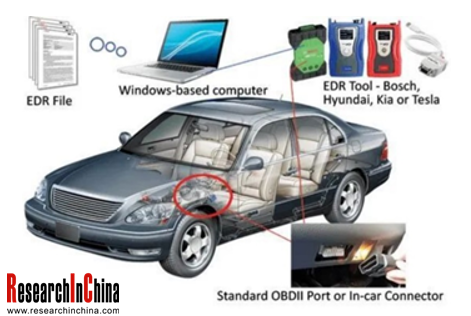

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupant protection information for a very brief period of time before, during and after a crash.

EDR gets compulsorily installed to new passenger cars starting from 2022

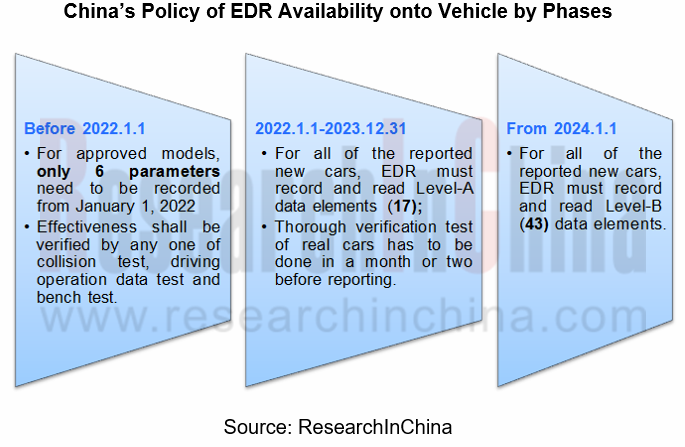

In December 2020, China publicized GB39732-2020 Vehicle Event Data Recorder System to replace GB39732-2017, requiring passenger cars be equipped with EDR from January 1, 2022.

Abide by the new national standards, some requirements are posed on EDR to record crashes, i.e., 1) have certain trigger threshold; 2) the recorded data will be locked automatically and cannot be modified; 3) the system can record data of at least three consecutive collision events.

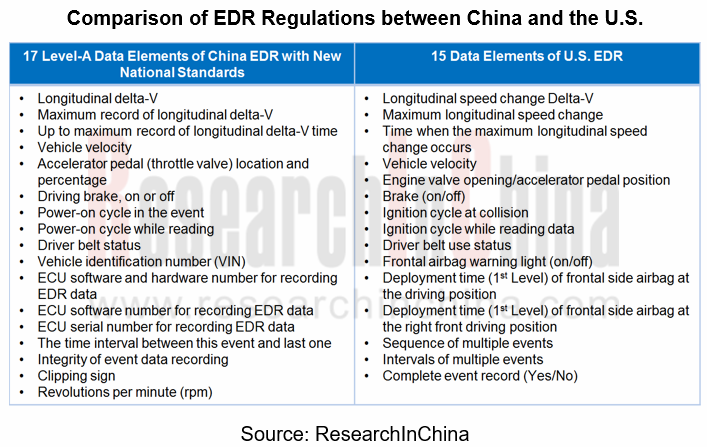

The data recorded by EDR is divided into Level-A and Level-B, including 17 Level-A data and 43 Level-B data, effective from January 1, 2022 and January 1, 2024 respectively.

It is in 2006 that the U.S. formulated regulations concerning EDR, and it is clearly stipulated in NHTSA CFR regulations in 2012 that all vehicles sold after September 2014 need to be equipped with EDR.

In Europe, EDR is compulsory in all new cars from March 2022 on (pursuant to the general safety regulation issued in March 2019), and corresponding CDR must be purchased on the market. By March 2024, stock vehicles require to be installed with EDR as well.

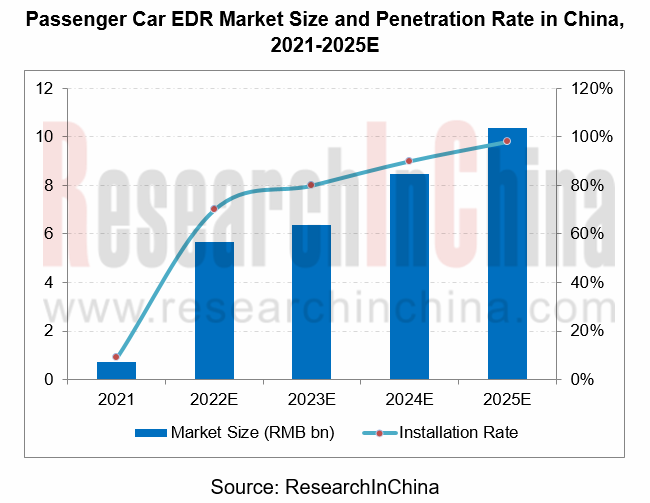

The incremental market size of passenger car EDR will surpass RMB5 billion in 2022

Millions of passenger cars and light-duty trucks worldwide are equipped with EDR, as is revealed by Bosch data, and a total of more than 200 million vehicles are installed with EDR in the U.S. and Canada where roughly 98% of the new cars on the market carry EDR.

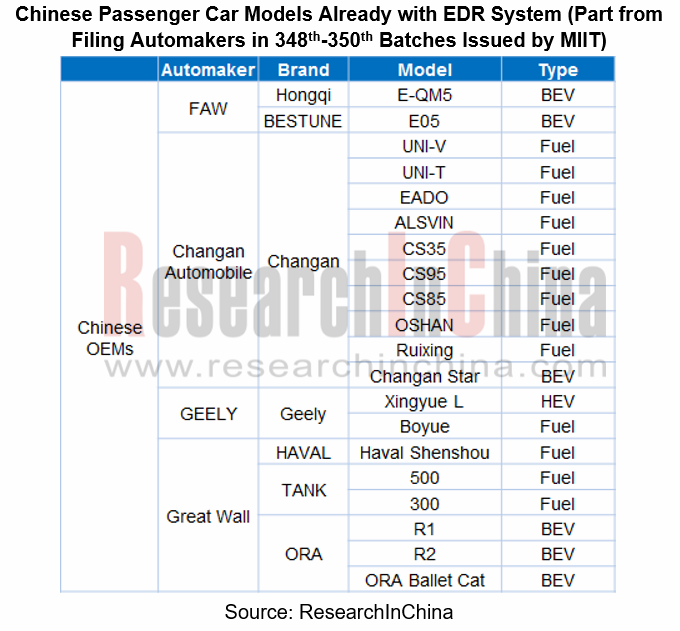

The brands like BMW, Mercedes-Benz, Lexus, Tesla, Toyota, BYD, XPENG and Haval first employ EDR. Through our analysis of the motor vehicle filing enterprises in 348th-350th batches issued (from Sept.2021 to Dec.2021) by the Ministry of Industry and Information Technology (MIIT), the passenger cars reported are all nearly with EDR, indicating the readiness of Chinese automakers for the policy about compulsory installation of EDR, and thus ushering in the explosive EDR market in 2022.

In 2021, the rate of EDR installations onto passenger cars in China remained low, about 9%, a figure projected to climb over 70% in 2022 along with compulsory installation of EDR, and even surge to at least 90% in 2024, according to ResearchInChina.

If with EDR data retrieval tools unconsidered, EDR hardware alone is priced between RMB300 and RMB500, and then the market in 2022 is valued at RMB4.85 billion to RMB8.03 billion.

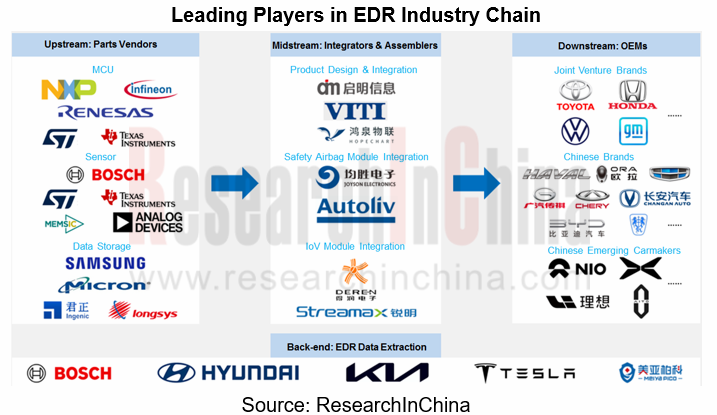

The players in the industrial chain are scrambling for EDR market dividends

EDR market ushers in explosive growth from 2022 when the new national standards for EDR take effect, and the players in the EDR industry chain are stepping up efforts in this lucrative segment.

EDR gets increasingly used onto passenger cars besides commercial vehicle.

The providers of data storage, chips, data retrieval tool, etc. race to beef up production lines and technology input.

OEMs expedite the testing and verification of their products and make them available onto cars.

Qiming Information Technology: It started in 2020 to develop products in line with national standards for EDR, has boasted a rich portfolio of EDR related data storage products and got them used in commercial vehicle.

Bosch: a world-renowned provider of EDR data retrieval tools has got its CDR (crash data retrieval) available for information acquisition of EDR on passenger cars and light-duty trucks since 2000.

As of January 2022, Bosch CDR has been iterated to the version 21.4, which fully supports a multitude of vehicle models (2022) in China such as Bentley, Maserati, Ferrari, Chrysler, Fiat, Jeep, and Toyota Corolla.

GigaDevice Semiconductor (Beijing) Inc.: MCUs have been used in EDR devices and shipped massively, particularly the MCUs like 105 and 305 with handsome deliveries; wherein, GD32F105 is the EDR used for commercial vehicle.

Ingenic Semiconductor Co., Ltd.: It grows into a leading supplier of automotive memories through acquisition of ISSI (Beijing) in 2019. For automotive sector, the company delivers FLASH memory for EDR.

On the whole, it takes quite a period of time for independent suppliers’ products to be verified for access to the OEM passenger car market although without a high technical barrier for EDR. The technology provider, by contrast, is faced with more opportunities. No matter which side it is, overall competence is vital in competition.

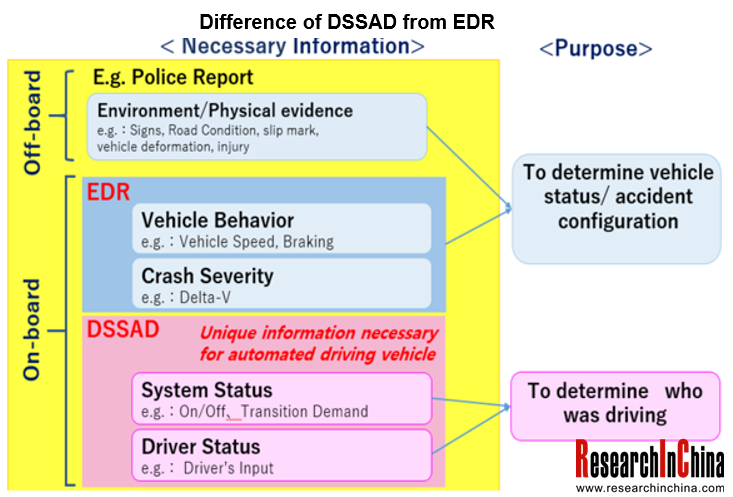

For autonomous driving, EDR is gearing towards DSSAD.

EDR alone can no longer meet the future market demand amid the prevailing autonomous vehicle. With a focus on recording information about vehicle and the driver when an accident occurs, EDR is unable to record whether the driver or the automated driving system is held accountable. To that end, DSSAD, short for data storage system for automated driving, is needed.

It is clearly required in the world’s first international regulations in June 2020 on L3 autonomous vehicle that autonomous vehicle must be equipped with DSSAD. The Chinese DSSAD standards is still being formulated.

In the DSSAD market, the competitors such as CalmCar and Duvonn Electronic Technology have made preemptive moves and rolled out DSSAD products. Noticeably, CalmCar DSSAD system suited for more than a dozen vehicle models in 2021.

Hopefully, DSSAD system will be popularized as the policy on L3 autonomy gets enforced and advanced autonomous vehicle is produced on a large scale.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...