China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from extensive management to refined management. In the automotive industry chain, the upstream parts manufacturers provide all kinds of parts and components to the midstream automakers who are responsible for design, R&D, manufacturing and brand building, while the downstream dealers sell new cars and provide after-sales services for consumers. In the entire industry chain, automakers occupy a dominant position, and they have a strong voice in managing dealers through authorization and rebate measures.

According to data from China Association of Automobile Manufacturers (CAAM), 26.082 million and 26.275 million automobiles were produced and sold respectively in 2021, up 3.4% and 83.8% year-on-year correspondingly. This is the first growth since 2019. The COVID-19 pandemic has brought unprecedented challenges to China's automotive dealership industry which still performs well. According to the data of CAAM, the total revenue and output value of the top 100 automotive dealership groups in 2020 jumped 4.9% year-on-year to RMB1.82 trillion. In 2020, the number of authorized 4S dealers nationwide experienced negative growth for the first time in history. The number of 4S stores in the network dropped to 28,000. A total of 3,920 4S stores withdrew throughout the year, namely over 10 4S stores exited every day averagely.

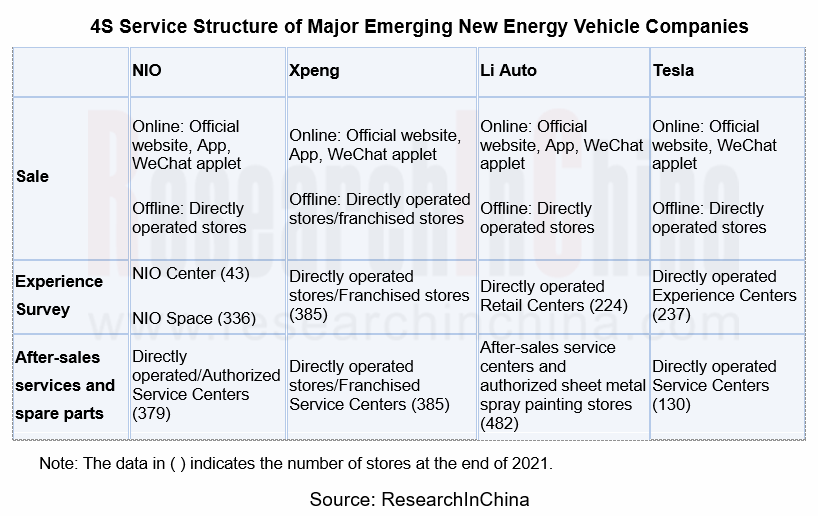

Different from the national dealership model of conventional auto brands, the current sales models and channels of emerging automakers have evolved from the dealership model to the direct operation of chain stores by brand automakers or the cooperative operation with authorized agents. The direct sales model offers users refreshing brand experience through services covering the entire life cycle of products, and avoids many drawbacks (like opaque prices and poor services) of the conventional dealership model. However, it also triggers multiple problems such as huge capital and complex operation, which are not applicable to all new energy vehicle manufacturers. But even if the dealership model is still adopted, the service structure and profit structure of 4S stores will be significantly altered.

The automotive aftermarket refers to all the services needed by consumers around the use of automobiles after they are sold until being scrapped.

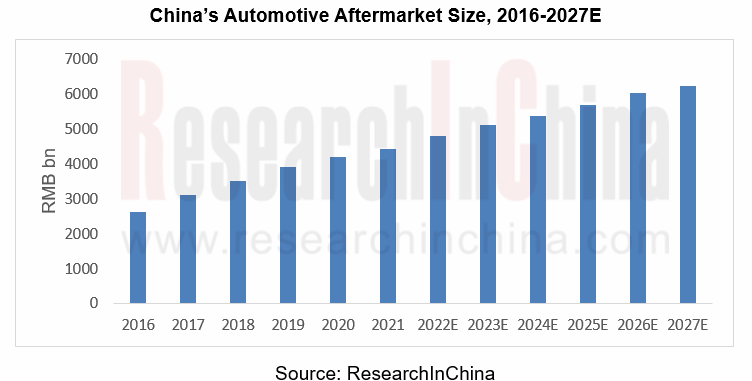

The automotive aftermarket, especially the maintenance market, expands year by year with the increase of automobile age, because the older the automobile, the more worn the accessories, the more repairs per year, and the higher the repair cost. At present, the average age of automobiles in China has reached 6 years. The growth in both automobile age and automobile ownership has driven the booming development of automotive aftermarket which has gradually become a new industrial focus, meaning the industry has seen lucrative opportunities.

The automotive aftermarket mainly includes auto repair and maintenance, auto finance, used cars, car leasing, auto supplies, beauty and modification, car recycling, aftermarket alliance platform integration/automotive e-commerce, etc. Among them, auto finance, auto maintenance and used cars are the top three segments of the automotive aftermarket:

Used Cars

Factors such as consumption upgrade, occupational needs, and consumer preference will allow car owners to swap their existing cars through channels such as used car dealers and used car e-commerce platforms. In recent years, the state and local governments have increased their efforts to promote automobile consumption, and taken favorable measures to drive the consumption of used cars. China's used car market has maintained growth with a wider transaction scale. In 2020, approximately 17.59 million used cars were transacted in China, a spike of 22.6% over the previous year. In the future, the used car market is expected to raise its market share in the automotive aftermarket.

Maintenance

Under the background of high automobile ownership, high automobile age and maintenance concept change, the auto repair and maintenance market size continues to swell. The annual automobile maintenance cost escalates year by year with the increase of automobile age, because the older the automobile, the more worn the accessories, the more repairs per year, and the higher the repair cost. According to the experience of developed countries, China is about to see the maintenance demand hit the peak. In the past ten years, the sales volume of automobiles has been considerable, but the growth rate of new car sales volume has slowed down. In the future, the average automobile age will continue to rise, which will prompt the automotive maintenance industry into a golden age. China's auto maintenance market size had reached about RMB1,533 billion as of 2021, and it is expected to exceed RMB2 trillion by 2027. In the context of anti-monopoly, independent auto repairers are gradually encroaching on the market share of traditional 4S stores; with the help of the "Internet +" model, the independent repair model will further burgeon.

Auto Finance

Pivoting on OEMs, auto finance is the combination of various financial products derived from upstream and downstream of the industry to end consumers. It targets companies, individuals, governments, auto operators and other entities. Typical auto finance products include dealer inventory financing, auto loans, auto leasing, and auto insurance. In recent years, the overall penetration rate of China's new car finance has ticked up year by year. However, compared with mature markets in Europe and the United States, China's new car finance market still lags behind. With consumption upgrade and higher credit acceptance, auto finance will further grow. In 2021, the assets of 25 auto finance companies ascended 15% year-on-year to RMB1.12 trillion.

China Automotive Distribution and Aftermarket Industry Report, 2022-2027 highlights the following:

Definition, classification, industry chain, business models, etc. of the automotive dealership industry and aftermarket;

Definition, classification, industry chain, business models, etc. of the automotive dealership industry and aftermarket;

Market size and forecast of Global and Chinese automobile and dealership industry, including automobile sales volume, dealer network, automobile sales volume by dealers, competition pattern, sales models of the new energy vehicle industry, etc.;

Market size and forecast of Global and Chinese automobile and dealership industry, including automobile sales volume, dealer network, automobile sales volume by dealers, competition pattern, sales models of the new energy vehicle industry, etc.;

Market size, forecast, competition pattern, trends, etc. of automotive aftermarket segments including auto finance, used cars, maintenance and beauty, etc.;

Market size, forecast, competition pattern, trends, etc. of automotive aftermarket segments including auto finance, used cars, maintenance and beauty, etc.;

Profile, business, agency brands, operating network and marketing of major auto dealers in China.

Profile, business, agency brands, operating network and marketing of major auto dealers in China.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...