New Energy Vehicle Thermal Management System Market Research Report, 2021

Research on EV Thermal Management System: Fast iterative Application of New Technologies such as Heat Pump Air conditioning and Fourth-generation Refrigerant

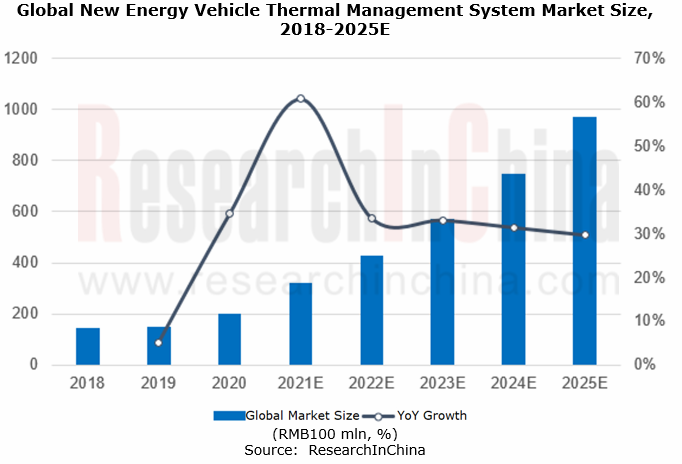

China's new energy vehicle thermal management system market size will exceed RMB40 billion in 2025

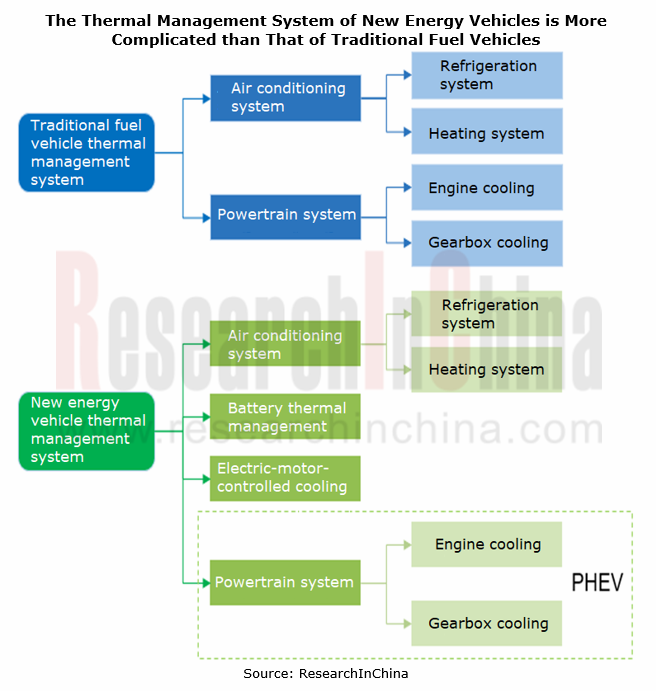

Due to the low efficiency of the internal combustion engine and the sufficient residual heat from the engine, the temperature management of traditional fuel vehicles mainly focuses on cooling and heat dissipation, with a relatively simple structure. In contrast, the new energy vehicle thermal management system is more complex, including refrigeration system, heating system (PTC/heat pump), battery thermal management system (air cooling /liquid cooling /direct cooling), and electric-motor-controlled cooling system (liquid cooling/independent heat exchange) and PHEV's unique engine cooling and gearbox cooling systems. Therefore, the value of a new energy vehicle is higher.

With the popularization of new energy vehicles, the automotive thermal management system has become complicated, with an increasingly complex structure and a higher integration level. The upgrade from independent modules to system engineering directly makes the cost of the automotive thermal management system swell from RMB1,600-2,500 (traditional fuel models) to RMB6,000-7,000 (new energy models). By 2025, 15 million new energy vehicles will be sold globally, so that China's new energy vehicle thermal management system market size is expected to hit RMB40.1 billion, accounting for more than 40% of the global scale.

As new technologies evolve rapidly, the application of the heat pump air conditioning system and the fourth-generation refrigerants like CO2 and R1234yf will accelerate

(1) Heat pump air conditioners will gradually be included in the standard configuration of high-end new energy passenger cars

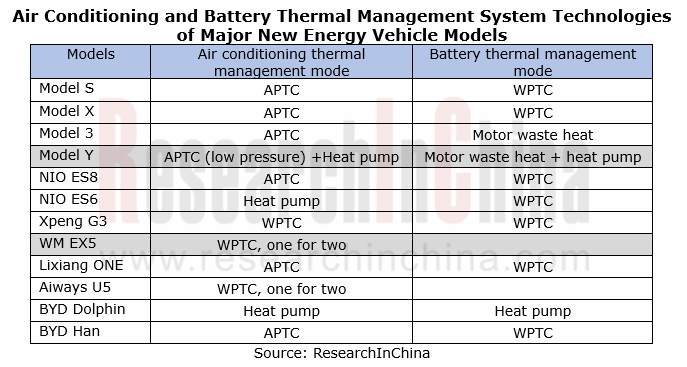

At present, there are two main air conditioning system solutions for battery-electric vehicles: (1) Air conditioning system with cooling function only + PTC (Positive Temperature Coefficient) heating; (2) Heat pump air conditioning system.

For new energy passenger cars, most domestic air conditioning system manufacturers use PTC air heaters for heating (PTC water heaters are generally available in plug-in hybrid vehicles), that is, PTC is heated by consuming battery power, which features high energy consumption. The heat pump air conditioning system adopts air as the heat source, and its heating and cooling share the same system. Thanks to heating, dehumidification and high energy efficiency ratio, it is the perfect solution for the high energy consumption of new energy vehicle air conditioners and longer recharge mileage of electric vehicles.

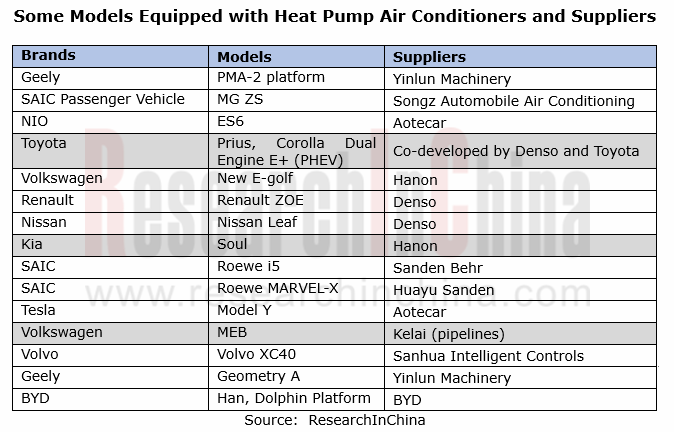

At present, more and more new energy vehicle manufacturers, including Nissan, Renault, BMW, Volkswagen, Audi, Toyota, Tesla, BYD, SAIC, GAC and Geely, have adopted heat pump air conditioning systems.

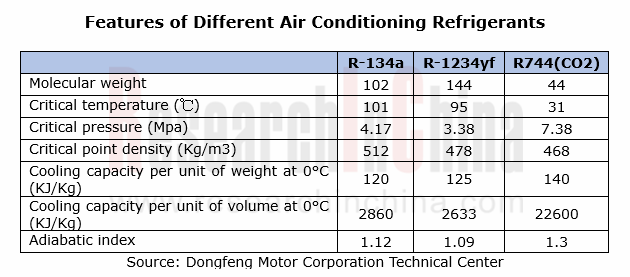

(2) The fourth-generation air conditioning refrigerants will become the main technical direction of automakers in the future

With a long history, refrigerants are an indispensable part of the air conditioning system. As people’s awareness of environmental protection improves and requirements are proposed on the performance of air conditioning systems, refrigerants have undergone several updates since 1830:

1. The first generation of refrigerants mainly focus on workability. Main representatives: NH3, etc.;

2. The second-generation refrigerants mainly feature safety and toxicity. Main representatives: R11, R12, etc.;

3. The third-generation refrigerants, mainly the refrigerants with low ODP (ozone depletion potential), pay attention to the destruction of the ozone layer. Main representatives: R22, R134a, etc.;

4. The fourth-generation refrigerants, like the refrigerants with zero ODP and low GWP (global warming potential), begin to be involved with the issue of global warming. Main representatives: CO2, R1234yf, etc.

Automotive air conditioning refrigerants are transitioning from the third generation to the fourth generation. The first-generation refrigerants, mainly R11 and R12, damage the ozone layer severely and pose a greenhouse effect. Now, R12 has been eliminated and been banned on new cars in China since 2002. With the steady progress of environmental protection policies, the replacement of R-134a is inevitable, but automakers have different opinions on using which refrigerant, R-1234yf or CO2, to substitute it.

OEMs choose thermal management technology roadmaps and system architectures according to their own needs, bringing many development opportunities for domestic suppliers.

Compared with mature fuel vehicles, automakers are still exploring and redefining the technology roadmaps and system architectures of the thermal management system for new energy vehicles. Major automakers have proposed their own solutions, especially Tesla and Volkswagen are the forerunners whose exploration in the thermal management system of new energy vehicles may indicate the future development direction of the industry.

Tesla’s thermal management system solutions have evolved into the fourth generation. From Model S to Model 3, then to Model Y, the architecture of Tesla’s thermal management system is becoming more and more complex, with much more working modes. Volkswagen started to explore heat pump air conditioning technology earlier and has accumulated rich experience. However, due to the small scale of new energy vehicles, its heat pump technology has not been widely promoted within the group. In the future, with the mass production of models on the battery-electric MEB platform, Volkswagen's sophisticated heat pump technology will bolster its new energy products greatly.

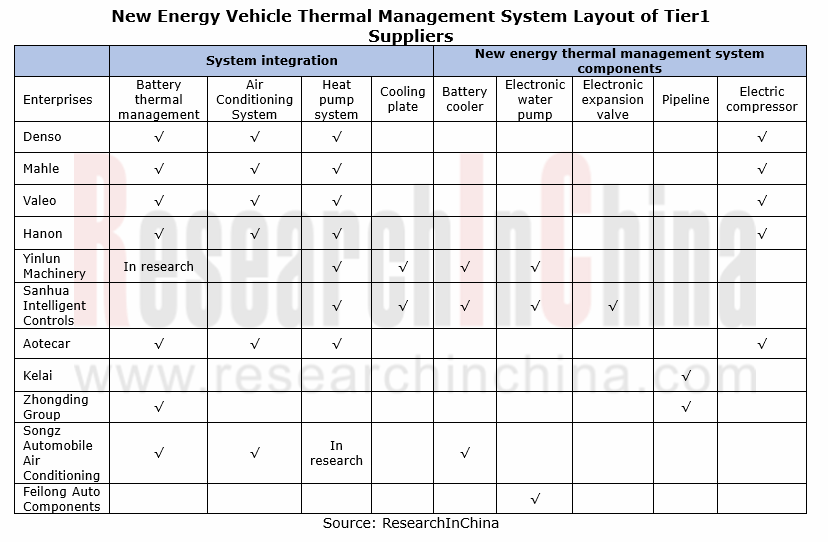

In the thermal management system market for traditional energy and new energy vehicles, traditional foreign-funded giants such as Denso, Valeo, Hanon, Mahle, etc. still dominate the supply of first-level system integration by virtue of deep technology accumulation and enormous customer resources, while domestic counterparts supply system components.

With the popularization of new energy vehicles in China, domestic manufacturers, such as Yinlun Machinery and Sanhua Intelligent Controls, quickly seize domestic new energy vehicle companies thanks to rapid response, cost control and geographical advantages, and have obtained experience in mass production of thermal management integrated systems. On April 18, 2021, Huawei released TMS 2.0, a smart car thermal management solution, which will be mass-produced in 2022. Compared with TMS 1.0 installed on BAIC ARCFOX, it has a higher level of integration, and it is improved in energy efficiency, calibration efficiency and experience.

Domestic Tier1 companies started with parts in the early stage, focusing on the R&D and production of valves, pumps, and pipelines. They have broken the foreign monopoly, mastered the key technology of core components, entered the thermal management industry, endorsed the scale and products of key customers by binding foreign system integration customers, and accumulated valuable experience in system integration. On this basis, they are gradually transforming into suppliers of automotive thermal management solutions, offering more product types to domestic OEMs.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...