Driven by market demand and policies, passenger cars equipped with L2 assisted driving functions have been mass-produced, which triggers enthusiastic market response and robust demand.

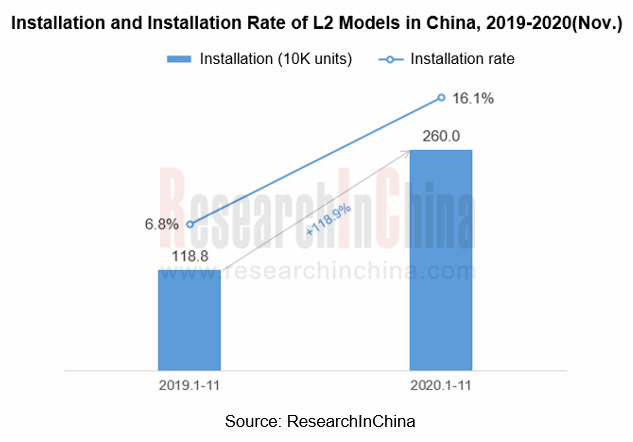

1. Installations of L2 autonomous driving functions increased by 118.9% year-on-year

In 2020, the automobile market was affected by the economic downturn and COVID-19. From January to November 2020, the number of passenger cars insured in China was 16.136 million, a year-on-year decrease of 7.5%. Among them, there were 2.60 million ones equipped with L2 autonomous driving functions, a year-on-year spike of 118.9%; the installation rate jumped 9.3 percentage points year-on-year to 16.1%. Plus multiple negative factors, installations of L2 autonomous driving functions bucked the trend to grow, with strong market demand.

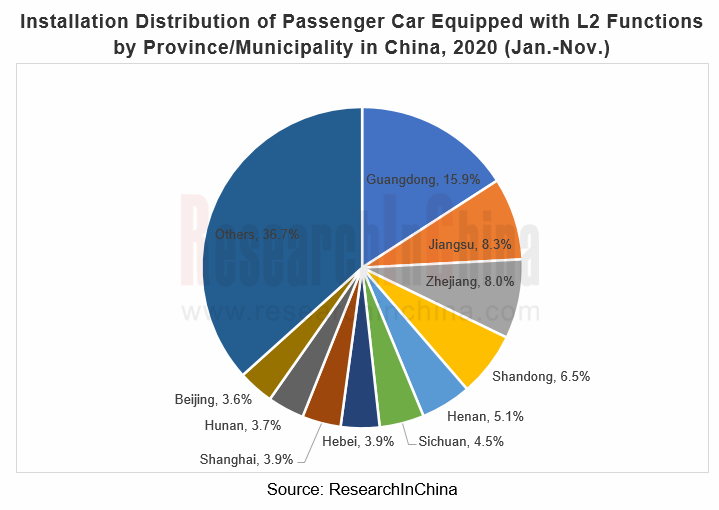

In terms of regions, models equipped with L2 autonomous driving functions are mainly sold to economically developed regions such as Guangdong, Jiangsu and Zhejiang. Among them, installations in Guangdong accounted for 15.9%, much higher than other provinces.

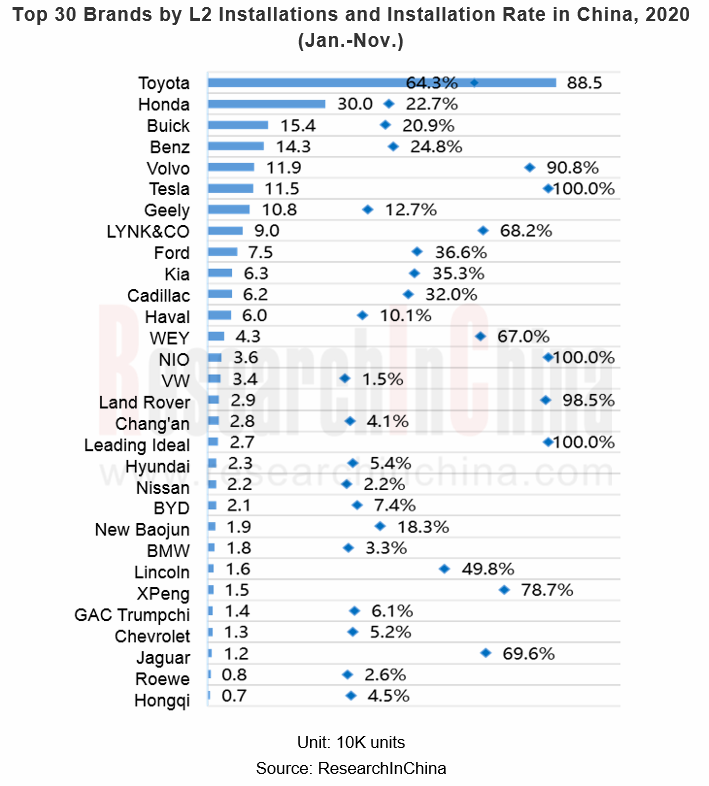

2. Emerging brands such as Tesla, NIO and Lixiang are more aggressive, with the L2 installation rate reaching 100%

From January to November 2020, a total of 57 passenger car brands (including 32 independent brands and 25 joint venture brands) in China launched L2 autonomous driving functions. Among them, 28 brands (including 11 independent brands and 17 joint venture brands) installed the functions on more than 10,000 cars.

From the perspective of installations, Toyota tops among the industry with 885,000 cars equipped with L2 autonomous driving functions. Its Toyota Safety Sense system has been installed on popular models such as Corolla, Levin, RAV4, AVALON, etc. to feature lane tracking assist (LTA), which can follow the preceding vehicle, provide some necessary steering operations, and keep the vehicle in the center of the lane when the lane line is difficult to identify in traffic jams, or follow the trajectory of the preceding vehicle at low speed.

As for installation rate, emerging automakers represented by Tesla, NIO and Lixiang adopt advanced electronic and electrical architectures to enable vehicles to achieve L2 or L2+ assisted driving functions through OTA upgrades, and further develop toward intelligence.

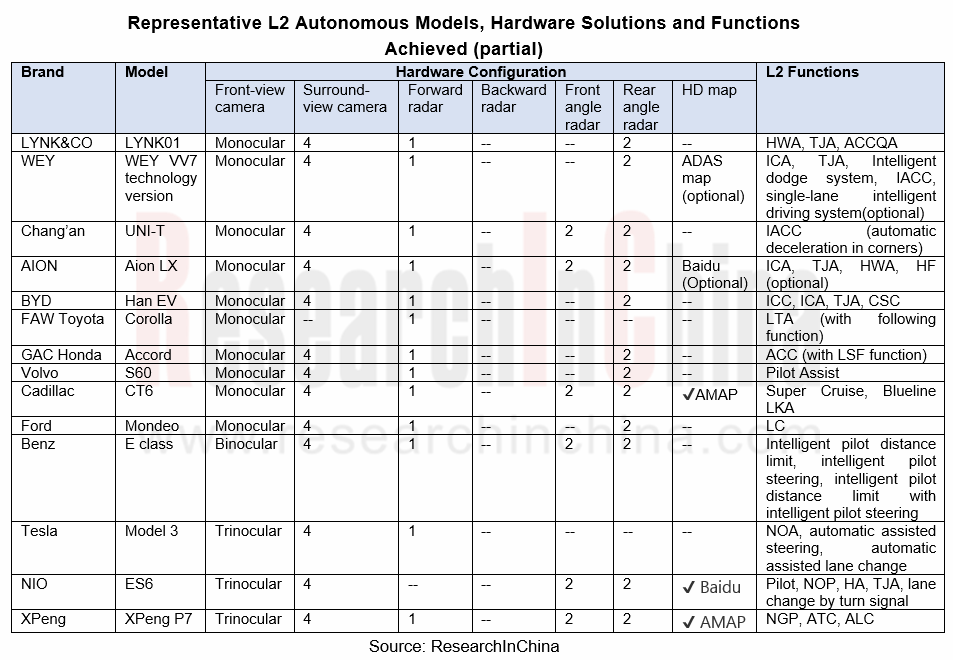

The current L2 autonomous driving functions are mainly divided into two categories: autonomous driving in a single lane, such as integrated adaptive cruise (ICA), traffic jam assist (TJA); autonomous driving that supports commanded lane changes, such as highway assist (HWA).

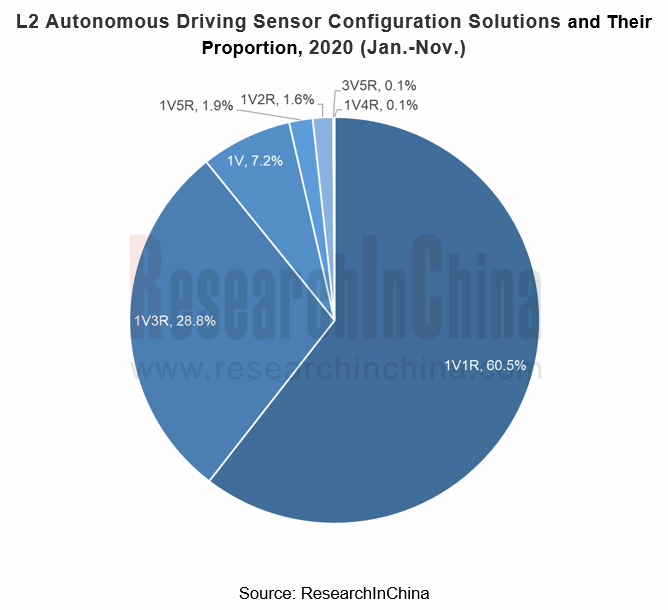

3. 1V1R is the mainstream sensor configuration solution

At present, the mainstream solutions of L2 autonomous driving include 1V1R (a camera + a forward radar) and 1V3R (a camera + a forward radar + 2 rear angle radar), which seize the combined market share of 89.3%; however, 1V1R enjoys the lion’ s share of 60.5%.

Given roadmaps or cost control, some automakers realize L2 autonomous driving through a single vision solution (1V). Some other manufacturers use 1V5R, 1V2R, 1V4R, 3V4R and the like to explore solutions and functions.

For example, NIO ES6 adopts the 3V4R solution

The 2020 NIO ES6 adopts a trinocular camera, 2 front-angle radars, 2 rear-angle radars, and a Mobileye chip to achieve Navigation on Pilot (NOP), Highway Pilot, and Traffic Jam Pilot (TJP), Auto-Lange Change (ALC) and many other L2 autonomous driving functions, and upgrade functions through OTA.

The trinocular camera used by NIO ES6 has wider field of view and higher accuracy than a monocular camera. The 52-degree camera detects general road conditions, the 28-degree camera detects long-distance targets and traffic lights, and the 150-degree camera detects the sides of the car body and cutting-in vehicles in short distance, with better front recognition performance.

In addition, ES6's NOP is based on the basic pilot functions, so that it can automatically switch high-speed lanes, enter or exit ramps according to navigation, and can intelligently adjust the cruising speed on the current road. Based on the realization of pilot lane keeping, ALC enables the automatic lane change of the vehicle by turning the turn signal lever.

4. L2 autonomous driving based on HD map is expected to prevail

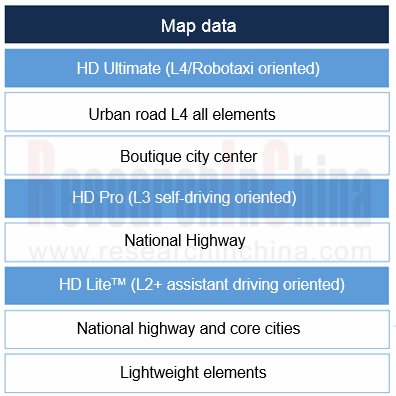

With centimeter-level accuracy and rich road information, HD map has become an indispensable element of L3-L5 autonomous driving. But with the deepening of L2 autonomous driving, HD map is expected to find a new scenario.

Some top automakers have tried to apply HD map to L2 autonomous driving:

Tesla, NIO, Xpeng and other emerging automakers have launched L2+ highway cruise based on navigation/HD map, and enabled autonomous driving on highways through navigation path planning.

In July 2020, SAIC-GM Cadillac CT6 equipped with the Super Cruise driver-assistance feature officially debuted. With HD map, Super Cruise can control vehicles on highways and keep them within lanes.

Map suppliers have also introduced corresponding solutions.

Baidu released ANP, a high-level intelligent driving solution based on HD map

In December 2020, Baidu released ANP (Apollo Navigation Pilot), a high-level intelligent driving solution based on HD map.

ANP is a low-level Apollo Lite which is Baidu’s L4 autonomous driving solution. Equipped with the HD map tailored by Baidu for autonomous vehicles, ANP not only supports highways and city loops, but also fits for urban roads. Through CVIS, the driving experience is close to the L4 Robotaxi.

NavInfo launched LitePilot, an HD map product for L2+ autonomous driving

NavInfo has launched HD map for L2+, L3, and L4-5 respectively. LitePilot, an HD map product for L2+ autonomous driving scenarios, can help vehicles drive through ramps, roundabouts and intersections, as well as prepare to turn right.

NavInfo HD map products for different scenarios:

Focusing on L2+ autonomous driving, HD Lite is currently the main product of NavInfo. Compared with HD Pro, HD Lite has fewer map elements, but it can provide autonomous driving map services with lower cost, wider area coverage and higher update frequency, enable highway and city map services, and accelerate the implementation of L2+ autonomous driving technology.

Under the background that L3 autonomous driving features have not been mass-produced, OEMs, integrators, map vendors and other industry chain companies will strive to maximize the capability of L2 autonomous driving and move closer to L3. HD map is expected to find new market space herein.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...