Automotive steering system research: EPS dominates the market, SBW prepares for fully autonomous driving

After hundreds of years of development, automotive steering systems have derived HPS, EHPS, EPS, SBW and other types. At present, HPS (hydraulic power steering) and EHPS (electronic hydraulic power steering) have been widely used in commercial vehicles, while EPS (electric power steering) is mainly applied to passenger cars, and SBW (Steer-by-Wire) has the lowest penetration rate.

EPS occupies the passenger car market, while HPS and EHPS dominate the commercial vehicle market

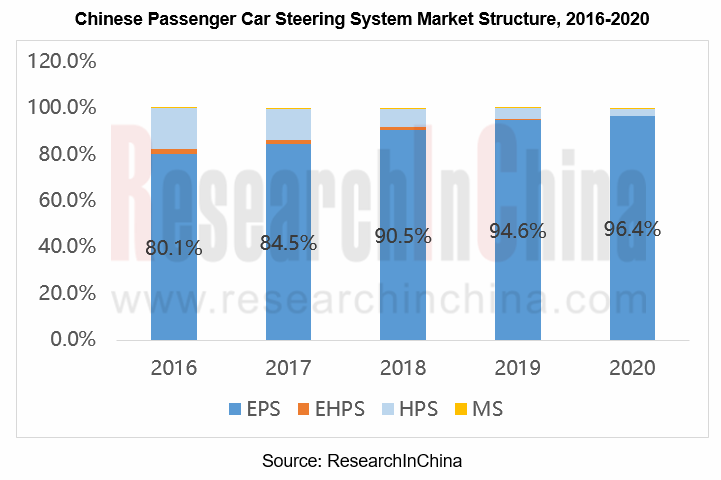

In Chinese passenger car steering system market, the share of EPS has increased from 80.1% in 2016 to 96.4% in 2020; only a small number of passenger cars adopt HPS and EHPS solutions. Relatively speaking, the higher the price of cars, the higher the proportion of EPS solutions applied.

Due to its small size, low power consumption, light weight and flexibility, EPS is the first choice for new energy vehicles. EPS accounted for 99.91% of the new energy passenger car market in 2020, and this proportion is expected to reach 100% in the future.

HPS and EHPS are usually seen in most commercial vehicles, especially heavy-duty vehicles, thanks to their high power and low prices. In 2020, China's commercial vehicle steering systems were still dominated by HPS and EHPS, of which EHPS made up for 40.1%. However, the market shares of HPS and EHPS will gradually be grabbed by EPS in the future because they not only consume lots of power, but also cause hydraulic oil leakage, which do not meet environmental protection requirements.

The EPS penetration rate of local passenger car brands is gradually increasing

In the Chinese passenger car market, the EPS penetration rate of Chinese passenger car brands is much lower than that of foreign passenger car brands. In 2020, the former was 90.7%, while the latter hit as high as 100%. However, with the gradual tightening of environmental protection, local brands will gradually abandon the polluting steering systems such as HPS and EHPS. By 2026, the EPS penetration rate of Chinese passenger car brands is expected to reach 100%.

Multinational companies dominate the market, while local companies strive to survive

At present, the global automotive steering system market is mainly occupied by vendors such as JTEKT, Bosch, ZF, ThyssenKrupp, NSK, Mando, Hitachi Astemo. These multinational companies have deployed the Chinese market through sole proprietorship or joint ventures, firmly occupied the supply channels of luxury and joint venture brand automakers, and penetrated into the supply system of local automakers.

There are more than 100 local companies in China, but most of them are small companies targeting the aftermarket with weak competitiveness. Zhejiang Shibao, CAAS, Elite, Nexteer Automotive, etc. which have relatively strong competitiveness can compete with multinational giants. For example, Nexteer Automotive and Zhejiang Shibao have entered the supply systems of American, German and Japanese automakers by virtue of their robust strength, and have taken places in the siege of multinational companies.

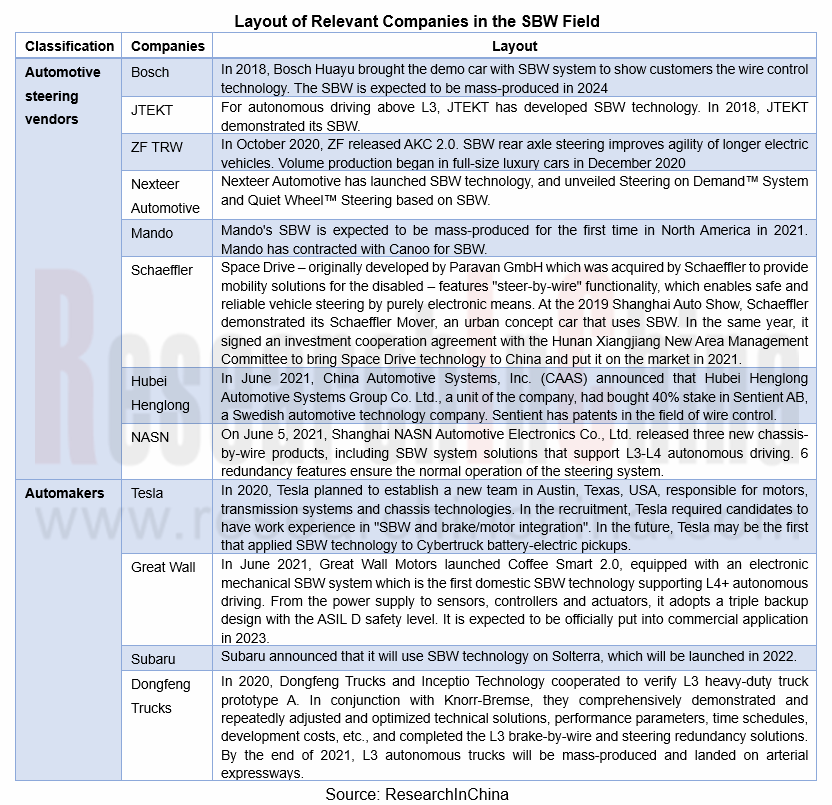

Major vendors and automakers have deployed SBW which will be promising in the future

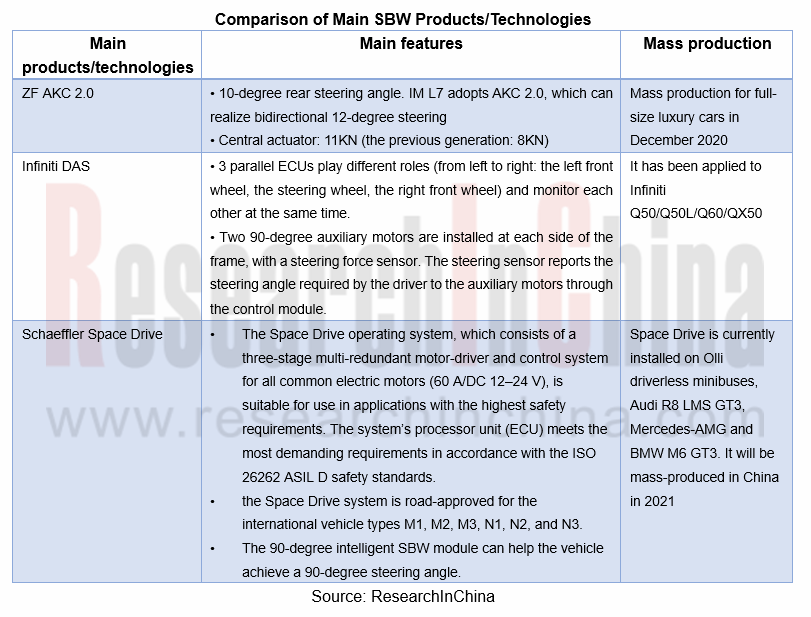

The biggest difference between SBW and EPS is that the former removes the mechanical connection between the steering wheel and the rack and uses ECU to transmit commands instead. SBW features fast response, flexible installation, lighter weight, and improved collision safety.

SBW technology was proposed as early as 1950. After decades of development, it has now been mass-produced on Infiniti’s several models. Although SBW still has problems such as high cost, immature technology, limited user acceptance, low penetration rate, etc., some automotive steering vendors and automakers are very optimistic about SBW technology and are making efforts herein. There will be a number of production models using SBW.

China Automotive Engineering Research Institute Co., Ltd. (CAERI) has worked with Huawei, Baidu, Schaeffler and many other companies to jointly compile SBW and Brake System Communication Protocol Requirements and Test Specifications, which is conducive to promoting the development of SBW technology and its application in intelligent vehicles.

At present, the penetration rate of SBW in China is extremely low, and was estimated at 0.1% in 2020. In the next few years, the penetration rate will jump rapidly, and it is expected to reach 15% by 2026. Meanwhile, the market scale will gradually expand to RMB12.16 billion, with lucrative development prospects.

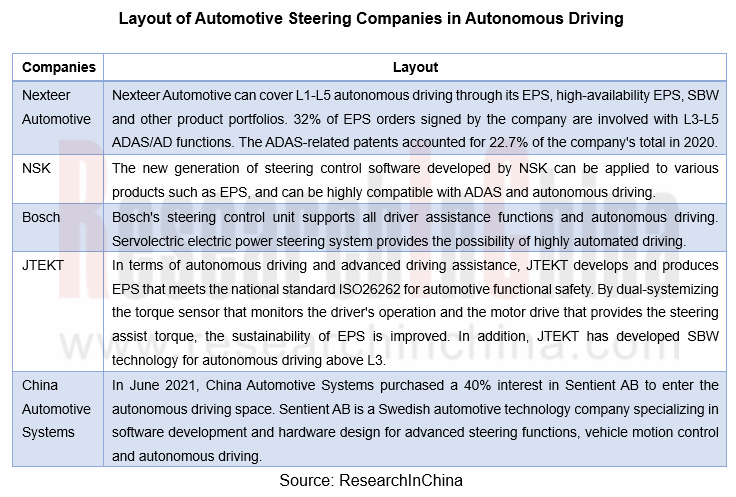

EPS is the key to ADAS functions, while SBW is one of the key technologies for fully autonomous driving

The automotive steering system is closely related to the development of autonomous driving. At present, EPS is the key to ADAS functions, serving different levels of autonomous driving with typical ADAS functions like APA, LDW&LKA and DSR. However, in essence, the steering signal of EPS still comes from the driver, while the steering signal of SBW stems from the algorithm. Therefore, SBW can be completely separated from the driver to control steering as one of the key technologies for fully automatic driving in the future.

At present, some automotive steering system companies have begun to deploy autonomous driving.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...