As the electric vehicle market is developing rapidly, new energy vehicle power electronics see a lucrative development opportunity

According to EV Sales, the global electric vehicle sales volume soared by 249% year-on-year to 392,000 units in April 2021. As the electric vehicle market is developing rapidly, new energy vehicle power electronics see a lucrative development opportunity. New energy vehicle power electronics generally include motor controllers (including inverters) and automotive power supplies (automotive chargers and DC/DC).

I. Motor Controller Market

1. BYD leads the highly competitive motor controller market

Benefiting from the rapid development of China's local new energy vehicle brands, Chinese local motor controller vendors led by BYD have obvious advantages in the motor controller market. In 2020, BYD still ranked first with a market share of 13.6%; among the top 10 companies, 7 are Chinese local vendors, except two foreign companies Tesla and Nidec as well as UAES, a Sino-foreign joint venture.

2. Motor controllers are developing towards integration and high voltage

Electronic control is developing towards integration, and three-in-one drive system will become the mainstream

Motor controllers gradually develop from a single function to multi-functional integration, and the integration of motors and electronic control has become a major trend, among which three-in-one electric drive system will become the mainstream. In 2020, China's passenger car three-in-one electric drive system shipments exceeded 500,000 sets, accounting for about 37% of motor controller shipments.

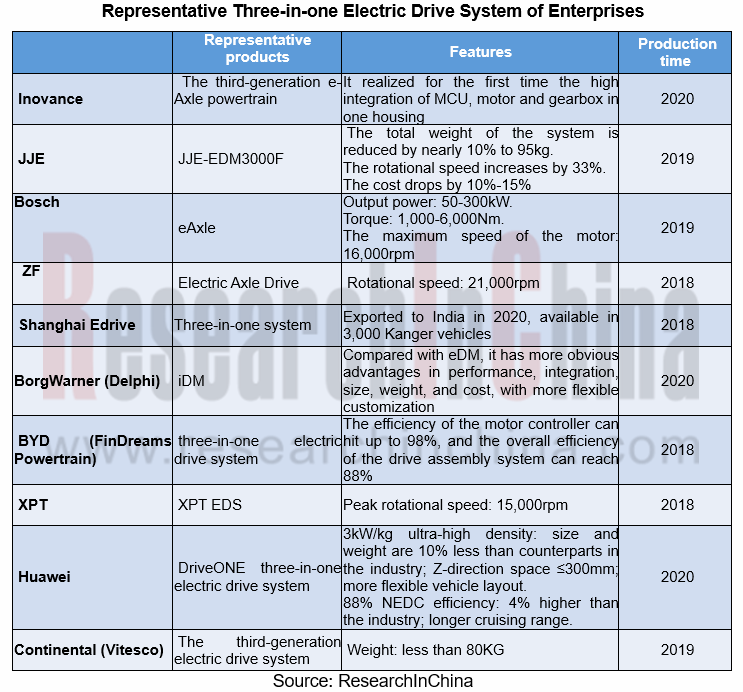

At present, most companies still focus on two-in-one electric drive system, and companies including Bosch, BYD, Inovance, and JJE have launched three-in-one electric drive system. In 2020, Tesla, BYD, XPT and Nidec together accounted for 82.1% of the total sales volume.

The DriveONE three-in-one electric drive system launched by Huawei has the peak power density of 3kW/kg, marking the highest level in the industry, higher than Bosch eAxle which boasts 1.67 kW/kg. In the future, with the efforts of local vendors represented by Huawei and BYD, the gap between local companies and international vendors will gradually narrow.

SiC motor controllers are expected to replace IGBTs

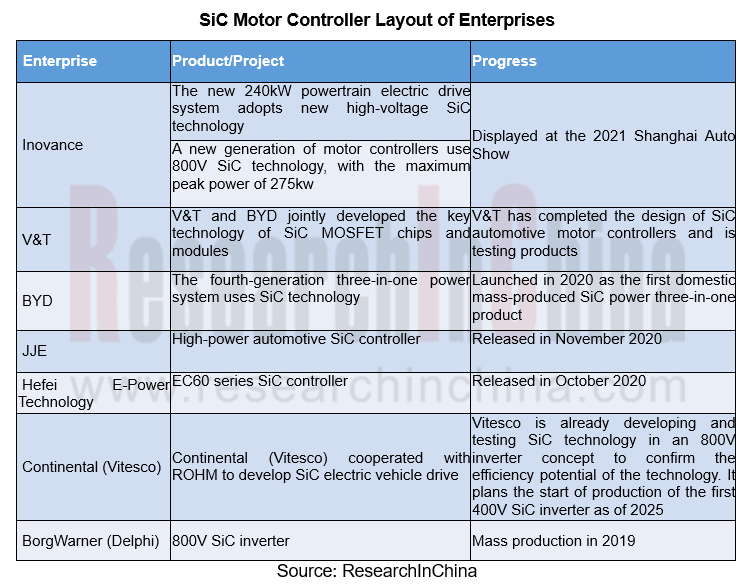

As the core components of motor controllers, IGBT modules account for about 45% of the total cost. In 2020, the global new energy vehicle IGBT module market valued approximately USD850 million. However, high-priced automotive IGBT modules have severely compressed the profit margins of electronic control companies and even automakers.

Compared with silicon-based IGBT power devices, SiC power devices feature advantages such as smaller size, lower weight, higher power density, longer cruising range, less controller loss, better thermal conductivity, and higher temperature resistance. Therefore, vendors represented by Delphi and BYD have begun to deploy SiC motor controllers which are expected to replace IGBTs in the future.

II. Automotive Power Supply Market

In Chinese new energy vehicle power supply market, there are mainly four types of players:

Foreign-funded companies mainly target joint venture automakers, while local companies support independent brands. Thanks to the relatively higher sales volume of local new energy vehicles, local companies have a certain advantage in the automotive power supply market. In 2020, there were 6 local companies among the top 10 companies in Chinese new energy vehicle charger OBC market, with the combined market share of 66%.

At present, automotive power supply products are mainly developing towards integration, high power, and bidirectional style.

(1) Integration: By integrating DC/DC, OBC, motors, electronic control devices, etc., the space occupied by the automotive power supply can be reduced, the size of the circuit board, the assembly cost as well as the BOM and PCB cost can be lowered.

(2) High-power: With longer cruising range and higher electrified capacity of electric vehicles, high power like 10kW, 20kW or more will become the mainstream, which is mainly accomplished by the three-phase AC technology. At present, BYD and Shinry have already deployed in this field.

(3) Bidirectional style: Bidirectional DC/DC features high efficiency, small size, and low cost. At the same time, it can also output battery power to the outside, effectively improving power utilization. Two-way automotive chargers can output the electric energy of the battery to realize vehicle-to-vehicle, vehicle-to-load, and vehicle-to-grid charging.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...