Global and China Heavy Truck Industry Report, 2021-2027

-

Jan.2022

- Hard Copy

- USD

$3,000

-

- Pages:130

- Single User License

(PDF Unprintable)

- USD

$2,800

-

- Code:

ZXF002

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,200

-

- Hard Copy + Single User License

- USD

$3,200

-

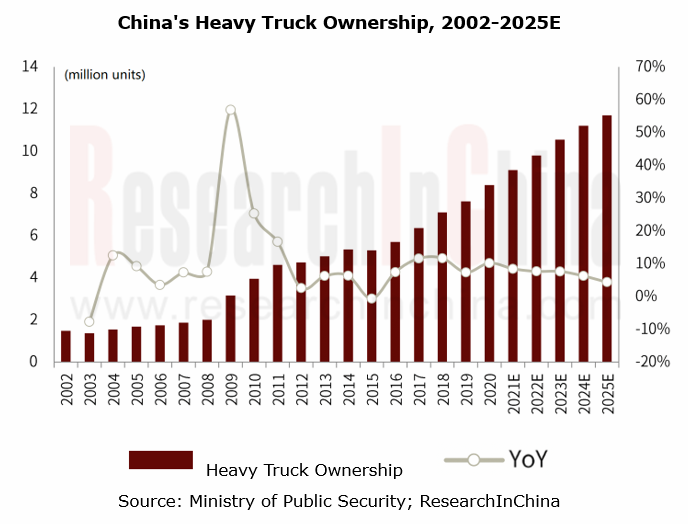

From 2016 to 2020, China’s heavy truck sales surged from 728,000 units to 1,617,000 units, hitting new records for the consecutive four years. In 2021, a combination of factors such as sluggish freight market and demand overdraft led to an annualized 14.1% slump in the heavy truck sales to 1.39 million units, a figure projected to be around 1.2 million in 2022. It is conceivable that China’s heavy truck ownership will reach 11.7 million units in 2025.

First, the stagnating freight market and the increasing unbalance between supply and demand have brought about slowing demand for heavy trucks since April 2021, and plus a range of other factors like transport overcapacity, falling freight rates, and insufficient construction of infrastructure projects, led to less-than-expected orders from heavy truck end users.

Second, the “crazy growth” of heavy truck market in 2020 overdrew part of demand in 2021. The full implementation of China Phase VI Emission Standards kicked companies into high gear to produce China V models from early 2021, and dealers across the country also went all out to stock up, which moved up the release time of the end demand and caused the plummeting demand for heavy trucks in the second half of 2021.

Third, users’ doubts about the reliability and fuel adaptability of China VI heavy trucks with high price and high use cost slashed the rigid demand. The successive issuance of policies for controlling China V diesel vehicles in some regions made it hard to digest the China V vehicle inventory.

In 2022, the demand for heavy trucks will show a trend of opening low but going up and the market will enter the phase of stock competition, thanks to the Winter Olympics and economic recovery cycle among other factors. First, the resumption of infrastructure projects will create opportunities for the construction vehicle market; second, the goal of “double carbon” (carbon peaking and carbon neutrality) will spur the new energy vehicle market; third, the end of phase-out of China III diesel vehicles and the restriction on China IV ones will leave the scope for replacement and update; fourth, people's livelihood security and specialized transport will bring opportunities to market segments.

Sales of China VI tractors may surge.

In 2021, China sold a total of 1.39 million heavy trucks, including about 250,000 China VI heavy trucks, or 18% of the total, 4 percentage points higher than in 2020 (14%). In 2021, the first year to implement the China Phase VI Emission Standards, China VI diesel heavy trucks however shared lower than 1/5. In the future, as the restriction on China V and below vehicles become stricter, the sales of China VI heavy trucks will sustain growth, of which the sales of tractors may soar.

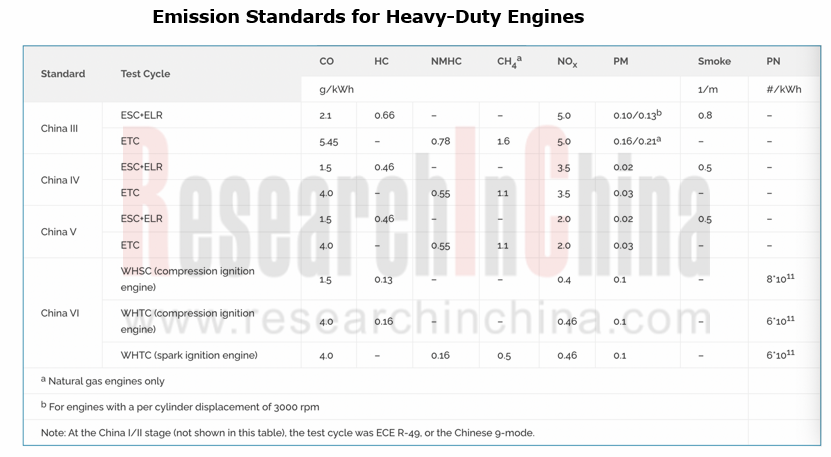

In 2018, China finalized China VI standards that will apply to new heavy-duty diesel vehicles nationwide in two stages. The first stage, China VI-a, is largely equivalent to Euro VI and applied to gas engines in July 2019, urban HDVs in July 2020, and all new HDVs in July 2021. The second stage, China VI-b, adds requirements such as anti-tampering monitoring and remote on-board diagnostics data reporting that are expected to enhance real-world emissions compliance. China VI-b will apply to gas engines nationwide starting in January 2021 and all new HDVs in July 2023.

The intelligent connected heavy trucks will be a megatrend.

Intelligent connected vehicles are taken as one of the key industrial growth drivers in the future, according to the Action Plan for the Development of the Intelligent Connected Vehicle (ICV) Industry, a policy issued by the Ministry of Industry and Information Technology (MIIT) in 2018. The Intelligent Connected Vehicle Technology Roadmap 2.0 released by the National Innovation Center of Intelligent and Connected Vehicles in 2020, indicates that: in 2025, the sales of ICVs at levels of PA (partial automation) and CA (conditional automation) will make up more than 50% of the total. In 2021, the MIIT set up an Intelligent Connected Vehicle Promotion Group to carry out pilot projects of urban and intelligent connected vehicles.

Intelligent transportation has been as important as a national strategy, and the intelligent connected heavy trucks have also become a development trend, so to speak. In August 2018, Beijing announced a regulation: China V and above diesel heavy trucks registered in Beijing must be connected to Beijing Municipal Ecology and Environment Bureau before December 31, 2021. National strategies and transportation policies will favor the wider adoption of intelligent connected heavy trucks which may be a new sales driver in 2022.

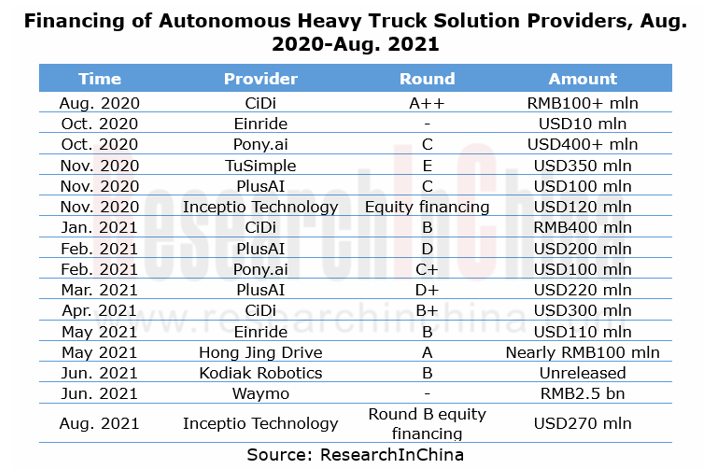

According to incomplete statistics, several autonomous heavy truck solution providers at home and abroad have closed a total of at least 16 funding rounds in the most recent year (August 2020 to August 2021). Examples include PlusAI and Inceptio Technology, two Chinese firms which have raised over USD800 million in all in their recent several funding rounds.

The sales of new energy heavy trucks may enjoy a big growth spurt.

As China works towards the “double carbon” goal, energy saving and emission reduction will be the main theme of the future industrial development. In the first eleven months of 2021, the sales of new energy heavy trucks totaled 7,442 units, a like-on-like spurt of 222.4%, gathering momentum. Wherein, 6,840 units, or 91.91% of the total new energy heavy truck sales were electric heavy trucks, up by 201% compared with the same period of the previous year. It can be seen that electric heavy trucks were the major contributor to the rapid growth of new energy heavy trucks in 2021.

Noticeably, in late December, the Ministry of Finance released a notice on another 30% reduction in new energy vehicle purchase subsidies and confirmed that the new energy vehicle purchase subsidy policy will be terminated on December 31, 2022, that is, vehicles registered and licensed after December 31, 2022 will not be subsidized. This regulation may trigger a big upsurge in sales of new energy heavy trucks in 2022, especially port logistics and urban special vehicles.

Global and China Heavy Truck Industry Report, 2021-2027 highlights the following:

China heavy truck industry (definition and classification, development trends, technology, industry standards, etc.);

China heavy truck industry (definition and classification, development trends, technology, industry standards, etc.);

China heavy truck market size (ownership, production, sales, import and export, competitive landscape, etc.);

China heavy truck market size (ownership, production, sales, import and export, competitive landscape, etc.);

Market segments (the market size of complete and incomplete heavy trucks and semi-tractors, competitive landscape, development trends, etc.);

Market segments (the market size of complete and incomplete heavy trucks and semi-tractors, competitive landscape, development trends, etc.);

Relevant industry chain (industry chain, upstream raw materials, downstream investment and real estate development, etc.);

Relevant industry chain (industry chain, upstream raw materials, downstream investment and real estate development, etc.);

15 heavy truck companies including FAW Jiefang, Dongfeng Group, Sinotruk, Foton Motor, Shaanxi Automobile Group, JAC, Hualing Automobile, Qingling Motors, Dayun Automobile, Beiben Truck, SAIC Iveco Hongyan, Tri-ring Special Vehicle, XCMG Automobile, Feidie Automobile and Hanma Technology Group (profile, operation, revenue structure, heavy truck business, development strategy, etc.).

15 heavy truck companies including FAW Jiefang, Dongfeng Group, Sinotruk, Foton Motor, Shaanxi Automobile Group, JAC, Hualing Automobile, Qingling Motors, Dayun Automobile, Beiben Truck, SAIC Iveco Hongyan, Tri-ring Special Vehicle, XCMG Automobile, Feidie Automobile and Hanma Technology Group (profile, operation, revenue structure, heavy truck business, development strategy, etc.).

1. Overview of Heavy Truck Industry

1.1 Definition and Classification

1.2 Technology Introduction

1.3 Emission Standards

1.4 Product Trends

1.5 Self-driving and Telematics

1.5.1 Self-driving Truck

1.5.2 Truck Telematics

1.5.3 The Autonomous Trunk Logistics Market Will Be Worth Nearly RMB1 Trillion in 2030

1.6 Hydrogen Fuel Cell Heavy Truck

1.6.1 Key Drivers for Popularity

1.6.2 Market Updates

1.6.3 Important Issues

2. Overall Heavy Truck Market

2.1 Global Zero-emission Heavy-Duty Trucks

2.2 Ownership

2.3 Output and Sales

2.3.1 Output

2.3.2 Sales

2.4 Market Structure

2.5 Competitive Landscape

2.6 Natural Gas Heavy Truck

2.7 High-end Heavy Truck

2.8 Trends

2.9 Export

3.Heavy Truck Market Segments

3.1 Complete Heavy Truck

3.1.1 Output and Sales

3.1.2 Import & Export

3.1.3 Competitive Landscape

3.2 Incomplete Heavy Truck

3.2.1 Output and Sales

3.2.2 Competitive Landscape

3.3 Semi-trailer Tractor

3.3.1 Output and Sales

3.3.2 Import & Export

3.3.3 Competitive Landscape

3.3.4 Market Segments

4. Heavy Truck Industry Chain

4.1 Overview

4.2 Key Components

4.2.1 Cost Structure

4.2.2 Supporting

4.3 Raw Materials Market

4.3.1 Steel Market

4.3.2 Rubber Market

4.4 Downstream Market

4.4.1 Infrastructure Construction

4.4.2 Property Development

4.4.3 Highway Freight

5. Key Companies

5.1 FAW Jiefang Automotive Company, Ltd.

5.1.1 Profile

5.1.2 Sales

5.1.3 Launch of New Products

5.2 China National Heavy Duty Truck Group Co., Ltd. (SINOTRUK)

5.2.1 Profile

5.2.2 Operation

5.2.3 Heavy Truck Business

5.2.4 Autonomous Driving

5.3 Dongfeng Motor Corporation

5.3.1 Profile

5.3.2 Operation

5.3.3 Revenue Structure

5.3.4 Output and Sales

5.3.5 R&D Expenses

5.3.6 Autonomous driving

5.4 Beiqi Foton Motor Co., Ltd.

5.4.1 Profile

5.4.2 Financial Situation

5.4.3 Revenue Structure

5.4.4 Output and Sales

5.4.5 New Energy Commercial Vehicle

5.4.6 Production Capacity

5.4.7 R&D Expenses

5.4.8 Autonomous Driving

5.5 Shaanxi Automobile Group Co., Ltd.

5.5.1 Profile

5.5.2 Main Products

5.5.3 Heavy Truck Business

5.6 Anhui Jianghuai Automobile Co., Ltd.

5.6.1 Profile

5.6.2 Heavy Truck Business Operation

5.7 Anhui Hualing Automobile Co., Ltd.

5.7.1 Profile

5.7.2 Operation

5.7.3 Heavy Truck Business

5.8 Qingling Motors (Group) Co., Ltd.

5.8.1 Profile

5.8.2 Operation

5.8.3 Truck Business

5.8.4 Connected Vehicle

5.9 Chengdu Dayun Automobile Manufacturing Co., Ltd.

5.9.1 Profile

5.9.2 Heavy Truck Business

5.10 BEIBEN Trucks Group Co., Ltd.

5.10.1 Profile

5.10.2 Heavy Truck Business

5.11 SAIC-IVECO Hongyan Commercial Vehicle Co., Ltd.

5.11.1 Profile

5.11.2 Heavy Truck Business

5.12 Hubei Tri-ring Special Vehicle Co., Ltd.

5.12.1 Profile

5.12.2 Heavy Truck Business

5.12.3 Launch of High-end Intelligent Heavy Truck

5.13 Xugong Automobile Manufacturing Co., Ltd.

5.13.1 Profile

5.13.2 Heavy Truck Business

5.14 Zhejiang Feidie Automobile Manufacturing Co., Ltd.

5.14.1 Profile

5.14.2 Heavy Truck Business

5.15 Hanma Technology

5.15.1 Profile

5.15.2 Operation

5.15.3 Truck Business

5.15.4 Output and Sales

Classification of Heavy Truck Industry

Technology Introduction of Key Heavy Truck Manufacturers in China

Nationwide Emission Standards for Heavy-Duty Diesel and Gasoline Vehicles

Advanced Implementation of Heavy-Duty Emission Standards in Sub-National Regions

Emission Standards for Heavy-Duty Engines

Emission limits for WNTE test in China VI

PEMS testing requirements

China PEMS emission limits for diesel

Emission Durability Requirements

Autonomous Heavy Truck Development of Heavy Truck Companies in China

Issuance of Autonomous Heavy Truck Trial Operation Licenses

Policies and Regulations on Commercial Vehicle Telematics, 2007-2021

Survey on Truck Telematics at Home and Abroad

Ownership of Heavy Trucks for Trunk Logistics in China, 2021E-2030E

Potential Economic Benefits and Market Size of Autonomous Trunk Logistics in China, 2021E-2030E

Fuel Cell Vehicle Sales in China, 2018-2020

Subsidy Snapshot for Related Vehicle Types

2020 vs 2021 comparison for vehicle models in the NEV recommended catalogue

Vehicle models in 2021 NEV recommended catalogue

Application Scenarios and Player Overview

Economic competitiveness provided by the subsidies

Global Heavy-Duty Trucks Market, by Type 2019-2026(Million USD)

Governments with targets toward phasing out sales of internal combustion engine trucks by a certain date

CO2 emissions and final energy consumption in transport in the Announced Pledges and Net Zero Emissions by 2050 scenarios

Tracking progress towards 2030 milestones in the transport sector by Scenario

Truck makers announce close to half of their sales to be ZEVs by 2030

China's Heavy Truck Ownership, 2002-2025E

China's Heavy Truck Output, 2013-2027E

China's Heavy Truck Sales Volume, 2002-2021

China's Heavy Truck Sales Volume, 2022-2027E

Sales of Heavy Truck Manufacturers (Top 10) in China, 2019-2020

Production of Heavy Truck Manufacturers (Top 10) in China, 2019-2020

Monthly Sales of Heavy Natural Gas Trucks in China, 2019-2021

High-end Heavy Truck Products Launched by Enterprises in China

New Energy Heavy Truck Market Structure, 2017-2030E

Penetration of Telematics, 2016-2020

Heavy Truck Sales Structure in China by Price, 2013-2025E

China's Complete Heavy Truck Output & Sale Volume, 2018-2021

China's Complete Heavy Truck Output & Sale Volume by Enterprises, Jan.-Nov., 2021

China's Complete Heavy Truck Output & Sale Volume by Enterprises, 2020

China's Complete Heavy Truck Output & Sale Volume by Enterprises, 2019

China's Complete Heavy Truck Output & Sale Volume by Enterprises, 2018

China's Incomplete Heavy Truck Output & Sale Volume, 2018-2021

China's Incomplete Heavy Truck Output & Sale Volume by Enterprises, 2021(1-11)

China's Incomplete Heavy Truck Output & Sale Volume by Enterprises, 2020

China's Incomplete Heavy Truck Output & Sale Volume by Enterprises, 2019

China's Incomplete Heavy Truck Output & Sale Volume by Enterprises, 2018

China's Semi-trailer Tractor Output & Sale Volume, 2018-2021

China's Semi-trailer Tractor Output & Sale Volume by Enterprises, 2021(1-11)

China's Semi-trailer Tractor Output & Sale Volume by Enterprises, 2020

China's Semi-trailer Tractor Output & Sale Volume by Enterprises, 2019

China's Semi-trailer Tractor Output & Sale Volume by Enterprises, 2018

Output and Sales Volume of Semi-trailer Towing Vehicles (≤25 Tonnage) in China, 2018-2021

Output and Sales Volume of Semi-trailer Towing Vehicles (25-40 Tonnage) in China, 2018-2021

Output and Sales Volume of Semi-trailer Towing Vehicles (>40 Tonnage) in China, 2018-2021

Automotive Industry Chain

Cost Structure of Heavy Truck Industry

Transmission Supply of Major Heavy Truck Manufacturers in China

China's Galvanized Sheet (Strip) Output and Sales Volume, 2016-2021

China's (Shanghai) Galvanized Coil Price, 2011-2021

China's Cold-rolled Thin Sheet Weekly Output, 2016-2021

China's (Shanghai) Cold-rolled Coil Price, 2015-2021

China's Natural Rubber Spot and Future Price, 2011-2021

China Urban Fixed Asset Investment, 2021

China Fixed Asset Investment Annual Growth, 2017-2021

China's Investment in Real Estate Development, 2010-2021

China's New Housing Start Area and Sales Area, 2005-2020

China's Highway Freight Volume and Turnover, 2005-2020

Financial Indicators of FAW Jiefang, 2018-2021

Revenue Structure of FAW Jiefang by Business, 2019-2020

Revenue Structure of FAW Jiefang by Region, 2019-2020

Products of FAW Jiefang

Main Truck Manufacturing Bases of FAW Group

Commercial Vehicle Output and Sales of FAW Jiefang, 2019-2020

Sinotruk’s Revenue and Net Income, 2014-2021

Sinotruk’s Gross Margin, 2014-2021

Sinotruk’s Revenue Structure by Business, 2020

Sinotruk’s Heavy Truck Product Family Genealogy

Sinotruk’s Main Product Configuration

Sinotruk’s Truck Output and Sales Volume, 2016-2020

HOWO T5G Electric Truck

Financial Indicators of Dongfeng Motor, 2016-2021

Revenue Structure of Dongfeng Motor by Business, 2019-2020

Revenue Structure of Dongfeng Motor by Region, 2019-2020

Commercial Vehicle Output and Sales of Dongfeng Motor, 2017-2021

Capacity and Utilization Rate of Dongfeng Motor by Product, 2020

New Energy Vehicle Capacity and Utilization Rate of Dongfeng Motor, 2020

New Energy Vehicle Output and Sales Volume of Dongfeng Motor, 2017-2020

R&D Costs of Dongfeng Motor, 2014-2020

Dongfeng’s Autonomous Container Truck

Main Financial Indicators of Beiqi Foton Motor, 2016-2021

Revenue Structure of Beiqi Foton Motor by Business, 2019-2020

Revenue Structure of Beiqi Foton Motor by Region, 2019-2020

Bus Output and Sales of Beiqi Foton Motor by Type, 2019-2021

New Energy Bus Output and Sales of Beiqi Foton Motor, 2014-2020

Major Suppliers of New Energy Bus of Beiqi Foton Motor

New Energy Truck Output and Sales of Beiqi Foton Motor, 2016-2020

Beiqi Foton Motor Production Capacity Layout

R&D Costs of Beiqi Foton Motor, 2014-2020

Beiqi Foton Motor's Autonomous Vehicle

Main Heavy Trucks of Shaanxi Automobile Group

Shaanxi Automobile Group’s Heavy Truck Output and Sales Volume, 2018-2021

Anhui Jianghuai’s Heavy Truck Output and Sales Volume, 2018-2021

Anhui Hualing’s Heavy Truck Output and Sales Volume, 2018-2021

CAMC’s Products Series

Qingling Motors’ Revenue and Net Income, 2014-2021

Qingling Motors’ Gross Margin, 2013-2020

Qingling Motors’ Revenue Breakdown by Product, 2019-2020

Qingling Motors’ Sales Volume, 2015-2020

Qingling Motors’s Electric Vehicle Products

Qingling Motors’s Hydrogen Fuel Vehicle

Qingling Motors L3 Autonomous Logistics Vehicle

Chengdu Dayun’s Heavy Truck Output and Sales Volume, 2018-2021

BEIBEN Trucks’s Heavy Truck Output and Sales Volume, 2018-2021

SAIC-IVECO Hongyan’s Heavy Truck Output and Sales Volume, 2018-2021

Main Heavy Truck Products of Tri-Ring Special Vehicle

Hubei Tri-ring’s Heavy Truck Output and Sales Volume, 2018-2021

Xugong’s Heavy Truck Output and Sales Volume, 2018-2021

Zhejiang Feidie’s Heavy Truck Output and Sales Volume, 2018-2021

Hanma Technology’s Assets and Net Income, 2012-2020

Revenue Structure of Hanma Technology by Business, 2019-2020

Hanma Technology’s Products Series

Hanma Technology’s Truck Output and Sales Volume, 2019-2020

Hanma Technology’s Truck Sales at Home and Abroad, 2019-2020

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...