China Around View System (AVS) Suppliers and Technology Trends Report, 2021 – Chinese Brands

Research on Chinese Brands’ Around View System: AVS Going to Integrate with Features of ADAS and Transparent Chassis

ResearchInChina published "China Around View System (AVS) Suppliers and Technology Trends Report, 2021 – Chinese Brands", which sorts and analyzes the Chinese OEMs’ around view functions, Chinese AVS suppliers’ technologies, typical Chinese manufacturers of AVS components, and the AVS development tendencies.

AVS (Around (Surround) View System) serves as a system that delivers real-time imaging to the driver in a 360-degree range around the vehicle at low speeds (excluding systems with only rear cameras).

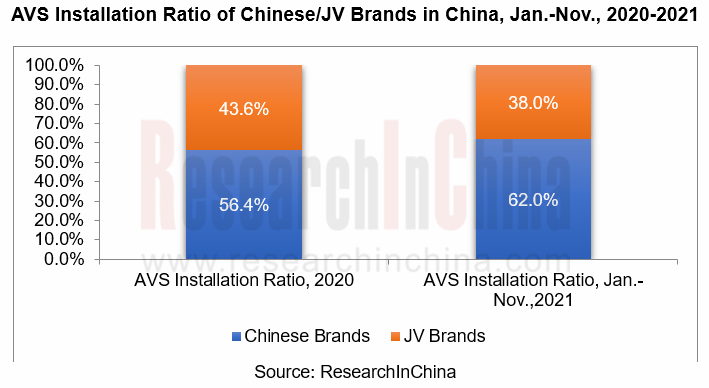

Chinese Brands Dominate the Market in Terms of AVS Installations

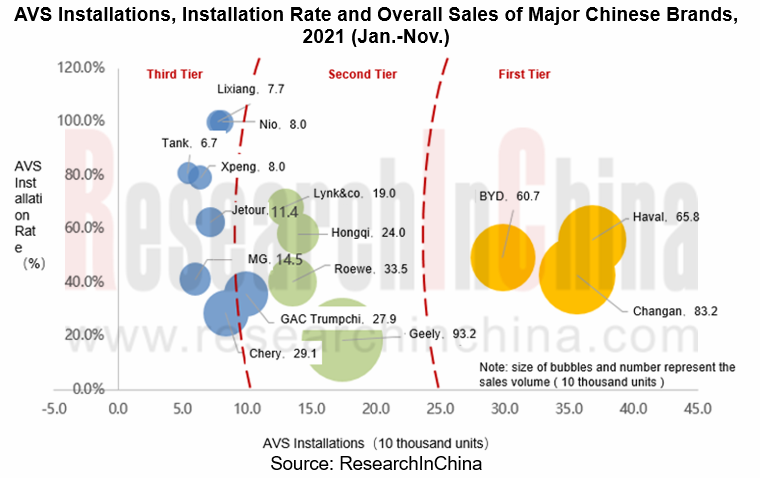

From January to November of 2021, AVS was available onto 4.266 million vehicles in China, an upsurge of 49.2% year-on-year; the installation rate of AVS registered 23.6%, a rise of 6 percentage points on an annualized basis, according to ResearchInChina. Elaborately, local Chinese brands’ AVS installations accounted for 62.0%, an increase of 5.6 percentage points year-on-year, among which Haval, Changan and BYD stand at the first tier; while Geely, Hongqi, Roewe and Lynk&co were in the second echelon.

By price, from January to November 2021, Chinese brand models priced between RMB100,000-RMB150,000 constitute the largest part of AVS installations, reaching 1,366,000 vehicles, sharing 51.7%, and the local brands AVS installation rate in this range is 48.1%, up 4.3 percentage points year-on-year, followed by the Chinese brand models priced at RMB150,000-RMB200,000 and a total of 496,000 vehicles installed with AVS, accounting for 18.8%, and the local brand AVS installation rate in this range is 67.0%, up 8.3 points year-on-year.

By models, from January to November 2021, the top three Chinese brands’ models in terms of installation were Haval H6 (208,000 units), Changan CS75 (156,000 units) and Hongqi HS5 (100,000 units).

In future, AVS installation rate will rise further with the cost reduction brought by gradual integration of AVS into the cockpit domain as well as the popularization of parking solutions combining surround view and ultrasonic.

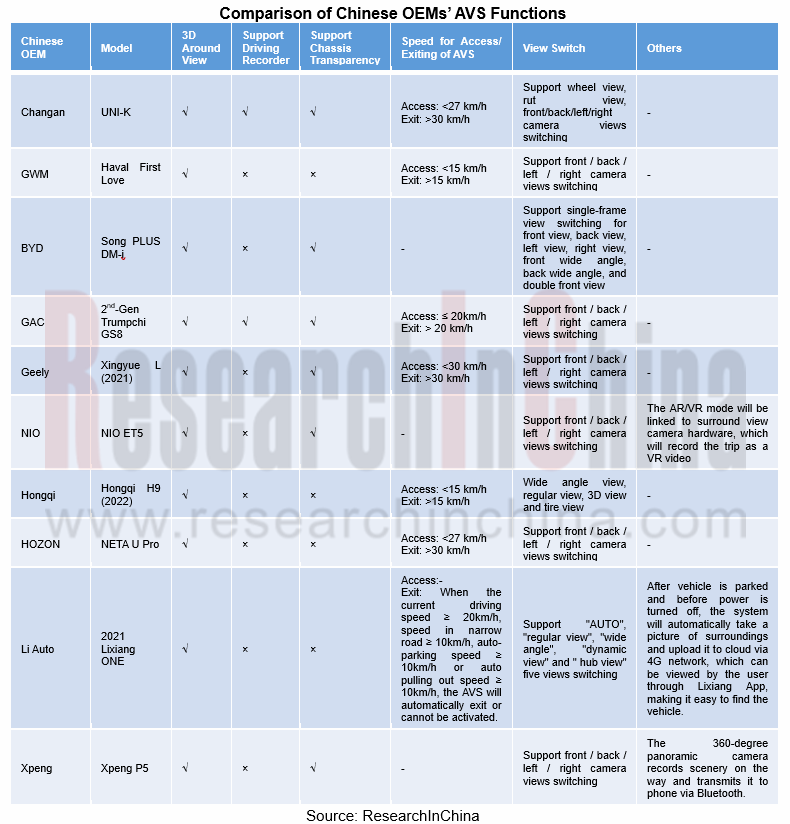

Chinese OEMs’ around view function gets continuously optimized, expanding to transparent chassis and ADAS function

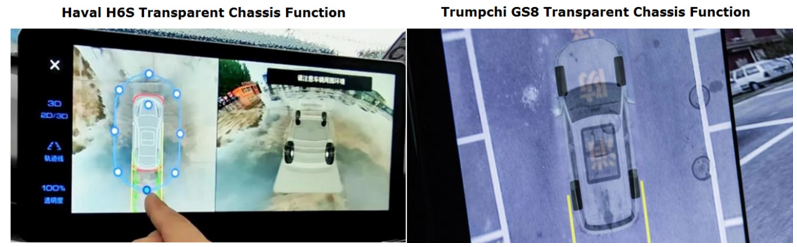

The AVS of Chinese OEMs is functionally evolving from a single 360° panoramic view in the past to rich ADAS features (such as moving object detection and warning (MOD), lane departure warning (LDW), and driving recorder, etc.) and transparent chassis.

For instance, Haval H6S (launched in October 2021) is added with 180-degree transparent chassis based on 360-degree panoramic image, which can realize 0%, 50% and 100% transparency settings; Trumpchi GS8 (unveiled in December 2021) has the AVS not only enabling 2D/3D panorama, MOD (moving object detection), driving recorder, and transparent chassis functions, but with a fusion of ultrasonic to achieve APA automatic parking.

Surround view cameras move toward higher pixel and more powerful perception

For clearer imaging, Chinese AVS suppliers are aggressively developing high pixel surround view cameras.

Ofilm, for example, spawned 2-megapixel HD surround view cameras in September 2021 and is working on 5-megapixel (to be launched in 2023) and 8-megapixel. SOE, a subsidiary of Minth Group, has upgraded its camera pixels from traditional VGA and current popular 1.3-megapixel HD camera to 2-megapixel FHD products, also with a plan for improvement to 8 megapixels in future. CalmCar, in cooperation with ZF, provides 192° fisheye cameras embedded with deep learning-based garage position recognition to enable higher perception capability in the AVP system based on surround view.

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...

China Passenger Car HUD Industry Report, 2025

ResearchInChina released the "China Passenger Car HUD Industry Report, 2025", which sorts out the HUD installation situation, the dynamics of upstream, midstream and downstream manufacturers in the HU...

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2025 – Chinese Companies

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2025 – Chinese Companies

Research on Domestic ADAS Tier 1 Suppliers: Seven Development Trends in the Era of Assisted Driving 2.0

In the ...

Automotive ADAS Camera Report, 2025

①In terms of the amount of installed data, installations of side-view cameras maintain a growth rate of over 90%From January to May 2025, ADAS cameras (statistical scope: front-view, side-view, surrou...

Body (Zone) Domain Controller and Chip Industry Research Report,2025

Body (Zone) Domain Research: ZCU Installation Exceeds 2 Million Units, Evolving Towards a "Plug-and-Play" Modular Platform

The body (zone) domain covers BCM (Body Control Module), BDC (Body Dom...

Automotive Cockpit Domain Controller Research Report, 2025

Cockpit domain controller research: three cockpit domain controller architectures for AI Three layout solutions for cockpit domain controllers for deep AI empowerment

As intelligent cockpit tran...

China Passenger Car Electronic Control Suspension Industry Research Report, 2025

Electronic control suspension research: air springs evolve from single chamber to dual chambers, CDC evolves from single valve to dual valves

ResearchInChina released "China Passenger Car Elect...

Automotive XR Industry Report, 2025

Automotive XR industry research: automotive XR application is still in its infancy, and some OEMs have already made forward-looking layout

The Automotive XR Industry Report, 2025, re...

Intelligent Driving Simulation and World Model Research Report, 2025

1. The world model brings innovation to intelligent driving simulation

In the advancement towards L3 and higher-level autonomous driving, the development of end-to-end technology has raised higher re...

Autonomous Driving Map (HD/LD/SD MAP, Online Reconstruction, Real-time Generative Map) Industry Report 2025

Research on Autonomous Driving Maps: Evolve from Recording the Past to Previewing the Future with "Real-time Generative Maps"

"Mapless NOA" has become the mainstream solution for autonomous driving s...