VCU research: rapid evolution to integration and domain control

OEMs gradually realize independent supply amid the competitive landscape of VCUs for new energy passenger cars

The VCU is the "brain" of new energy vehicles. In the early development stage of China's new energy vehicle industry, VCUs were mainly supplied by foreign vendors. Afterwards, domestic automakers and automotive electronics suppliers have gradually mastered core technologies, so that their industrialization capabilities were greatly improved.

For example, BYD has fully realized independent supply of VCUs, Geely has continuously increased the proportion of self-produced VCUs to about 60%, almost 80% of Changan Automobile’s VCUs are produced by itself, and Chery can produce more than 90% of its own VCUs.

The VCUs of some OEMs or some models are purchased from third-party suppliers like UAES, Bosch, Continental, Denso, G-Pulse Electronics Technology, Atech, Hefei Softec Auto Electronic, Hangsheng Electronics, etc. Suppliers can provide their own software and hardware directly to OEMs, or they can be the foundries of OEMs.

The VCU market size is related to the output of new energy vehicles. By 2025, China new energy vehicle VCU market size will hit RMB5.03 billion (including self-supply of automakers).

Lightweight promotes the development of "electric drive + electric control + VCU" integrated system

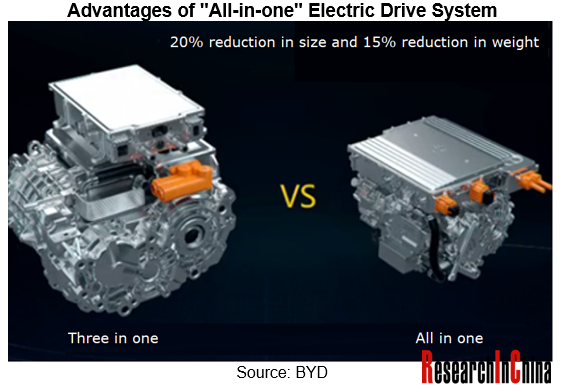

In order to cater to the development trend of electrified, intelligent and lightweight vehicles, VCUs will tend to be highly integrated in the future. OEMs and Tier 1 suppliers have launched "all-in-one" electric drive systems, containing VCUs.

To further reduce the weight of new energy vehicles, improve product performance and ride comfort, BAIC started to try highly integrated products, followed by GM, Huawei, BYD, etc.. "Electric drive + electronic control + VCU" integrated systems have become the focus of OEMs and Tier 1 suppliers.

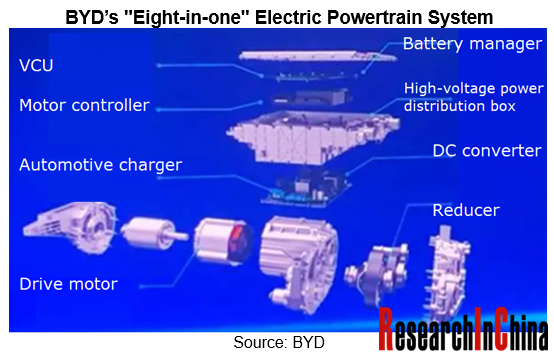

In September 2021, FinDreams Powertrain under BYD launched the "eight-in-one" electric powertrain, which deeply integrates drive motor, motor controller, reducer, automotive charger, DC converter, power distribution box, VCU, and battery manager.

One of the main purposes of BYD's "eight-in-one" integrated system is to reduce the weight of electric vehicles. It can realize the sharing of external high-voltage filters, external interface filter circuits and high-voltage sampling, as well as the in-depth integration of system DC, OBC, power distribution, transformers, inductors and VCU/BMC/MCU chips, so that an H-Bridge, transformers and a lot of high-voltage wiring harness are unnecessary, the magnetic module size is reduced by 40%, the overall volume is cut down by 16% (which can expand the riding space or increase the battery capacity), and the weight is slashed by 10% (which can further reduce power consumption).

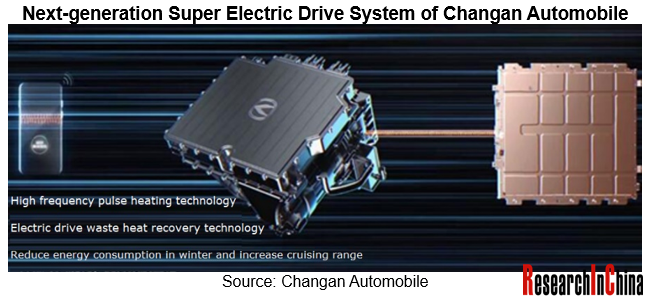

In July 2021, Changan Automobile released the second-generation electric drive integrated system, which combines seven components: VCU, high-voltage junction box, motor controller, DC converter, charger, motor, and reducer. Compared with the first-generation "three-in-one" (integrated motor, electronic control, and reducer) system, the second generation has been significantly improved in comprehensive performance, with the size reduced by 5%, the weight reduced by 10%, the power density increased by 37%, and the efficiency improved by 5%.

Changan Automobile expects to mass-produce next-generation super integrated electric drive in the second quarter of 2022, and which will be first deployed on C385, the first strategic model of the dedicated electric platform (EAP1).

Under the new EEA, VCU develops towards domain control integration

From the perspective of evolution process, automotive E/E architecture (EEA) will inevitably develop towards centralized EEA. From the perspective of mass-produced models, domain-centralized EEA prevail now. The quasi-central architecture consisting of the central computing platform + zonal controllers will be the next step for automakers who finally evolve towards the central computing architecture concentrating the functional logic to a central controller.

With the evolution of the vehicle's EEA, the "all-in-one" electric drive system will eventually be integrated into the domain control system. For example, Huawei's "seven-in-one" DriveONE electric drive system has the most eye-catching domain control solution. The integration of modules, systems, scenarios and solutions effectively improves the system security.

(1) VCUs are integrated into domain controllers

For the development of vehicle EEA, the VCUs of the domain control architecture can be integrated into domain controllers. For example, ENOVATE integrates VCU and BMS to form the first-generation power domain controller VBU with completely independent research and development.

Hardware: The VBU uses Infineon's tri-core processor, has rich I/O resources, and supports Fast Ethernet;

Software: AUTOSAR architecture. The software architecture and interface protocol comply with AUTOSAR 4.2.2;

Application: At present, the VBU has integrated vehicle control, battery management, charging control, and extended range control.

Huawei's CC architecture includes 3 central controllers (smart cockpit, vehicle control, and smart driving) and 4 zonal controllers. Among them, the vehicle domain control (VDC) integrates the original VCU, adopts VOS system, and is compatible with AutoSar.

On the VDC platform, Huawei will develop an MCU and a vehicle control operating system which will be open to automakers, allowing automakers to perform differentiated vehicle control based on the VDC platform.

In April 2021, BYD released the e-platform 3.0, which gradually integrates dozens of ECUs in the vehicle into domain controllers of intelligent power domain, intelligent vehicle control domain, intelligent cockpit domain and intelligent driving domain; wherein, intelligent power domain integrates the control part of VCU, BMS, Inverter, PDU, DC/DC and AC/DC.

(2) VCUs are integrated into central computing unit

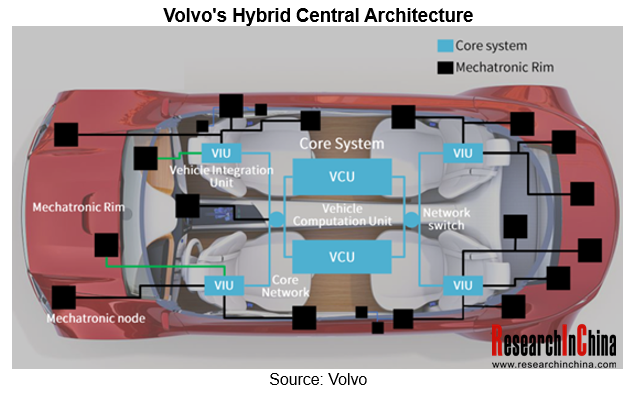

Under the central computing architecture, the central gateway degenerates into multiple zonal gateways, and VCU functions will be integrated into the vehicle control unit of the central computing unit.

For example, Volvo's hybrid central architecture includes a central computing platform, an intelligent interconnection module (IHU), and an autonomous driving module (ADPM) to integrate the original domain controllers into a central computing platform.

ResearchInChina’s New Energy Vehicle VCU Industry Report, 2021 mainly studies the following contents:

Industry overview, market size, competitive landscape, etc. of VCUs for new energy vehicles;

Industry chain, status quo of upstream and downstream of VCUs for new energy vehicles;

The impact of the EEA reform on VCUs for new energy vehicles, the development trend of VCU technology, etc.;

VCU solutions of some OEMs (such as BYD, ENOVATE, Changan, etc.);

VCU solutions of major domestic and foreign suppliers.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...