China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

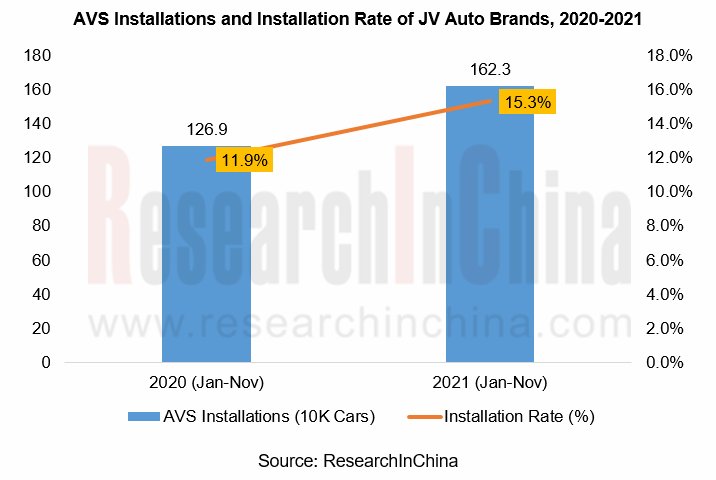

During January to November of 2021, a total of 4.266 million vehicles were installed with around view system (AVS) in China, a year-on-year upsurge of 49.2%, including AVS installations onto 1.623 million cars of joint-venture brands, sharing as high as 38.0% and a year-on-year increase of 27.9%; the installation rate was 15.3%, a rise of 3.4 percentage points on an annualized basis. Noticeably, the JV brands’ cars priced between RMB400,000 and RMB500,000 and installed with AVS constitute the largest portion 22.4% (364,000 units) of the total, according to ResearchInChina.

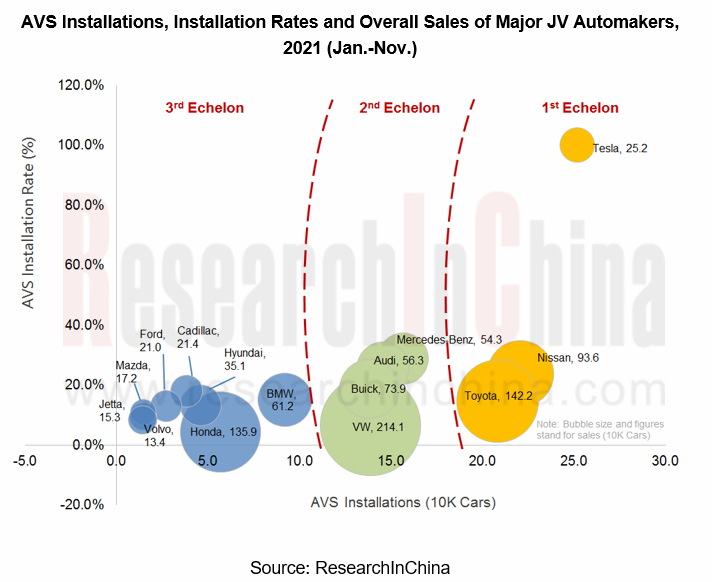

By brands, Tesla, Nissan and Toyota are in the first echelon as concerns AVS installations (onto more than 200,000 cars apiece), which is largely boosted by the best-selling models like Model Y, Model 3, RAV4 and QASHQAUI. The second echelon is home to Mercedes-Benz, Audi, Volkswagen and BUICK, with AVS installed to 100,000 to 200,000 cars each. In the third hierarchy, 92,000 BMW cars are configured with AVS, hopefully striding towards the second echelon. Concerning vehicle models, during 2021 (Jan.-Nov.), the top five vehicle models of joint venture automakers by AVS installations are RAV4 (133,000 units), Model Y (130,000 units) & Model3 (121,000 units), Mercedes-Benz E Class (100,000 units), and Qashqai (99,000 units).

AVP is on the cusp of massive implementation, and Tier1 suppliers are promoting the parking fusion solution earnestly.

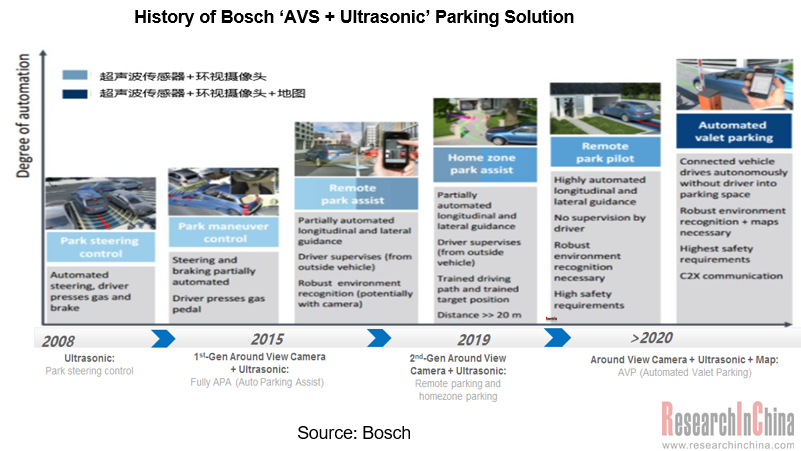

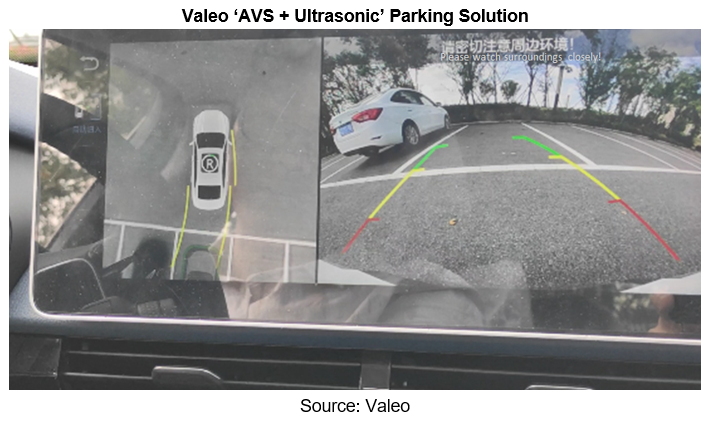

The parking system is evolving apace, amid the previous reversing camera system being increasingly replaced by AVS. The parking solution integrating AVS with ultrasonic sensors grows a popular trend. At the same time, the suppliers are forging partnerships with OEMs on faster mass production of AVP.

Take example for Bosch’s Home Zone Park Assist system exhibited during 2021 BOSCH Automobile & Intelligent Transportation Technology Innovation Experience Day, it does data fusion through 12 Bosch ultrasonic sensors together with an around view camera system made up of 4 near-range cameras, coupled with the reuse of 4 corner radars (driving assistance function), and successfully enables HPP (Homezone Parking Pilot) by software upgrades and without additional hardware sensors. Such parking solution has been available onto GAC AION V.

At the IAA Mobility held in Frankfurt in September 2021, Valeo and its partners NTT DATA and Embotech unveiled their joint AVP (Automated Valet Parking) solution that encompasses ECU, ultrasonic, radar and around view cameras, and dispenses with the costly LiDAR.

Progress of autonomous driving facilitates the around view camera market, and foreign parts suppliers beef up local cooperation.

The advances in autonomous driving technology come with the growing number of varied perception sensors in vehicle. Every car carries ten to fifteen cameras rather than one to five ones in the past, and even more in the future. Besides, the automotive CMOS image sensors get ever improved in pixel, from VGA to 1-megapixel, 2-megapixel and to date 8-megapixel.

To meet the market demand for around view cameras, ON Semiconductor as a leading supplier of automotive cameras CMOS image sensors has been in cooperation with many Chinese autonomous driving companies. In July 2021, the fifth-generation driverless system – AutoX Gen5, the outcome of joint efforts by ON Semiconductor and AutoX was launched, for which ON Semiconductor offered a total of 28 high-definition 8-megapixel image sensors AR0820AT and 4 LiDAR SiPM matrices, thus enabling 360-degree reversing image without any blind spots. Concurrently, ON Semiconductor also deepened its collaboration with Baidu Apollo and established a joint studio for image development with the latter, focusing on self-driving image perception solutions.

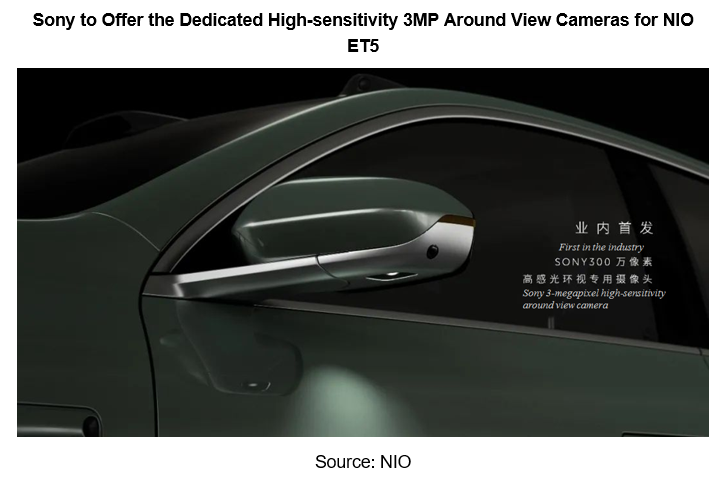

Sony, another leading supplier of image sensors, will provide NIO ET7 (to be delivered in March 2022, built on NT2.0 technology platform) and ET5 (to be delivered in September 2022) with the dedicated 3-megapixel high-sensitivity around view cameras. Compared with the 8-megapixel cameras previously used in ET7, this 3MP camera outperforms in dim light and the exterior rearview mirror is also added with ambient light compensation lamp that acts as a better enabler for 360-degree panorama imaging, transparent chassis, guard mode, park assist, etc.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...