Global and China Commercial Vehicle Telematics Industry Report, 2020

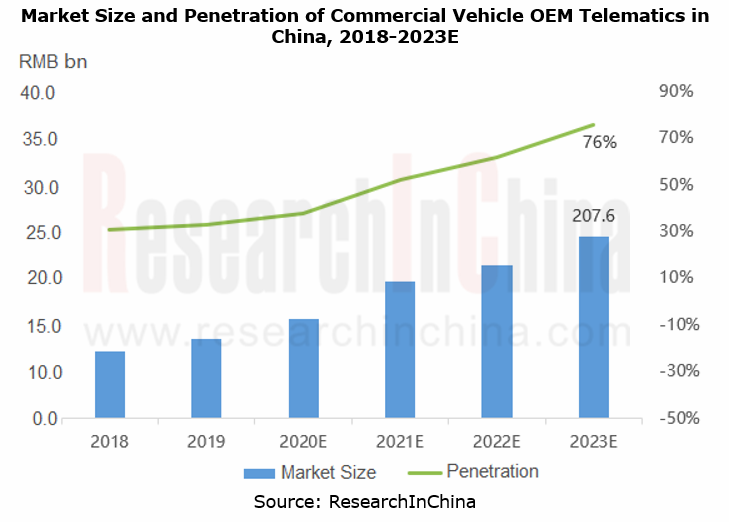

Commercial vehicle telematics research: before 2023, policies will drive the penetration up to 76% and the market will be worth more than RMB20.7 billion.

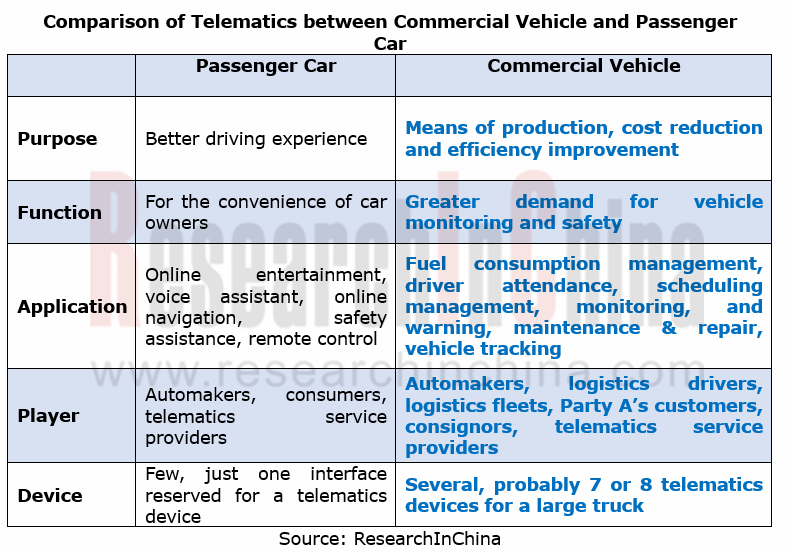

Differing from passenger car telematics mainly for better user experience, commercial vehicles that take first into account cost reduction, higher efficiency and safe operation because of their attribute of means of production, focusing more on telematics availability to improve vehicle efficiency and cost performance.

Policies and regulations serve as key drivers

Mandatory installation of driving record-enabled satellite positioning devices into “two buses, one special vehicle” (tourism chartered buses, Category III scheduled buses, and special vehicles for transporting hazardous chemicals, fireworks and firecrackers, and civil explosives), heavy trucks and tractors as policies required in 2013, ushered in an epoch-making era of commercial vehicle telematics.

Semi-trailer tractors and >12t trucks are required to pack driving record-enabled satellite positioning devices and intelligent video surveillance devices, and to be connected to standards-compliant monitoring platforms, according to the Regulation on Road Transport (Revised Draft for Comment) the Ministry of Transport of China drafted in November 2020, which invigorates China’s commercial vehicle telematics market further.

In the next three years, China’s Phase VI Emission Standard will be a key contributor to the market growth, according to which all sold and registered heavy vehicles should be subject to the Stage A requirements from July 1, 2020 onwards and all sold and registered light vehicles should be subject to the Stage B requirements starting from July 1, 2023. In the upcoming three years, the demand for telematics terminals that can monitor vehicles remotely online and detect exhaust will be blooming. On one estimate, the penetration of OEM telematics for commercial vehicles in China will hit 76% in 2023, with the market being valued over RMB20 billion.

OEMs’ deployments are being made inch by inch.

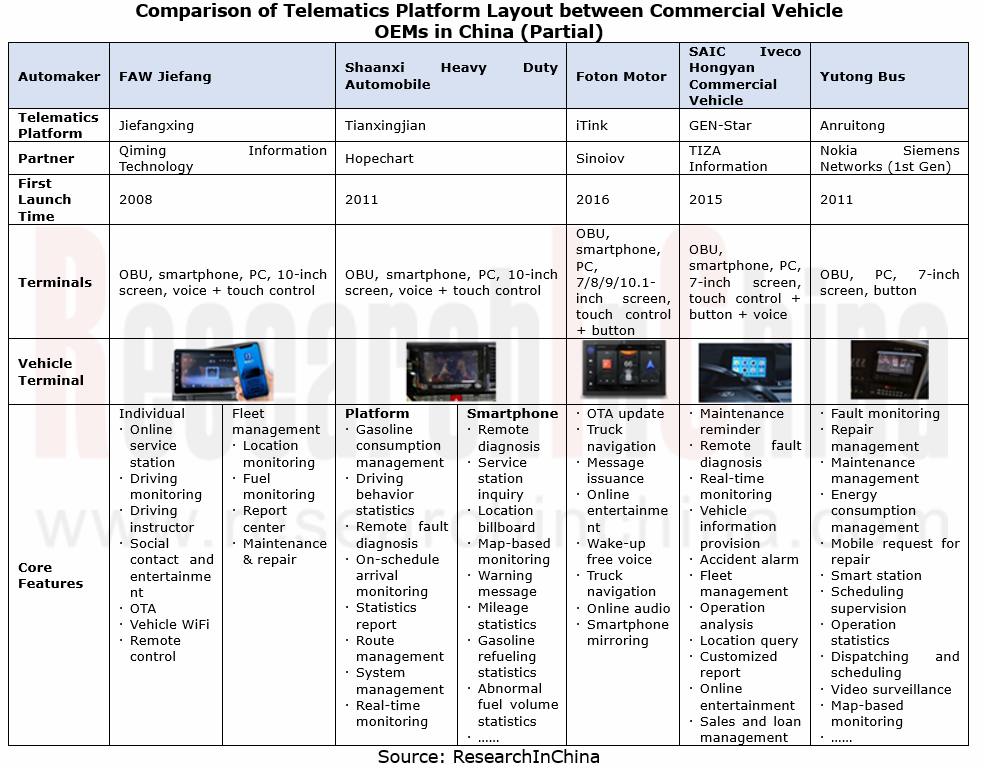

Stimulated by policy requirements and robust demand, major heavy truck manufacturers like FAW Jiefang, Shaanxi Automobile and Dongfeng Trucks have taken the lead in deploying and raced to make plans of using telematics as a standard configuration.

“Jiefang Pilot” and “Jiefangxing”, respective telematics platform of FAW Jiefang Changchun Base and Jiefang Qingdao Base, was reshuffled into one in March 2020. The full family of FAW Jiefang models have been equipped with telematics system as a standard configuration since 2019, with more than 700,000 units connected since then.

Shaanxi Automobile Group Commercial Vehicle Co., Ltd. has started deploying telematics since 2010. Its “Tianxingjian” telematics system launched together with Hopechart in 2019 has been a standard configuration of its full range of trucks, with 600,000 units installed.

Foton Motor has set about deploying telematics since 2011, and established Foton iTink Information Technology Service Company for telematics development in 2012. Since its launch in 2016, Foton iTink Telematics System has boasted more than 1 million installs.

Telematics platform will deepen data application.

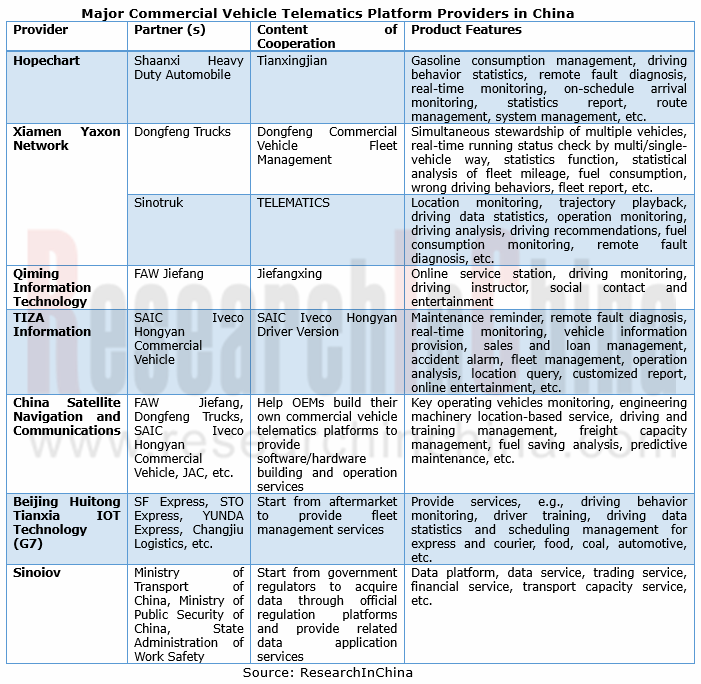

Operating platform remains the epicenter of telematics. OEMs and platform providers forge close partnerships now. Examples include Shaanxi Heavy Duty Automobile developing Tianxingjian with Hopechart, and Dongfeng Trucks in harness with Xiamen Yaxon Network to develop “Dongfeng Commercial Vehicle Fleet Management”, with telematics capabilities available during the lifespan of vehicles. Deeper application of telematics data will be the next development priority of platforms.

FAW Jiefang: underline telematics data + scenario enabler.

In May 2020, FAW Jiefang and China Satellite Navigation and Communications set up Smartlink Intelligent Technology (Nanjing) Co., Ltd.. Based on the new-generation “Jiefangxing” telematics platform, the joint venture provides partners with telematics data enabling ‘vehicle data plus scenario data’, combining FAW Jiefang’s three key products, Jiefangxing Individual APP, Fleet Management System (FMS) and Transportation Management System (TMS).

Shaanxi Heavy Duty Automobile: commercialize telematics data + insurance applications.

In October 2020, Shaanxi Tianxingjian Telematics Information Technology Co., Ltd., Maxim Insurance Brokers (Shanghai) Co., Ltd. and China Pacific Property Insurance Co., Ltd. (CPIC Property) negotiated about collaboration on commercial vehicle UBI. This move will broaden Tianxingjian Telematics’ big data use in the aftermarket.

Intelligent vehicle terminals will be a future hit.

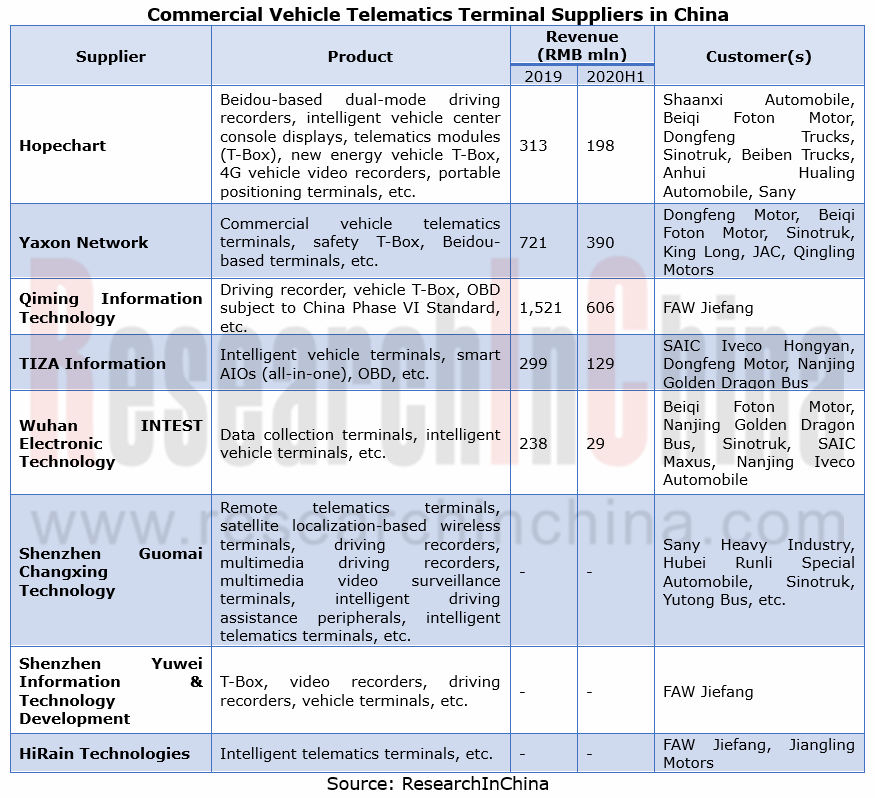

In China, typical commercial vehicle telematics terminal suppliers like Hopechart and Yaxon Network have sharp edges in both OEM market and aftermarket on strength of their large customer bases. The implementation of China Phase VI Emission Standard, the Regulation on Road Transport and other polices will bring in more revenues to them.

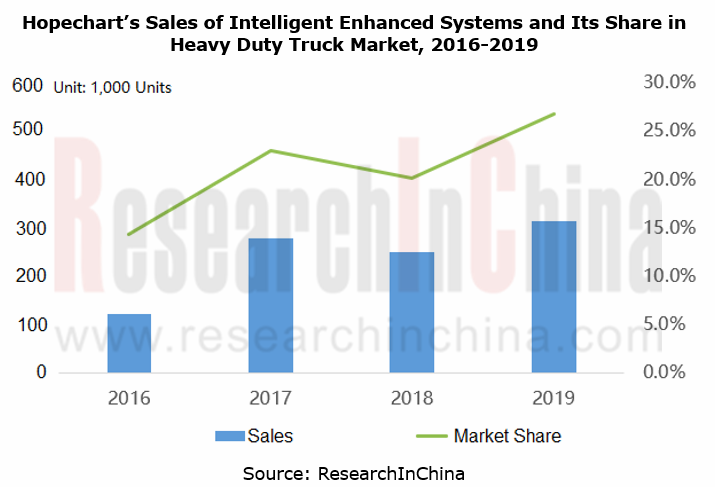

Hopechart, China’s biggest supplier of commercial vehicle telematics terminals, sold 313,000 sets of “intelligent enhanced driving terminals” (including hardware devices (T-BOX, driving recorder, etc.), intelligent enhanced driving modules and big data cloud platform) in 2019, commanding over 20% of the heavy duty truck market. In 2020, Hopechart becomes a qualified supplier of Sinotruk, which will further push up its share in the market.

Commercial vehicle telematics will fuse with automated driving features.

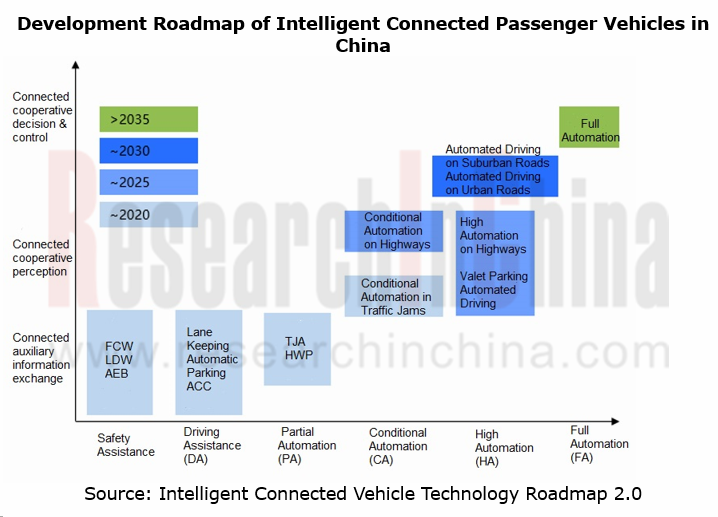

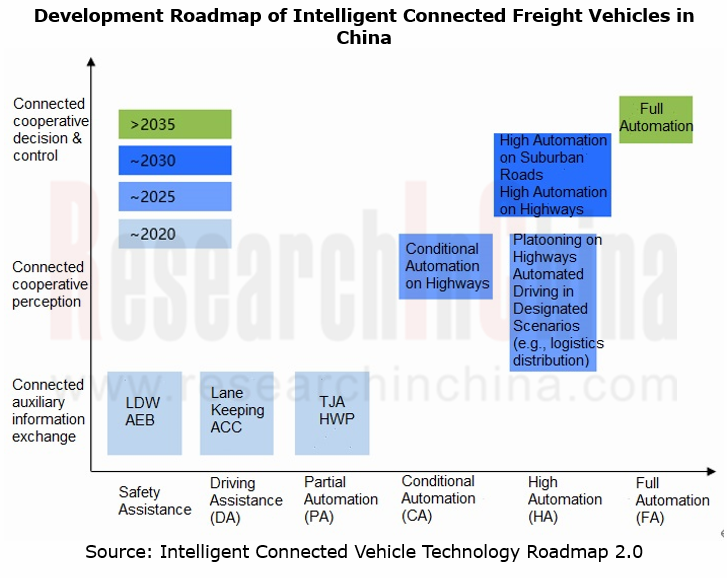

In an age of intelligence, telematics and automated driving lean toward a fusion with the support of V2X and 5G, and capabilities like platooning and predictive cruise are expected to become available first.

Platooning: commercial vehicle platooning is hopefully the first application where automated driving is implemented, an effective solution to control on the distance between vehicles and feet driving status for a big cut in fuel consumption (by 10%-15% in truck platooning according to TNO, the Netherlands Organization for Applied Scientific Research), labor cost reduction, lower driver working intensity, and less cost of operating commercial vehicles. At present, quite a few OEMs have set foot in the field.

Predictive cruise: data like slope, curvature, heading and speed limit are extracted from telematics-based map data to make driving decisions and reduce fuel consumption, coupled with improving fuel saving algorithms.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...