Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the automotive industry when it makes its debut. Also, there emerge a number of skateboard chassis manufacturers like Canoo, Arrival and REE as well as the Chinese peers such as UPower, PIX Moving, ECAR, and IT BOX.

1. Where to sell chassis

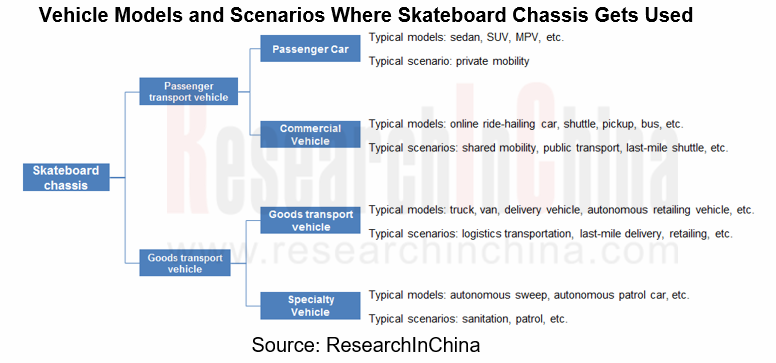

Similar to chassis essential to vehicle, skateboard chassis can broadly finds application in commercial vehicles of varied sizes and tonnage as well as passenger cars with different wheelbases.

Skateboard chassis can be divided by scenario into manned scenarios and non-manned ones, of which the former refers to the transportation of passengers and falls into civil use and commercial purpose; and the latter is complex in a relative sense where the use to carry goods take larger shares, such as trucks, vans and delivery vehicle.

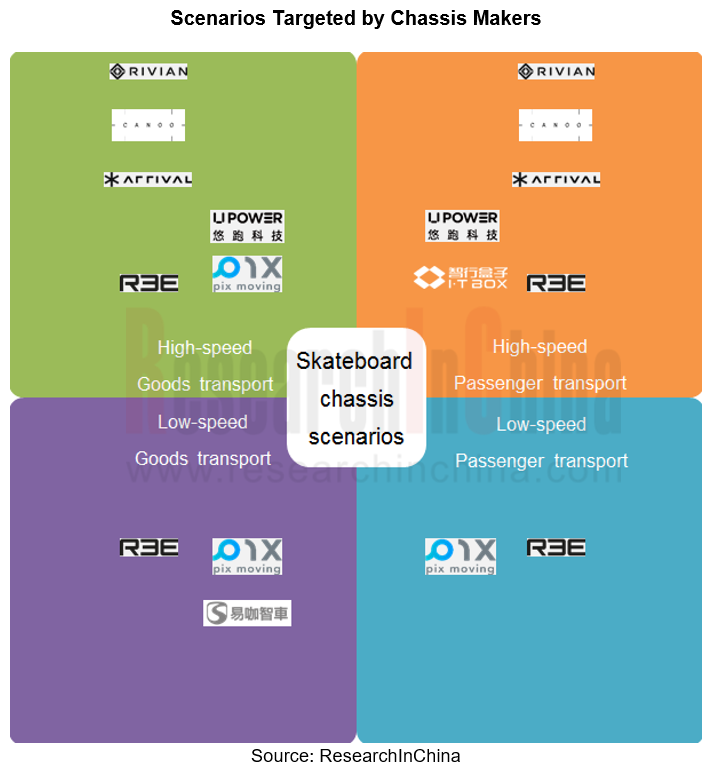

The majority of chassis makers are exploring high-speed transportation of passengers and goods, and only Israeli REE and Chinese PIX Moving and ECAR are involved in low-speed scenarios.

Viewed from the influential skateboard chassis entrants in the market, only Canoo and Rivian chose to enter C-end vehicle market and confront Ford, GM and others. More chassis makers access to B-end market from various aspects, such as Arrival, which engages in both mobility/public transport market and logistics transportation market, IT BOX with a focus on mobility market, and REE, UPower, etc. that set foot in autonomous driving scenario.

2.Skateboard chassis business model: How to sell?

Once its target market is decided and R&D is in place, it is really a teaser for the manufacturers of skateboard chassis how to sell their products and make profit.

Three major business models for skateboard chassis makers:

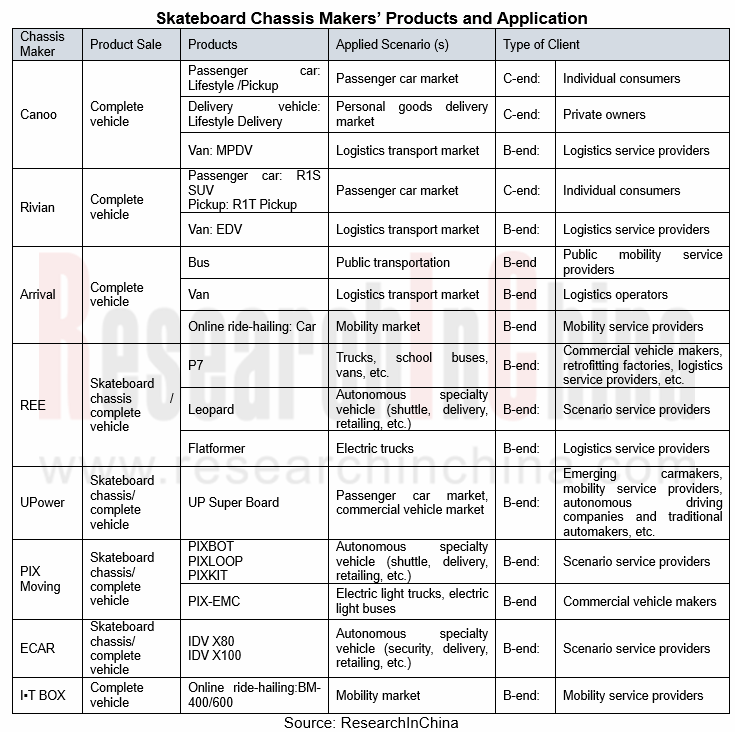

?① For own use, i.e., to sell vehicles based on skateboard chassis, such as Canoo, Rivian, and Arrival.

?② To meet others’ needs, i.e., to sell chassis only and provide customers with the solutions concerned, such as REE, UPower and PIX Moving.

?③ To partner with OEMs and provide customers with vehicle solutions. This model coexists with the second model above.

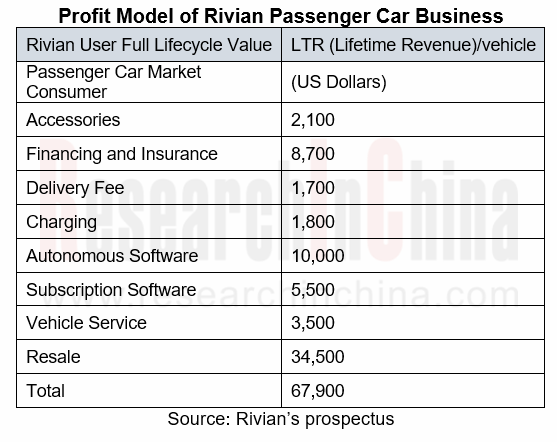

When it comes to the profitability of products, chassis makers bring in profits in the early stage and the middle & later stage, spanning the lifecycle of products. In the early stage, they gain a handful of orders and make some profits by selling either vehicle or skateboard chassis; in the middle & later stage, chassis makers will give full play to its strength in software and seize sizable income through providing software subscription and value-added services for the sold vehicles or skateboard chassis.

3. Where are the opportunities?

Overall, chassis manufacturers have four types of customers:

1) Low-speed autonomous driving. Various models of autonomous driving companies, such as autonomous shuttle, sanitation sweeper, self-driving retailing vehicle and delivery vehicle, have successively run into the autonomous driving demonstration bases across China and have been tested on public roads or in enclosed areas. The L4 autonomy is regarded by chassis makers as a basic skill in the infancy of their chassis development.

2) Scenario service provider. A broad range of such clients are covered, including logistics & transportation scenario, mobility scenario, sanitation scenario, etc., with a high demanding on vehicle model, but with higher demand for custom-made products.

3) Pure electric chassis (class-III) market. Skateboard chassis is highly similar to the chassis of 3rd class in hardware structure, and what differs between them is that skateboard chassis has the walking ability inclusive of support for intelligent driving or automated driving, and are specially developed for battery electric vehicles, more friendly to special-purpose vehicle like school bus. (Note: class-III chassis refers to the chassis that has no vehicle body on it but with engine and powertrain, front and rear axles, steering gear, suspension, wheels and tires, braking system and other assemblies, which cannot drive.

4) Laggard OEMs. They are faced with the amounting pressure and survival is the first concern for them, which, however, can be helped by the chassis makers who stay ahead in ideas of developing autonomous driving and intelligent chassis and enjoy the advantages of low cost, short development cycle and general suitability of products. The partnerships and alliances of chassis makers with OEMs do more good than harm, and they help each other, indeed.

Take the laggard OEMs and scenario service providers for example,

1) For laggard Chinese brand carmakers, it can be a life-saving straw.

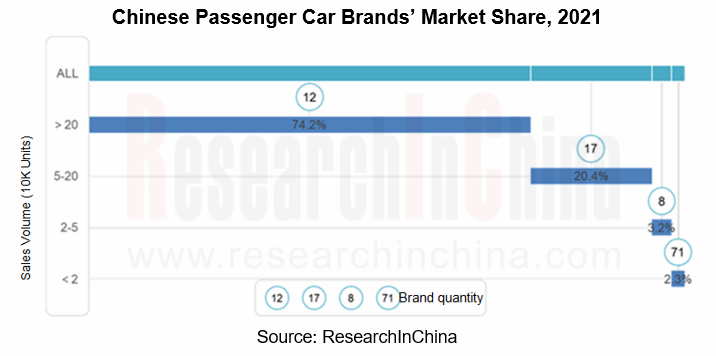

According to ResearchInChina, in 2021, there were 108 Chinese auto brands with more than 1 passenger car insured, including 79 Chinese car brands with less than 50,000 units insured (including 71 ones each with less than 20,000 units), with a total market sales share of just 5.5%, which can be truly described as survival in adversity and extremely fierce competition. Small scale, lack of funds, untimely transformation and other reasons make it even more difficult for many laggard automakers amid the COVID-19 pandemic. The emergence of skateboard chassis, shorter R & D cycle and less R & D capital investment seem to be a good way for behindhand carmakers to stage a comeback.

Public information shows that traditional automakers at home and abroad have begun to cooperate with chassis manufacturers about skateboard chassis.

REE: In October 2019, REE and HINO released the Flatformer, a skateboard chassis based on the REEcorner technology solution, and plan to release a prototype in 2022.

UPower: In September 2021, it signed a blanket framework agreement with Sichuan COWIN Auto for joint development and entrusted production of skateboard chassis. (Note: In 2021, Sichuan COWIN Auto had 19,747 vehicles insured)

PIX Moving: In March 2022, PIX Moving reached strategic cooperation with Shanxi Victory Auto, and the two parties will jointly develop and mass-produce the manned intelligent electric trucks, light buses and other commercial vehicle models all of 1.8-6.0ton based on the PIX Moving skateboard chassis EMC platform (electric modular commercial vehicle). (Note: In 2021, Shanxi Victory Auto had 631 vehicles insured.)

2) Domestic logistics & transportation service providers with considerable potential demand

In all scenarios, it is logistics transportation that needs a large number of vehicles to build a fleet, such as YTO Express, STO Express, ZTO Express, Yunda Express, JD Express, SF Express and China Post. In urban areas, a certain scale of van models is required for logistics transportation and distribution. Unlike ordinary van models, express delivery firms need to customize van cockpits and carriages to meet their delivery service needs.

Overseas, UPS and Amazon have placed custom-made orders to chassis makers about the development of pure electric logistics vehicle, which are being delivered successively.

Rivian: In September 2019, it signed an order with Amazon for 100,000 electric vans based on skateboard chassis (a total of three model sizes).

Arrival: In January 2020, it received a directional order for 10,000 dedicated electric trucks and an intentional order for 10,000 units from UPS.

In China, logistics transporters’ attitudes towards skateboard chassis still remain unclear. However, the volume of express delivery in China registered 108.30 billion pieces cumulatively in 2021, a year-on-year spike of 29.9%, indicating a huge market scale. Correspondingly, the demand from enterprises for logistics vehicles is a sizable one.

4. With so big a cake, how should OEMs, Tier1 suppliers and chassis makers share?

The market is full of competitors. By the merit of not changing the chassis but changing the cockpit, the skateboard chassis can give birth to a variety of functional vehicles, with infinite potential. Besides the newly established chassis makers, there are also Tier 1 and OEMs competing to partake of the cake. But the cake is so big, how do the OEMs, Tier 1 suppliers and chassis makers divide it?

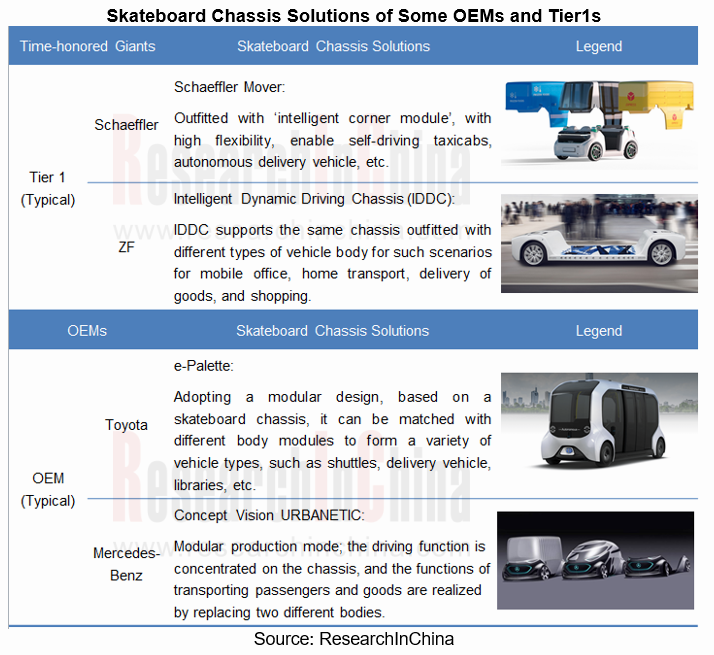

It seems that the time-honored conventional OEMs and Tier 1 suppliers enjoy more edges and a louder voice in chassis manufacturing. Rich technical knowhow and strong R&D strength, strong supply chain management and assembly & debugging capabilities are superior to chassis makers. The influential international giants like Bosch, Schaeffler, and ZF have frequently rolled out their concept models based on skateboard chassis over the recent years.

Entering 2022, Geely Farizon, IAT Automobile Technology and Ningbo Tuopu Group have successively announced their entry into skateboard chassis.

Geely Farizon: On January 19, 2022, Geely Farizon unveiled a super Van based on a control-by-wire skateboard chassis, which can be flexibly combined with the upper body and used for both passenger cars and commercial vehicles, satisfying all scenarios and custom-made needs of urban logistics.

Ningbo Tuopu Group: On February 10, 2022, Ningbo Tuopu Group's wholly-owned subsidiary, Tuopu Skateboard Chassis (Ningbo) Co., Ltd., was established in Hangzhou Bay New District, Ningbo City to develop skateboard chassis, X-by-wire products, among others.

IAT: In February 2022, IAT Automobile Technology Co., Ltd, IAT’s chairman Xuan Qiwu and former Huawei Honor CEO Liu Jiangfeng, and Hong Kong Faristar jointly invested RMB10 million to establish Shenzhen GECKO New Energy Vehicle Technology Co., Ltd. with a focus on skateboard chassis technologies and products, providing related services for urban logistics, commerce, family, shared mobility and other fields.

The time-honored Tier 1 suppliers branch out to skateboard chassis, which is a technical and strategic trend, and also to better serve customers. Service contents cover provision of full or partial skateboard chassis solutions, such as brake-by-wire/ steering/ throttle, suspension, ‘battery + motor + electric control’, etc.; and the service objects are: probably the powerful OEMs from which big orders come and with which deep cooperation have been constantly conducted. For small-batch orders, the quotation of Tier 1 is often too high, which is unbearable for general firms.

The OEM has always regarded chassis as the soul, and it will never be handed over to others, at least not for powerful OEMs. Based on the skateboard chassis, the OEM customers cover B-end and C-end, where the consumer market is basically dominated by OEMs. The painful facts of startups such as Byton, Singulato, and Qiantu Motor have proved that it is not easy for chassis manufacturers to directly build cars; in the to-B market, mobility service providers and logistics service providers hold considerable custom-made demand, a certain confrontation with chassis makers.

For chassis manufacturers, the cake is so big that they can partake of it. There are plenty of needs for autonomous vehicles in different self-driving scenarios, such as autonomous retailing vehicle/ delivery vehicle/ patrol car, etc. The demand for such orders is relatively scattered, which is suitably undertaken by chassis makers. What’s more, mobility service providers, logistics service providers and laggard automakers are also bigger prospective customers.

Avoiding edges, attacking weaknesses, and taking a differentiated route have become the safest and most secure choice for chassis makers. With limited funds and strength, chassis manufacturers especially in Chinese market are exploring the fields where OEMs hardly engage, such as low-speed autonomous driving scenarios.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...