Global Passenger Car Vision Industry Chain Report 2021

-

July 2021

- Hard Copy

- USD

$3,900

-

- Pages:210

- Single User License

(PDF Unprintable)

- USD

$3,700

-

- Code:

BHY004

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$5,600

-

- Hard Copy + Single User License

- USD

$4,100

-

ResearchInChina has released Global Passenger Car Vision Industry Chain Report 2021 to analyze and predict global camera technology and market trends, and conduct research on global mainstream camera vendors.

With policies support of governments worldwide, the rapid development of automotive intelligence has promoted the continuous growth of automotive cameras. The global passenger car camera market was worth USD7.02 billion in 2020, and is expected to hit USD19.26 billion in 2025.

In terms of segmented products, in-car surveillance cameras will be a growth engine in the future. In 2018, Japan's ``Preparation Outline for Autonomous Driving Systems'' required vehicles with autonomous driving functions to record steering wheel operations and the operating conditions of autonomous driving systems. The ADAS directive of "Europe on the Move" issued in 2019 stipulates that all new vehicles must be equipped with "Drowsiness Warning System" and "Distraction Recognition and Prevention System" from May 2022. In 2024, all vehicles in stock must be equipped with the above functions.

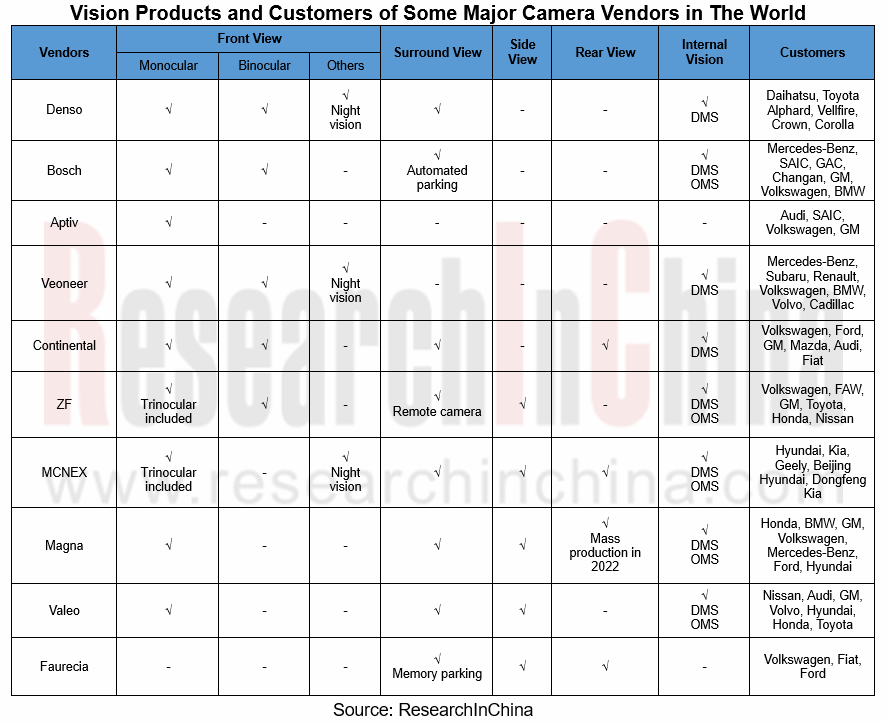

Endeavored by the government and policies, global camera vendors are following market trends and developing new products to meet the demand for advanced autonomous driving. On the one hand, they expand product lines and strive for a complete range of products. Denso develops electronic rear view mirrors based on monocular, binocular, night vision, surround view, internal vision and other products. Magna has already offered a variety of vision products such as Front View monocular cameras, surround view cameras, side view cameras, internal view DMS, internal view OMS, and internal view rear monitors. It plans to mass-produce interior rear view mirrors in 2022. Combined with cameras, mirrors and software products, the rear view mirrors feature a frameless design and can be electronically switched between traditional rear view mirrors and video displays which can customize the field of view.

On the other hand, enhanced visual recognition and algorithms are integrated with other products to offer diverse functions. In June 2021, ZF and CalmCar cooperated to develop an automated valet parking system based on surround view. The system includes ZF's four surround view 192° fisheye cameras, CalmCar's ultrasonic radar and 360° surround view perception software solutions. Bosch and Hyundai Mobis plan to produce the "in-car monitoring system combined with artificial intelligence" and the "high-performance image recognition technology based on deep learning" in 2022 separately.

Finally, automotive vision should not only integrate autonomous driving functions, but also pay more attention to user experience. 3D surround view will prevail. For example, the new Valeo 360Vue? 3D surround view system gives not only the aerial view of the vehicle, but also a 3D view of the vehicle in the car. The driver can clearly see all obstacles and blind sports near the vehicle. In February 2021, Magna released the 3D surround view system, which can directly see the surrounding environment of the vehicle through the 360° surround view camera to help the driver park and move the vehicle in a narrow space. This system is mainly used in luxury vehicles. In addition, Chinese 3D vision company Smarter Eye is also developing a 3D surround view system.

1. Status Quo and Development Trends of Global Passenger Car Vision Industry

1.1 Overview of Passenger Car Vision Industry

1.1.1 Introduction to ADAS and Functions

1.1.2 Automotive Camera Classification and ADAS Functions Supported

1.1.3 Camera Structure and Imaging Principle

1.2 Status Quo and Development Trends of Global Passenger Car Vision Industry

1.2.1 Status Quo and Development Trends of Global Passenger Car Vision Industry

1.2.2 America’s Policies for Promoting the Development of Autonomous Driving

1.2.3 America Regards the Development of Autonomous Driving as a National Strategy

1.2.4 EU’s Policies for Promoting the Development of Autonomous Driving

1.2.5 EU Autonomous Driving Technology Development Roadmap

1.2.6 Germany's Autonomous Driving Policies are at the Forefront of the World

1.2.7 Policies, Regulations and Planning for Autonomous Driving in the UK

1.2.8 Japan’s Policies for Promoting the Development of Autonomous Driving

1.2.9 Japan’s Autonomous Driving Development Planning

1.2.10 Autonomous Driving Regulations and Policies in South Korea

1.2.11 Development Progress and Planning of Autonomous Driving in South Korea

1.3 Status Quo and Development Trends of Global Passenger Car Vision Product Technology

1.3.1 Multi-sensor Integration Will Be the Trend

1.3.2 Simplified Hardware, Central Integration of Computing Power

1.3.3 Binocular or Multinodular Solutions Will Gradually Replace Monocular Solutions

1.3.4 In-car Driver Monitoring Cameras Will be Included in Standard Configuration

2. Foreign Passenger Car Vision Companies

2.1 Meta-analysis of Foreign Passenger Car Vision Companies - Basic Information

2.2 Meta-analysis of Foreign Passenger Car Vision Companies - Products, Vision Customers, Development Directions

2.3 Denso

2.3.1 Profile

2.3.2 Revenue

2.3.3 Main Customers and Revenue

2.3.4 ADAS Products

2.3.5 Forward View Products

2.3.6 Binocular Stereo Vision Sensors

2.3.7 Driver Monitoring Cameras

2.3.8 DMS Application

2.3.9 Denso Ten 360° Surround View System

2.3.10 Customers and Dynamics of Vision Products

2.4 Bosch

2.4.1 Profile

2.4.2 ADAS Products

2.4.3 The Third-generation Front View Camera

2.4.4 The Third-generation Binocular Camera

2.4.5 The Third-generation Monocular Camera

2.4.6 360° Surround View System

2.4.7 In-car Monitoring System

2.4.8 Customers and Dynamics of Vision Products

2.5 Aptiv

2.5.1 Profile

2.5.2 Operating Data in 2020

2.5.3 Business Goals in 2021

2.5.4 ADAS Products

2.5.5 Single-camera Solutions, Sensor Fusion Solutions

2.6 Panasonic

2.6.1 Profile

2.6.2 Automotive Business Revenue in FY2021

2.6.3 Automotive Electronic Products Series

2.6.4 Automotive Vision Products - Rear View Cameras (1)

2.6.5 Automotive Vision Products - Rear View Cameras (2)

2.6.6 Automotive Vision Products - Driving Recorders

2.6.7 Automotive Camera Dynamics

2.7 Veoneer

2.7.1 Profile

2.7.2 Global Layout and Revenue

2.7.3 Products and Customers

2.7.4 Vision System

2.7.5 Night Vision System

2.7.6 DMS

2.7.7 ADAS Technology Released in 2021

2.7.8 ADAS Products Available in Vehicles in 2021

2.8 Continental

2.8.1 Profile

2.8.2 Global Layout and Revenue in 2020

2.8.3 ADAS Products

2.8.4 Vision Products

2.9 ZF

2.9.1 Profile

2.9.2 Revenue in 2020

2.9.3 ADAS Products

2.9.4 Vision Products

2.10 MCNEX

2.10.1 Profile

2.10.2 Operating Data in 2018-2020

2.10.3 Global Business Distribution and Main Customers

2.10.4 Vision Product Layout

2.10.5 Vision Products

2.11 Magna

2.11.1 Profile

2.11.2 Operation in 2020 and Outlook

2.11.3 ADAS Hardware Products, Vision Product Customers

2.11.4 Vision Products

2.12 Valeo

2.12.1 Profile

2.12.2 Revenue in 2020

2.12.3 Vision Sensor Development History

2.12.4 Vision Product Overview

2.12.5 Vision Products

2.12.6 Partners

2.13 Faurecia

2.13.1 Profile

2.13.2 Revenue in 2020

2.13.3 Vision Products

2.14 Gentex

2.14.1 Profile

2.14.2 Revenue in 2020

2.14.3 Automotive Vision Products: Front View Cameras, In-car Cameras

2.14.4 Vision Products: FDM

2.14.5 Next-generation FDM

2.14.6 Automotive Vision Products: CMS

2.14.7 Automotive Vision Products: Hybrid CMS Cases, Vision Product Customers

2.15 First Sensor

2.15.1 Profile

2.15.2 Revenue in 2020

2.15.3 ADAS Product Layout and Application

2.15.4 Vision Products (1)

2.15.5 Vision Products (2)

2.15.6 Vision Products (3)

2.15.7 Vision Products (4)

2.15.8 Vision Product Customers Distribution

2.16 Hyundai Mobis

2.16.1 Profile

2.16.2 Product System and Software R&D Planning

2.16.3 ADAS Product Layout

2.16.4 Vision Products (1)

2.16.5 Vision Products (2)

2.16.6 Vision Products (3)

2.16.7 Customers and Dynamics of Vision Products

2.17 LG

2.17.1 Profile

2.17.2 Operating Data in 2020

2.17.3 Automotive Electronic Product Line

2.17.4 Vision Products: Front View Cameras, Panoramic Surveillance Image System

2.17.5 Customers and Dynamics of Vision Products

2.18 Ricoh

2.18.1 Profile

2.18.2 Operating Data in 2020

2.18.3 Vision Products: Binocular Modules and Application

2.19 Hitachi

2.19.1 Profile

2.19.2 Operating Data in FY2017-FY2021

2.19.3 ADAS Products

2.19.4 Vision Products: Binocular Stereo Cameras, Customers, Dynamics

3. Foreign key Passenger Car Vision Chip Companies and Other Companies

3.1 Mobileye

3.1.1 Profile

3.1.2 Revenue in 2020

3.1.3 Vision Chip Roadmap

3.1.4 Vision Chips: EyeQ5 and Customers

3.1.5 Vision System

3.1.6 Vision Algorithm

3.1.7 Target Recognition Technology

3.2 ON Semiconductor

3.2.1 Profile

3.2.2 Operation in 2020

3.2.3 Automotive Products and Partners

3.2.4 OEM Customers

3.2.5 Vision Chips: CMOS Image Sensors

3.2.6 CMOS Image Sensor: AR0138AT

3.2.7 CMOS Image Sensor: AR0220AT

...............

3.2.13 Vision Chips: Image Processors

3.2.14 Automotive Imaging Sensor System

3.3 OmniVision Technologies

3.3.1 Profile

3.3.2 Vision Products

3.3.3 Automotive Vision Products: Driver Monitoring System Parts

3.3.4 Automotive Vision Products: Parts for Autonomous Driving System

3.3.5 Automotive Vision Products: Display-based Image Sensor Parts

3.3.6 Automotive Vision Products: Parts for Surround View Video

3.3.7 Product Development History and Directions

3.4 Sony

3.4.1 Profile

3.4.2 Operating Data in 2020

3.4.3 Automotive CMOS Development History

3.4.4 Product Portfolio and Customers of Automotive CMOS

3.4.5 Automotive CMOS (1)

3.4.6 Automotive CMOS (2)

3.4.7 Automotive CMOS (3)

3.4.8 Image Sensor Development Plan

3.5 Samsung Electronics

3.5.1 Profile

3.5.2 Operating Data in 2020

3.5.3 ADAS Product Layout

3.5.4 Automotive Image Sensor - ISOCELL Auto

3.5.5 R&D of New Automotive Image Sensors

3.6 Texas Instruments

3.6.1 Profile

3.6.2 Operating Data in 2020

3.6.3 Vision Products: Monocular Vision Processing Chips

3.6.4 Vision Products: Surround View System Processing Chips

3.7 Xilinx

3.7.1 Profile

3.7.2 Operating Data

3.7.3 Application of Chips in ADAS

3.7.4 Vision Products

3.8 Cipia

3.8.1 Profile

3.8.2 Vision Technology

3.8.3 Vision System

3.8.4 Vision System: Cabin Sense

3.8.5 Solution: Fleet Sense

3.8.6 Dynamics of Vision Products

3.9 StradVision

3.9.1 Profile

3.9.2 Vision Products (1)

3.9.3 Vision Products (2)

3.9.4 Cooperation with Renesas

3.10 Foresight

3.10.1 Profile

3.10.2 Revenue and Expenditure in 2020

3.10.3 Vision Products

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...