Global and China Automotive Operating System (OS) Industry Report, 2021

Automotive OS Research: Automotive OS Is Highly Competitive

Automotive OS has always been complicated and dazzling.

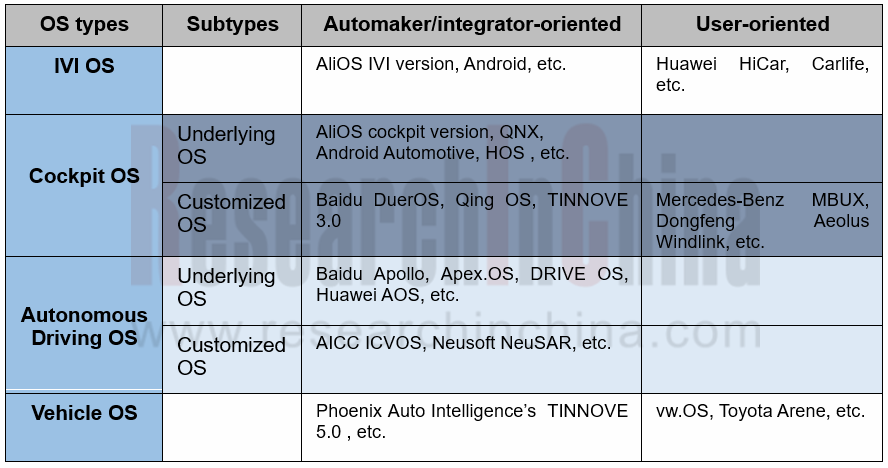

A year ago, ResearchInChina classified "Automotive OS" into four types:

1) Basic Auto OS: it refers to base auto OS such as AliOS, QNX, Linux, including all base components like system kernel, underlying driver and virtual machine.

2) Custom-made Auto OS: it is deeply developed and tailored on the basis of basic OS (together with OEMs and Tier 1 suppliers) to eventually bring cockpit system platform or automated driving system platform into a reality. Examples are Baidu in-car OS and VW.OS.

3) ROM Auto OS: Customized development is based on Android (or Linux), instead of changing system kernel. MIUI is the typical system applied in mobile phone. Benz, BMW, NIO, XPeng and CHJ Automotive often prefer to develop ROM auto OS.

4) Super Auto APP (also called phone mapping system) refers to a versatile APP integrating map, music, voice, sociality, etc. to meet car owners’ needs. Examples are Carlife and CarPlay.

However, profound changes have taken place in the Automotive OS field so far. In this report, we classified Automotive OS from another perspective.

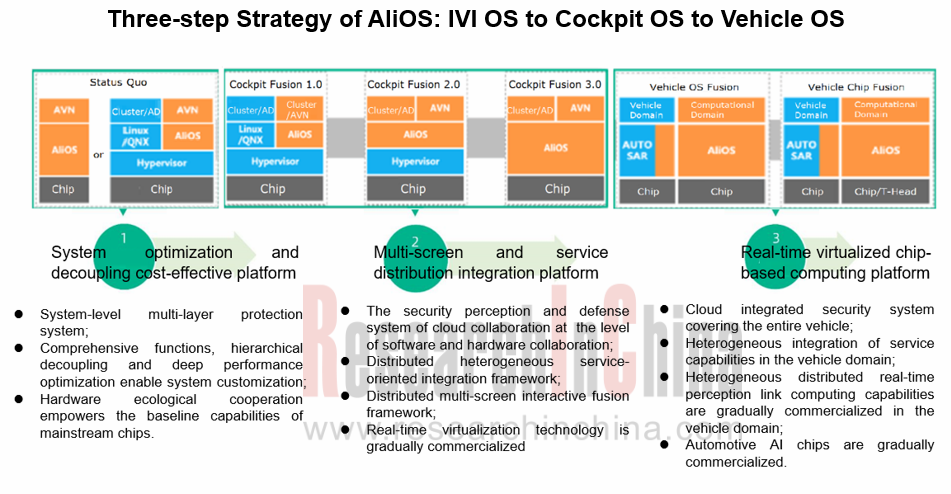

Many Automotive OS vendors have started from IVI OS, with the technological evolution: IVI OS-->Cockpit OS -->Vehicle OS. They are expected to head toward Vehicle OS after 2024.

In 2020, Banma SmartDrive proposed the evolution route of AliOS, namely Smart IVI OS-->Smart Cockpit OS -->Smart Vehicle OS.

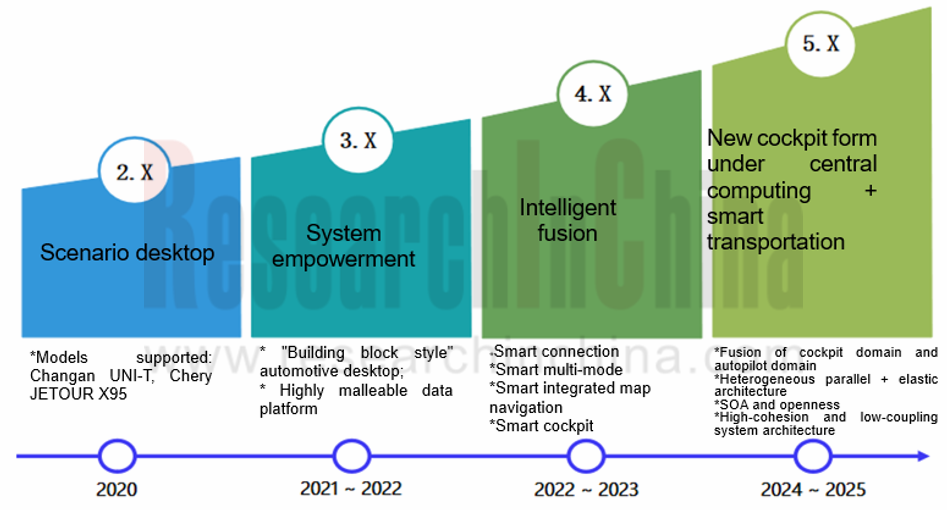

Based on Tencent's ecology, TINNOVE OS follows the technology roadmap from Cockpit OS to Vehicle OS that integrates the cockpit domain and the autonomous driving domain.

Through the "open" and "ecological" approach, TINNOVE OS transfers Tencent’s ecosystem to the system and OEMs. At present, it has cooperated with Changan Automobile, Audi, Chery JETOUR, Ford and other brands. TINNOVE OS has been installed in more than a dozen models like Changan CS75Plus, UNI-T, CS35Plus and CS85 COUPE. Phoenix Auto Intelligence has recently reached in-depth cooperation with Qualcomm, and SemiDrive, etc.

Autonomous Driving OS and Domain Controllers Are Integrated to Be Autonomous Driving Computing Platform

With the popularity of software-defined vehicles and domain controllers, automakers, Tier1 suppliers and core chip vendors have been all making layout from the perspective of platforms and ecology.

Autonomous driving computing platform providers not only lay out Autonomous Driving OS, but also launch domain controllers, and build ecosystems based on computing platforms consisting of Autonomous Driving OS and domain controllers. With these autonomous driving platforms, OEMs and autonomous driving integrators no longer have to deal directly with the underlying operating system and chips, which can greatly simplify the development process and shorten the product cycle.

Neusoft Reach and AICC are typical autonomous driving computing platform providers.

Neusoft Reach’s next-generation autonomous driving computing platform includes the software platform NeuSAR3.0, the all-in-one X-Cube3.0 for ADAS, and the autonomous driving domain controller X-Box 3.0. In October 2021, Neusoft Reach was invested by SDIC and Virtue Capital with a total of RMB650 million.

In February 2021, AICC released the intelligent driving computing platform "Intelligent Vehicle Basic Brain" (iVBB) 1.0, including intelligent connected vehicle operation system (ICVOS), intelligent vehicle domain hardware (ICVHW), and intelligent connected vehicle-edge-cloud basic software (ICVEC). It features rapid application development, platformization, connectivity, scalability and compliance with automotive regulations.

Automotive OS investment soars, and market competition becomes fierce

In March 2021, Evergrande New Energy Vehicle and Phoenix Auto Intelligence signed an agreement to invest 60% and 40% respectively in establishing an operating system joint venture.

In July 2021, the veteran shareholders Alibaba Group, SAIC Group, SDIC, and Yunfeng Capital jointly injected RMB3 billion into Banma SmartDrive for further R&D and promotion of intelligent vehicle OS.

In June 2021, AICC the completed the angel financing of nearly RMB100 million. In October 2021, AICC raised hundreds of millions of yuan in the pre-A round of financing.

The background of the above three companies: Phoenix Auto Intelligence is backed up by Tencent, Alibaba is behind Banma SmartDrive, and AICC is supported by CICV (invested by more than a dozen traditional OEMs and Tier1 suppliers). Plus Baidu and Huawei, which are aggressive in the Automotive OS market, all players are powerful.

The competition in automotive computing platforms, including operating systems, is essentially ecological competition. Who can win the support of more software developers, component companies, service operators, etc. will dominate the future autonomous driving.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...