Research on hybrid vehicles: Five global major hybrid technologies compete fiercely in China

The hybrid technology is one of the important technology roadmaps to achieve emission peak, carbon neutrality and dual credit compliance.

In September 2020, President Xi Jinping pledged that China would reach its CO2 emissions peak before 2030 and achieve carbon neutrality before 2060. For this goal, China proposes to carry out transformation and innovation in ten fields, among which the construction of a green low-carbon transportation system and the promotion of green and low-carbon technological innovation involve automotive energy-saving technologies covering electric vehicles, hybrid, and hydrogen fuel cells.

Measures for the Parallel Management of Average Fuel Consumption of Passenger Car Companies and New Energy Vehicle Credits (hereinafter referred to as the dual credit policy) stipulates the average fuel consumption credits of passenger car companies and new energy vehicle credits. In 2020, the passenger car industry’s fuel consumption credits were -7.33 million and new energy vehicle credits 3.3 million. In the face of the regulation on emission peak, carbon neutrality and double integration, hybrid technology will be one of the important technical routes for automakers to meet the standards for automakers.

Energy-Saving and New Energy Vehicle Technology Roadmap 2.0 released by China-SAE points out the development goal of China’s automobile industry: “the total industrial carbon emissions should reach the peak around 2028 in advance of the national carbon emission reduction commitment, and the total emissions should drop by more than 20% from the peak by 2035. The sales volume of new hybrid passenger cars should account for 50%-60% of traditional energy passenger cars by 2025, 75%-85% by 2030, and 100% by 2035. This clarifies that energy-saving vehicles do not represent a transitional technology, but a high-efficiency technology that allows engines and motors to complement each other, replaces internal combustion engine vehicles on a large scale within a reasonable price range, and reduces fuel consumption.

Five global major hybrid technologies compete fiercely in China

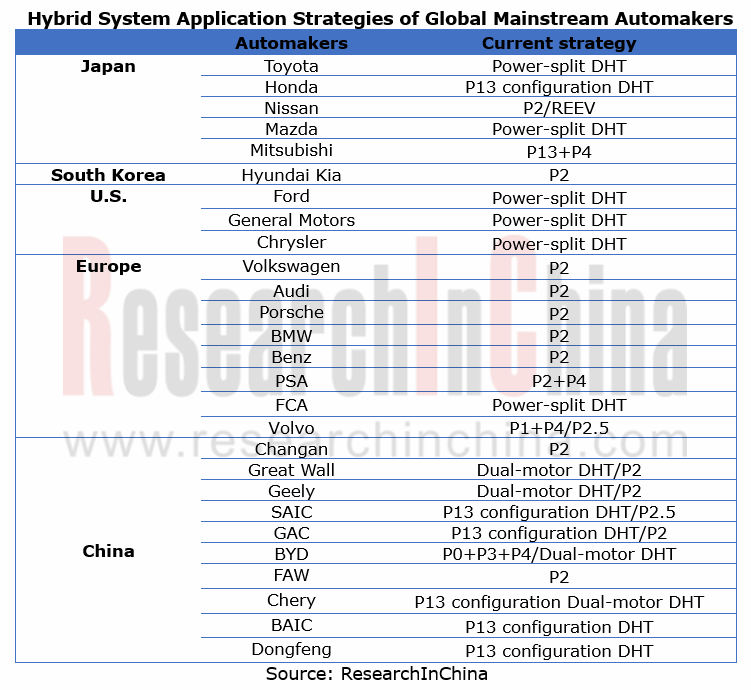

Currently, hybrid power is mainly being developed in Japan, the United States, Europe, and China which choose different hybrid technology roadmaps according to their technical reserves and development goals:

- Japanese cars are mainly powered by Toyota's Power-split (PS) and Honda's i-MMD series-parallel hybrid. Through strong hybrid, the best fuel-saving effect can be achieved. For example, Toyota THS available in Toyota Prius adopts a single planetary row structure design to maximize fuel economy in common vehicle speed ranges. Toyota is committed to licensing the hybrid technology to Chinese automakers. For example, the new-generation GAC Trumpchi GS8 hybrid system is planned to be equipped with the Julang Hybrid System composed of Trumpchi 2.0T engine and Toyota THS; Hunan Corun New Energy has purchased the core technology Toyota's THS for RMB1 and promoted the application in conjunction with Geely.

- American cars are mainly based on Power-split (PS) of GM and Ford; for example, the general hybrid power system of GM LaCrosse adopts a dual-row planetary structure design to achieve two “power split” modes (high and low speed modes) and one or multiple fixed gears so as to further improve the fuel economy and transmission efficiency of the car.

- German cars are mainly based on 48V low-voltage and high-voltage hybrid technology arranged in P0/P2. The system replaces traditional lead-acid batteries with power-type lithium-ion batteries with a voltage of 48V and an energy of less than 1kW·h, and replaces traditional starter motors and generators with B/ISG motors. A large number of Chinese plug-in models have exploited German technology roadmap and suppliers.

- Chinese automakers have transferred from the original technology diversification to the dual-motor-based series-parallel mode. For example, the GAC Trumpchi Electromechanical Coupling System (G-MC) adopts the series-parallel mode, which is mainly used for plug-in hybrid; BYD's DM-i super hybrid technology adopts the EHS to open up a new technology system in addition to Toyota's THS Power-split and Honda's i-MMD.

- The series extended-range hybrid power roadmap is represented by Nissan e-Power, Lixiang ONE, Dongfeng Voyah, etc.; In series mode, the engine and the electric motor are not mechanically connected, so the engine can obtain the best efficiency at different vehicle speeds and loads. In 2020, 32,600 Lixiang ONE cars were sold, ranking first in the extended-range field.

The world's mainstream OEMs have conducted diversified explorations in hybrid systems, and finally chose the hybrid strategy that is most suitable for their own models. We have summarized the hybrid strategies of the global mainstream automakers.

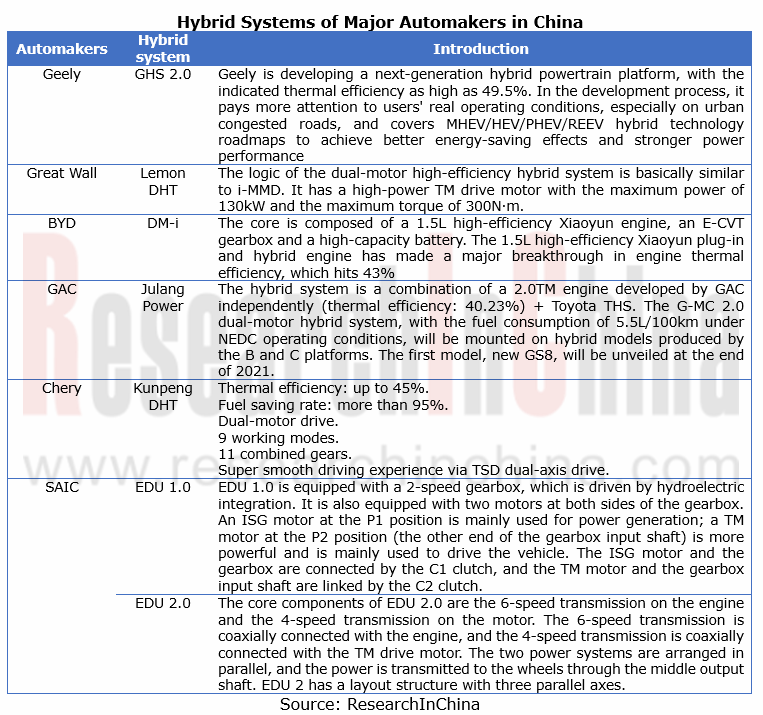

Chinese automakers have developed hybrid systems independently to seize the hybrid market

In the context of energy saving and emission reduction, Chinese automakers have made efforts to develop the hybrid technology in recent years. They have launched self-developed hybrid systems, such as Great Wall Lemon DHT Hybrid System, BYD DM-i Super Hybrid, GAC Julang Hybrid System, Chery Kunpeng DHT System, etc.

Sales Volume of China's Hybrid Vehicle Market Segments

(1) PHEV passenger cars

According to CPCA (China Passenger Car Association)’s data, the sales volume of PHEV passenger cars in China increased by 2.7% year-on-year to approximately 211,900 units in 2020. From January to June 2021, the sales volume reached 183,200 units.

At present, China's PHEV passenger cars companies are mainly represented by BYD, SAIC, and Lixiang. In 2020, SAIC ranked first with the sales volume of 59,900 PHEV passenger cars, followed by BYD and Lixiang with the sales volume of 51,700 and 32,600 respectively.

(2) HEV passenger cars

According to the data from CAAM (China Association of Automobile Manufacturers), the sales volume of HEV passenger cars in China jumped by 21.9% year-on-year to about 290,400 units in 2020, approximately 272,400 units in H1 2021. It is expected to hit 500,000 units in 2021;

In 2021, the sales volume of HEV passenger cars in China soars. On the one hand, Toyota has added dual-engine to a variety of models to meet demand for energy-efficient and fuel-efficient vehicles. On the other hand, China has raised higher requirements on carbon emission, which forces automakers to reduce emissions. Automakers mainly promote lower-displacement dual-engine vehicle models.

At present, the sales volume of HEV passenger cars in China is mainly contributed by GAC Toyota, FAW Toyota, GAC Honda, and Dongfeng Honda. The sales volume of GAC Toyota’s HEV passenger cars accounted for 32% of the total in 2020, and 41% in H1 2021 with a spike of 9 percentage points. Under the pressure of carbon emissions, Toyota actively boosts dual-engine models and has installed the dual engine technology on multiple models.

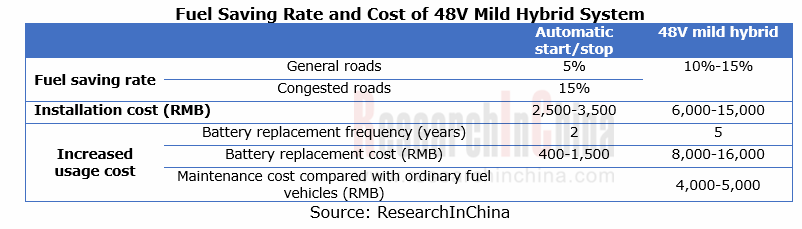

(3) 48V mild hybrid system

The 48V mild hybrid system is evolved from the 12V electrical system which is not completely abolished but continues to exist. The biggest advantage of the 48V mild hybrid system is that it can save much more energy and reduce emissions to comply with stringent emission policies at low costs:

1. The application of start-stop technology makes the carrying capacity of the traditional 12V system approach the limit. Electrical systems with higher carrying power are needed to achieve better energy-saving effects;

2. More and more electronic functions are integrated in a single vehicle, while the 12V system cannot match high-power electrical equipment.

In 2020, the sales volume of passenger cars equipped with the 48V mild hybrid system in China was swelled 39% year-on-year to 331,000 units. According to China Association of Automobile Manufacturers, 20.178 million passenger cars were sold in China in 2020, of which only 1.64% was 48V mild hybrid cars. By 2025, the sales volume of passenger cars with the 48V mild hybrid system in China will reach 3.12 million units.

The 48V mild hybrid system can reduce fuel consumption to a certain extent at a low cost. Considering carbon emissions and costs, automakers are keen to install the 48V mild hybrid system on traditional fuel vehicles. However, from a consumer's point of view, the fuel saved by the 48V system is not obvious, so the subsequent promotion still requires continuous technological progress and cost reduction.

Of course, 48V mild hybrid is only a transitional technology, not a solution that can be done once and for all. The 48V system can meet the average fuel consumption limit of passenger cars in the fourth and fifth stage (the fourth stage: 5.0L/100km (2020); the fifth stage: 4.0L/100km (2025) with a reduction of 42%), but it is difficult to realize the goal in the sixth stage (3.2L/100km (2030)). Therefore, Chinese automakers need to step up research and development of strong HEV, PHEV, high-efficiency engines and other advanced technologies while introducing the 48V mild hybrid technology so as to prompt the long-term development.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...