Global and China Automotive Magnesium Alloy Industry Report, 2012-2015

-

May.2013

- Hard Copy

- USD

$1,900

-

- Pages:72

- Single User License

(PDF Unprintable)

- USD

$1,800

-

- Code:

LPJ024

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$2,800

-

- Hard Copy + Single User License

- USD

$2,100

-

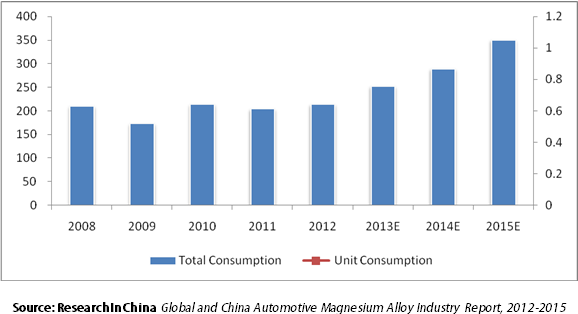

Global automotive magnesium alloy industry in recent years is getting out of the shadow of the financial crisis and magnesium price skyrocketing, both production and consumption have been restored. Favorable factors such as the rapid recovery of American and Japanese automobile industry, the upgrading of product structure of China’s automotive industry, international magnesium-aluminum price ratio back to less than 1.3, and the lightweight of vehicle all have provided impetus for the rebound of automotive magnesium alloy market. In 2012, the global automotive magnesium alloy consumption reached 214,000 tons, a year-on-year increase of 4.9%. During this period, China with rich magnesium resources and a huge automotive industry has become a hot spot for investments in the industry.

Global Automotive Magnesium Alloy Consumption, 2008-2015E (Unit: kt)

After 2008, affected by the increased tax rate of magnesium alloy exports as well as the rapid development of automobile industry, China’s automotive magnesium alloy industry showed contrarian growth against the financial crisis worldwide, thus changing the previous situation that domestic magnesium alloy auto parts mainly relied on imports. In 2012 China’s capacity of magnesium alloy auto parts reached 47,000 tons/a, and the demand over the corresponding period was 45,000 tons, a basic balance between supply and demand. However, as a great number of automotive magnesium alloy producers in China are the new entrants with weak technical reserves and products concentrated in the middle and low ends, high-end automotive magnesium alloys still depend on imports.

In nowadays China, joint venture branded vehicles occupy the main medium- and high-end market, which is precisely the most important consumer market for automotive magnesium alloy. These automakers are extremely concerned about the supply quality and stability of automotive magnesium alloy, which is also the basic literacy that some new manufacturers lack. For these reasons, magnesium alloy parts used in joint venture branded vehicles are often provided by regular suppliers, which increasingly becomes an obstacle to the development of new entrants. Moreover, products of Chinese firms are mostly concentrated in magnesium alloy wheel, steering wheel and other several products, with relatively single variety and narrow coverage, which to some extent also limits their development.

In China, following the structural upgrade of automobile industry, a step-by-step increase in the proportion of medium- and high-end cars, the clearer trend of automotive lightweight, the gradually improved production technology of automotive magnesium alloy, coupled with the effect of cancelling magnesium alloy export duties in January 2013 by China Customs, the demand for automotive magnesium alloy is expected to achieve sustained growth in future.

In addition to a detailed analysis on the development status of the global and China automotive magnesium alloy industry, this report also highlights the automotive magnesium alloy business of five multinational companies i.e. Meridian, STOLFIG, TAKATA, Autoliv and GF as well as 21 domestic companies e.g. Nanjing Yunhai Special Metals Co., Ltd., DongGuan EONTEC Co., Ltd. and Shanghai Meridian Magnesium Products Co., Ltd..

In response to the financial crisis, Meridian as the global automotive magnesium alloy industry leader has implemented strategic adjustment in industrial distribution since 2009, which has significantly improved capacity in key areas. In 2011, Meridian expanded operations in the UK and raised the capacity of local factories twice that of 2010. In May, 2012, the production capacity of Meridian’s joint venture in Shanghai, China saw an increase of 20%; followed by another rise of 30% in early 2013.

Beijing Guangling Jinghua Science & Technology Co., Ltd. (also known as “Gonleer”) is one of the major automotive magnesium alloy manufacturers in China. By 2004, the company has completed the whole industry chain layout from the upstream minerals to the downstream smelting and processing. In 2013, its products have covered five major areas i.e. magnesium and magnesium alloys, sacrificial anode, mechanical parts, sections and magnesium sheet, with annual capacity up to 50,000 tons, becoming a supplier of magnesium alloy auto parts for Volkswagen, Hyundai, Ford and other well-known carmakers.

Relying on its rich resources of magnesium and magnesium alloys, Nanjing Yunhai Special Metals Co., Ltd. has also achieved comprehensive coverage of the whole industry chain over the past few years. As a key supplier of magnesium alloy auto parts for Chery Automobile, the company reaches capacity of 3,000 tons/a automotive magnesium alloy in 2013.

1 Overview of Automotive Magnesium Alloy

1.1 Profile

1.2 Classification and Application

1.3 Industry Chain

2 Development of Global Automotive Magnesium Alloy Industry

2.1 Development Course

2.2 Production

2.3 Demand

2.3.1 Consumption

2.3.2 Main Customers

2.4 Market Competition

2.5 United States

2.5.1 Development Environment

2.5.2 Market Status

2.6 Europe

2.6.1 Development Environment

2.6.2 Market Status

2.7 Japan

2.7.1 Development Environment

2.7.2 Market Status

Summary

3 Development of China Automotive Magnesium Alloy Industry

3.1 Development Course

3.2 Development Environment

3.2.1 Policy Environment

3.2.2 Industry Environment

3.3 Production

3.4 Demand

3.5 Market Competition

3.6 Key Projects Planned and Under Construction

3.7 Problems

Summary

4 Key Companies Worldwide

4.1 Meridian

4.1.1 Profile

4.1.2 Automotive Magnesium Alloy Business

4.2 STOLFIG

4.2.1 Profile

4.2.2 Automotive Magnesium Alloy Business

4.3 TAKATA

4.3.1 Profile

4.3.2 Operation

4.3.3 Automotive Magnesium Alloy Business

4.4 Autoliv

4.4.1 Profile

4.4.2 Operation

4.5 GF

4.5.1 Profile

4.5.2 Automotive Magnesium Alloy Business

Summary

5 Key Companies in China

5.1 Nanjing Yunhai Special Metals Co., Ltd.

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Gross Margin

5.1.5 Automotive Magnesium Alloy Business

5.2 DongGuan Eontec Co., Ltd.

5.2.1 Profile

5.2.2 Operation

5.2.3 Production and Marketing

5.2.4 Key Projects

5.2.5 Automotive Magnesium Alloy Business

5.3 Shanghai Meridian Magnesium Products Co., Ltd.

5.3.1 Profile

5.3.2 Automotive Magnesium Alloy Business

5.4 Qingcoo Technology

5.4.1 Profile

5.4.2 Automotive Magnesium Alloy Business

5.5 Chongqing Magnesium Science and Technology Co.,Ltd

5.5.1 Profile

5.5.2 Automotive Magnesium Alloy Business

5.6 Faw Foundry Co.,Ltd

5.6.1 Profile

5.6.2 Automotive Magnesium Alloy Business

5.7 DY Group

5.7.1 Profile

5.7.2 Key Projects

5.7.3 Automotive Magnesium Alloy Business

5.8 Yinguang Magnesium Group

5.8.1 Profile

5.8.2 Capacity Expansion

5.8.3 Automotive Magnesium Alloy Business

5.9 Chongqing BoAo Mg-Al Manufacture Co.,Ltd

5.10 Yuyao Ruide Auto Parts Co., Ltd

5.11 Gonleer

5.11.1 Profile

5.11.2 Automotive Magnesium Alloy Business

5.12 Shenyang Jinbei Magnesium Auto-parts Co.,Ltd

5.13 Stolfig(Huaihua)

5.13.1 Profile

5.13.2 Automotive Magnesium Alloy Business

5.14 Huaying Magnesium Group

5.14.1 Profile

5.14.2 Key Projects

5.15 Ningxia Huameite Magnesium Alloy Manufacturing Co., Ltd.

5.15.1 Profile

5.15.2 Automotive Magnesium Alloy Projects

5.16 Chongqing Sun Magnesium Co.,Ltd

5.16.1 Profile

5.16.2 Automotive Magnesium Alloy Business

5.17 Jiangsu Yuantong Auto-parts Co.,Ltd

5.17.1 Profile

5.17.2 Automotive Magnesium Alloy Projects

5.18 Wuhu Magnesium Industrial Co., Ltd.

5.19 Others

5.19.1 Changzhou Precision Machinery Manufacturing Co., Ltd.

5.19.2 Weihai Wanfeng Magnesium Industry Science and Technology Development Co.,Ltd

5.19.3 Zhongshan Yuefumei Electrical Appliance Company Limited

Summary

Applications of Magnesium Alloy Auto Parts

Operational Performance of Typical Magnesium Alloy Auto Parts

Automotive Magnesium Alloy Industry Chain

Effects of Mass Reduction on 41 Kinds of Auto Parts by Adopting Magnesium Alloy Materials

Global Automotive Magnesium Alloy Output, 2008-2015E

Global Sedan/Commercial Vehicle/Car Production, 2008-2015E

Global Automotive Magnesium Alloy Consumption (Total vs. Per Vehicle), 2008-2015E

Application of Magnesium Alloy Parts in the World’s Major Car Brands, 2006-2012

Capacity and Products of the World’s Leading Automotive Magnesium Alloy Manufacturers, 2012

Automotive Material Structure in North America, 2020

Sedan / Commercial Vehicle / Car Production in the United States, 2008-2015E

Automotive Magnesium Alloy Consumption in the United States, 2008-2015E

Sedan / Commercial Vehicle / Car Production in Europe, 2008-2015E

Automotive Magnesium Alloy Consumption in Europe, 2008-2015E

Sedan / Commercial Vehicle / Car Production in Japan, 2008-2015E

Automotive Magnesium Alloy Consumption in Japan, 2008-2015E

Global Automotive Magnesium Alloy Production and Consumption, 2008-2015E

Policies on Automotive Magnesium Alloy Industry in China, 2007-2012

Primary Magnesium Production and Sales in China, 2008-2015E

Magnesium Alloy Production and Sales in China, 2008-2015E

China’s Magnesium Aluminum Spot Prices and Price Ratio, 2007-2013

China’s Automotive Magnesium Alloy Capacity, 2008-2015E

China’s Automotive Production by Type, 2008-2015E

China’s Automotive Magnesium Alloy Demand and Consumption per Vehicle, 2008-2015E

Capacity and Products of China’s Top 10 Automotive Magnesium Alloy Manufacturers, 2012

Client Distribution of China’s Top 10 Automotive Magnesium Alloy Manufacturers, 2012

Key Automotive Magnesium Alloy Projects Planned or Under Construction in China, 2013

China’s Automotive Magnesium Alloy Capacity and Demand, 2008-2015E

Capacity and Clients of Major Magnesium Alloy Auto Parts of Meridian, 2013

Production Bases and Corresponding Markets of Major Magnesium Alloy Auto Parts of Meridian, 2013

Major Clients of Magnesium Alloy Auto Parts Business of Meridian, 2013

Products and SOP Time of STOLFIG’s Production Bases

Magnesium Alloy Auto Parts Products and Clients of STOLFIG

Revenue and Net Income of TAKATA, FY2008-FY2015E

Sales and Profit of TAKATA by Region, FY2012

Revenue and Net Income of Autoliv, 2010-2015E

Revenue Breakdown of Autoliv by Region, 2012

Revenue Breakdown of Autoliv by Client, 2012

Output of Main Products of Autoliv, 2012

Production Bases and Capacity of Magnesium Alloy Auto Parts of GF

Capacity of the World’s Leading Automotive Magnesium Alloy Manufacturers, 2012

Revenue and Net Income of Nanjing Yunhai Special Metals, 2007-2015E

Revenue Structure of Nanjing Yunhai Special Metals by Product, 2010-2012

Gross Margin of Nanjing Yunhai Special Metals by Product, 2010-2012

Automotive Magnesium Alloy Capacity, Product Type and Clients of Nanjing Yunhai Special Metals, 2013

Revenue and Net Income of Dongguan Eontec, 2009-2016E

Revenue Structure of Dongguan Eontec, 2009-2012

Capacity, Output and Capacity Utilization of Products (by Product Weight), 2009-2016E

Output, Sales Volume and Sales-Output Ratio of Products (by Product Quantity), 2009-2011

Key Automotive Magnesium Alloy Projects of Dongguan Eontec

Revenue and Gross Margin of Magnesium Alloy Business of Dongguan Eontec, 2009-2012

Auto Parts Products and Clients of Shanghai Meridian Magnesium Products, 2013

Capacity of Qingoo Technology by Product, 2013

Magnesium Alloy Die Casting Project of Qingoo Technology, 2010-2011

Magnesium Alloy Auto Parts of Qingoo Technology

Automotive Magnesium Alloy Products of Chongqing Magnesium Science and Technology, 2013

Main Products and Capacity of Subordinate Units of Faw Foundry, 2013

Automotive Magnesium Alloy Products of Faw Foundry

Magnesium Alloy Deep-Processing Projects of DY Group

Capacity of Yinguang Magnesium Group by Product, 2013

Capacity of Magnesium Alloy Deep-Processing Products of Yinguang Magnesium Group, 2006-2015E

Automotive Magnesium Alloy Products of Yinguang Magnesium Group, 2013

Magnesium Alloy Auto Parts Products and Clients of Chongqing BoAo Mg-Al Manufacture, 2013

Automotive Magnesium Alloy Products of Yuyao Ruide Auto Parts

Organizational Structure of Gonleer

Capacity of Shenyang Jinbei Magnesium Auto-parts by Product, 2012

Automotive Magnesium Alloy Projects of Stolfig(Huaihua)

Sun Mountain Magnesium Alloy and Coal Chemical Recycling Economy Industrial Park Project of Huaying Group

Automobile Hub Project of Ningxia Huameite Magnesium Alloy Manufacturing

Capacity of Chongqing Sun Magnesium, 2012-2013

Magnesium Alloy Automobile Hub Project of Jiangsu Yuantong Auto-parts

Capacity of Magnesium Alloy Products of Wuhu Magnesium Industrial, 2013

Capacity, Products and Clients of Major Automotive Magnesium Alloy Manufacturers in China, 2012

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...