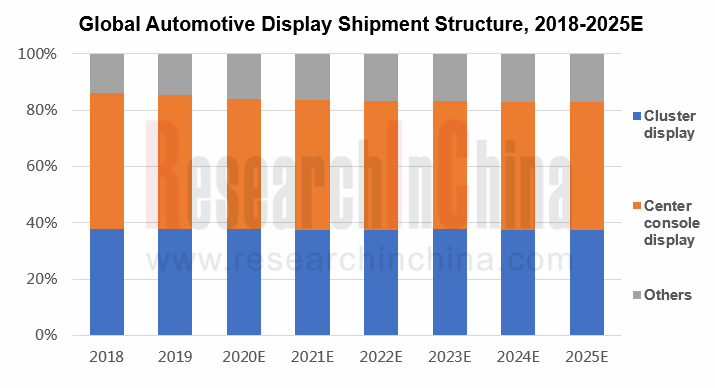

Being bound up with automobile sales, automotive display shipments worldwide edged down 1.5% year-on-year to approximately 159 million units in 2019 when auto sales continued a bearish trend. In 2020, the COVID-19 pandemic drags down global automobile sales (a like-for-like slump of 25.5% in H1 2020, and may recover a bit in H2 2020), with a projected year-on-year plunge of 20% or so. Against this, global automotive display shipments are expected to fall 12.1% year-on-year to 140 million units in 2020. In the long run, the automotive display market, however, will resume growth alongside intelligent connected vehicles at a gallop, with shipments projected to reach 180 million units by 2025.

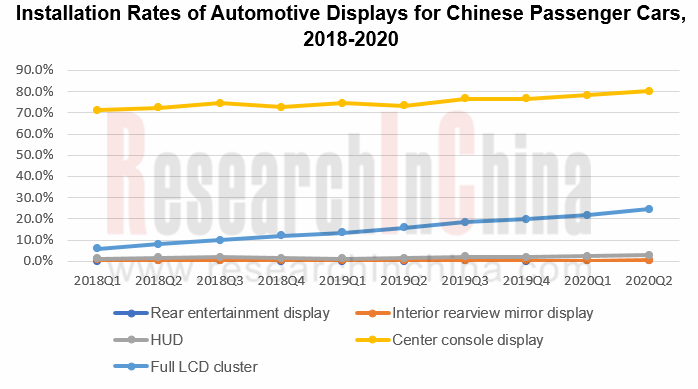

In the Chinese market, the installation rate of console displays exceeds 80%, while full LCD cluster displays see the fastest installation rate, accompanied by a marked rise in installation rates of rearview mirror displays, HUD, center console displays, among others.

In 2019, the automotive display shipments of global panel vendors grew concentrated ever, especially the top five’s rose by 4.3 percentage points. JDI led the pack in the market, while Tianma Microelectronics, the largest Chinese automotive panel supplier, took the third place in the world with its shipments growing at a far higher rate than those of JDI and LGD; however, BOE saw the quickest shipment growth rate as high as 73.2%. Chinese players are growing strong.

Automotive Display Technology: Given LCD Overcapacity, Suppliers Are Racing to Develop New Technologies such as AMOLED

LCD still prevails in the automotive display market, but Japanese and Korean panel makers led by JDI and LGD have been gearing from a-Si products to LTPS and even AMOLED to suit to the changing automotive demand.

Moreover, the rapid release of new LCD capacities will lead to a severer oversupply, ever lower prices and less meager profits, forcing vendors to cut production and seek for a transition and even a retreat from the LCD market.

BOE: it announced at the end of 2019 that it would stop investing in LCD capacity, but focus on OLED and next-generation Mini LED and Micro LED instead, with a plan to spawn Mini LED in Q4 2020.

LGD: It will stop production of LCD panels in South Korea before the end of 2021 to slash losses.

AUO: It trims LCD capacity and quickens to develop new products.

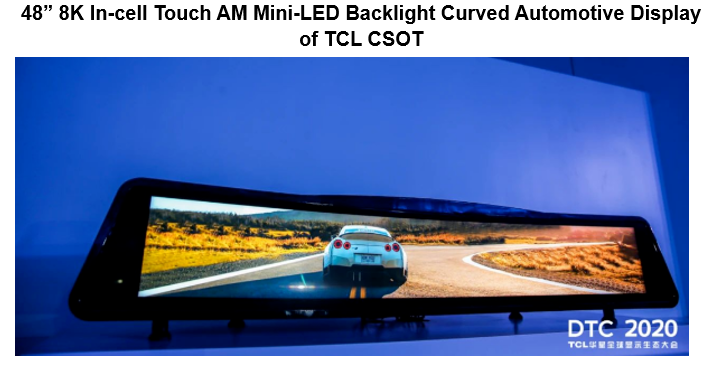

With the CASE (connected, autonomous, shared, electrified) trend in the automotive sector, automotive displays tend to be bigger, and in the form of conjugate displays and multi-displays. The rising of novel automotive displays such as vehicle control displays and curved displays has brought opportunities to Chinese vendors. Major suppliers have rolled out new technical solutions like AMOLED and Mini LED successively in 2020.

LGD: In February 2020, it provided a digital cockpit based on an OLED curved display for the new Cadillac Escalade. In June 2020, it announced that it will develop a retractable display before 2024.

Tianma Microelectronics: The ACRUS technology, debuted in January 2020, raises the contrast to over 30,000:1 by laminating LTPS double-layer panels.

Innolux: In July 2020, it launched a 29-inch free-form curved display incorporating a cluster board and a CID display, and planned to achieve mass production in 2022.

TCL CSOT: In October 2020, the 48” 8K In-cell Touch AM Mini-LED backlight curved automotive display was released, as the first 5096 partition AM Mini-LED backlight and 100% NTSC display in the automotive industry and the world’s first 6.7” AMOLED cloud scroll display.

Automotive Display Installation: Integrated Displays Grow a Standard Configuration, and OLED/AMOLED Displays Begin to Penetrate in High-end Cars.

At present, automotive dual-displays or even triple-displays represent a trend. A larger display spans the entire center console, featuring the functionality involved with the copilot. As per the center console display configuration of Chinese passenger cars in 2018-2020, the installation rate of multi-displays was up from 0.3% in 2018 to 1.3% in Q2 2020. The interiors of Mercedes-Benz, Volkswagen, Chang’an and other models in 2020 reveal that dual-displays have almost become the standard.

The multi-display layout is basically available in models priced above RMB150,000, except Chang'an Benni E-Star launched in April 2020, a mini-car priced below RMB100,000 that has full LCD cluster & center console dual-displays, signaling the penetration of dual-displays into the medium and low-end models.

With the evolvement of intelligent connectivity technology, cars are growing to be mobile smart terminals. In addition to cluster & center console dual displays, HUD, electronic rearview mirror displays, copilot recreation displays, rear seat entertainment displays, and transparent A-pillars have emerged. HOZON U, for instance, launched in 2019, is equipped with a vehicle control display and transparent A-pillars besides dual displays. ENOVATE ME7 unveiled in September 2020 carries 5 high-definition displays including a cluster display, a center console display, a copilot display and dual displays in the rear row.

According to the concept models released by OEMs, curved displays will shine in the automotive display field in future. Luxury brand cars and new energy vehicles are first making use of OLED displays.

Previously, only small displays such as transparent A-pillars, and Audi virtual rearview mirror displays applied OLED. In 2020, some production models use OLED on large displays for center consoles and the copilot. Mercedes-Benz S-class launched in August 2020 is provided with a 12.8-inch OLED curved center console display; the 2021 Cadillac Escalade will be packed with the industry’s first large-size curved OLED cluster display; Nissan’s IMQ concept uses a 33.1-inch curved display; Audi-Aicon concept adopts a surrounded display.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...