China Automotive Ultrasonic Radar and OEM Parking Roadmap Research Report, 2021

China Automotive Ultrasonic Radar & OEM Parking Roadmap Research Report, 2021 combs through automotive ultrasonic radar market characteristics, suppliers, development trends and OEM’s automatic parking roadmaps. At present, the market presents the following features:

①Proportion of 12 ultrasonic radar solution continues to increase;

②Home-zone parking pilot (HPP) and automated valet parking (AVP) put forward higher requirements for sensor fusion;

③ Cockpit applications such as life detection and gesture control are expected to become new growth points of ultrasonic radar.

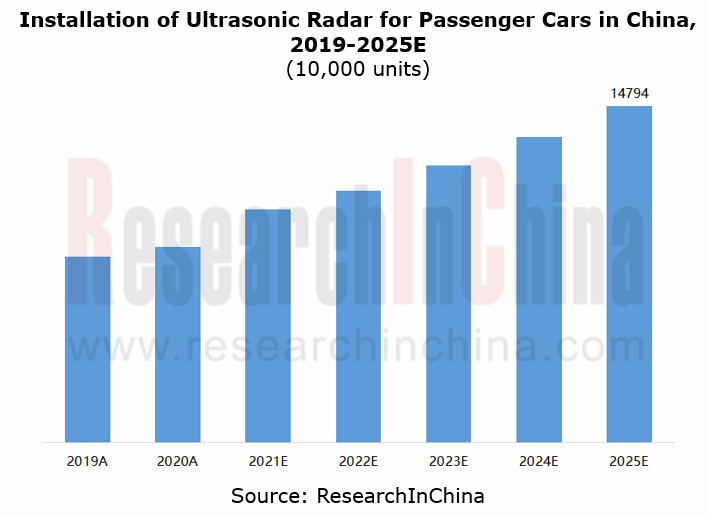

Installation of China’s automotive ultrasonic radars will hit 150 million units by 2025

Installation of China’s automotive ultrasonic radars attained 86.20 mln units (factory-installed market), up 5.2% yr-on-yr. The ultrasonic radars are mainly applied to reversing assist and parking assist. With the upgrading of parking functions and the improvement of installation rate, demand for ultrasonic radars is steadily increasing, further to nearly 150 million units by 2025.

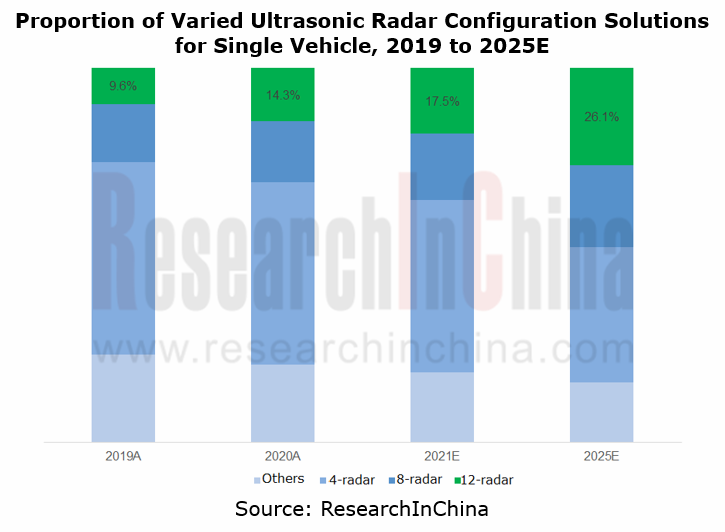

Proportion of 12 ultrasonic radar solution continues to increase

Viewed from ultrasonic radar configuration solution for single vehicle, 4 ultrasonic radar solution occupied most of the market share from 2019 to 2020, applied for realizing reversing assist. With the commercial promotion of automatic parking, the proportion of 12 ultrasonic radar solution is rapidly rising and is expected to become the mainstream of smart cars in the future.

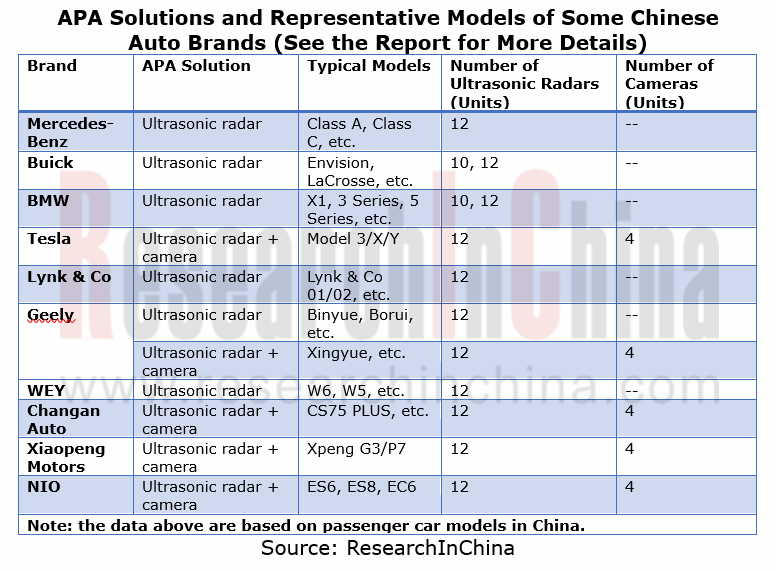

At present, APA solution launched by OEMs basically adopts 12 ultrasonic radars. Among them, BMW and Buick mainly adopt full ultrasonic radar solution. Partial OEMs (such as NIO, Xpeng, Changan and Geely) adopt the vision fusion solution of ultrasonic radar plus surround view camera to improve the success rate of parking in/out of the automatic parking system.

HPP and AVP put forward higher requirements for sensor fusion

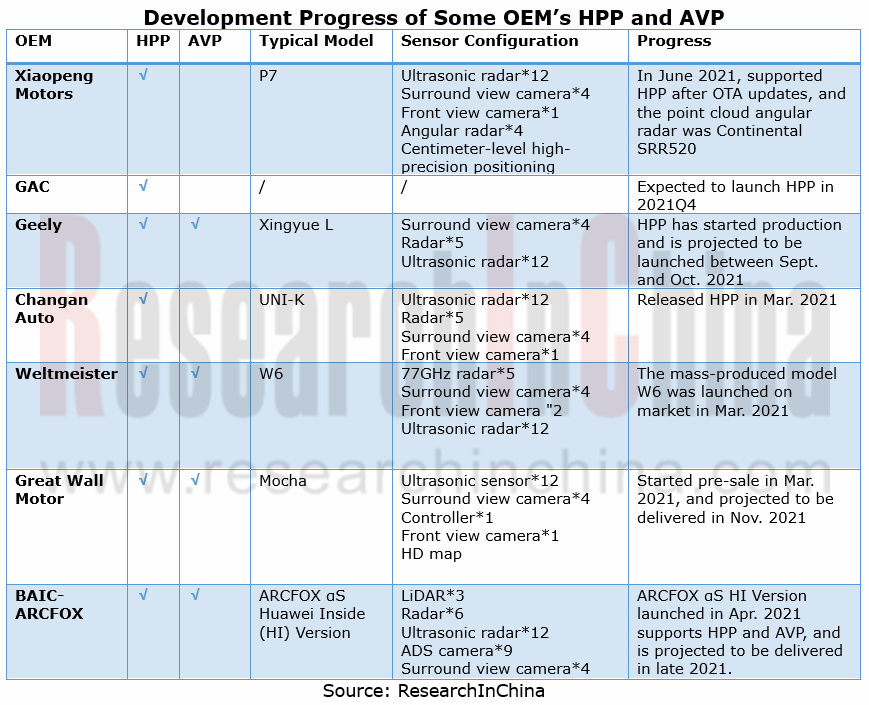

Existing L2 and L2 + automatic parking fusion solutions mostly adopt ultrasonic + visual fusion. L3 HPP and L4 AVP will realize the fusion of more sensors, such as the introduction of front-view cameras, radar or LiDAR.

Viewed from HPP, mass production time of HPP is scheduled in 2021 to 2022. Generally, OEMs adopt the solution of adding more sensors (such as front-view camera, millimeter wave angle radar, and high-precision positioning) on the basis of APA sensors, which puts forward higher requirements for sensor fusion.

In April 2021, WM W6 was released to the market. It is equipped with HAVP (Home-AVP) for one-key autonomous driving, obstacle avoidance, intelligent search for parking spaces, and automatic parking in or out without human intervention. WM W6’s HAVP supports up to 100m distance and 5 routes learning.

WM W6’s HAVP integrates autonomous driving computing platform (Apollo ACU Wuren), with sensors integrating ultrasonic radars, surround view cameras, front-view angle radars and angle radars. Sensor configurations include 5 77GHz radars, 4 surround view cameras, 2 front-view cameras and 12 ultrasonic radars.

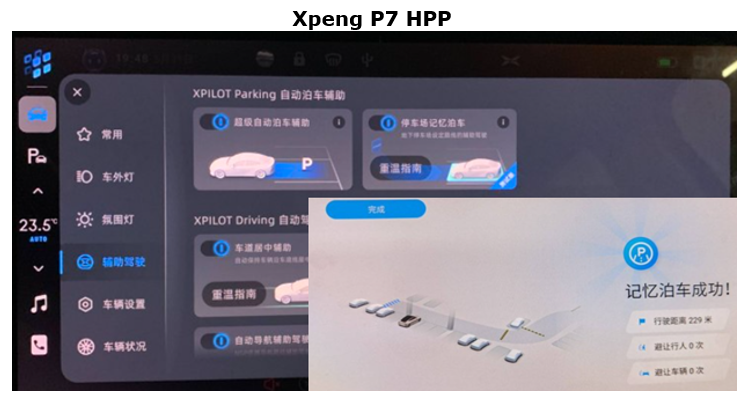

In June 2021, Xpeng Motor added HPP function in the OTA upgrade of Xpeng P7 (Xmart OS 2.6.0). The HPP does not rely on the renovation of parking lot end, with up to 1,000m of route learning, supporting up to 100 routes learning in the parking lots (learning one route for each parking lot).

Xpeng P7’s HPP integrates ultrasonic radars + surround view cameras + front-view camera + angle radars. Sensor configuration includes 12 ultrasonic radars, 4 surround view cameras, 1 front-view camera, 4 angle radars and centimeter-level high-precision positioning. Of which, its angle radars adopt SRR520 point cloud radars provided by Continental.

As of AVP, many OEMs actively deploy AVP at present. But most of AVP projects are under demo stage

Great Wall WEY Mocha, scheduled to be delivered in Nov.2021, adopt AVP solution of car-end intelligence. Its sensors integrate ultrasonic sensors, surround view cameras, front-view cameras and HD map. The AVP solution is mainly applied for parking scenarios in areas such as supermarkets.

ARCFOX αS S Hi version, with mass production scheduled for the end of 2021, adopts AVP solution of car end intelligence. Its sensor configuration includes LiDAR, radar, ultrasonic radar, ADS camera and surround view camera.

Cockpit applications like life detection and gesture control are expected to be new drivers for the growth of ultrasonic radar

As intelligent cockpits advance, ultrasonic radar may become applicable to new functions such as life detection and gesture control.

One example is Audiowell Rear Occupant Alert (ROA), a system that detects moving objects via ultrasonic radar. When confirming a moving object at the rear row, it sends a warning to the owner; when the rear occupants fall sleep, it detects slight movements caused by breathing through the Doppler Effect of ultrasonic waves.

With ultrasonic signals as the carrier, Maxus Tech enables gesture control, a function applicable to scenarios such as smart home, smart wearable device and intelligent cockpit.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...