Autonomous Driving Tier1 Supplier Research: centralized implementation of L2+, middleware layout of Tier 1 suppliers

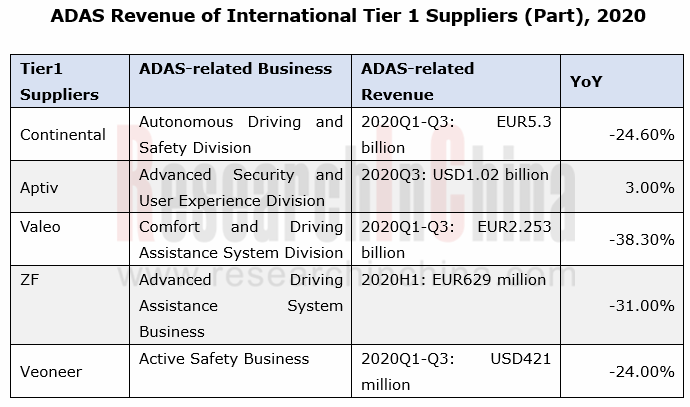

1. The ADAS revenue of foreign Tier 1 suppliers declines amid the pandemic

The outbreak of COVID-19 has led to the declining demand for automobiles and the temporary suspension of production in the automobile industry. In this case, the overall revenue of most Tier1 suppliers has fallen sharply as they have difficulties in business development. For example, more than 40% of Continental's 249 production bases around the world decided in April 2020 to temporarily suspend production for several days or several weeks in order to protect employees and respond to lower demand.

2. Tier 1 suppliers actively promote the mass implementation of L2 autonomous driving, and L3 autonomous driving enters the market

While Tier 1 suppliers' normal production is hindered, the technology of L2/L3 autonomous driving is advancing in an orderly manner.

From January to November 2020, 57 domestic auto brands launched 208 L2 models, and sold 2.60 million vehicles with a year-on-year upsurge of 118.9% thanks to the efforts of Tier 1 suppliers. For example, Bosch helped 40 local models achieve L2 autonomous driving in 2019, and focused on the implementation of L2+ autonomous driving in 2020.

Benefiting from the effective control over the domestic epidemic, Chinese Tier1 suppliers have constantly launched new products. Among them, Huawei and Baidu have attracted the most attention from the market. Huawei has successively unveiled perception layer products such as radar and LiDAR, as well as decision layer products like intelligent driving computing platform MDC and intelligent driving operating system AOS. Baidu APOLLO has released the autonomous driving computing platform ACU (1.0/2.0/3.0) and the L2 intelligent driving solution ANP, and also has successively landed in Changsha, Cangzhou, and Beijing with Robotaxi which is fully open to the society for operation.

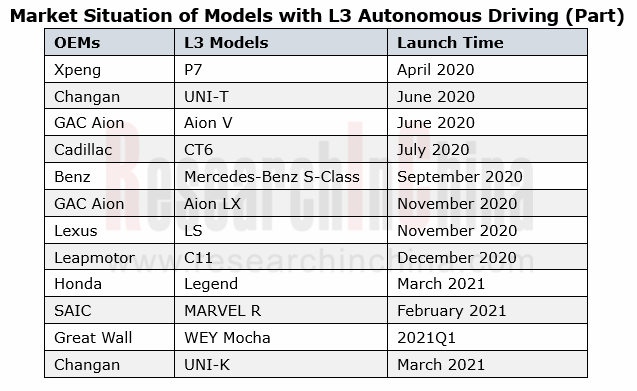

With the introduction of HD maps, Tier 1 suppliers have assisted OEMs to head towards L3 autonomous driving. Xpeng P7, GAC Aion LX and other models with L3 autonomous driving have debuted successively.

3. Foreign Tier 1 suppliers dabble in middleware, while domestic Tier 1 suppliers are deeply tied up with OEMs

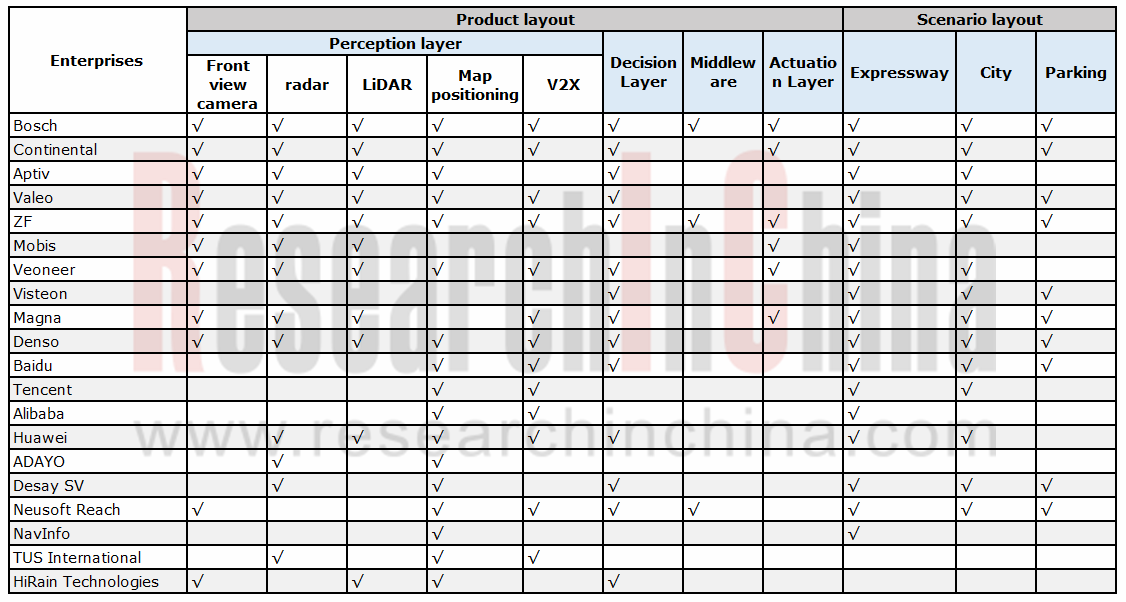

From the perspective of autonomous driving products and scenarios, Bosch, Continental and ZF have the most comprehensive layout among foreign Tier1 suppliers. Both Bosch and ZF launched middleware designed for autonomous driving in 2020. As for the domestic Tier 1 suppliers, Huawei and Desay SV take the lead in the perception layout; however, all the domestic Tier1 suppliers are absent in the field of actuation.

In July 2020, Bosch launched Iceoryx, a middleware for advanced autonomous driving, compatible with ROS2 and Adaptive AutoSAR interfaces to meet the requirements of different development periods (pre-ROS, mass production of Autosar).

In July 2020, Bosch launched Iceoryx, a middleware for advanced autonomous driving, compatible with ROS2 and Adaptive AutoSAR interfaces to meet the requirements of different development periods (pre-ROS, mass production of Autosar).

In December 2020, ZF released ZF Middleware, providing a modular solution that can be integrated into automakers' software platforms. At the same time, the middleware will be installed on mass-produced vehicles in 2024.

In December 2020, ZF released ZF Middleware, providing a modular solution that can be integrated into automakers' software platforms. At the same time, the middleware will be installed on mass-produced vehicles in 2024.

It is worth noting that foreign Tier 1 suppliers dabble in underlying system R&D and build a bridge between system and software applications while accomplishing functions. Bosch and ZF have successively released middleware products, hoping to centrally configure autonomous driving solutions for OEMs through a comprehensive sensor layout so as to simplify system integration, lower development costs and accelerate product launch.

The domestic Tier 1 suppliers (Huawei, Alibaba and Baidu) have teamed up with OEMs to launch autonomous driving and other technologies by in-depth cooperation or establishment of joint ventures to jointly help automakers build high-end brands or accelerate transformation to electrification, connectivity, intelligence and sharing.

Changan and Huawei. On November 14, 2020, Changan, Huawei and CATL established a new high-end smart car brand together. They will jointly develop the CHN smart electric vehicle platform, which will be equipped with Huawei's smart cockpit platform CDC, autonomous driving domain controller ADC, and some components of electric drive, batteries and electric control.

Changan and Huawei. On November 14, 2020, Changan, Huawei and CATL established a new high-end smart car brand together. They will jointly develop the CHN smart electric vehicle platform, which will be equipped with Huawei's smart cockpit platform CDC, autonomous driving domain controller ADC, and some components of electric drive, batteries and electric control.

SAIC and Alibaba. On November 26, 2020, SAIC and Alibaba jointly founded a high-end battery-electric vehicle brand "IM", which will adopt Alibaba's Banma Telematics system and SAIC's electric drive, battery, electric control and intelligent driving technologies.

SAIC and Alibaba. On November 26, 2020, SAIC and Alibaba jointly founded a high-end battery-electric vehicle brand "IM", which will adopt Alibaba's Banma Telematics system and SAIC's electric drive, battery, electric control and intelligent driving technologies.

Geely and Baidu. On January 11, 2020, Geely and Baidu erected a smart electric vehicle company. Baidu will fully empower the joint venture with technologies such as artificial intelligence, autonomous driving, Apollo, and Baidu Map.

Geely and Baidu. On January 11, 2020, Geely and Baidu erected a smart electric vehicle company. Baidu will fully empower the joint venture with technologies such as artificial intelligence, autonomous driving, Apollo, and Baidu Map.

4. Summary

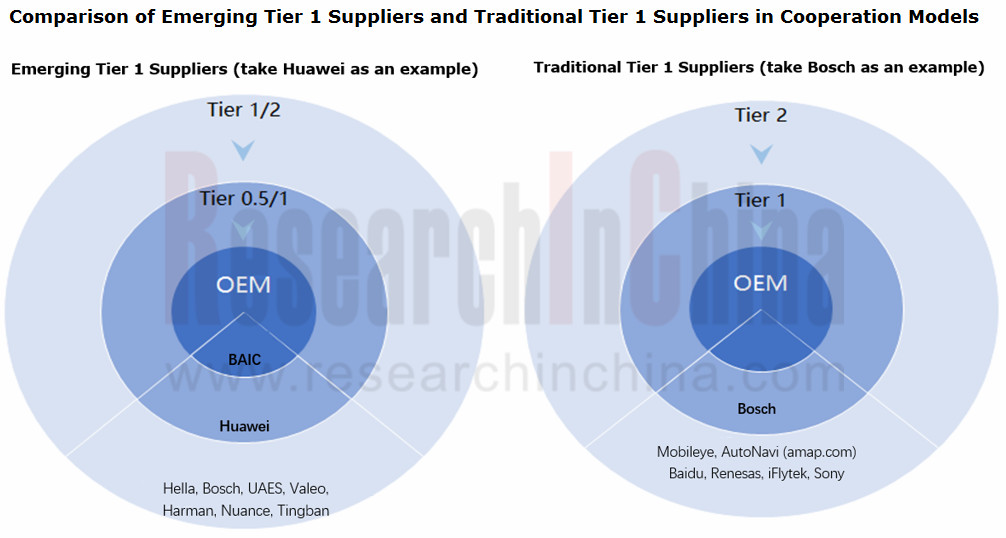

Comparing the development models of Tier 1 suppliers at home and abroad, emerging Tier 1 suppliers represented by Huawei and Mobileye directly penetrate into OEMs, deeply participate in product R&D, and position themselves as Tier 0.5 suppliers. For example, at the beginning of BAIC ARCFOX R&D, Huawei directly took part in R&D of many system functions of the vehicle, including smart driving, smart cockpit and smart electronics. Similarly, Mobileye acted as a Tier 0.5 supplier amid the cooperation with Geely Lynk & Co. Previously, Mobileye only supplied semi-finished components to Tier 1 suppliers, but now it is responsible for the complete solution stack for the first time, including hardware, software, drive strategy and control. Mobileye will also provide a multi-domain controller and provide software OTA updates after the system is deployed.

The emergence of the Tier 0.5 cooperation model will reshape the cooperation pattern of the traditional automobile industry chain.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...