Automotive PCB research: vehicle intelligence and electrification bring about demand for PCBs, and local manufacturers come to the fore.

The share of electronics in curb weight of a vehicle is rising, expectedly up to 34.3% in 2020, which is accompanied by more vehicle entertainment and safety functions and the growth of new energy vehicles. This gives a direct boost to demand for automotive printed circuit boards (PCB).

The COVID-19 epidemic in 2020 slashed the global vehicle sales and led to a big shrinkage of the industry scale to USD6,261 million. Yet the gradual epidemic control has driven the sales up a lot. Moreover, the growing penetration of ADAS and new energy vehicles will favor sustained growth in demand for PCBs, which is projected to outstrip USD12 billion in 2026.

As the largest PCB manufacturing base and also the biggest vehicle production base in the world, China demands a great many of PCBs. By one estimate, China’s automotive PCB market was worth up to USD3,501 million in 2020.

Vehicle intelligence pushes up demand for PCBs.

As consumers demand safer, more comfortable, more intelligent automobiles, vehicles tend to be electrified, digitalized and intelligent. ADAS needs many PCB-based components such as sensor, controller and safety system. Vehicle intelligence therefore directly spurs demand for PCBs.

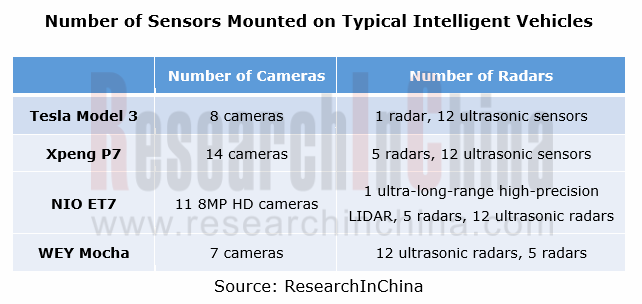

In ADAS sensor’s case, the average intelligent vehicle carries multiple cameras and radars to enable driving assistance functions. An example is Tesla Model 3 which packs 8 cameras, 1 radar and 12 ultrasonic sensors. On one estimate, the PCB for Tesla Model 3 ADAS sensors is valued at RMB536 to RMB1,364, or 21.4% to 54.6% of total PCB value, which makes it clear that vehicle intelligence boost demand for PCBs.

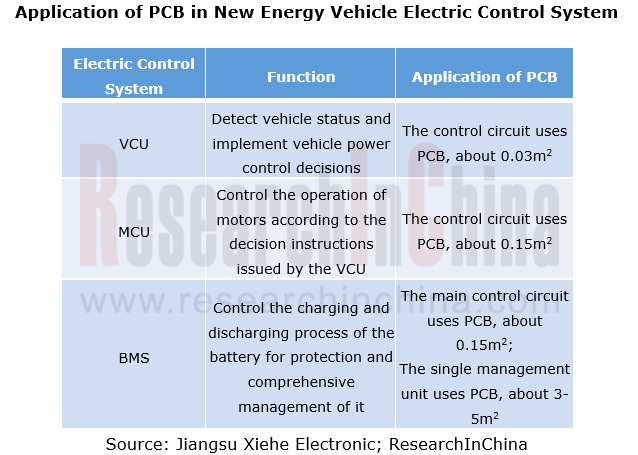

Vehicle electrification stimulates demand for PCBs.

Differing from conventional vehicles, new energy vehicles need PCB-based power systems like inverter, DC-DC, on-board charger, power management system and motor controller, which directly boosts demand for PCBs. Examples include Tesla Model 3, a model with total PCB value higher than RMB2,500, 6.25 times that of ordinary fuel-powered vehicles.

In recent years, the global penetration of new energy vehicles has been on the rise. Major countries have formulated benign new energy vehicle industry policies; mainstream automakers race to launch their development plans for new energy vehicles as well. These moves will be a major contributor to the expansion of new energy vehicles. It is conceivable that the global penetration of new energy vehicles will ramp up in the years to come.

It is predicted that the global new energy vehicle PCB market will be worth RMB38.25 billion in 2026, as new energy vehicles become widespread and the demand from higher levels of vehicle intelligence favors a growth in PCB value per vehicle.

Local vendors cut a figure in the severer market competition.

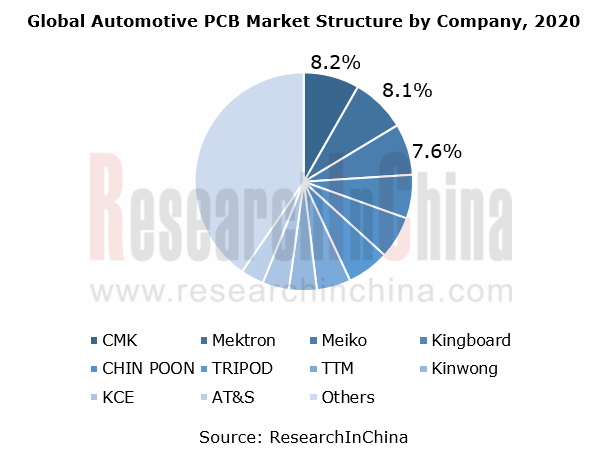

At present, the global automotive PCB market is dominated by Japanese players such as CMK and Mektron and Taiwan’s players like CHIN POON Industrial and TRIPOD Technology. The same is true of the Chinese automotive PCB market. Most of these players have built production bases in Chinese Mainland.

In Chinese Mainland, local companies take a small share in the automotive PCB market. Yet some of them already make deployments in the market, with increasing revenues from automotive PCBs. Some companies have a customer base covering the world’s leading auto parts suppliers, which means it is easier for them to secure bigger orders to gain strength. In future they may command more of the market.

Capital market helps local players.

In recent two years, automotive PCB companies seek capital support to expand capacity for more competitive edges. With the backing of capital market, local players will become more competitive as a matter of course.

Automotive PCB products head in high-end direction, and local companies make deployments.

At present, automotive PCB products are led by double-layer and multi-layer boards, with relatively low demand for HDI boards and high frequency high speed boards, high value-added PCB products which will be more in demand in future as demand for vehicle communication and interiors increases and electrified, intelligent and connected vehicles develop.

The overcapacity of low-end products and fierce price war make companies less profitable. Some local companies tend to deploy high value-added products for becoming more competitive.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...