TOP4 Emerging Automakers’ CASE Layout and Strategy Research Report, 2020

Our TOP4 Emerging Automakers’ CASE Layout and Strategy Research Report, 2020 highlights in-depth analysis of CASE situation (connectivity, automation, sharing and electrification) of NIO, Xiaopeng Motors, Weltmeister and Leading Ideal.

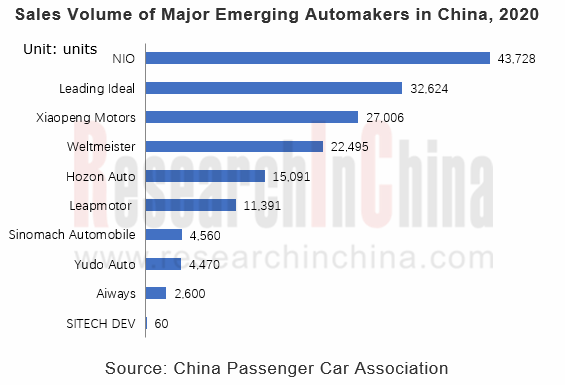

By sales, vehicle model and brand recognition, NIO, Leading Ideal, Xiaopeng Motors and Weltmeister are the first-echelon emerging automakers in China.

Favored by investors, the top four emerging automakers have raised more than RMB100 billion in all.

Internet firms and strategic investment companies are particularly optimistic about intelligent new energy vehicles, and some investors make simultaneous deployments of more than one emerging automakers. Examples include Sequoia Capital investing NIO, Xiaopeng Motors and Weltmeister, and Tencent that has funded NIO, Weltmeister and Aiways. Local governments attract new energy automakers to settle as well. For instance, NIO secured RMB7 billion strategic investment from Hefei in April 2020; Xiaopeng Motors raised RMB4 billion from Guangzhou Development District in September 2020.

As of December 2020, NIO has closed 14 funding rounds and raised around RMB71.3 billion, the largest amount among all emerging automakers in China; Xiaopeng Motors has obtained approximately RMB51.8 billion in its 15 funding rounds; a total of 8 funding rounds have raised over RMB30 billion for Weltmeister; Leading Ideal has reported 8 funding rounds and raised funds of more than RMB32.9 billion.

This report summarizes fives reasons why emerging automakers are a hotspot for investors and explains what emerging automakers mean.

1.Adopt direct sales or partially direct sales model, with digital operation covering full life cycle of vehicle.

Through the lens of business model, emerging automakers employ direct sales or partial direct sales model, which means they put greater emphasis on user operation and bind themselves to users for close communication. An example is NIO which uses fully direct sales model where car picking and customization are done online and most customer feedback and communications are carried out offline. NIO House provides car owners with free meeting rooms and libraries, among others. NIO APP connects users in full life cycle from pre-sales consultation to online picking and reservation for test drive, then to fully digital tracking in after-sales service, enabling the carmaker to know using habit, needs and preference of its users and potential users. Moreover, NIO APP that is open to NIO users or non-users, allows them to contact with each other or share experience in the community, not only improving customer loyalty but enlarging fan and potential user bases.

Xiaopeng Motors adopts a model of partially pre-sales franchise and fully direct after-sales service, paying more attention to after-sales service experience. It has three types of physical stores: 2S (experience + sales), 2S (delivery + service), and 4S (experience + sales + delivery + service).

Weltmeister sets up “new 4S” outlets: Space (experience store, displaying its products and providing premium fan services), Store (user center, offering test drive, delivery, maintenance, mobility, charging, etc.), Station (service home, after-sales services, e.g., charging, maintenance and repair and emergency rescue), and Spot (E station, convenient services, e.g., car washing, beauty and daily maintenance, being planned).

Leading Ideal uses a direct pre-sales and after-sales franchise model where retail and delivery centers are set up separately. In future, the carmaker will increase its service outlets, expectedly up to over 1,000 in 2024.

2. Superior autonomous driving configurations for new cars, especially ET7, pose great stress to conventional automakers.

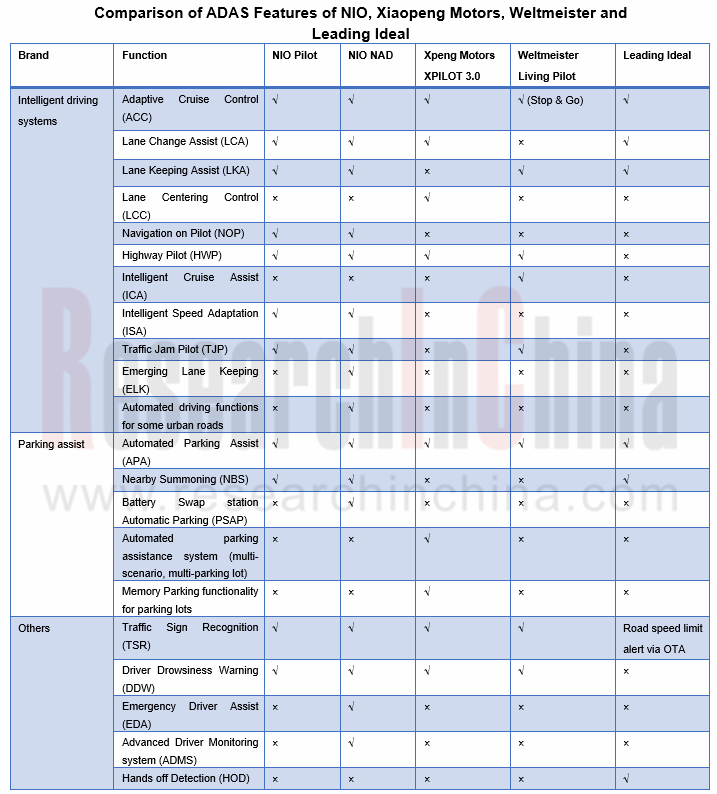

NIO Autonomous Driving (NAD), a safety and driving assistance system mounted on ET7 which was launched in January 2020, delivers functions such as advanced driver monitoring system (ADMS), autonomous driving (available to some urban roads and closed highways), and low-speed automated parking (fully automated parking pilot, remote parking, remote summon, narrow road passing and reversing in a parking lot), and driving assistance (navigation on pilot (NOP) and auto lane change (ALC)). ET7 features 1016TOPS computing force, 300-channel LiDAR, 2 positioning units, V2X vehicle-infrastructure cooperation and perception, and higher precision hardware like ADMS, supporting future upgrades to more functions.

New car launches like ET7 make emerging automakers stay ahead in the race to configure intelligent connected vehicle capabilities, weighing heavily on conventional automakers.

Xiaopeng Motors’ XPILOT 3.0 boasts navigation guided pilot (NGP) and a Memory Parking functionality for parking lots. The NGP highway solution enables traffic cone recognition and avoidance, super follow-up on congested roads, night overtaking reminder, faulty vehicle avoidance, large truck avoidance, automatic speed limit adjustment, optimal lane selection, automatic on/off-ramp, and automatic overtaking, and works on highways, expressways, and some urban trunk roads. The automaker plans release of mass-produced intelligent vehicles equipped with Lidar and L3 autonomous driving function in 2021, L4 autonomous driving technologies in 2023 and implementation of XPILOT 5.0 in 2025 to realize L5 full automation.

Weltmeister and Baidu partner more closely. Their L3 driving assistance functions are expected to be rolled out and mounted on mass-produced cars in 2021.

Leading Ideal plans to deliver navigate on autopilot (NOA) capability between 2021 and 2022, and introduce X01, a model with standard configurations of L4 hardware and single NVIDIA Orin SoC that affords 200TOPS computing force (upgraded to dual SoC, 400TOPS) and 45W power consumption.

3. Brand-new architecture design allows for more frequent OTA updates and rapid function iteration

As of December 2020, NIO’s IVI system has undergone 16 OTA updates, every 1.9 months a time on average, of which at least 7 OTA updates were on the intelligent voice system NOMI, which totally added 8 features and optimized 3 functions. NOMI that increased 6 new in-vehicle control functions in the latest update, is expected to achieve more control features. Moreover, the digital operation throughout the life cycle enables NIO to collect user data quickly for offering targeted better product experience.

Xiaopeng Motors backed by Alibaba, introduces applets like Tmall Yangche, Tao Piao Piao, Fliggy, Ele.me, Che Dian Dian, Tuhu, AliHealth and Umetrip, and provides more convenient services, for example, when a vehicle knows the driver goes to the office, an applet will wake up itself to ask if there is a need to reserve breakfast.

Weltmeister and Xiaomi have established a close partnership. Xiaoai Speaker allows users to control their vehicle remotely and also to control 8 categories of Xiaomi smart home appliances in over 20 kinds just in their vehicle.

4. Adopt a totally new mode of hardware first and charged software upgrade

As a pioneer of the “embedded hardware + charged software unlock” model, Tesla is expected to introduce FSD subscription service before July 2021. Charged software service has been a business model of Tesla.

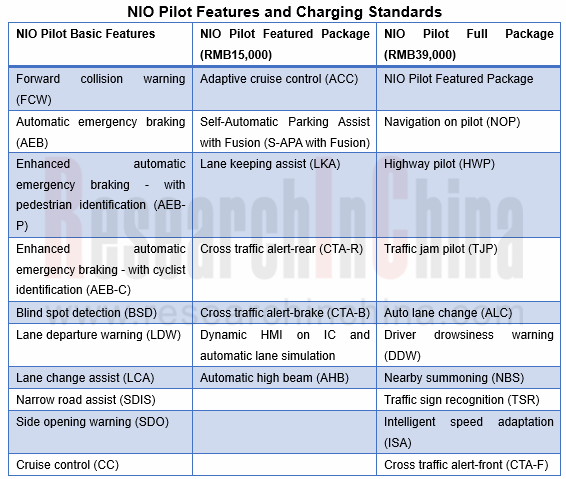

Following Tesla that has rolled out its software service model, NIO and Xiaopeng Motors have unveiled related services as well. For instance, NIO Pilot Featured Package service priced at RMB15,000 incorporates such capabilities as automated parking system and adaptive cruise control, and NIO Pilot Full Package service priced at RMB39,000 offers navigation on pilot, automated driving in traffic jams and other functions.

Xiaopeng Motors’ XPILOT 3.0 software and upgrade services are split into: Standard Lifetime Service (RMB36,000), Preferential Lifetime Service ordered with car (RMB20,000), and Yearly Service (RMB12,000/year).

5. Emerging automakers hoard more R&D talents and constantly enlarge their software talent base.

In 2020, NIO had a R&D workforce of 3,400, or 50% of its total employees; as of June 2020, Xiaopeng Motors has hired 3,676 persons in all, including 1,570 R&D workers, or 42.7% of the total; Leading Ideal’s Shanghai R&D Center plans to employ 2,000 engineers and add another 300 persons in its 300-person automated driving R&D team by the end of 2021, with half R&D budget to be spent on autonomous driving.

Comparably, conventional automakers have 10%-20% R&D employees, lack of software talents, especially the top-class software engineers who prefer emerging automakers with internet/IT genes. Yet they learn fast how emerging bellwethers make successes, and have begun to rid themselves of old systems in order to build themselves into innovative companies. For example, Geely and Baidu co-funded Jidu Auto; SAIC and Alibaba jointly founded IM Motors; Great Wall Motor set up HAOMO.AI, its autonomous driving subsidiary which introduces former Baidu worker Gu Weihao as CEO.

Mutual contest and learning between emerging and established automakers is a booster to make the Chinese automotive market the most innovative and dynamic one across the globe.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...