Global and China Tire Mold Industry Report, 2013-2014

-

June 2014

- Hard Copy

- USD

$2,000

-

- Pages:83

- Single User License

(PDF Unprintable)

- USD

$1,900

-

- Code:

LMX051

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$2,950

-

- Hard Copy + Single User License

- USD

$2,200

-

The Chinese tire mold industry prosperity rose again in 2013, with annual sales approximating RMB3.565 billion, up 18.44% YoY, mainly because domestic tire companies successively proposed and expanded tire projects against a sharp decline of rubber prices in 2013, which pulled the tire mold demand.

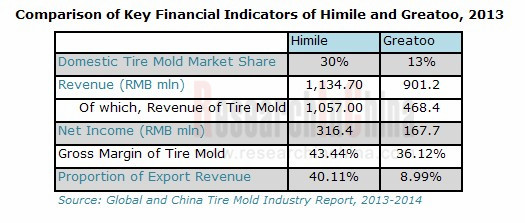

Judging from the earnings of key enterprises, China’s major tire mold enterprises showed varying degrees of growth in sales in 2013, of which, Shandong Himile Mechanical Science & Technology Co., Ltd. as the tire mold industry leader performed outstandingly, its sales from tire mold rose 57.11% YoY to RMB1.057 billion; followed by Greatoo Inc. whose tire mold sales attaining RMB468 million, up 14.04% YoY.

The high-speed growth in Himile’s tire mold business was mainly owing to its constantly-growing revenue from export sales, which accounted for 40.11% of the company’s total revenue in 2013, 2.96 percentage points higher than 2012, with CAGR up to 35% (2011-2013).

Meanwhile, Greatoo also continued to increase its investment in the tire mold business. In 2011, Greatoo put USD23 million into the radial tire mold production base construction in India; the project, put into production in 2012, now occupies about 30% share of India’s high-end tire mold market, with business radiation to the entire Southeast Asia. In July 2013, the “Large OTR and Special Tire Mold Expansion Project” went into operation, and brought benefit of RMB6.8355 million for the company that year.

Both Himile and Greatoo are actively moving into new areas and creating new profit growth points while constantly developing their main business. The former thorough the acquisition of the Group company’s assets expanded new business; the latter extended to the upper steam of the industry chain.

On December 12, 2013, Himile purchased large gas turbine parts processing business projects and assets of Himile Machanical Manufacturing Co., Ltd. under the Group company with RMB114 million.

By virtue of the higher product and technical level of molds, Chinese tire mold enterprises will continue to enhance their comprehensive strength in the future. In the context of China’s ceaselessly-growing production and ownership of cars, its tire mold industry is bound to keep steady growth.

Global and China Tire Mold Industry Report, 2013-2014 mainly covers the followings:

Development status, competition and trends of global tire mold industry;

Development status, competition and trends of global tire mold industry;

Policy environment, development history, corporate capacity, sales, competition pattern, corporate earnings of China tire mold industry;

Policy environment, development history, corporate capacity, sales, competition pattern, corporate earnings of China tire mold industry;

Demand analysis of China tire mold industry, mainly involving domestic sales, exports and tire mold replacement demand;

Demand analysis of China tire mold industry, mainly involving domestic sales, exports and tire mold replacement demand;

Analysis on four key enterprises worldwide, including the introduction to their tire mold business, corporate earnings, as well as their development in China;

Analysis on four key enterprises worldwide, including the introduction to their tire mold business, corporate earnings, as well as their development in China;

Analysis on 12 key enterprises in China, covering the introduction to their tire mold business, operating conditions, gross margin, revenue structure, major projects, as well as development strategy.

Analysis on 12 key enterprises in China, covering the introduction to their tire mold business, operating conditions, gross margin, revenue structure, major projects, as well as development strategy.

Preface

1. Overview of Tire Mold Industry

1.1 Definition

1.2 Classification

1.3 Upstream and Downstream

1.4 Production Process

1.5 Features

2. Development of Global Tire Mold Industry

2.1 Development Status

2.2 Competition

2.3 Trends

3 Development of China Mold Industry

3.1 Industry Policy

3.2 Development History

3.3 Capacity and Projects

3.4 Sales

3.5 Competition

3.5.1 Market Competition

3.5.2 Corporate Earnings

3.6 Existing Problems

4 Demand of China Tire Mold Industry

4.1 Overall Demand

4.2 Export

4.2.1 Tire Giants Reduce Mold Self-supply

4.2.2 Import Substitution Speeds up

4.3 Domestic Sales

4.3.1 Auto Production and Sales Rise

4.3.2 Global Tire Manufacturing Transfers to China

4.4 Replacement

5 Key Global Enterprises

5.1 Quality Mold Inc.

5.2 A-Z Formen- und Maschinenbau GmbH

5.3 HERBERT Maschinenbau GmbH & Co. KG

5.3.1 Profile

5.3.2 Main Tire Mold Products

5.4 SAEHWA IMC

5.4.1 Profile

5.4.2 Development History

5.4.3 Main Tire Mold Products

5.4.4 Operation

5.4.5 Development in China

5.4.6 Development Strategy

6 Key Chinese Enterprises

6.1 Shandong Himile Mechanical Science & Technology Co., Ltd.

6.1.1 Profile

6.1.2 Development History

6.1.3 Tire Mold Products

6.1.4 Operation

6.1.5 Revenue Structure

6.1.6 Gross Margin

6.1.7 R & D and Projects

6.1.8 Asset Acquisition

6.1.9 Clients

6.1.10 Performance Forecast

6.2 Greatoo Inc.

6.2.1 Profile

6.2.2 Tire Mold Products

6.2.3 Operation

6.2.4 Revenue Structure

6.2.5 Gross Margin

6.2.6 Clients

6.2.7 R & D and Projects

6.2.8 Into Intelligent Equipment Manufacturing Industry

6.2.9 Performance Forecast

6.3 Tianyang Mold Co., Ltd.

6.3.1 Profile

6.3.2 Operation

6.4 Shandong Wantong Mould Co., Ltd.

6.4.1 Profile

6.4.2 Operation

6.5 Dongying Jintai Rubber Machinery Co., Ltd.

6.6 Qingdao Yuantong Machinery Co., Ltd.

6.7 Hefei Dadao Mold Limited Liability Company

6.8 Shandong Hongji Mechanical Technology Co., Ltd.

6.9 Rongcheng Hongchang Mold Co., Ltd.

6.10 Anhui Mcgill Mould Co., Ltd.

6.11 Zhejiang Laifu Mould Co., Ltd

6.12 MESNAC Precise Processing Industry Co., Ltd.

7. Market Summary and Prospects

7.1 Market Summary

7.2 Prospects

7.2.1 Trends

7.2.2 Demand Forecast

Classification of Tire Mold

Classification of Segmented Radial Tire Mold

Upstream and Downstream of Tire Mold Industry

Comparison of Tire Mold Pattern Processing Technologies in China

Global Radial Tire Output and Its YoY Growth, 2007-2013

Business Modes of Major Tire Mold Manufacturers in the World

Global Tire Mold Market Share

Policies and Regulations on China Tire Mold Industry, 2005-2014

Development History of China Tire Mold Industry

Capacity of Major Tire Mold Manufacturers in China, 2013

Expansion Plans of Major Tire Producers in China

Sales of China Tire Mold Industry, 2010-2013

Product Comparison of Major Tire Mold Manufacturers in the World

Chinese Tire Mold Market Share

TOP 10 Tire Mold Manufacturers (by Sales) in China, 2013

YoY Growth in Revenue of Major Listed Tire Mold Companies, 2009-2014

YoY Growth in Net Income of Major Listed Tire Mold Companies in China, 2009-2014

% of Export Revenue of Major Listed Tire Mold Companies in China, 2009-2013

Cost Structure of Tire Mold Production in China

Tire Mold Demand-driven Factors in China

Foreign Tire Clients of Himile

% of Export Revenue of Himile, 2009-2013

Automobile Output and Its YoY Change in China, 2005-2013

Automobile Sales Volume and Its YoY Change in China, 2005-2013

Car Ownership per 1,000 People in Major Countries, 2011

Output of Global Major Tire Companies in China, 2008-2013

Output and YoY Growth of Rubber Tire Covers in China, 2007-2014

Output and YoY Growth of Radial Tire Covers in China, 2007-2014

Major Tire Mold Production Bases of Quality Mold Inc

Major Pattern Types of Tire Mold of Quality Mold Inc

Main Tire Mold Products of A-Z

Main Production Bases of HERBERT in the World

Main Tire Mold Products of HERBERT

Global Business Distribution of SAEHWA IMC

Main Production Bases of SAEHWA IMC in South Korea

Global Production Bases of SAEHWA IMC (Excluding South Korea)

Development History of SAEHWA IMC

Development History of SAEHWA IMC’s Products

Main Tire Mold Products of SAEHWA IMC

Turnover of SAEHWA IMC, 2011-2012

Operating Income and Profit of SAEHWA IMC, 2011-2012

Key Operating Indicators of SAEHWA IMC, 2010-2012

Key Operating Indicators of Tianjin Xinhan Mould, 2008-2009

Key Operating Indicators of Saehan (Tianjin) Mold, 2008-2009

Medium and Long-term Development Plan of SAEHWA IMC

Development History of Himile

Main Tire Mold Products and Applications of Himile

Revenue and Net Income of Himile, 2008-2014

Revenue Structure of Himile (by Product), 2011-2013

Revenue Structure of Himile (by Region), 2009-2013

Sales Gross Margin of Himile, 2008-2013

R&D Costs and % of Total Revenue of Himile, 2009-2013

Tire Mold Fundraising Projects of Himile

Business of Himile Group’s Major Companies

Tire Mold Clients of Himile

Revenue and Net Income of Himile, 2014-2016E

Major Tire Mold Products of Greatoo Inc.

Revenue and Net Income of Greatoo Inc., 2008-2014

Revenue Structure of Greatoo Inc. (by Business), 2012-2013

Revenue Structure of Greatoo Inc. (by Regions), 2008-2013

Gross Margin of Main Products of Greatoo Inc., 2012-2013

Global Client Distribution of Greatoo Inc.

Greatoo’s Major Clients at Home and Abraod

R&D Costs and % of Total Revenue of Greatoo Inc., 2008-2013

Main Fundraising Projects of Greatoo Inc.

Revenue and Net Income of Greatoo Inc., 2014-2016E

Sales of Tianyang Mold Co., Ltd., 2009-2013

Major Clients of Tianyang Mold Co., Ltd.

Tire Mold Products of Shandong Wantong Mould Co., Ltd.

Tire Mold Sales of Shandong Wantong Mould Co., Ltd., 2009-2013

Sales of Dongying Jintai Rubber Machinery Co., Ltd., 2011-2013

Sales of Qingdao Yuantong Machinery Co., Ltd., 2011-2013

Major Clients of Qingdao Yuantong Machinery Co., Ltd.

Sales of Hefei Dadao Mold Limited Liability Company, 2011-2013

Sales of Rongcheng Hongchang Mold Co., Ltd., 2011-2013

Sales of Anhui Mcgill Mould Co., Ltd., 2011-2013

Key Financial Indicators of MESNAC Precise Processing Industry Co., Ltd., 2012-2013

Changes in China Tire Radialization Rate, 2006-2012

YoY Growth in Output of Radial Tire Covers and Cars in China, 2007-2014

YoY Growt in Revenue of China Tire Manufacturing Industry, 2003-2014

Sales of China Tire Mold Market, 2014E-2017E

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...