Research Report on Telematics Service Providers (TSP) and Their Products, 2021

Small and medium TSPs will fade away and TSP giants will come to the front

As “smart car as a service” grows, automakers focus more on introduction of technologies or platforms from big data and cloud computing to security, content platform and artificial intelligence, providing more intelligent, more diversified content and value-added services, while making an expansion in OEM market. As the gateway for vehicle traffic flow, telematics service providers (TSP) are catering to the industrial change by constantly extending services content and boundaries, across fields from initial remote service to phone mirroring and connectivity, then to connected IVI system, finally to integrated telematics system covering people, vehicle and life.

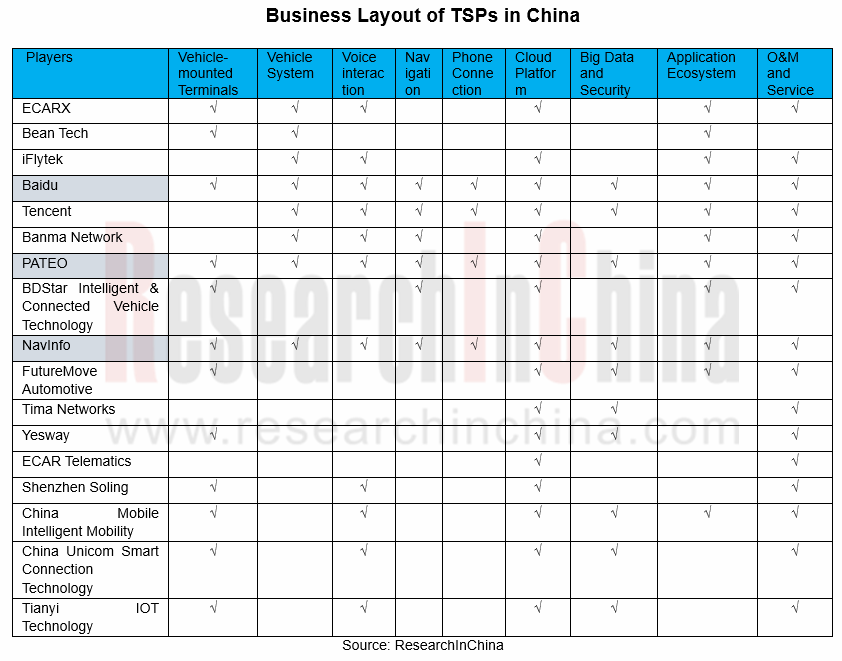

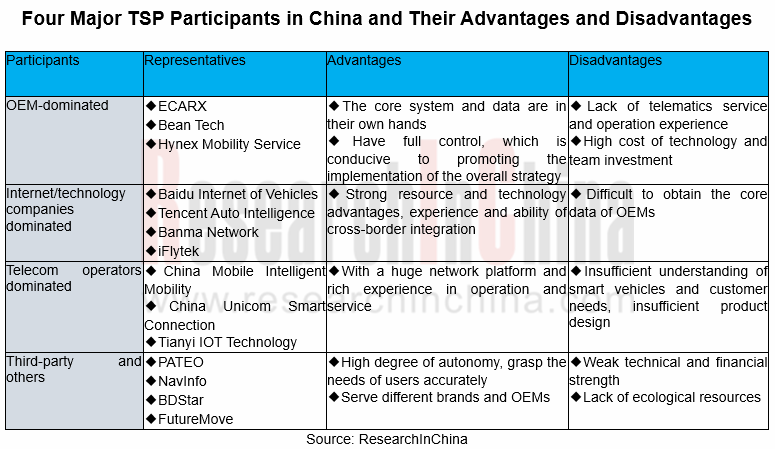

There are four typical types of TSPs: OEMs, telecom operators, internet/technology companies, and third-party platform providers. These players have built a mode of multi-party cooperation. For example, OEMs push for their partnerships with BATH, Pateo and more in their efforts to improve their ability to develop telematics and provide services, and work together with telecom operators to explore 5G + telematics application scenarios and application ecosystem. In the long run, the four major participants will integrate with each other across fields for win-win cooperation.

In future, China’s TSP industry will head in the following directions:

1. The closer connection of a vehicle with people, other vehicles, smart home appliances, living services and smart city comes with TSPs’ greater attempts to extend their services and open up their technology and ecosystem for a gradual coverage of all scenarios of mobile phone, car, home and city.

For example, based on extended BATH ecosystem (Baidu, Huawei, Tencent, Suning, Ping An, UnionPay, China Telecom, etc.) and third-party ecosystem, Pateo has made deployments in mobile phone, car, home and city scenarios, and will add “five new operations”, i.e., New Mobility, New Finance, New Retail, New Insurance and New Marketing. Now it has carried out its landing of new car retail strategy together with New Baojun and Sunning Car.

2. As cross-field integration becomes normal, players will achieve complementary advantages, resource sharing, and ecological integration to build a large ecosystem ultimately.

Examples include Baidu, Alibaba and Tencent (BAT) which are establishing closer partnerships with OEMs in more areas. Among them, in late 2020 Alibaba joined hands with SAIC again to set up IM Motors in charge of developing smart electric vehicles, following their establishment of Banma Network Technology (which finished strategic restructuring with AliOS in May 2020, aiming at improving automotive operating system and AI technology and upgrading the cloud-network-edge-terminal open system); based on their in-depth cooperation on intelligent connectivity, cloud technology and Baidu Ecosystem, Baidu and Geely announced they would co-found an intelligent vehicle company in January 2021, with Jidu Auto coming into being on March 2.

3. OEMs-lead TSPs to provide better IVI system-centric services.

Currently, OEMs have found common ground on intelligent connectivity and digital transformation acceleration. To hold core technology and data, Geely, Great Wall Motor and Honda China have founded their telematics company independently or together with others, with IVI system at the core of their multi-directional deployments:

ECARX: by the end of 2020, GKUI ECARX designed for Geely has been found in more than 40 models under Geely, Lynk & Co, Proton and served a total of over 2.3 million users.

On this basis, ECARX built in-depth cooperation with Baidu, with GKUI19-enabled Boyue PRO access to Baidu Map and Baidu Scenario for recommendation in 2020;

In November 2020, Baidu Map vehicle version became first available to Geely Preface upgrade edition.

In October 2020, ECARX raised RMB1.3 billion in a Series A funding round led by Baidu, which will be spent developing its automotive chip business.

In February 2021, ECARX joined hands with Visteon and Qualcomm to jointly provide intelligent cockpit solutions for the global market; in the same month, ECARX was invested USD200 million in its A+ funding round, which will be used for building an international R&D system and further expanding its global operation.

Bean Tech: Haval Fun-Life 2.0 system co-developed by Bean Tech and Haval integrates with Tencent TAI 3.0 features, and has been installed in several models like Haval Big Dog, Haval F7, Gen 3 H6, and WEY Tank 300. In future, Bean Tech will partner more closely with Haval and Tencent to promote its cloud services (supplied by Tencent Cloud Platform) in Great Wall Motor’s overseas markets and provide full-stack intelligent marketing closed loop services from user profiling and SCRM to advertising and user operation.

4. TSPs face intensified competition and a new reshuffle amid telematics industry change, with four or five giants expected to be born by 2025

Currently, most conventional TSPs have been acquired and integrated into other business by tycoons. A handful of TSPs can run independently. Even Baidu, Alibaba, Tencent and Huawei (BATH) are able to deploy just one of dozens of intelligent connected vehicle product lines each. As OEMs regain dominance in software development, TSPs will contend more fiercely and face a new reshuffle. It is predicted that by 2025, four or five bellwethers that have ability to develop full-stack telematics systems and link vehicles with V2X equipment facilities, earphones, watches, bracelets and various IOT (Internet of Things) device will come out. Small and medium TSPs will be edged out by TSP giants.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...