China Automotive Distribution and Aftermarket Industry Report, 2020-2026

Since 4S store model was introduced in China at the end of the 20th century, China’s authorized dealer system has made a shift from single stores to corporate operation and from extensive management to fine management. For the upstream raw materials, components suppliers provide an array of components to automakers; at the midstream end are automakers which take on design, R&D, manufacture and branding; dealers are downstream players responsible for selling new vehicles and offering aftermarket services. In the whole industry chain, automakers that manage dealers by authorization and rebate policy play a dominant role and have a big say.

In 2019, China produced 25.72 million automobiles and sold 25.77 million units, down 7.5% and 8.2% on the previous year, up 3.3 and 5.4 percentage points, separately, according to the China Association of Automobile Manufacturers (CAAM). China’s automobile circulation industry faces unprecedented challenges as the automobile market is getting through an ever-colder winter. The automotive distribution industry however performs well as a whole. The data from the China Automobile Dealers Association (CADA) shows that in 2019, the top 100 dealers reported a combined output value of RMB1.74 trillion, up 6.3% compared with RMB1.63 trillion in 2018; their total asset investment was RMB802.4 billion, 5.7% less than in 2018 (RMB851.1 billion). In 2019, there were a total of 6,038 4S outlets in China, down 7.5% versus 2018 (6,529); total employment was 420,000 persons, a reduction of 10.6% from 470,000 in 2018.

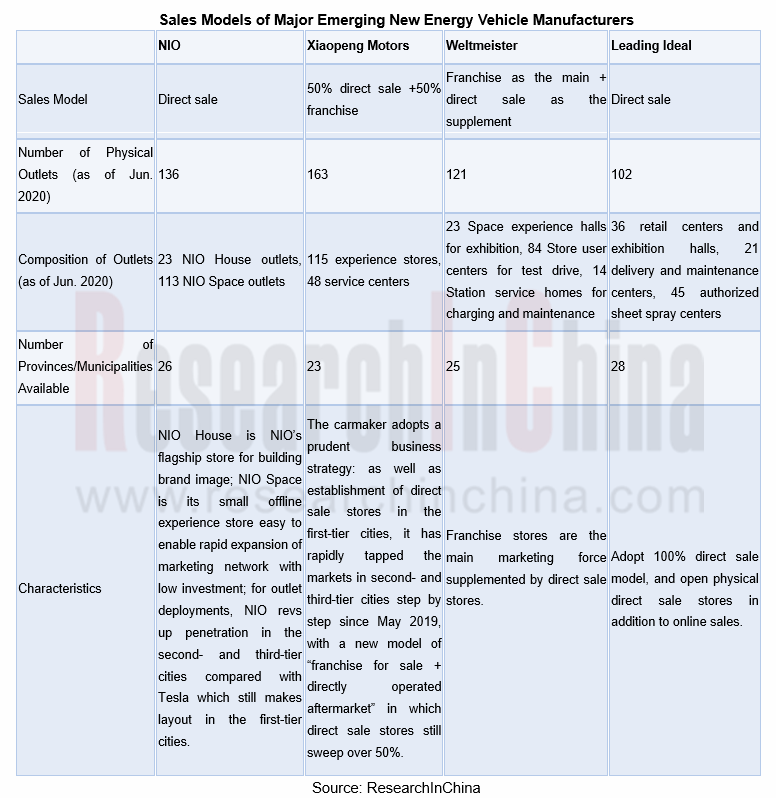

Emerging automakers adopt branding sales models and channels differing from the nationwide dealership model of conventional auto brands, changing from dealership model to direct operation of chain stores by auto brands or their cooperation with authorized dealers. The direct sale model offers totally different brand experience by providing full life cycle services for users, which serves as a solution to drawbacks of the common dealership model, such as non-transparent price and bad user service experience. Yet this model with some disadvantages like enormous investment and complicated operation process does not apply to all new energy vehicle manufacturers. 4S stores still need to shake up their service and profit structures even if they continue to employ the dealership model.

Automobile aftermarket refers to all the car-centric services needed by consumers in the period from post-sale to scrap. The growing aftermarket, especially maintenance and repair segment is accompanied by aging vehicles. That’s because the older the auto parts, the more frequent repairs they need and the more they cost. In current stage, the average vehicle in China is 5 years old, and those aged 4-10 seize over 58%. Vehicle aging, and increasing ownership are dual effective booster to prosperity of the aftermarket, making it a new industrial hotspot. The industry will usher in a boom period.

Automobile aftermarket involves maintenance and repair, auto finance, used car, rental, accessories, beauty and refit, recycling, and aftermarket alliance platform integration/car e-commerce, among which auto finance, maintenance & repair, and used car are the top three segments.

Used Cars

Factors such as household demand, profession, consumer preferences, etc. will prompt car owners to replace or resell their cars in the circulation market through used car dealers, used car e-commerce platforms and other channels. In recent years, the state and local governments will make more efforts to promote automobile consumption with favorable measures which will drive used car consumption and fuel Chinese used car market to grow with larger scale of transactions. In 2020, China saw approximately 14.34 million used cars transacted, with the estimated value of RMB888.8 billion. Although the annual transaction volume dropped by 3.9% in the entire 2020 due to the epidemic, the domestic used car transaction volume experienced consecutive growth from March to December. In the future, the used car market is expected to occupy more market share in the automotive aftermarket.

Repair and Maintenance

In the context of high ownership, aging of vehicles and changes in the maintenance concept, the auto repair and maintenance market continues to swell. The annual repair and maintenance cost increases year by year as vehicles become older, because the number of repairs and the expenses of each repair for old and worn auto parts jump each year. Learning from the experience of developed countries, China is about to see the demand for repair and maintenance hit the peak. In the past ten years, automobile sales volume has been impressive while the growth of new car sales volume has slowed down. In the future, the average vehicle age will continue to rise, which will boost the auto repair and maintenance industry into a golden age. The scale of China's auto repair and maintenance had reached approximately RMB1,332 billion as of 2019, and is expected to hit RMB2,458 billion by 2026, surpassing the auto finance market to rank first in the aftermarket. Amid the anti-monopoly, independent auto repairers are gradually eroding the market share of traditional 4S stores. With the help of the "Internet +" model, the independent repair model will develop more radically.

Auto Finance

Auto finance refers to a variety of financial products for companies, individuals, governments, automotive operators and other entities. It centers on automotive OEMs, stretching to the upstream and downstream of the industry, and eventually to end consumers. Typical auto finance products include dealer inventory financing, auto consumption loans, auto leasing and auto insurance. In recent years, the overall penetration rate of China's new car finance has ascended year by year, like 43% in 2019. According to the proportion of cars involved with financial products, the loan penetration rate is about 35% and the financial leasing penetration rate 8%, meaning loans still lead by a high margin. Compared with mature markets in Europe and America, China's auto finance market for new cars has enormous potentials. As terminal consumption upgrades and credit is widely accepted, auto finance will witness further growth. The car sales volume has fluctuated and the growth rate of the auto finance market has slowed down (about 20%) since 2017, but the momentum of auto finance is more robust than the trend of the car sales volume. In 2019, the overall scale of China's auto finance market reached approximately RMB1.58 trillion, of which licensed auto finance companies accounted for approximately 50%.

China Automotive Distribution and Aftermarket Industry Report, 2020-2026 sheds light on the followings:

Introduction to the automotive distribution industry and aftermarket, including definition, classification, industrial chain, business models, etc.;

Introduction to the automotive distribution industry and aftermarket, including definition, classification, industrial chain, business models, etc.;

Global and Chinese automotive distribution market scale and forecast, including total automobile sales volume, dealer networks, dealers’ automobile sales volume, competitive landscape, new energy vehicle sales models, etc.;

Global and Chinese automotive distribution market scale and forecast, including total automobile sales volume, dealer networks, dealers’ automobile sales volume, competitive landscape, new energy vehicle sales models, etc.;

Automotive aftermarket segments, including market size and forecast, competitive landscape, industry trends, etc. of auto finance, used cars, repair & maintenance, beauty, etc.;

Automotive aftermarket segments, including market size and forecast, competitive landscape, industry trends, etc. of auto finance, used cars, repair & maintenance, beauty, etc.;

Profile, business analysis, brand agency, business networks and marketing of major auto dealers in China.

Profile, business analysis, brand agency, business networks and marketing of major auto dealers in China.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...