Amid “CASE” (connected, autonomous, shared and electrified) prospering in automotive sector, Chinese and joint venture auto brands are vying for connectivity and intelligence. In China, domestic brands have gained first-mover advantages in the country’s telematics market on the strength of local resources. In January 2019, joint venture brands were left behind by Chinese OEMs, with an 11.8 percentage points lower telematics penetration. Since 2019 their deploying telematics has been expedited: they endeavor to develop underlying technologies and seek partners, with roll-outs of more secure, more intelligent in-vehicle infotainment (IVI) systems; they also focus more on user experience and exert themselves to upgrade telematics capabilities by setting up joint ventures, or cooperating with BATH (Baidu, Alibaba, Tencent and Huawei) to answer Chinese customers’ needs for services from in-vehicle entertainment to mobility. In the first ten months of 2020, joint venture brands boasted a telematics installation of up to 49.8%, closing the gap with their Chinese peers (57.7%) to 7.9 percentage points.

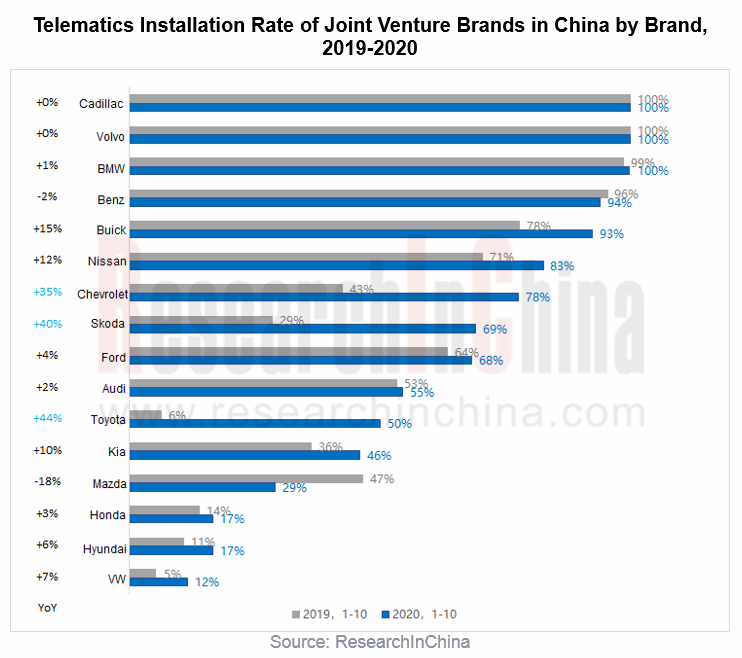

From January to October 2020, joint venture brands saw their installation of telematics jump by 14.3 percentage points from 35.6% in the prior-year period. Among them, the installation of Toyota, Chevrolet and Skoda all surged by over 30% on a like-on-like basis, because Toyota introduced Toyota Connect system into China in 2019, Chevrolet launched widely available MyLink+ system in the second half of 2018, and Skoda brought into use Skoda Connect system, a local telematics system for SAIC Volkswagen, in 2020.

In comparison, Audi and KIA post a relatively low installation, but they have set about deploying with great efforts. As an example, in December 2020 FAW Volkswagen Audi and Baidu Internet of Vehicles jointly released Audi Q2L T-Box; in October, Hyundai Kia forged a close partnership with Baidu on installation of Xiaodu In-Car OS in all future models planned to be sold in China and imported cars.

In future, joint venture automakers will head in the following directions:

1. It is estimated that their installation of telematics will outstrip 50% in 2020 and leap to around 70% in 2025.

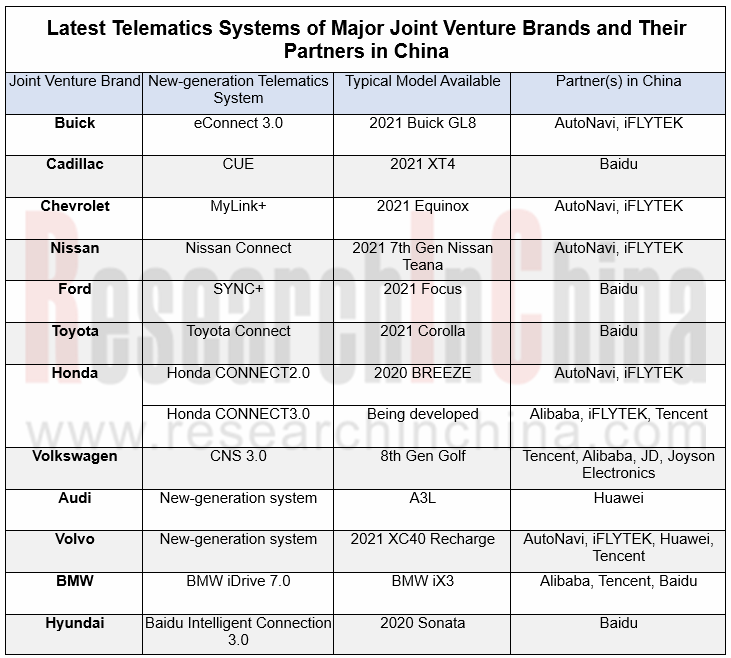

2. They will deliver better use experience to cater to Chinese clientele who has developed a unique habit of using internet, as they partner closely with Chinese companies like BATH (Baidu, Alibaba, Tencent and Huawei) to introduce new features in their IVI systems, including short video, group driving, delivery to car, biometrics, WeChat vehicle version, applets, and Huawei APP.

3. Accelerate iteration and upgrade of telematics system. IVI systems of joint venture brands like Toyota and Honda have yet to offer OTA updates, while Tesla, NIO and Xiaopeng Motors already provide full vehicle FOTA capability. In the second half of 2020, the mass-adoption of OTA updates by joint venture OEMs such as BMW and SAIC GM was enabled.

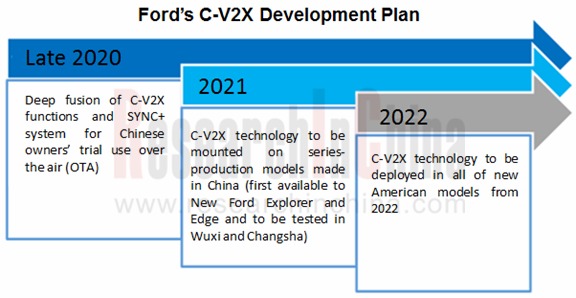

4. Apply V2X. For example, Buick has made it clear that its next-generation IVI system is to support V2X; Ford will roll out its first production model packing V2X capabilities in China in 2021.

In October 2020, BMW China released its “Customer Centric Digitalization Strategy” where China will go first in research and development, products, and user experience on the vehicle end. BMW announced the latest iDrive 7.0 OTA update for about 750,000 cars worldwide from October 19, 2020 onwards, including roughly 200,000 units in China.

BMW unveils a range of IVI system features for the Chinese market this year, including Ximalaya FM (in April 2020), Ixigua Short Video and a parking lot indoor map (in July 2020), upcoming Tencent Mini Scenario (within 2020), and WeChat vehicle version (in future). On this basis, for Chinese customers, BMW has also designed My BMW APP, an exclusive APP launched in September 2020 and offering more than 60 capabilities under three categories --“Car Selection, Service, and Social Contact”.

In future, BMW China will push on with development and launch of digital experience products for China through its Chinese R&D teams (with 1,100-plus talents including more than 400 software staffs) and its digital service outfit -- LingYue Digital Information Technology Co., Ltd. founded in 2019.

In July 2020, Dongfeng Nissan released its “Intelligent Connected Future” Program which highlights the following: 1. to launch 8 car models carrying Nissan Connect in 2020; 2. to equip 80% of its models with telematics systems in 2021; 3. to iterate Nissan Connect for four times during 2020-2024.

Nissan Connect, one of the five core technologies of Nissan Intelligent Mobility, encompasses six functional sectors (e.g., Remote Online, Online Control and Online Resources) offering 59 capabilities, of which 12 are included in the Online Resources sector, such as online payment (WeChat, Alipay and UnionPay Online Payment), account bound with third-party APPs, smart refueling (supporting online payments), and vehicle safety functions (violation query, safe arrival reminder, vehicle health monitoring and maintenance reservation). As of November 2020, Nissan Connect has been available to nine of Nissan’s models (2021) including Kicks, Tiida, Sylphy Classic, Sylphy, Qashqai, X-Trail, Murano and Teana.

In April 2019, Ford China announced “Ford China 2.0” strategy which contains “330” Product Plan, Smart Technology Plan, China Partner Plan, China Innovation Plan and China Talent Plan, among which Smart Technology Plan involves: 1. launching the new SYNC+ in-vehicle infotainment system together with Baidu; 2. Equipping most of Ford and Lincoln brand new cars made in China with SYNC+ system from 2019; 3. spawning the first C-V2X-enabled model in China in 2021.

As for telematics, Ford has built SYNC+, its new-generation in-vehicle infotainment system built on Xiaodu In-Car OS for the Chinese market. The IVI system is a fusion of capabilities such as Baidu AI Voice Assistant, Baidu Navigation and Baidu Home To Vehicle, as well as infotainment features like iQiyi, QQ Music and Himalaya FM, and is connected with FordPass APP for “IVI system-smartphone-home” interconnection.

In November 2020, Volvo’s new-generation IVI system was first seen in XC40 BEV. The system runs Google Android Automotive OS, and packs Huawei’s HMS for Car intelligent in-vehicle cloud service (that offers such application services as Huawei APP Store, Huawei Quick APP, Huawei Assistant Service, My Car, Huawei Music, and Huawei Video), iFLYTEK’s voice technology, Tmall Genie Car-Home Interconnection and Tencent Aiquting, among others.

OTA updates will bring features like WeChat vehicle version to Volvo’s new-generation IVI system. Furthermore, Volvo will team up with Huawei and China Unicom to create a next-generation 5G intelligent telematics system.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...