Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade out in 2022

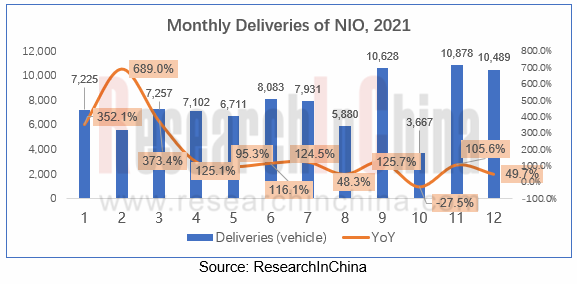

In 2021, NIO sold 90,805 cars, a year-on-year surge of 108%. However, its ranking among emerging automakers by sales volume dropped from the first in 2020 to the third. This is mainly affected by three factors.

First, the delivery plunged in October 2021 due to the reorganization and upgrade of the production line as well as the preparation for the launch of new products.

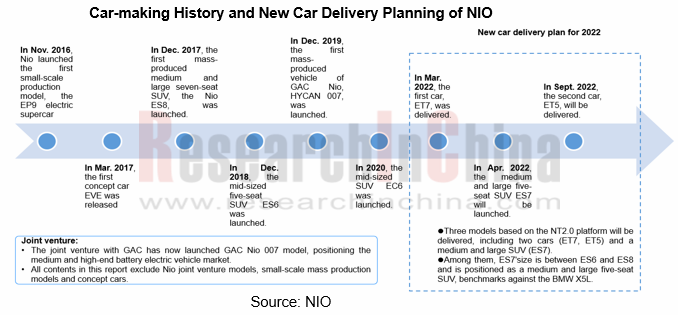

Second, the upcoming ET7, ET5 and ES7 will all be delivered in 2022, which led to a gap throughout 2021 when the existing models ES6 and EC6 were squeezed by new stronger rivals such as Model Y and BMW iX3.

Third, new cars were mainly sold in first-tier cities. In 2021, NIO saw the highest sales volume in the economically developed coastal provinces and cities, especially Shanghai, Beijing and Hangzhou contributed the overwhelming 33%.

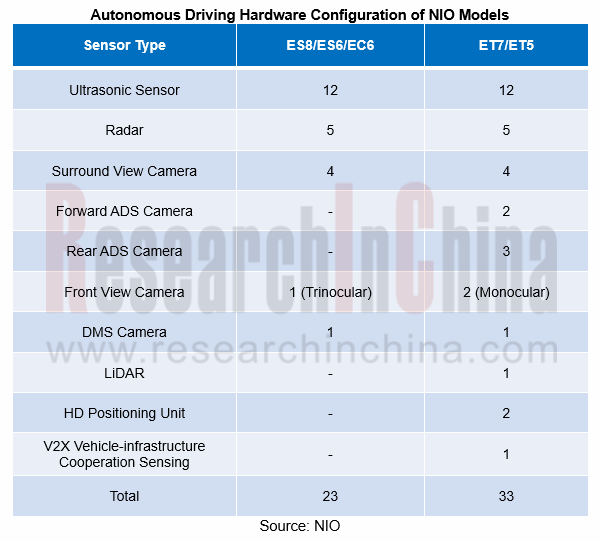

In 2022, NIO will deliver three new models one after another, and its sluggish sales status is expected to fade out. ET7 delivered on March 28th is the first model based on the NT2.0 platform. It is equipped with NIO Autonomous Driving (NAD). Compared with NIO Pilot, it adds emergency active Parking Assist (EAS), emergency lane keeping (ELK), Advanced Driver Monitoring System (ADMS), Power Station Parking Assist (PSAP), autonomous driving functions on some urban roads, etc.

ET7 is equipped with four NVIDIA DRIVE Orin chips with a computing power of 1016TOPS. Two Orin SoCs are used as master chips to realize NAD full-stack computing. The third Orin SoC acts as a redundant backup; if any main chip fails, NAD can ensure safety. The fourth Orin SoC implements local training, and can personalize training as per user habits to speed up NAD evolution.

In terms of hardware configuration, ET7 is equipped with radar, ultrasonic radar, 1,550nm LiDAR and CVIS perception controls in preparation for software upgrades for higher-level autonomous driving in the future. It is worth mentioning that the solid-state LiDAR provided by Innovusion has a horizontal viewing angle of 120°, a maximum detection distance of 500 meters, and a maximum resolution of 0.06°x0.06°. In addition, the watchtower-like layout reduces the blind spots of the sensor.

Relying on Internet operation, community marketing has become a role model in the industry

Most traditional automakers take delivering orders as the ultimate goal, and they terminate marketing campaigns as soon as deals are completed. NIO regards the purchase of products by users as the beginning of its marketing, and makes experience and marketing penetrate into the entire life cycle of products.

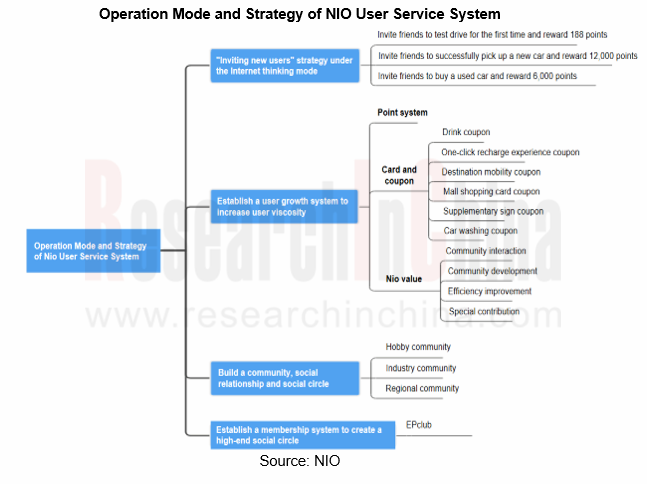

In NIO's ripple model, core car owners are in the kernel, accounting for about 10% of the total car owners. Core car owners play an exemplary role to attract followers closer to them, and continuously expand their influence. Similarly, this model is also vividly reflected in the operation of APP community. For community operation, NIO has established a set of user service system, with the following operation methods and strategies:

1. Recruitment strategy: the Internet operation method is adopted, with reward points for old users who invite new users successfully. The points earned by users can be exchanged for gifts at NIO Life (NIO’s mall), or for coffee coupons, event tickets and some other rewards at NIO House (NIO’s offline user center).

2. User growth system: three evaluation criteria - points, coupons and NIO Value.

Points: exchange for gifts and other benefits.

Cards and coupons: including drink coupons, one-click recharge coupons, destination mobility coupons, etc.

NIO Value: It is an accumulated value that records each user's activities in NIO community and his/her contribution to the community. Its unit is N.

3. A community was established to create a social circle for ordinary users: The community of NIO APP makes it easier for users to find like-minded people according to hobbies, regions and industries.

4. A membership system was erected to forge a high-end social circle.

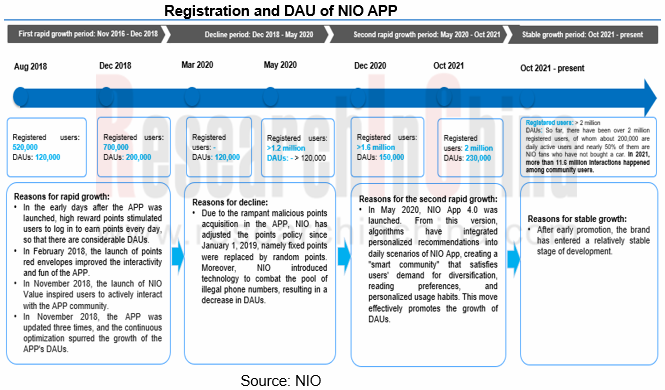

The update frequency of NIO APP is very high. From its launch in November 2016 to February 2022, NIO APP experienced four versions - 1.0, 2.0, 3.0, and 4.0, with a total of 44 updates and an update every two months averagely. The functions of the APP are continuously optimized and adjusted, so that users can always feel refreshed.

Under such operational measures, NIO APP has become the cornerstone for establishing deep connections with users. So far, there have been over 2 million registered users, of whom about 200,000 are daily active users and nearly 50% of them are NIO fans who have not bought a car. In 2021, more than 11.6 million interactions happened among community users, and each EPclub member recommend 25 NIO cars for sale averagely, equivalent to RMB10 million as per the unit selling price of RMB400,000.

NIO lays out the operation ecology of the Internet of Vehicles in advance by manufacturing mobile phones

In terms of intelligent connectivity, NIO's smart cockpit is equipped with the NOMI in-vehicle artificial intelligence system, so that NIO car owners can communicate with other people and vehicles through NOMI. NIO also continuously upgrades and optimizes the functions of NOMI via OTA. For example, NIO has improved the recognition capability and wake-up rate (especially the response to children's wake-up) of NOMI in the Aspen 3.0 unveiled in September 2021; at the same time, it has ramped up NOMI’s control over cars, such as memory of seat positions, adjustment of ambient light brightness, switching of sound field modes and other car control commands. In the Aspen 3.1 launched in January 2022, wake-up words + continuous instructions are added, without calling NOMI before giving a command. NIO plans to optimize the understanding, hearing, and understanding of NOMI in the future.

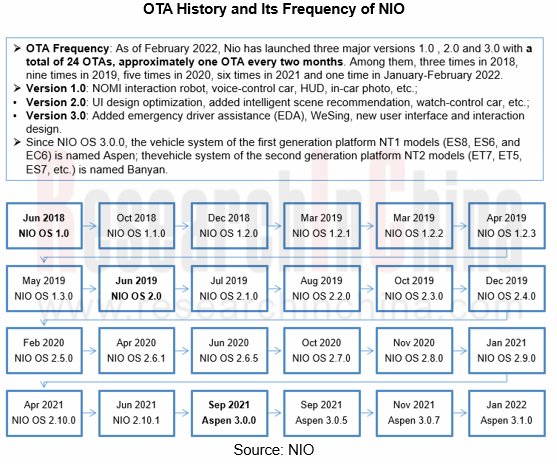

Besides, NIO has maintained a high frequency of OTA updates for the Internet of Vehicles. As of February 2022, NIO had launched three major versions, 1.0, 2.0, and 3.0, with a total of 24 OTA updates and about once every two months. Specifically, three updates occurred in 2018, nine in 2019, five in 2020, six in 2021, and one in January-February 2022.

Features of OTA updates for the Internet of Vehicles:

? All models support OTA updates.

?A major system upgrade is carried out almost every year, such as NIO OS 2.0 (Jun 2019), Aspen 3.0 (Sep 2021).

?As of February 2022, there had been 351 OTA updates, 56.1% of which were reflected in IVI, ADAS and autonomous driving.

In its future planning, NIO expects to form a closed “people-vehicles-mobile phones” loop through interconnection between mobile phones and IVI, realize data sharing, and provide users with more intelligent interactive life experience. It is reported that NIO is preparing for dabbling in the mobile phone industry. Yin Shuijun, the former president of Meitu, has joined NIO and leads the mobile phone business.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...