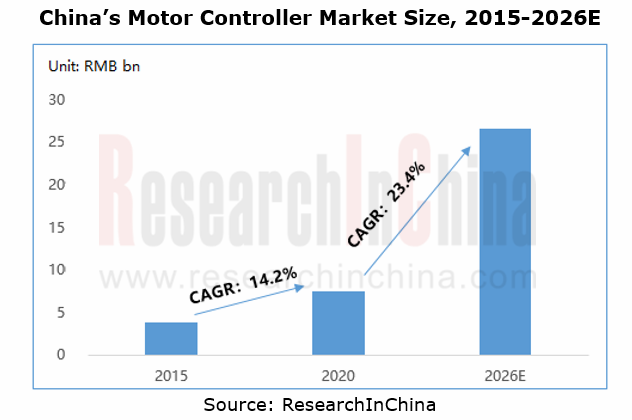

Automotive motor controller industry is expected to grow at CAGR of 23.4%, and local manufacturers are rising.

1) The growing new energy vehicle market gives a boost to the motor controller market.

The supply and demand in the electric vehicle motor controller market is dependent on the expansion of new energy vehicle market.

At present, countries and automakers worldwide have formulated their plans and requirements for the development of new energy vehicles. In future, new energy vehicle sales will be bound to surge. As the new energy vehicle market booms, the motor controller market will make steady growth. It is predicted that China’s motor controller market will sustain a CAGR of up to 23.4% between 2020 and 2026.

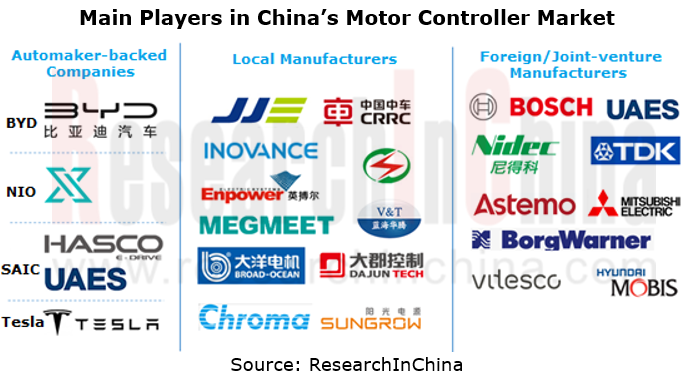

2) In the fiercely competitive motor controller market, local manufacturers lead the way.

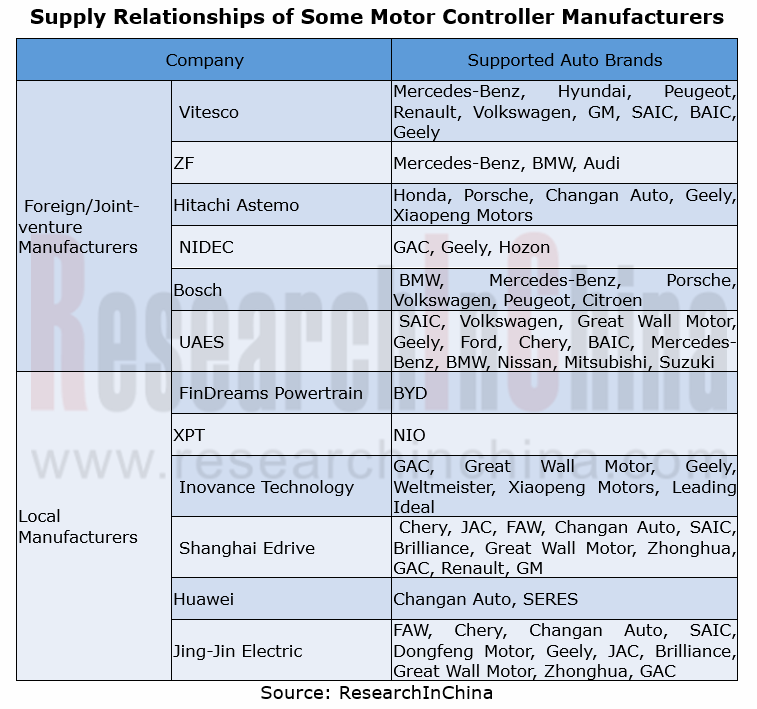

Currently, China’s electric vehicle motor controller market is intensely competitive. There are mainly three types of players: automaker-backed companies, local manufacturers, and foreign/joint-venture manufacturers. Among them, automaker-backed players support their own vehicles; local manufacturers are suppliers of Chinese independent auto brands; foreign/joint-venture companies build supply relationships with foreign/joint-venture auto brands.

Local manufacturers now have the upper hand on the strength of the development of homegrown new energy vehicle brands, especially emerging automakers. In 2020, seven out of the top ten manufacturers by market share were local companies, among which BYD still dominated the list with a 13.5% share; Inovance Technology, Sungrow and Huayu E-drive first edged into the top-ten list.

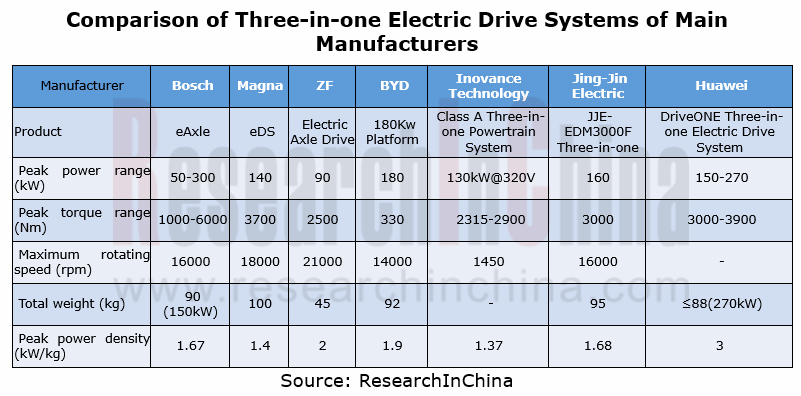

3) N-in-one products hold the trend, and three-in-one drive system will become the mainstream

Motor and ECU integration is a way to not only reduce weight and size of products but cut costs of production and procurement and improve efficiency. In current stage, most companies still stay at the two-in-one phase, while the three-in-one drive system will become the mainstream.

In 2020, China shipped more than 500,000 sets of three-in-one electric drive systems for passenger cars, or around 37% of the total motor controller shipments. Companies including Bosch, BYD, Inovance Technology and Jing-Jin Electric have rolled out their three-in-one electric drive systems. One example is Huawei DriveONE three-in-one electric drive system which boasts peak power density of 3kW/kg, the highest in the industry.

Through the lens of market share, the three-in-one system is still an oligopolistic market. In 2020, Tesla, BYD, XPT and NIDEC took a combined 82.1% of the total sales. Yet as Dongfeng SERES SF5 equipped with Huawei three-in-one system goes into mass production in 2021, the competition in the three-in-one electric drive system market will be more intense.

4) Power modules head in high voltage, and silicon carbide becomes a mainstream material.

New energy vehicles now use 400V electrical voltage systems. 80% SOC for a battery takes about 30 minutes, but the use of an 800V voltage system will cut the time down to 10 minutes. The need for fast charge makes high voltage power modules an inevitable trend.

Manufacturers like Hitachi Astemo, BorgWarner, Vitesco, Inovance Technology and ZF currently have introduced their 800V inverter/electric drive system products to meet fast charge needs, and all use silicon carbide (SiC) material except for Hitachi Astemo.

In BorgWarner’s case, its SiC inverter mass-produced in 2019 is the first 800V inverter using SiC power switch. The double-sided cooling structure makes the inverter 40% lighter and 30% smaller, improves its power density by 25%, and allows the inverter to perform better in thermal conductivity, high temperature stability and efficiency for shortening the charging time and extending the range.

Electric Controller Upstream Market

1) Automotive IGBT market—local companies gear up to scramble

IGBT module which plays a crucial role in new energy vehicles makes up roughly 45% of the cost of electric vehicle motor controller.

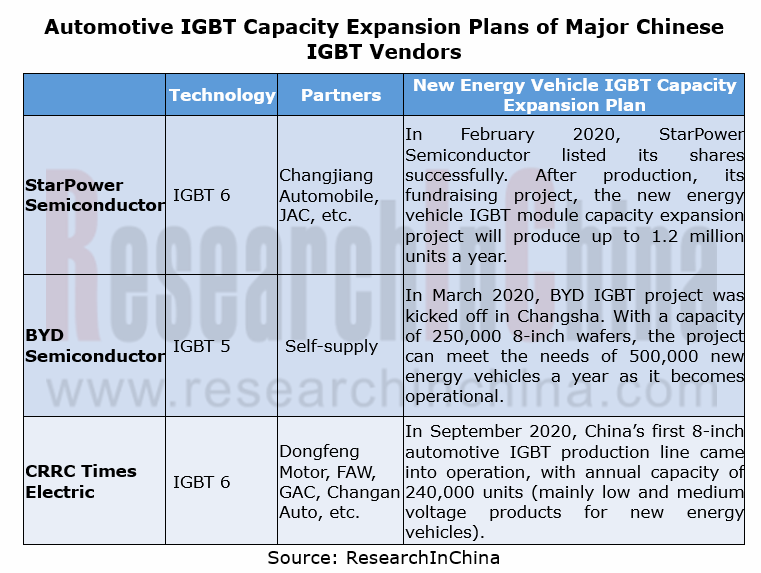

Current local companies such as BYD Semiconductor, StarPower Semiconductor and CRRC Times Electric already work hard on new energy vehicle IGBT development, and race to expand their capacity to rival their foreign peers.

China’s automotive IGBT market is dominated by international vendors like Infineon, Mitsubishi Electric, Semikron and Denso, among which Infineon shares over half the market, up to 58.2% in 2019. BYD Semiconductor, StarPower Semiconductor and CRRC Times Electric were however on the list of the top ten automotive IGBT vendors in 2019, especially BYD Semiconductor which became the runner-up with market share of 18%, far higher than the third-ranking Mitsubishi Electric which occupied just 5.2%.

2) Silicon carbide power devices are expected to be an alternative to IGBT, a key component of motor controller.

Globally, there is a belief that silicon carbide is the next-generation semiconductor material.

Compared with Si-based IGBT power devices, silicon carbide (SiC) power devices feature lighter weight, smaller size, higher power density, longer range, lower controller loss, better thermal conductivity, and stronger high temperature resistance. Motor controllers using SiC power devices are an effective way for new energy vehicles to improve range, power mass density, and electric energy conversion efficiency. So SiC power devices are expected to replace IGBT as a key component of motor controller.

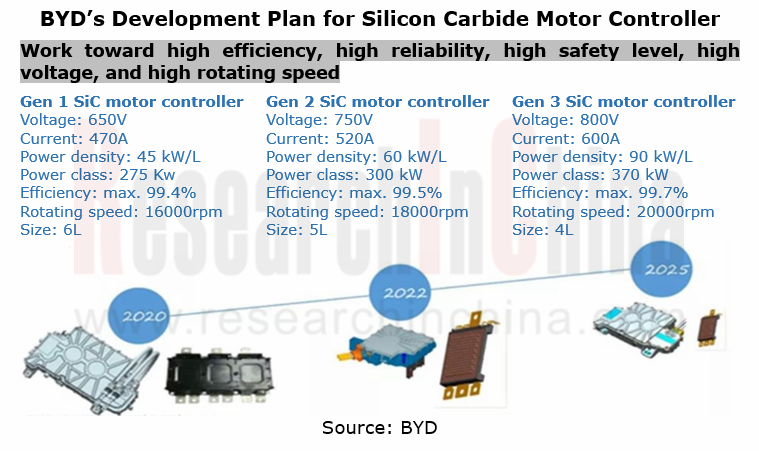

Manufacturers such as Delphi and BYD have set about making deployments in SiC motor controller. BYD indicated that from 2020 to 2025, its SiC motor controllers will have three iterations, with applicable voltage platforms up to 800V, power density up to 90kW/L, efficiency up to 99.7%, and rotating speed up to 20,000 rpm.

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...

China Passenger Car HUD Industry Report, 2025

ResearchInChina released the "China Passenger Car HUD Industry Report, 2025", which sorts out the HUD installation situation, the dynamics of upstream, midstream and downstream manufacturers in the HU...

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2025 – Chinese Companies

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2025 – Chinese Companies

Research on Domestic ADAS Tier 1 Suppliers: Seven Development Trends in the Era of Assisted Driving 2.0

In the ...

Automotive ADAS Camera Report, 2025

①In terms of the amount of installed data, installations of side-view cameras maintain a growth rate of over 90%From January to May 2025, ADAS cameras (statistical scope: front-view, side-view, surrou...

Body (Zone) Domain Controller and Chip Industry Research Report,2025

Body (Zone) Domain Research: ZCU Installation Exceeds 2 Million Units, Evolving Towards a "Plug-and-Play" Modular Platform

The body (zone) domain covers BCM (Body Control Module), BDC (Body Dom...

Automotive Cockpit Domain Controller Research Report, 2025

Cockpit domain controller research: three cockpit domain controller architectures for AI Three layout solutions for cockpit domain controllers for deep AI empowerment

As intelligent cockpit tran...

China Passenger Car Electronic Control Suspension Industry Research Report, 2025

Electronic control suspension research: air springs evolve from single chamber to dual chambers, CDC evolves from single valve to dual valves

ResearchInChina released "China Passenger Car Elect...

Automotive XR Industry Report, 2025

Automotive XR industry research: automotive XR application is still in its infancy, and some OEMs have already made forward-looking layout

The Automotive XR Industry Report, 2025, re...

Intelligent Driving Simulation and World Model Research Report, 2025

1. The world model brings innovation to intelligent driving simulation

In the advancement towards L3 and higher-level autonomous driving, the development of end-to-end technology has raised higher re...

Autonomous Driving Map (HD/LD/SD MAP, Online Reconstruction, Real-time Generative Map) Industry Report 2025

Research on Autonomous Driving Maps: Evolve from Recording the Past to Previewing the Future with "Real-time Generative Maps"

"Mapless NOA" has become the mainstream solution for autonomous driving s...