China Electric Vehicle Industry Report, 2013

-

May.2013

- Hard Copy

- USD

$2,200

-

- Pages:88

- Single User License

(PDF Unprintable)

- USD

$2,100

-

- Code:

WEW043

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,300

-

- Hard Copy + Single User License

- USD

$2,400

-

By 2012, 25 pilot cities had promoted 27,432 new energy vehicles totally within two years after the subsidy policy was implemented, including 23,032 ones used in public services and 4,400 ones bought by individuals.

In March, 2013, the Ministry of Finance, the Ministry of Science and Technology, the Ministry of Industry and Information Technology and Development and Reform Commission reached a consensus, determining to prolong the new energy vehicle subsidy policy by three years. The new subsidy policy emphasizes two aspects: First, it expands the scope of pilot cities; second, it plans to support energy-saving hybrid models with more subsidies. In addition, the new subsidy policy unifies the subsidies of all regions and changes the situation that subsidies vary from region to region.

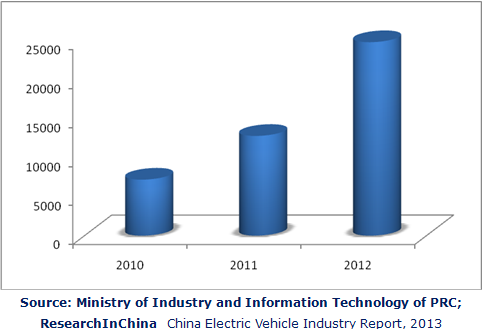

As new energy vehicles are demonstrated and popularized as well as individuals enjoy subsidies when purchasing new energy vehicles, the domestic output of electric vehicles still maintains a rapid growth. According to the Ministry of Industry and Information Technology, the output of 628 models included in Directory of Recommended Models of Energy-saving and New Energy Vehicles for Demonstration and Application hit 24,800 in 2012, up 94% year on year, of which there were 14,700 passenger cars and more than 10,000 commercial vehicles; there were 13,300 pure electric vehicles, 10,400 conventional hybrid vehicles, and more than 1,000 plug-in hybrid vehicles.

Output and Sales Volume of Electric Vehicles in China, 2010-2012

The report analyzes the industrial environments and market of electric vehicles, main demonstration cities, and major production enterprises. Besides, it studies the models contained in the demonstration and promotion directory released by the Ministry of Industry and Information Technology (As of April 2013, there had been 44 batches).

Anhui JAC Co., Ltd. is one of the first companies that are engaged in research and development of new energy vehicles in China. In 2009, JAC clarified that it targeted "pure electric vehicles”. In 2010 and 2011, JAC popularized 1,585 pure electric vehicles. As of the end of 2012, JAC had built a production line with an annual capacity of 20,000 electric vehicles. In accordance with the development plan, the company's annual electric vehicle capacity will reach 100,000 by 2015, and the models will extend from sedans to SUV, special vehicles and buses.

Anhui Ankai Automobile Co., Ltd. is a listed company designated by China to produce luxury buses. As of April 2013, Ankai's 44 hybrid and pure electric models had been incorporated in Directory of Recommended Models of Energy-saving and New Energy Vehicles for Demonstration and Application. It acts as one of leading players in the domestic new energy bus field. As of the end of 2012, Ankai had boasted over 1,000 new energy buses, which run in 27 cities including Beijing, Shanghai, Dalian and Hefei.

1. Overview of China Electric Vehicle Industry

1.1 Introduction and Classification of Electric Vehicle

1.1.1 Introduction

1.1.2 Classification

1.1.3 Technology Roadmap

1.2 Industry Chain

2 Chinese Policy on Electric Vehicle

2.1 Major Policies

2.1.1 Fiscal Subsidies Policy

2.1.2 Demonstration and Promotion Policy

2.1.3 Other Favorable Policies

2.2 Planning of Electric Vehicle Industry

2.2.1 Industry Planning

2.2.2 Technology Development Planning

2.2.3 Charging Station Planning

3 Regional Pattern of Electric Vehicle Industry in China

3.1 Development in Main Regions

3.2 Beijing

3.2.1 Status Quo

3.2.2 Development Planning

3.3 Shanghai

3.3.1 Status Quo

3.3.2 Development Planning

3.4 Tianjin

3.4.1 Status Quo

3.4.2 Development Planning

3.5 Chongqing

3.5.1 Status Quo

3.5.2 Development Planning

3.6 Shandong

3.6.1 Status Quo

3.6.2 Development Planning

3.7 Jilin

3.7.1 Status Quo

3.7.2 Development Planning

3.8 Jiangsu

3.8.1 Status Quo

3.8.2 Marketing Planning

3.9 Zhejiang

3.9.1 Status Quo

3.9.2 Development Planning

3.10 Anhui

3.10.1 Status Quo

3.10.2 Development Planning

3.11 Fujian

3.11.1 Status Quo

3.11.2 Development Planning

3.12 Jiangxi

3.12.1 Status Quo

3.12.2 Development Planning

3.13 Henan

3.13.1 Status Quo

3.13.2 Development Planning

3.14 Hunan

3.14.1 Status Quo

3.14.2 Development Planning

3.15 Hubei

3.15.1 Status Quo

3.15.2 Development Planning

3.16 Guangdong

3.16.1 Status Quo

3.16.2 Development Planning

3.17 Guangxi

3.17.1 Status Quo

3.17.2 Development Planning

3.18 Hainan

3.18.1 Status Quo

3.18.2 Development Planning

3.19 Hebei

3.19.1 Status Quo

3.19.2 Development Planning

3.20 Sichuan

3.20.1 Status Quo

3.20.2 Development Planning

4 Chinese Electric Vehicle Market

4.1 Market Size

4.2 Market Pattern

4.3 Electric Passenger Car

4.3.1 Market Pattern

4.3.2 Market Size

4.3.3 Major Companies

4.4 Electric Bus

4.4.1 Overview

4.4.2 Market Size

4.4.3 Major Companies

5 Key Electric Vehicle Companies in China

5.1 SAIC Motor

5.1.1 Profile

5.1.2 Operation

5.1.3 Electric Vehicle Business

5.2 FAW

5.2.1 Profile

5.2.2 Operation

5.2.3 Electric Vehicle Business

5.3 Dongfeng Motor Corporation

5.3.1 Profile

5.3.2 Operation

5.3.3 Electric Vehicle Business

5.4 BYD

5.4.1 Profile

5.4.2 Operation

5.4.3 Electric Vehicle Business

5.5 Changan Automobile

5.5.1 Profile

5.5.2 Operation

5.5.3 Electric Vehicle Business

5.6 Chery Automobile

5.6.1 Profile

5.6.2 Operation

5.6.3 Electric Vehicle Business

5.7 JAC

5.7.1 Profile

5.7.2 Operation

5.7.3 Electric Vehicle Business

5.8 Beijing Automotive Group Co.,Ltd (BAIC Group)

5.8.1 Profile

5.8.2 Operation

5.8.3 Electric Vehicle Business

5.9 GAC

5.9.1 Profile

5.9.2 Operation

5.9.3 Electric Vehicle Business

5.10 Ankai

5.10.1 Profile

5.10.2 Operation

5.10.3 Electric Vehicle Business

5.11 Xiamen King Long Motor Group Co.,Ltd.

5.11.1 Profile

5.11.2 Operation

5.11.3 Electric Vehicle Business

5.12 Zhongtong Bus

5.12.1 Profile

5.12.2 Operation

5.12.3 Electric Vehicle Business

5.13 Yutong Group

5.13.1 Profile

5.13.2 Operation

5.13.3 Electric Vehicle Business

5.14 Yangzhou Yaxing Motor Coach Co., Ltd.

5.14.1 Profile

5.14.2 Operation

5.14.3 Electric Vehicle Business

Classification of Electric Vehicles

Classification of Hybrid Electric Vehicle

Electric Vehicle Technology Focus in Main Countries or Regions

Technology Roadmap of China Electric Vehicle

Electric Vehicle Industry Chain and Extended Industries

Subsidies for Private Purchase of New Energy Vehicles

Electric Vehicle Subsidies in Major cities of China

Electric Vehicle Demonstration Cities And Local Car Manufacturers in China

Cities That Are Expected to Enter Electric Vehicle Promotion Directory

Models of electric sedans used by Communist Party and Government Organs, 2012

Investment of Local Governments in Electric Vehicles in China, 2011-2015

Key Technical Directions and Tasks for Electric Vehicles in China, 2011-2015

Electric Vehicle Charging Station Construction Planning in China by Region, 2011-2015

Electric Vehicle Capacity and Market Promotion Plan by Region in China, 2015E

Development Planning for New Energy Vehicle in Shandong Province, 2015E-2020E

Capacity Planning of Leading Electric Vehicle Companies in Henan Province, 2012-2020E

Key Supported Electric Vehicle and Parts Companies in Hebei Province

Output of Vehicles in China, 2005-2013

Sales Volume of Vehicles in China, 2005-2013

Output And Sales Volume of Electric Vehicles in China, 2010-2012

Electric Vehicle Output Structure (by Model) in China, 2012

Recommended Electric Vehicle Structure (by Model) in China, 2013

Recommended Models of China’s Electric Vehicle by Power Type, 2013

Recommended Models of China’s Passenger Car by Power Type, 2013

China’s Output of Passenger Cars, 2005-2013

China’s Sales Volume of Passenger Cars, 2005-2013

Electric Passenger Car Output and Share in China, 2011-2012

Leading Passenger Car Manufacturers in China, 2013

Marketing Vehicle Models of Major Chinese Electric Passenger Car Companies, 2013

Supporting of Major Chinese Electric Passenger Car Companies, 2013

Recommended Models of China’s Electric Buses by Power Type, 2013

Procurement Mode of China’s Electric Buses

China’s Output of Buses, 2005-2013

China’s Sales Volume of Buses, 2005-2013

China’s Sales Volume of Buses by Type, 2005-2013

China’s Sales Volume of Electric Buses, 2010-2012

Major Chinese Electric Bus Manufacturers, 2013

Suppliers of Components for Leading Electric Bus Companies

Auomotive Sales Volume of SAIC Motor, 2008-2012

Revenue and Net Income of SAIC Motor, 2008-2012

Revenue of SAIC Motor by Product, 2008-2012

Automotive Sales Volume of FAW, 2008-2012

Revenue and Total Profit of FAW, 2008-2012

Sales Volume of Dongfeng Motor, 2008-2012

Revenue of Dongfeng Motor, 2008-2012

Revenue and Net Income of BYD, 2008-2012

Automotive Sales Volume of BYD, 2008-2012

Automotive Sales Volume of Changan Automobile, 2008-2012

Revenue and Net Income of Changan Automobile, 2008-2012

Revenue Breakdown of Changan Automobile by Product, 2012

Automotive Sales Volume of Chery Automobile, 2008-2012

Automotive Sales Volume of JAC, 2008-2012

Revenue and Net Income of JAC, 2008-2012

Revenue of JAC by Product, 2008-2012

Automotive Sales Volume of BAIC Group, 2008-2012

Automotive Revenue and Total Profit of BAIC Group, 2009-2012

Automotive Sales Volume of GAC, 2008-2012

Revenue and Net Income of GAC, 2008-2012

Automotive Sales Volume of Ankai, 2008-2012

Revenue and Net Income of Ankai, 2008-2012

Revenue of Ankai by Product, 2008-2012

Automotive Sales Volume of Xiamen King Long Motor, 2008-2012

Automotive Revenue and Net Income of Xiamen King Long Motor, 2008-2012

Bus Sales Volume of Zhongtong Bus, 2008-2012

Revenue and Net Income of Zhongtong Bus, 2008-2012

Bus Sales Volume of Yutong Group, 2008-2012

Revenue and Net Income of Yutong Group, 2008-2012

Bus Sales Volume of Yangzhou Yaxing Motor Coach, 2008-2012

Revenue and Net Income of Yangzhou Yaxing Motor Coach, 2008-2012

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...