Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

-

Mar.2022

- Hard Copy

- USD

$3,600

-

- Pages:270

- Single User License

(PDF Unprintable)

- USD

$3,400

-

- Code:

ZLC131

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$5,000

-

- Hard Copy + Single User License

- USD

$3,800

-

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year upsurge of 108% and with a penetration rate up to 8.1% in 2021. There exists vigorous demand for new energy vehicles whose sales would be even stronger if not for the "long-term shortage of auto parts" faced by OEMs.

As the global new energy vehicle market springs up, BMS for new energy vehicle takes a sizable market scale. In 2021, global NEV sales soared 108% year on year, which boosted the BMS market value to register $11.5 billion and rise 56.5% on an annualized basis.

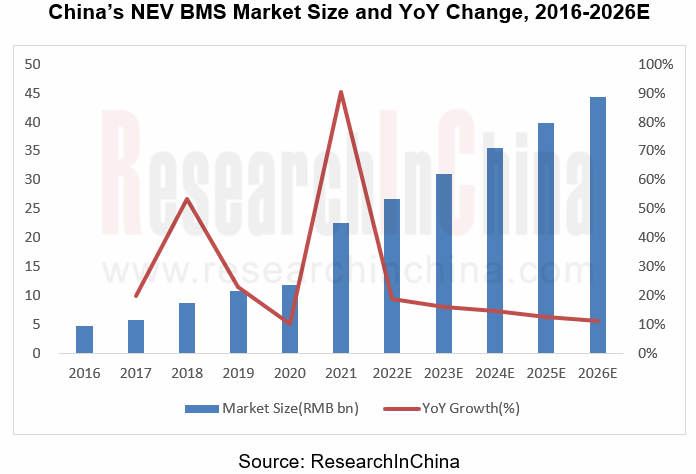

In 2021, China’s NEV sales reported 3.521 million units as a percentage of 54.2% in global total, with a year-on-year spike of 157.6% and the market penetration of 13.4%. As the world's largest producer and consumer of new energy vehicles, China's demand for BMS has been climbing continuously. The Chinese new energy vehicle BMS market was estimated to be worth RMB22.51 billion in 2021, up 90.6% from a year earlier.

2. Competition pricks up and OEMs enjoy superiorities

The global new energy vehicle BMS market is tripartite: carmakers represented by Tesla and BYD; the battery manufacturers like CATL and LGC; and the third-party BMS providers such as Ningbo Preh Joyson Automotive Electronics and SINOEV Technologies.

Among them, Tesla and BYD, with handsome NEV sales, were the top two giants sweeping 14.4% and 9.1% of the global new energy vehicle BMS market in 2021 respectively, followed by Preh Joyson (8.8%). Battery vendors CATL and LGC were ranked fourth and fifth.

In the Chinese NEV BMS market, BYD, CATL and Tesla stay ahead of others; wherein, BYD (FinDreams Battery) overtook CATL in 2021 to become the No.1 (a 15.5% share) whose deliveries skyrocketed 253.3% year on year.

3. Preferential policies draw to an end, and the NEV BMS market will be impacted.

In April 2020, the Ministry of Finance, the State Taxation Administration and the Ministry of Industry and Information Technology jointly issued the Announcement on Policies Relating to the Exemption of New Energy Vehicles from Vehicle Purchase Tax, proposing that from January 1, 2021 to December 31, 2022, it will be exempt from purchase tax to buy NEVs.

The NEV subsidy policy will end on December 31, 2022, and vehicles licensed after December 31 will no longer be subsidized, according to the latest new energy vehicle purchase subsidy policy issued jointly by four ministries on December 31, 2021,

Starting from 2023, the new energy vehicle purchase tax exemption and NEV purchase subsidies in China will be terminated concurrently, which will affect the NEV sales to a certain extent, thus inflicting the demand for BMS.

4. New energy vehicle BMS is evolving towards ‘wireless, integrated and cloud-based’

(1) Wireless

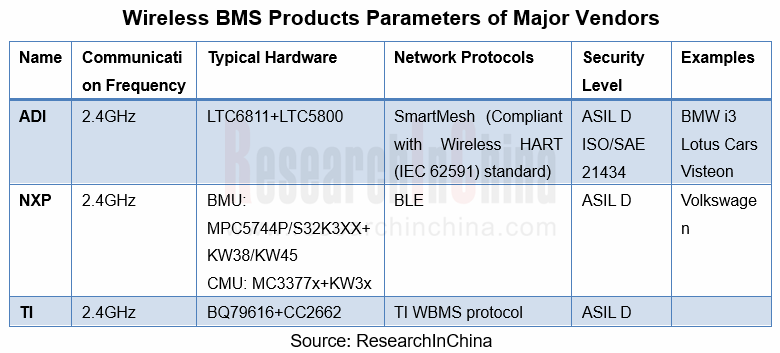

Wireless BMS has the merits of low power consumption, reduced in-package wiring harness, simplified structure, flexible deployment, etc., enabling lower assembly costs and weight reduction to agree with the lightweight trend of NEV. To date, ADI (Linear Technology), Texas Instruments, Visteon, NXP, etc. have forayed into wireless BMS.

(2) Integrated

With a universe of data brought by intelligent connectivity, the automotive electronic and electrical architecture (EEA) has also been upgraded, with the domain controller highly integrating all features of the split BMS, VCU and MCU into one, for centralized control and management to form a true one "system".

In June 2020, ENOVATE's self-developed and world's first power domain controller --Vehicle Battery Unit (VBU) was successfully produced, integrating the key technologies of Vehicle Controller Unit (VCU) and Battery Management System (BMS), managing the ‘motor, battery, electric control’ system in a more efficient and accurate manner, while facilitating platform scalability and rapid iteration.

(3) Cloud-based

The cloud-based BMS connects the BMS on electric vehicle to the cloud, enabling the whole life cycle of battery data to be "uploaded to the cloud" and the data collected to be evaluated with machine learning algorithms over the cloud to deliver better battery management strategies and battery failure warning functions.

In 2021, Huawei unveiled the pioneering AI BMS solution to address battery safety issue by a fusion of high-precision BMS chips with cloud-based AI technology. A number of automakers have cooperated with Huawei commercially and in depth, and Huawei's AI BMS cloud platform system has accessed to data of over 100,000 NEVs, successfully warning 10-plus cases of battery thermal runaway failures and enabling early treatment of some high-risk vehicles.

The report highlights the following:

Policies about BMS, including NEV industry policy, BMS standards;

Policies about BMS, including NEV industry policy, BMS standards;

Global and China new energy vehicle industry;

Global and China new energy vehicle industry;

Global and China BMS industry (status quo, market size, competition, development

Global and China BMS industry (status quo, market size, competition, development  trend, etc.);

trend, etc.);

14 global and 18 Chinese BMS vendors (operation, BMS business, etc.);

3 global BMS chip vendors (operation, BMS chip solutions, etc.)

3 global BMS chip vendors (operation, BMS chip solutions, etc.)

1 Overview

1.1 Definition of BMS

1.2 BMS Classification

1.3 Core Functions of BMS

1.3.1 Battery Cell Monitoring Technology

1.3.2 Estimation Technology

1.3.3 Balancing Technologies

1.3.4 Core Features of BMS Software

1.4 BMS Industry Chain

2. Policies on BMS

2.1 New Energy Vehicle Industry Policy

2.1.1 Purchase Tax Reduction & Exemption Policy

2.1.2 Fiscal Subsidies for Purchase

2.2 BMS National Standards Updated and Improved in Line with Technological Advances

3. Global and China EV Industry

3.1 Global

3.2 China EV Industry

4. Global and China BMS Industry

4.1 Battery Safety

4.1.1 Fire Accidents of NEV

4.1.2 Causes for NEV Fire Accidents and Prevention

4.2 BMS Market

4.2.1 Global

4.2.2 China

4.2.3 BMS Chip

4.3 BMS Market Size

4.4 Competitive Landscape

4.4.1 Global

4.4.2 China

4.5 Development Trends

4.5.1 Gradually Concentrating BMS Industry, Squeezing out SMEs in Market

4.5.2 Rapid Growth in Market Demand

4.5.3 Key Concerns of BMS as Cost Reduction and Extending Service Life

4.5.4 Crucial BMS Algorithms Still Need Optimization

4.5.5 Improvement of Estimation Standard System

4.5.6 Emphasis on Innovation of BMS Software and Hardware Technology

4.5.7 BMS Heading towards Wireless

4.5.8 BMS Evolving towards Integration

4.5.9 BMS Moving to Cloud

5. Global BMS Vendors

5.1 Denso (Japan)

5.1.1 Profile

5.1.2 Operation

5.1.3 R&D Costs

5.1.4 BMS Business

5.2 MARELLI (Japan)

5.2.1 Profile

5.2.2 BMS Business

5.3 Hitachi Astemo (Japan)

5.3.1 Profile

5.3.2 Operation

5.3.3 BMS Business

5.4 Mitsubishi Electric (Japan)

5.4.1 Profile

5.4.2 Operation

5.4.3 BMS Business

5.5 Hyundai Kefico (Korea)

5.5.1 Profile

5.5.2 Operation

5.5.3 BMS Business

5.6 LG Energy Solution (Korea)

5.6.1 Profile

5.6.2 Operation

5.6.3 BMS Business

5.7 SK Innovation (Korea)

5.7.1 Profile

5.7.2 Operation

5.7.3 BMS Business

5.8 Tesla (USA)

5.8.1 Profile

5.8.2 Operation

5.8.3 BMS Business

5.9 Lithium Balance (Denmark)

5.9.1 Profile

5.9.2 BMS Products

5.9.3 BMS Application

5.9.4 Presence in China

5.10 Eberspaecher Vecture (Canada)

5.10.1 Profile

5.10.2 BMS Products

5.10.3 Application of BMS Products

5.10.4 Industrial Layout

5.11 Rimac Automobili (Croatia)

5.11.1 Profile

5.11.2 BMS Products

5.11.3 BMS Application

5.12 Digi-Triumph Technology (Taiwan)

5.12.1 Profile

5.12.2 BMS Business

5.13 Clayton Power (Denmark)

5.13.1 Profile

5.13.2 BMS Business

5.14 NXP Semiconductors (Netherlands)

5.14.1 Profile

5.14.2 Operation

5.14.3 BMS Business

6. Chinese BMS Vendors (Independent Third Parties)

6.1 Huizhou E-power Electronics

6.1.1 Profile

6.1.2 BMS Business

6.1.3 Application Cases

6.2 Shenzhen Klclear Technology

6.2.1 Profile

6.2.2 Operation

6.2.3 BMS Business

6.3 SINOEV (Hefei) Technologies

6.3.1 Profile

6.3.2 BMS Products

6.4 Ningbo Joyson Electronic Corp. (German Preh GmbH)

6.4.1 Profile

6.4.2 BMS Business

6.5 Anhui LIGOO New Energy Technology Co., Ltd.

6.5.1 Profile

6.5.2 BMS Business

6.6 Shanghai G-Pulse Electronics Technology Co., Ltd.

6.6.1 Profile

6.6.2 BMS Business

6.7 Neusoft Reach Automotive Technology (Shanghai) Co., Ltd.

6.7.1 Profile

6.7.2 Operation

6.7.3 BMS Business

6.8 United Automotive Electronic Systems Co., Ltd.

6.8.1 Profile

6.8.2 BMS Business

6.9 Guochuang New Energy Technology Co., Ltd.

6.9.1 Profile

6.9.2 Operation

6.9.3 BMS Business

7. Chinese BMS Vendors (OEMs)

7.1 BYD

7.1.1 Profile

7.1.2 Operation

7.1.3 BMS Business

7.2 BAIC BJEV

7.2.1 Profile

7.2.2 Operation

7.2.3 BMS Business

7.3 Shanghai E-Propulsion Auto Technology Co., Ltd.

7.3.1 Profile

7.3.2 BMS Business

8. Chinese BMS Vendors (Power Battery)

8.1 Beijing Pride Power Systems Technology Co., Ltd.

8.1.1 Profile

8.1.2 Battery Business

8.2 CATL

8.2.1 Profile

8.2.2 Operation

8.2.3 BMS Business

8.3 Hefei Gotion High-tech Power Energy Co., Ltd.

8.3.1 Profile

8.3.2 Operation

8.3.3 BMS Business

8.4 China Aviation Lithium Battery Co., Ltd.

8.4.1 Profile

8.4.2 BMS Business

8.5 Sunwoda Electronic Co., Ltd.

8.5.1 Profile

8.5.2 Operation

8.5.3 BMS Business

8.6 SVOLT Energy Technology Co., Ltd.

8.6.1 Profile

8.6.2 BMS Business

9. Global BMS Chip Vendors

9.1 Analog Devices (USA)

9.1.1 Profile

9.1.2 Operation

9.1.3 Revenue Structure

9.1.4 Gross Margin

9.1.5 BMS Solutions

9.2 Texas Instruments (USA)

9.2.1 Profile

9.2.2 Operation

9.2.3 Revenue Structure

9.2.4 Gross Margin

9.2.5 BMS Chip Business

9.3 Infineon (Germany)

9.3.1 Profile

9.3.2 Operation

9.3.3 Revenue Structure

9.3.4 Gross Margin

9.3.5 BMS Chip Business

General Architecture of BMS

Main Functions of BMS

Electrical Architecture of BMS

Functions of BMS Modules

BMS Classification

Comparison between Active and Passive Balancing Technologies

BMS Industry Chain

Position of BMS in Power Battery Industry Chain

Statistics of the 51st Batch of New Energy Vehicle Models Exempted from Vehicle Purchase Tax by MIIT

New Energy Vehicle Purchase Subsidy Policy in China, 2020-2021

Subsidy Solution for New Energy Passenger Cars in China (Non-public Field), 2022

Subsidy Solution for New Energy Buses in China (Non-public Field), 2022

Subsidy Solution for New Energy Trucks in China (Non-public Field), 2022

Subsidy Solution for New Energy Passenger Cars in China (Public Field), 2022

Subsidy Solution for New Energy Buses in China (Public Field), 2022

Subsidy Solution for New Energy Trucks in China (Non-public Field), 2022

Relevant Standards for BMS

Global New Energy Vehicle Sales Volume and Penetration Rate, 2014-2021

Global New Energy Vehicle Sales Volume by Month, 2016-2021

Global TOP10 New Energy Vehicle Models by Sales Volume, 2021

Global TOP10 New Energy Vehicle Models by Sales Volume, 2020

Global TOP10 New Energy Vehicle Brands by Sales Volume, 2021

Global TOP10 New Energy Vehicle Brands by Sales Volume, 2020

China's new energy vehicle ownership and YoY growth rate, 2017-2021

China's New Energy Vehicle Sales Volume and Global Share, 2014-2021

China's New Energy Vehicle Sales Volume Breakdown by Purpose, 2014-2021

China's New Energy Vehicle Sales Volume by Type, 2015-2021

Monthly sales volume and YoY growth rate of new energy passenger cars in China, 2021

TOP10 New Energy Sedan Manufacturers in China by Sales Volume, 2021

TOP10 New Energy Sedan Models in China by Sales Volume, 2021

TOP10 New Energy SUV Models in China by Sales Volume, 2021

TOP10 Battery-electric Passenger Car Manufacturers in China by Sales Volume, 2021

TOP10 Plug-in Hybrid Passenger Car Manufacturers in China by Sales Volume, 2021

NEV Ownership and Fire Accidents of NEV in China, 2017-2021

Number of EV Fire Accidents in China (by Months), 2020 VS 2021

Rate of NEV Fire Accidents in China, 2017-2021

What Sort of Status When NEVs Catch Fire

Causes for NEV on Fire

Causes and Measures for Thermal Runaway of Power Battery

BMS Development History in China

Global NEV BMS Market Size and YoY Change, 2016-2026E

China’s NEV BMS Market Size and YoY Change, 2016-2026E

Support from the Leading BMS Suppliers Worldwide

Competition Pattern of Chinese BMS Market

NEV BMS Market Shares (by Enterprise) in China, 2021

NEV BMS Market Shares (by Enterprise) in China, 2020

Shipments of Top 10 NEV BMS Suppliers in China, 2020-2021

Market Shares of Top 10 NEV BMS Suppliers (by Type) in China, 2020-2021

Supporting of Chinese BMS Suppliers

Number of Chinese BMS Vendors in 2016-2021 (unit: each)

Share of Chinese SMEs of BMS, 2016-2021

Sales Volume of Global and Chinese New Energy Vehicles, 2021-2026E

Structure of New Energy Vehicle Cost

Framework of BMS State Estimation Algorithms

Comparison of Three Communication Methods of BMS

Three Communication Methods of BMS

Wired BMS vs Wireless BMS

Wireless BMS Products Parameters of Major Vendors

Wireless BMS of Linear

Wireless BMS of ADI

NXP WBMS Roadmap

DEMO of NXP WBMS

Wireless BMS of TI

Circuit Diagram of TI Wireless BMS

Wireless DMS of Texas Instruments Satisfies ASIL D Safety Demands

Wireless DMS Scalability By TI

Wireless BMS by Visteon

Main Advantages of Visteon BMS

VBU by ENOVATE

AI BMS by Huawei

Four-step approaches of Huawei AI BMS

Revenue and Net Income of DENSO, FY2017-FY2022

Denso’s Revenue Structure by Product, FY2020-FY2022

Denso’s Revenue Structure by Client, FY2020-FY2022

Denso’s Revenue Structure by Client, FY2029-FY2021

Denso’s R&D Investment, FY2012-FY2021

Vehicle Models Supported by Denso's BMS

Main BMS Products of Denso

Global Presence of MARELLI

Vehicle Models Supported by Calsonic Kansei's BMS, 2012-2018

Global Network of Hitachi Astemo

Business Structure of Hitachi Astemo

Hitachi Astemo’s Progress of 2021 Mid-term Management Plan

48V Lithium-ion Battery Pack of Hitachi Automotive Systems for Mild Hybrid Vehicles

Specifications of 48V Lithium-ion Battery Pack for Mild Hybrid Vehicles

Revenue and Net Income of Mitsubishi Electric, FY2012-FY2022

Revenue Breakdown of Mitsubishi Electric by Business, FY2012-FY2022

Revenue Breakdown of Mitsubishi Electric by Region, FY2017-FY2022

Outline/Features of Mitsubishi Electric’s Battery Management Units

Position in Vehicle/Internal Block Diagram of Mitsubishi Electric’s Battery Management Units

Roadmap of Mitsubishi Electric’s Battery Management Units

Kefico’s Revenue and Net Income, 2010-2020

Kefico’s BMS products

Installation and Features of Kefico’s BMS

LG Energy Solution’s Operating Results, 2012-2021

LG Energy Solution’s Sales Structure by Region, 2020

BMS Products and Core BMS Technologies of LG Energy Solution

LG Energy Solution’s xEV Batteries

Revenue and Net Income of SK Innovation, 2017-2021

SK innovation’s Sales Structure by Region, 2019-2020

Revenue and Net Income of Tesla, 2017-2021

Tesla’s Revenue Breakdown by Segment, 2018-2020

Tesla’s Revenue Breakdown by Region, 2018-2020

Tesla’s Revenue from Power System and Related Components, 2011-2017

Smart fortwo Electric Vehicles

Toyota’s RAV4 EV

Battery Pack Breaking Down of Tesla Model S

BMS Products of Lithium Balance

Application of Lithium Balance BMS

Customers of Lithium Balance

Overview of Lithium Balance’s Agents in China

Lithium Balance BMS Equipped in Pure Electric Public Bus of Hybrid Kinetic Group Ltd.

BMS/ESS Production and R&D of Eberspaecher Vecture

Electronic Manufacturing Service of Eberspaecher Vecture

Eberspaecher Vecture's BMS Products

Eberspaecher Vecture’s Development Planning for BMS

Protection & Balancing of Eberspaecher Vecture's Non-Automotive Battery Systems

Teachncial Data of Eberspaecher Vecture's μC based Battery Management Systems (Integrated Systems: 2S up to 24S)

Eberspaecher Vecture's Large Format Battery Systems - Integrated / Distributed

Teachncial Data of Eberspaecher Vecture's μC based Battery Management Systems (Distributed Systems: AFE, Controllers, Current Sense)

Application of Eberspaecher Vecture's Products

Community Smart Grid Projects

‘Eve’ Project

Rimac’s BMS Products

Rimac’s Concept_One

Application of Digi-Triumph’s BMS Products

Digi-Triumph’s BMS Products

Digi-Triumph’s Main Co-partners

Clayton BMS

Customers of Clayton

Operating Results of NXP, 2018-2021

NXP’s Revenue by End Market

NXP BMS Application Block Diagram

NXP BMS Designs

NXP Battery Management Systems (BMS) Hardware Solutions

NXP HVBMS Solution Roadmap

NXP’s Scalable Battery Management Portfolio

NXP Customer Engagement with BJB Solution

Specifications of NXP Battery Cell Controller Portfolio

NXP Wireless BMS Roadmap

NXP WBMS V2.1 New Feature

NXP WBMS 2.1 Hardware

NXP “Wireless Module” Coverage upon battery modules

BMS Products of Epower Electronics

Some Partners of Epower Electronics

Revenue and Net Income of Klclear Technology, 2012-2021

BMS Revenue of Klclear Technology by Application, 2015-2021

Revenue Structure of Klclear Technology by Region, 2017-2021

Klclear Technology’s Revenue from TOP5 Clients and % of Total Revenue, 2020

Klclear Technology’s Procurement from TOP5 Suppliers and % of Total Procurement, 2020

BMS Solutions of Klclear Technology

Some Partners of Klclear Technology

BMS Products of Klclear Technology

4 Core Technical Concepts for Battery Management System of Klclear Technology

Key Features of Klclear Technology BMS

BMS Active Equalization Technology of Klclear Technology

Major Project Applications of Klclear Technology BMS

Battery Assembly of JAC iEV5

Electronics Division of Joyson Electronics

Preh’s Global Network

Performance of Preh BMS Products

Preh BMS Products

Development Course of Preh BMS Products

Preh BMS Products in Mass Production

BMS Trends and New Technology of Preh

Preh BMS Development

Facts & Figures of Preh

Customer Structure of Preh

Preh’s Global Divisions

48V Hybrid System BMS Products

Some Customers of LIGOO New Energy Technology

EK-FT-12 Commercial Vehicle BMS (Enhanced)

LIGOO BMS (B3 Series) for Light Vehicle

LIGOO BMS (B5 Series) for Medium and Large Vehicle

LIGOO BMS (B1 Series) for Mine Vehicle

BMS Products of Shanghai G-Pulse Electronics Technology

Major Customers of Shanghai G-Pulse Electronics Technology

Revenue and Net Income of Neusoft Reach, 2018-2021

The First Generation Products of Neusoft Reach BMS

The Second Generation Products of Neusoft Reach BMS

Neusoft Reach Cloud Battery Management System

BMS Products of UAES

System Architecture of UAES BMS8.3

Revenue and Net Income of Guochuang New Energy Technology, 2016-2021

Revenue and Net Income of BYD, 2015-2021

BYD’s EV Sales Volume, 2016-2021

Design of BYD’s Battery PACK and BMS

BMS Protection IC of BYD Microelectronics

Revenue and Net Income of BAIC BJEV, 2018-2021

Revenue Structure of BAIC BJEV by Product, 2020

Production of New Energy Vehicles of BAIC BJEV, 2018-2021Q1

Vehicle Sales of BAIC BJEV by Model, 2018-2021Q1 (Unit: Vehicle)

Architecture of BESK’s Power Battery Pack

Equity Structure of Beijing Pride New Energy Battery Technology, 2017

Equity Structure of Beijing Pride New Energy Battery Technology, 2022

Technology Roadmap of Beijing Pride New Energy Battery Technology

Customers and Cooperation Areas of Beijing Pride New Energy Battery Technology

Global Locations of CATL

Revenue and Net Income of CATL, 2015-2021

CATL’s Revenue from Top Five Customers and % of Total Revenue, 2015-2020

Revenue Structure of CATL by Product, 2018-2021

BMS for Passenger Car Solutions

BMS Product Parameter of CATL’s Electric Bus

BMS Product Parameter of CATL’s Electric Passenger Car

BMS Product Parameter of CATL’s Power Storage System

Business Performance of Hefei Gotion High-tech Power Energy, 2015-2021

Gotion’s High-tech BMS

R&D System of Gotion High-tech

History of CALB

Models Supported by CALB

Equity Structure of China Aviation Lithium Battery, 2022

Revenue and Net Income of Sunwoda Electronic, 2010-2021H1

Revenue Structure of Sunwoda Electronic by Product, 2017-2021H1

BMS Products of Sunwoda Electric Vehicle Battery

Major Indicators of Sunwoda Electric Vehicle Battery’s BMS

Sunwoda Electronic's BMS Development Plan

Features of Sunwoda Electronic’s BMS Hardware Platform

SVOLT BMS

Solutions of Major Global BMS Chip Vendors

ADI’s Revenue and Gross Margin, 2012-2022

ADI’s Net Income and Net Margin, 2012-2022

ADI’s Revenue (by Region), 2010-2021

ADI’s Revenue (by Industry), 2022Q1

ADI’s Revenue by Sales Channel, 2019-2022

ADI’s Gross Margin Growth, 2012-2022

ADI’s Battery Management IC Devices

BMS Details and Analog Devices’ Product Focus

ADI’s Battery Monitor Solutions

Purpose of ADI’s Battery Stack Monitor

LTC6810: 6-Cell Battery Monitor

LTC6811: 12-Cell Battery Stack Monitor

LTC6812/LTC6813: 15- and 18-Cell Battery Monitor

LTC681x Feature Matrix

LTC2949 Pack Monitor

Total Solutions for ADI BMS Application

Trends in ADI Battery Management

Diagram of ADI Wired BMS

TI’s Revenue and Gross Margin, 2012-2021

TI’s Net Income and Net Profit Margin, 2012-2021

TI’s Revenue (by Product), 2012-2021

TI’s Revenue (by Region), 2012-2021

TI’s Gross Margin Growth, 2012-2021

Operating Margin of TI’s Main Products, 2012-2021

TI’s Automotive Battery Management IC Products

System Diagrams of TI’s Automotive Battery Management IC Products

TI’s Roadmap Toward Zero Emission Transportation

TI’s Battery Management System Today and Tomorrow

TI Wireless BMS Overview

TI WBMS Reference Design

TI BQ79616-Q1

TI CC2662R-Q1

INFINEON’s Revenue and Gross Margin, FY2012-FY2022

INFINEON’s Net Income and Net Profit Margin, FY2012-FY2022

INFINEON’s Revenue (by Division), FY2012-FY2022

INFINEON’s Revenue (by Region), FY2012-FY2022

INFINEON’s Gross Margin Growth, FY2012-FY2022

Infineon’s Battery Management ICs

Configurations of Infineon’s Battery Management ICs

Infineon TLE9012AQU

Infineon TLE9015QU

Infineon’s 48V BMS Products

Infineon’s 48V BMS Boards

Revenue of INFINEON’s Automotive Division, FY2011-FY2022

Major Clients of INFINEON’s Automotive Division

INFINEON’s Revenue in China, FY2009-FY2022

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...