Research on JV-brand Telematics: Digitization and localization help the rise of joint venture brands

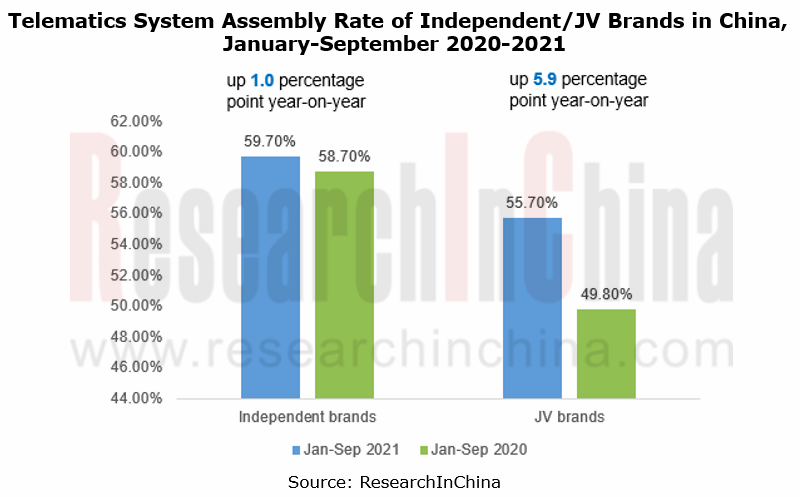

With the development of intelligence and connectivity, automobiles have become a "third space" integrating mobility, life, entertainment and business. In order to meet this demand, OEMs have increased their investment in and application of Telematics systems. Among them, independent brands have achieved leading advantages. From January to September 2021, independent brands secured the Telematics assembly rate of 59.7%, while joint venture brands only achieved 55.7%. However, joint venture brands saw a faster year-on-year growth rate in the assembly rate, namely 5.9 percentage points, while independent brands witnessed 1.0 percentage point, which shows that joint venture brands are catching up.

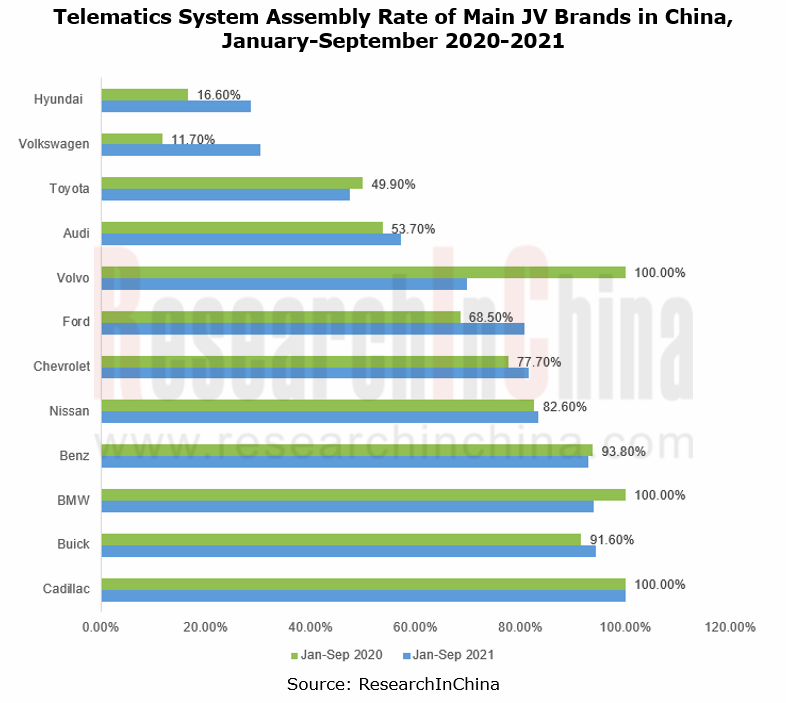

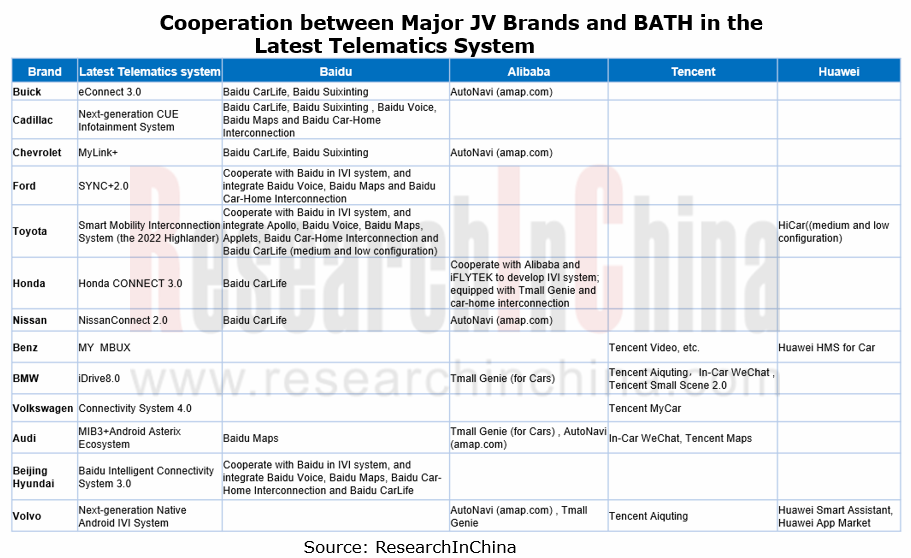

Among JV brands, BMW, Mercedes-Benz, Buick, Ford and so on have accelerated their transformation to Internet mobility service providers, bringing users brand-new digital experience. At the same time, Volkswagen, Toyota, Honda, etc. emerge by strengthening cooperation with BATH (Baidu, Alibaba, Tencent and Huawei), etc..

On the whole, JV brands are accelerating. OEMs represented by BMW and Mercedes-Benz are injecting new concepts (such as "zero layer", AR HUD) into the development of Telematics, and strive to create smarter all-round people-car-life interconnection solutions.

Main highlights:

1. Multi-screen, combined screens and (ultra) large screens tend to prevail. The "zero layer" design is beginning to show its edge

In early 2021, Mercedes-Benz revealed the MBUX Hyperscreen, whose 6 displays merge almost seamlessly into one another to create an impressive screen band over 141 centimeters wide and 2,432 cm2 area: Driver display (screen diagonal: 12.3 inch), central display (17.7 inch) and front passenger display (12.3 inch) appear as one visual unit. Three screens sit under a common bonded irregular curved cover glass, enabling the interconnection of navigation, entertainment, audio and video. In addition, there are two 11.6-inch rear passenger entertainment screens and a rear center armrest car control screen, which can realize multi-screen interaction. The MBUX Hyperscreen was first seen in EQS.

What attracts attention is that the MBUX Hyperscreen introduces the "zero layer" operation concept for the first time. Thanks to the so-called zero layer, the user does not have to scroll through submenus or give voice commands. The most important applications are always offered in a situational and contextual way at the top level in view.

Mercedes-Benz's "zero layer" design coincides with Volvo's next-generation IVI system concept. In June 2021, Volvo Cars announced its strategic collaboration with Google to take infotainment and connectivity to the next level. Future Volvo cars will also come with a large, centralized touch screen that provides rich content, easy-to-see information and responsive interaction. The principle is that everything customers need should always be easily accessible, either by touch or by voice command. No immediate needs or information are buried deep inside menus, many clicks away.

2. The “touch + voice” functions are further refined, and new interactive methods such as voiceprints, fingerprints, gestures and faces emerge

Touch + voice have been included into the standard configuration of new cars on the market; but in terms of functions, automakers continue to refine their functions, such as voice interaction systems, additional voice avatars, AI active learning, four-sound-zone pickup and greetings.

In early 2021, BMW launched the new iDrive 8 system, which will first land in the BMW iX. Compared with iDrive 7, iDrive 8 visualizes the Intelligent Personal Assistant. Light-emitting spheres of different sizes and brightness can breathe and move with voice and dialogue. The BMW Intelligent Personal Assistant can distinguish who is talking to it and appears on the relevant screen area. Through the camera, it judges the status of the target, predicts the behavior and intelligently gives reminder. For Chinese users, iDrive 8 provides both male and female customized voices, and send blessings on holidays and more.

In the new Mercedes-Benz S-Class, the voice assistant "Hey Mercedes" can not only be controlled by driver and co-driver, but also be controlled from the rear. Several microphones help to tell the system which seat the voice is coming from. The active ambient lighting flashes at this position and identifies the current speaker. "Hey Mercedes" now supports 27 languages with natural language understanding (NLU). Moreover, certain actions like navigation can be performed even without the activation keyword "Hey Mercedes". The back row can also share navigation, "heart-wake-up", music and other functions with the front row.

The new Mercedes-Benz S-Class uses the voice assistant "Hey Mercedes" in the rear for the first time

New interactive methods such as gesture recognition and face recognition have been applied to the new generation IVI systems of Mercedes-Benz, Ford, BMW, and Volkswagen. Using cameras in the overhead control panel and learning algorithms, MBUX Interior Assist recognizes and anticipates the wishes and intentions of the occupants. It does this by interpreting head direction, hand movements and body language, and responds with corresponding vehicle functions. MBUX Interior Assist can recognize up to 12 commands. For example, the driver or passengers can open the sliding sunroof with a wave of the hand.

The SYNC+2.0 system which is first available in Ford EVOS can recognize 10 gestures, including nodding, shaking head, hushing, OK sign, thumbing up, V sign, waving, gripping, etc.

3. Local cooperation strengthens. Baidu, Tencent, Alibaba and others speed up the installation of automotive ecology in vehicles

Toyota and Honda, which are always cautious, accelerated the localization of Telematics in 2021, and are striving to catch up in terms of IVI R&D, ecological applications and future planning.

Toyota: In 2021, Toyota cooperated with Tencent and Baidu to introduce TAI and Apollo. For example, the 2021 Camry is deeply integrated with TAI, equipped with in-vehicle WeChat, Tencent Aiquting, and Tencent Maps. The 2022 Highlander will cooperate with Baidu in depth to integrate Duer, including Baidu Voice, Baidu Maps (for Cars), Baidu Car-Home Interconnection, Baidu CarLife, Suixinkan (watch as you like) (iQiyi, etc.), Suixinting (listen to whatever you want) (QQ music, audiobooks, news), etc.; at the same time, interactive features such as face recognition and active recommendation (“I know you” mode) are introduced.

Honda: On June 10, 2020, Honda Motor (China) Investment Co., Ltd., a wholly-owned Honda subsidiary in China, announced the establishment of Hynex Mobility Service Co., Ltd., a new joint venture company with Neusoft Reach Automotive Technology (Shanghai) Co., Ltd. (Neusoft Reach). Honda holds 51% stake of the joint venture. Hynex Mobility Service will strive to advance connected services and offer new value users can enjoy through their connected experiences, while placing the primary focus on Honda CONNECT, Honda’s on-board connected system.

In March 2021, Hynex Mobility Service released its first R&D result - Honda CONNECT 3.0, which introduced local resources such as iFLYTEK and Tmall Genie to greatly improve speech recognition and semantic understanding (it supports more than 1,000 semantic analysis modes and can recognize dialects, including Mandarin, Sichuan dialect and Cantonese; it offers interest-based search, intelligent recommendation, etc.) and car-home life services (two-way car-home interconnection, online shopping, food ordering, etc.).

In October 2021, Honda held a virtual press conference on its electrification strategy in China. Honda will introduce the first 10 Honda-brand EV models in China, namely the “e:N Series,” in the next five years. Honda envisions exporting these models from China. The e:N Series is being developed with the series concept of “Dynamic, Intelligence and Beauty.” In terms of intelligence, the e:N OS, an integrated system consisting of Honda SENSING, Honda CONNECT and a smart Digital Cockpit, creates a safe and pleasant “space” for mobility. Toyota is ready to make a full breakthrough in the fields of electrification, intelligence, and connectivity in China.

4. More personalized and exclusive experiences

In order to improve the driving experience, OEMs have created unique services and make services reach people. Under normal circumstances, users log in to their exclusive ID through password (or fingerprint) + face recognition + voiceprint recognition, etc., and connect to the ecosystem and mobile phone APP to configure different functions, such as seats, rearview mirrors and personal preferences, etc. On this basis, services such as personalized voice, personalized driving modes, personalized holiday greetings, and exclusive spaces are emerging in an endless stream.

For example, the new "Space-Time Secret Message" function of Ford SYNC+2.0 can present personalized information, such as “Happy New Year”, at a specified time. In addition, the "Free Secret Realm" function has four picture modes: "Forest Secret Realm", "Stars & Sea", "Summer Night with Fireflies" and "Sky Secret Realm", with soothing music, ambient lights, and the best seating position to soothe body and mind, relieve fatigue.

5. The linkage between HMI system and assisted driving has become a trend

The second generation of MBUX (Mercedes-Benz User Experience) debuts in the new S-Class. The active ambient lighting with around 250 LEDs is now integrated into the driving assistance systems, is linked with HMI system and the "heart-wake-up" function and is able to reinforce warnings visually. For example, when there is a car on the left overtaking, or when the passenger wants to push the door to get off the car, the ambient lighting will flash red to remind the driver.

In addition, the intelligent digital headlights of the Mercedes-Benz S-Class are also integrated into the driving assistance system, which can automatically adjust the lighting method, angle, and brightness according to environment, climate, light and driving conditions.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...