Our Automotive High-precision Positioning Research Report, 2020-2021 highlights characteristics, industry dynamics and market size of different high-precision positioning technologies (based on signals, environmental features, inertial navigation, etc.), their application in automated driving (passenger cars, low-speed autonomous vehicles, special vehicles, etc.), OEM high-precision positioning solutions, and solution providers with different technology roadmaps.

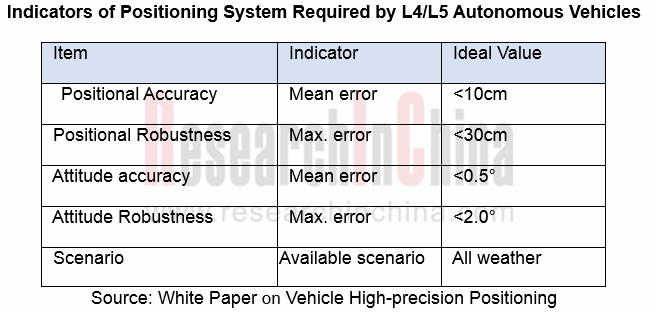

2020 C-V2X Cross-Industry & Large-scale Pilot Plugfest’s introduction of HD map/high-precision positioning technology indicates the significance of high-precision positioning to autonomous driving, especially highly automated driving that requires <10cm positioning accuracy.

The promising high-precision positioning market attracts quite a few new entrants.

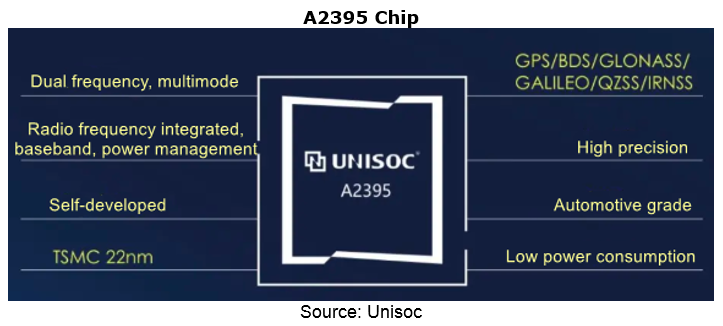

In November 2020, Unisoc released A2395, its first high-precision positioning 22nm chip featuring homemade CPU design. As China’s first automotive-grade dual-frequency positioning chip, A2395 supports L1+L5 dual-frequency positioning and delivers centimeter-level positioning accuracy 10 times higher than single-frequency ones.

In October 2020, BYD became the third largest shareholder of Allystar Technology (Shenzhen) Co., Ltd., a Beidou-based high-precision navigation and positioning chip vendor, after a capital increase.

In November 2020, BYD and Allystar formally started a lane-level positioning project, aiming to develop lane-level positioning vehicle models.

Providers race to deploy indoor and outdoor integrated positioning

Operation of multiple positioning technologies and construction of location-based service (LBS) platforms, including accuracy data feedback from satellite positioning, scenario positioning, and vehicle positioning, are a foundation for reliable high precision positioning, in addition to simple redundant design.

For higher level of automated driving needs both outdoor and indoor positioning, indoor and outdoor integrated high precision positioning technology will become a future trend, which means terminals will adopt the combination of technical means for indoor and outdoor scenarios.

Precise positioning for all scenarios will provide a critical guarantee for safe, reliable vehicle operation, contributing to massive commercial use of automated driving. In current stage, some positioning technology solution providers have begun to make deployments in this field.

In June 2020, Qianxun Spatial Intelligence Inc. (Qianxun SI) and Nullmax Inc. worked together on development of an indoor and outdoor integrated LBS solution which combines Qianxun SI’s indoor and outdoor high-precision positioning solution (RTK+UWB) and Nullmax’s perception, planning, control and visual simultaneous localization and mapping (VSLAM) capabilities for autonomous driving. Completely based on embedded system and automotive hardware, the solution can be really production-ready for OEM market.

In October 2020, Beijing NavInfo Internet Fund Management Center under NavInfo Co., Ltd. made an investment in Sichuan Zhongdian Kunchen Technology Co., Ltd., hoping to integrate the investee’s UWB positioning technology and products, coupled with high-precision satellite positioning technology (provided by Sixents Technology) and HD map (provided by NavInfo), to build map + positioning based indoor and outdoor integrated solutions.

In February 2021, Hi-Target Surveying Instrument Co., Ltd. and BlueIoT (Beijing) Technology Co., Ltd., an AOA solution provider (wholly owned by Tsingoal (Beijing) Technology Co., Ltd.) forged a strategic partnership. Combining Hi-Target’s high-precision positioning technologies (GNSS, IMU, HD map, etc.) and BlueIoT’s Bluetooth AOA/AOD high-precision positioning technology, the high-precision positioning capabilities available to all scenarios will be developed as a solution to challenges posed by integration and commercialization of positioning technologies for automated driving that integrates with CVIS V2X, automated parking and vehicle summon in a parking lot, for example. They plan to jointly release an all-scenario high-precision positioning solution for intelligent driving and human-vehicle interaction in the second half of 2021.

Chengdu Jingwei Technology Co., Ltd. projects to unveil its fourth-generation indoor and outdoor integrated positioning chip—JW900, in May 2021.

In October 2020, China Mobile launched OnePoint, its Beidou-based high-precision positioning service product. OnePoint offers 1 to 5cm-level dynamic high-precision positioning services and builds an all-weather, global accurate time and space service system for transportation fields from vehicle management and vehicle-infrastructure cooperation to autonomous driving and automated parking.

Mass-produced vehicle models with high precision positioning technology

In 2018, General Motors used Trimble RTX technology as the high-accuracy GNSS/GPS correction source to deliver absolute positioning to vehicles equipped with GM’s Super Cruise hands-free highway driving system, available on the 2018 Cadillac CT6.

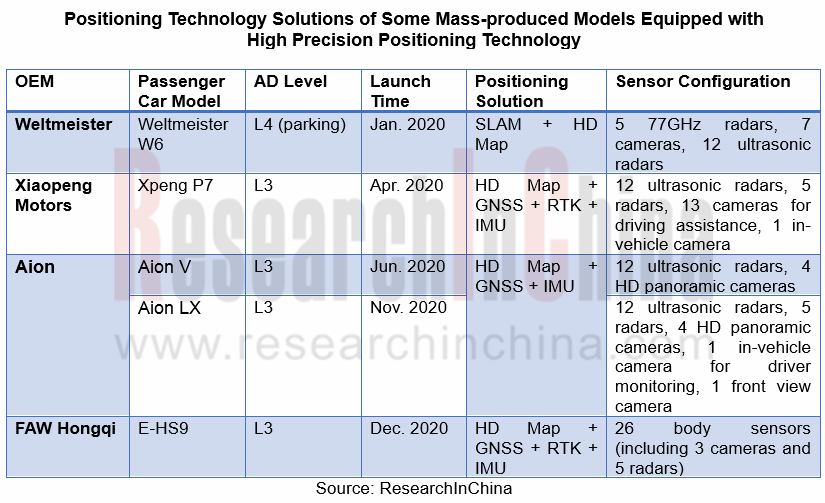

In 2020, 7 mass-produced models packing Qianxun SI’s high-precision positioning solution were launched on market, including GAC Aion V/LX, Xpeng P7, Hongqi HS5/H9/E-HS9 and SAIC-GM Buick GL8 Avenir.

As more L2+ and L3 vehicle models become available on market, high-precision positioning technology will be mounted on more models.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...