China Automotive Steering System Industry Report, 2012-2015

-

Apr.2013

- Hard Copy

- USD

$2,200

-

- Pages:105

- Single User License

(PDF Unprintable)

- USD

$2,100

-

- Code:

YSJ068

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,300

-

- Hard Copy + Single User License

- USD

$2,400

-

According to the data of China Association of Automobile Manufacturers, China’s annual production capacity of automotive steering system has now reached around 20 million sets. In 2012 the demand for automotive steering system in China was approximately 19.31 million sets, a year-on-year increase of 4.3%. It is expected that, in 2013-2015, the demand will grow at an average rate of 5% or so, and hit 22.35 million sets in 2015.

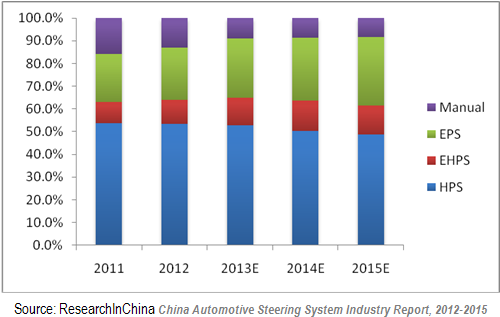

Seen from the demand structure, mechanical hydraulic steering system (HPS) is the most mainstream steering system in the current market, with demand accounting for about 50% of the total. However, as the electric power steering system (EPS) technology continues to become mature, its demand is in a stage of rapid growth. In the future, EPS will constantly replace HPS to become the mainstream of the automotive steering system market.

China Automotive Steering System Demand Structure, 2011-2015E?

At present, China’s automotive steering system industry characterizes fierce competition, and the manufacturers fall into two camps of foreign-capital / joint-venture enterprises and local enterprises, of which, the former represented by ZF, TRW, JTEKT, SHOWA, NSK, MANDO, etc., relying on their higher quality of products as well as the capital relations with foreign brand vehicle assembly plants, mainly support for foreign brand vehicles. By contrast, local Chinese companies with relatively backward production process are occupied in the production of mechanical steering system, mainly supporting for homegrown brand vehicle assembly plants. With the technological improvement and experience accumulation, China Automotive Systems, Inc., Zhejiang Shibao Company Limited, Zhejiang Wanda Steering Gear Co., Ltd., AVIC-Xinhang Yubei Steering System Co., Ltd. and other local enterprises have seen fast development and started to provide product supporting services to joint-venture vehicle assembly plants.

Among joint ventures, JTEKT CORPORATION occupies the largest share in China steering system industry, provided with a total of seven steering system production bases there, four of which are dedicated to the production of electric power steering system. JTEKT Steering System (Xiamen) Co., Ltd. as one of major steering system production bases is engaged in the production of electric power steering gear, with annual capacity up to 1.2 million units, well above its industry counterparts. It mainly supports for Japanese vehicle assembly plants such as Tianjin FAW Toyota Motor Co., Ltd., Zhengzhou Nissan Automobile Co., Ltd., Dongfeng Nissan and GAC Toyota.

Among local enterprises, China Automotive Systems, Inc. enjoys the largest production capacity. Through production and operation by its eight subsidiaries, the company reaches total capacity of 3.25 million units, mainly supporting for FAW Group Corporation, Dongfeng Motor Corporation, Shenyang Brilliance Jinbei Automobile Co., Ltd., Chery Automobile Co., Ltd., Geely Automobile Holdings Limited, etc.. To retain its competitive edge in the industry, China Automotive Systems applies electronic chip to the power steering system and has conducted technical cooperation with BISHOP, KDAC, Korea’s Namyang and other companies for the development of EPS and EHPS. Development target of the company is to achieve annual capacity of 6.35 million units at the end of 2015.

China Automotive Steering System Industry Report, 2012-2015 of ResearchInChina mainly covers the followings:

?Development, market demand, competition pattern, imports and exports, development trends, etc. of Chinese automotive system industry;

?Development, market demand, production capacity, development trends, etc. of China EPS and HPS industries;

?Chinese car support for EPS, HPS, EHPS;

?Output, sales volume and matching models of China’s leading automotive steering system components manufacturers;

?Development situation, production capacity, project construction, development planning, etc. of leading international and domestic steering system manufacturers.

1. Overview of Automotive Steering System

1.1 Classification

1.2 Development History

1.3 Technological Level

1.4 Business Model

2. Automotive Steering System Market

2.1 Overall Market

2.1.1 Status Quo

2.1.2 Demand

2.1.3 Specialized Production

2.1.4 Competition Pattern

2.1.5 Industry Entry Barriers

2.2 Equipping

2.2.1 Drive Mode

2.2.2 Front Suspension Type

2.2.3 Rear Suspension Type

2.2.4 Power Type

2.3 Import and Export

2.3.1 Import

2.3.2 Export

2.4 Industry Development Factors

2.4.1 Favorable Factors

2.4.2 Adverse Factors

2.5 Development Trends

2.5.1 Product Trends

2.5.2 Industry Trends

3. Automotive Steering System Market Segments

3.1 Electric Power Steering System

3.1.1 Global Market

3.1.2 Chinese Market

3.1.3 Market Demand

3.1.4 Key Companies

3.1.5 Equipping

3.1.6 Development Trends

3.2 Hydraulic Steering System

3.2.1 Market Situation

3.2.2 Market Demand

3.2.3 Mechanical-Hydraulic Power Steering System

3.2.4 Electro-Hydraulic Power Steering System

3.3 Steering-By-Wire System

4. Automotive Steering System Components

4.1 Steering Gear

4.2 Steering Column

4.3 Steering Wheel

4.4 Steering Knuckle

4.5 Steering Booster

4.6 Steering Tie Rod

5. Key International Manufacturers

5.1 JTEKT

5.1.1 Profile

5.1.2 Operation

5.1.3 Development in China

5.2 ZF

5.2.1 ZF Group

5.2.2 ZF Lenksysteme

5.2.3 Development in China

5.3 NSK

5.3.1 Profile

5.3.2 Operation

5.3.3 Development in China

5.4 TRW

5.4.1 Profile

5.4.2 Operation

5.4.3 Development in China

5.5 Mando

5.5.1 Profile

5.5.2 Operation

5.5.3 Development in China

5.6 Delphi

5.6.1 Profile

5.6.2 Operation

5.6.3 Development in China

6. Key Chinese Manufacturers

6.1 Zhejiang Shibao Company Limited

6.1.1 Profile

6.1.2 Revenue and Gross Margin

6.1.3 Cost of Revenue

6.1.4 Production Base

6.1.5 Major Customers and Suppliers

6.1.6 Development Planning

6.2 China Automotive Systems, Inc.

6.2.1 Profile

6.2.2 Organization

6.2.3 Operation

6.3 Zhuzhou ELITE Electro Mechanical Co., Ltd

6.3.1 Profile

6.3.2 Operation

6.4 Zhejiang Wanda Steering Gear Co., Ltd

6.5 Hubei Tri-Ring Motor Steering Gear Co., Ltd.

6.6 Guangzhou SHOWA Absorber Limited Company

6.7 Jiangmen Xingjiang Steering Gear Co., Ltd.

6.8 FAW Koyo Steering Systems Co., Ltd.

6.9 AVIC-Xihang Yubei Steering System Co., Ltd.

6.10 Tianjin Jinfeng Automobile Chassis Parts Co., Ltd.

6.11 Zhejiang Fulin Guorun Auto Parts Co., Ltd.

6.12 Golden Company

6.13 Chongqing Changfeng Machinery Co., Ltd.

6.14 Anhui Finetech Machinery Co., Ltd

6.15 Hafei Industrial Group Automobile Redirector Obligate Co., Ltd.

6.16 Donghua Automotive Industrial Co., Ltd.

Classification of Automotive Steering System

Comparison among Power Steering Systems by Energy Consumption

China’s Demand for Automotive Steering System, 2007-2016E

China’s Demand for Passenger Car Steering System, 2007-2016E

China Automotive Steering System Demand Structure, 2011-2015E

China Passenger Car Steering System Demand Structure, 2011-2015E

Capacity and Planning of Major Chinese Automotive Steering System Manufacturers, 2012 vs. 2015E

Major International Competitors of China Automotive Steering System Industry

Main Drive Modes of Passenger Car and Representative Models

Distribution of Chinese Cars by Drive Mode, 2013

Types of Passenger Car Front Suspension and Representative Models

Distribution of Chinese Cars by Front Suspension Type, 2013

Types of Passenger Car Rear Suspension and Representative Models

Distribution of Chinese Cars by Power Type, 2013

Distribution of China’s Steering System for Departments of Cars by Power Type, 2013

Distribution of China’s Steering System for Grades of Cars by Power Type, 2013

China’s Import Volume and Value of Automotive Steering System Components, 2006-2012

Major Import Origins of China’s Automotive Steering System Components, 2012

China’s Export Volume and Value of Automotive Steering System Components, 2006-2012

Major Export Destinations of China’s Automotive Steering System Components, 2012

Vehicle Models Supported with Various EPS

China’s Passenger Car EPS Equipping Ratio, 2010-2015

Demand for EPS in China, 2007-2015E

Capacity of China’s Leading EPS Manufacturers, 2013

Distribution of Cars with EPS in China by Price, 2013

Distribution of Cars Equipped with EPS in China by Departments, 2013

Distribution of Cars Equipped with EPS in China by Model, 2013

China's Demand for Auto Hydraulic Steering System, 2007-2015E

Distribution of Cars with Mechanical-Hydraulic Power Steering System in China by Price, 2013

Distribution of Cars Equipped with Mechanical-Hydraulic Power Steering System in China by Departments, 2013

Distribution of Cars Equipped with Mechanical-Hydraulic Power Steering System in China by Model, 2013

Distribution of Cars with Electro-Hydraulic Power Steering System in China by Price, 2013

Distribution of Cars Equipped with Electro-Hydraulic Power Steering System in China by Departments, 2013

Distribution of Cars Equipped with Electro-Hydraulic Power Steering System in China by Model, 2013

Capacity of China’s Leading EHPS Companies

Main Components of Automotive Steering System

Output and Sales Volume of China’s Leading Steering Gear Manufacturers, 2011

Output and Sales Volume of China’s Leading Steering Column Manufacturers, 2011

Capacity of China’s Leading Energy-absorbing Steering Device Manufacturers

Output and Sales Volume of China’s Leading Steering Wheel Manufacturers, 2011

Output and Sales Volume of China’s Leading Steering Knuckle Manufacturers, 2011

Output and Sales Volume of China’s Leading Steering Booster Manufacturers, 2011

Output and Sales Volume of China’s Leading Steering Tie Rod Manufacturers, 2011

Steering System Products of JTEKT

Operating Indicators of JTEKT, FY2008-FY2011

Sales of JTEKT, FY2007-FY2011

Net Income of JTEKT, FY2007-FY2011

Sales Breakdown of JTEKT by Department, FY2011

Sales Breakdown of JTEKT by Region, FY2011

Sales Breakdown of JTEKT by Region, FY2007-2011

Steering System Production Bases of JTEKT in China

Sales Volume and Supported Vehicle Models of Steering System Products of JTEKT Automotive (Tianjin) Co., Ltd., 2009-2011

Sales of ZF, 2008-2012

Sales Breakdown of ZF by Region, 2008-2011

Sales Breakdown of ZF by Department, 2008-2011

Sales Breakdown of ZF by Product, 2011

Workforce of ZF, 2008-2012

Sales of ZF Lenksysteme, 2008-2011

Sales Structure of ZF Lenksysteme by Product, 2011

Sales Structure of ZF Lenksysteme by Region, 2011

Sales Network of ZF (China)

Automotive Steering System Production Bases of ZF (China)

Sales Volume of Main Steering System Products of ZF (China), 2007-2011

Global Presence of NSK

Sales and Net Income of NSK, FY2007-FY2012

Sales Breakdown of NSK by Department, FY2012

Sales Breakdown of NSK by Department, FY2009-FY2013

Sales of NSK in China, FY2012-FY2013

Sales Breakdown of TRW by Department, 2010-2012

Revenue Structure of TRW by Product, 2012

Revenue Structure of TRW by Region, 2012

Main Clients of TRW, 2011-2012

Sales of TRW in China, 2010-2012

Sales and Net Income of Mando, 2011-2012

Sales Breakdown of Mando by Region, 2011-2012

Sales and EBIT of Mando, 2011-2012

Net Sales and Net Income of Delphi, 2010-2012

Sales Breakdown of Delphi by Department, 2010-2012

Sales Breakdown of Delphi by Region, 2012

Revenue and Gross Margin of Zhejiang Shibao, 2008-2012

Output, Sales Volume and Inventory of Zhejiang Shibao, 2011-2012

Revenue and Gross Margin of Main Products of Zhejiang Shibao, 2012

Operating Costs of Zhejiang Shibao, 2009-2012

Production Costs of Main Products of Zhejiang Shibao, 2011-2012

Steering System Production Bases and Operating Indicators of Zhejiang Shibao, 2012

Zhejiang Shibao’s Top Five Clients, 2012

Zhejiang Shibao’s Top Five Suppliers of Raw Materials, 2012

Major Clients of China Automotive Systems

Subsidiaries of China Automotive Systems

Capacity of Subsidiaries of China Automotive Systems

Net Sales and Gross Profit of China Automotive Systems, 2007-2011

Net Sales and Cost of Sales of Subsidiaries of China Automotive Systems, 2010-2011

Sales Volume of Zhuzhou ELITE Electro Mechanical, 2009-2017E

Output, Sales Volume and Supported Vehicle Models of Steering Gear of Zhejiang Wanda Steering Gear, 2006-2011

Output, Sales Volume and Supported Vehicle Models of Steering Column of Zhejiang Wanda Steering Gear, 2006-2010

Operating Indicators of Zhejiang Wanda Steering Gear, 2007-2009

Major Investment Projects of Zhejiang Wanda Steering Gear, 2011-2015E

Output, Sales Volume and Supported Vehicle Models of Steering Gear of Hubei Tri-Ring Motor Steering Gear, 2006-2011

Automotive Steering Gear Production Equipments of Guangzhou SHOWA Absorber

Output, Sales Volume and Supported Vehicle Models of Steering Gear of Guangzhou SHOWA Absorber, 2007-2011

Output, Sales Volume and Supported Vehicle Models of Steering Gear of Jiangmen Xingjiang Steering Gear, 2006-2011

Operating Indicators of Jiangmen Xingjiang Steering Gear, 2005-2009

Output and Sales Volume of Steering Gear of FAW Koyo Steering Systems, 2010-2011

Organizational Structure of AVIC-Xihang Yubei Steering System

Output, Sales Volume and Supported Vehicle Models of Steering Gear of AVIC-Xihang Yubei Steering System, 2007-2011

Ownership Structure of Yubei Koyo Steering System

Major Clients of Yubei Koyo Steering System

Output, Sales Volume and Supported Vehicle Models of Steering Gear of Yubei Koyo Steering System, 2007-2011

Operating Indicators of Tianjin Jinfeng Automobile Chassis Parts, 2004-2009

Operating Indicator of Zhejiang Fulin Guorun Auto Parts, 2006-2009

Output, Sales Volume and Supported Vehicle Models of Steering Gear of Chongqing Changfeng Machinery, 2006-2011

Output, Sales Volume and Supported Vehicle Models of Steering Gear of Anhui Finetech Machinery, 2006-2011

Operating Indicators of Anhui Finetech Machinery, 2006-2009

Output, Sales Volume and Supported Vehicle Models of Steering Gear of Hafei Industrial Group Automobile Redirector Obligate, 2006-2010

Operating Indicators of Hafei Industrial Group Automobile Redirector Obligate, 2004-2009

Output, Sales Volume and Supported Vehicle Models of Steering Gear of Donghua Automotive Industrial, 2008-2010

Capacity of Donghua Automotive Industrial, 2013

Product Sales Planning of Donghua Automotive Industrial, 2011-2015E

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...