UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) listed UWB as the next-generation vehicle security access technology, conducing to the massive availability to mobile devices. In June 2020, IEEE updated UWB-related standards (802.15.4z), enhanced UWB security functions (at the PHY/RF level), making for wider application of UWB.

OEM installation of UWB to passenger cars

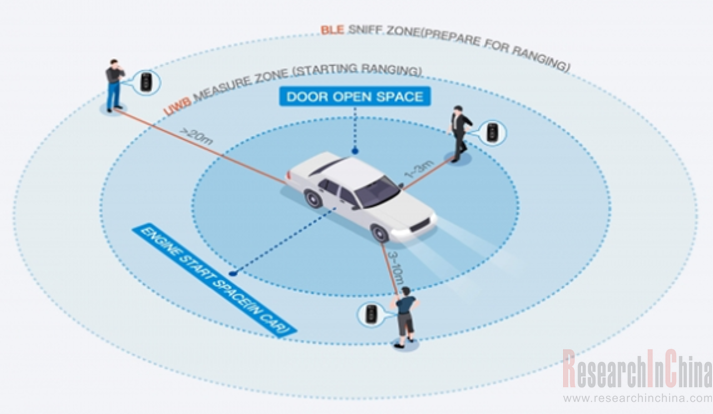

In July 2021, CCC officially issued the CCC3.0 standards, which clearly proposes that the combination of UWB and BLE (Bluetooth) wireless technologies enables passive keyless entry and engine start through compatible mobile devices.

CCC Digital Key 3.0 will bring better user experience by implementing UWB connectivity to add hands-free, location-aware keyless entry and location-aware capabilities.

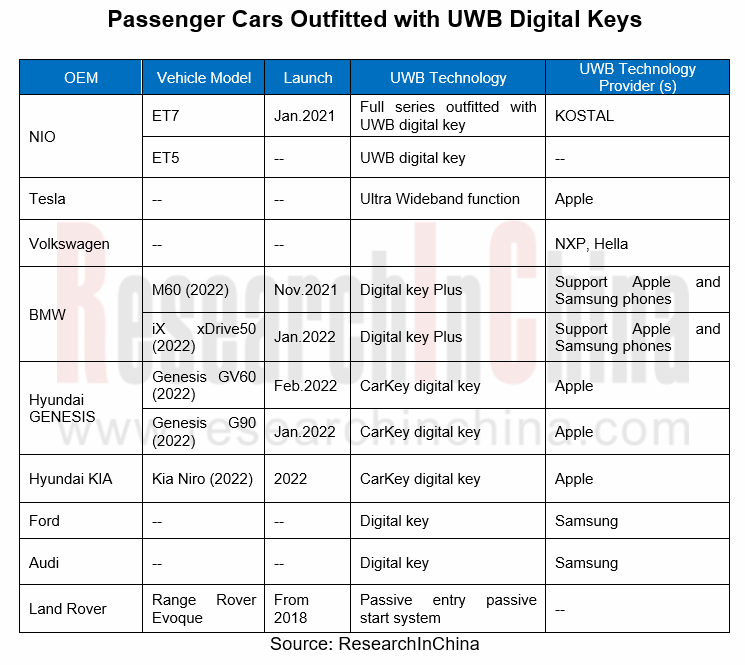

To date, a number of Chinese and foreign OEMs have begun to deploy UWB technology. To ensure the safety of the passive entry system, Range Rover Evoque has started to employ UWB technology since 2018; all NIO ET7 models delivered in early 2022 support the UWB key positioning function (leveraging UWB+Bluetooth+NFC fusion technology), and the upcoming NIO ET5 also plans to carry UWB technology.

In addition, BMW, Hyundai, etc. all plan to launch models outfitted with UWB digital key in 2022, and the UWB digital key will usher in mass production.

Enthusiastically promoted by NIO, Great Wall Motor, Land Rover, BMW and other OEMs, UWB is projected to be available onto millions of passenger cars, accompanied by a sharp fall in the cost of single car. UWB technology will be eventually a standard configuration of intelligent connected vehicles, connecting vehicle to everything.

BMW: In 2021, BMW unveiled the new BMW iDrive system, which is equipped with UWB technology for the first time, and upgraded the mobile car key technology to Digital Key Plus in line with CCC 3.0 communication standards.

BMW Digital Key Plus will be first installed on the BMW iX, which can unlock/lock the doors automatically, but which currently only supports Apple devices with the Apple U1 chip.

In the future, BMW will continue to cooperate with Apple and CCC to develop the digital key 3.0 criterion based on UWB technology, formulating a new technical standard for the global automotive industry.

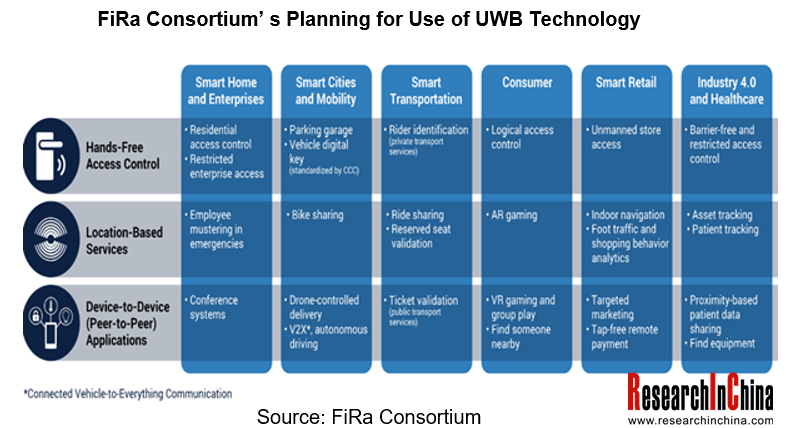

Measureless UWB derivatives attract the inrush of companies

UWB is still in its infancy in the automotive sector, and it is now used mainly in unconscious entry by UWB digital key. In the future, OEMs hope to open up a smart mobility ecosystem through UWB digital keys, and derive more personalized applications, such as UWB-based automotive AVP, car sharing and car payment.

Besides, UWB-based smart phones are increasingly accessible. In the future, if the mobile phone and automobile UWB technology potential markets are connected through, UWB application-based industry chain ecosystem will become a blue sea market.

It is because UWB can derive a broad industry ecosystem that the companies concerned have begun to actively deploy UWB technology.

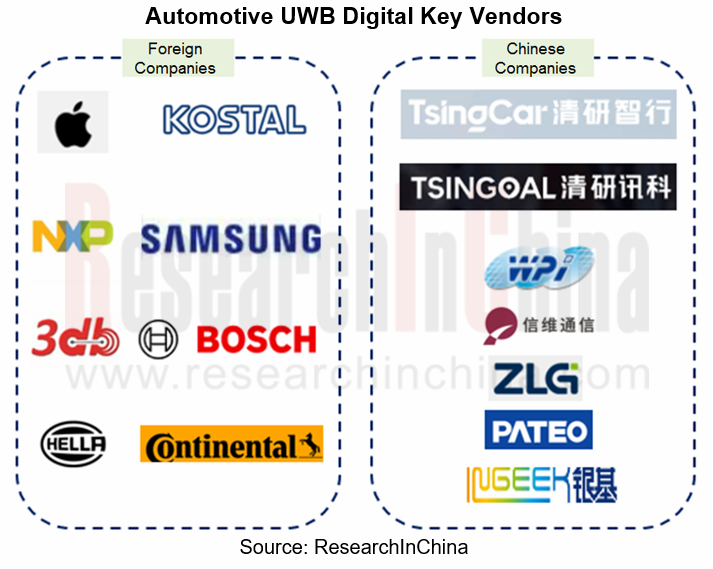

Auto parts system suppliers: promote the OEM deployment of UWB technology for mass production

KOSTAL: With the mass production and delivery of NIO ET7, KOSTAL's UWB digital key has been truly spawned. KOSTAL has developed an exclusive communication protocol for UWB digital key system, which is compatible with CCC protocol, so that the company's products can suit the wireless communication criteria of different OEMs, which is conducive to popularizing mass production.

In addition, KOSTAL is also proactively developing UWB-based derivative solutions, such as the tailgate kick sensor solution. Through the highly sensitive UWB radar algorithm, the kick action can be accurately detected to realize the automatic opening of the trunk. This technology will be massively available on cars in 2022.

HELLA: In June 2021, Hella rolled out a smart vehicle entry system based on UWB technology. When the car owner is within a distance of 50 meters, the car will automatically detect and identify his/her mobile device; when the owner is within two meters of the car, the car is automatically unlocked; however, the engine can only be started when the smartphone is in the car. The technology will be in mass production within two years, says Hella.

In addition, vehicle access authorization can be digitally managed and shared via HELLA's intelligent vehicle access system, so the technology can also be used in areas such as car sharing services or fleet suppliers.

TsingCar: Relying on R&D accumulation of the parent company TSINGOAL in the UWB field, TsingCar has successfully developed a UWB digital key solution, enabling UWB-based tailgate kick, in-cabin liveness detection, and UWB-based high-precision positioning and navigation AVP function.

Moreover, TsingCar is also actively exploring core algorithm iterations to build core competitiveness. Through self-developed TOA, TDOA, and AOA adaptive estimation algorithms, 10cm-level positioning accuracy is achieved.

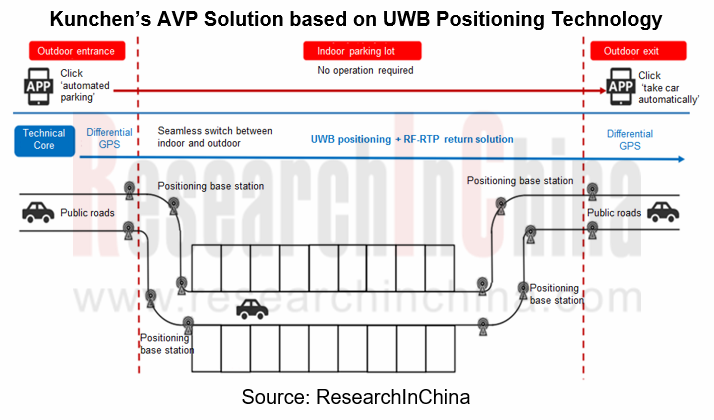

Kunchen: Kunchen has built public parking lots based on UWB technology in Shanghai, and plans to cover Chengdu, Beijing, Guangzhou and other cities. Also, the company integrates UWB module and RTK module to form an indoor and outdoor fusion positioning box, which transmits the fusion coordinate data to the car and supports AVP.

Jingwei Technology: It provides proprietary UWB chip modules, positioning hardware & software and system solutions. Notably, Great Wall Motor's ORA Haomao is equipped with the "Find ME Mobile Connect & Positioning System" of Jingwei Technology.

Tech companies: From mobile phones to automobiles, joint efforts are being made to foster a UWB industry chain ecosystem.

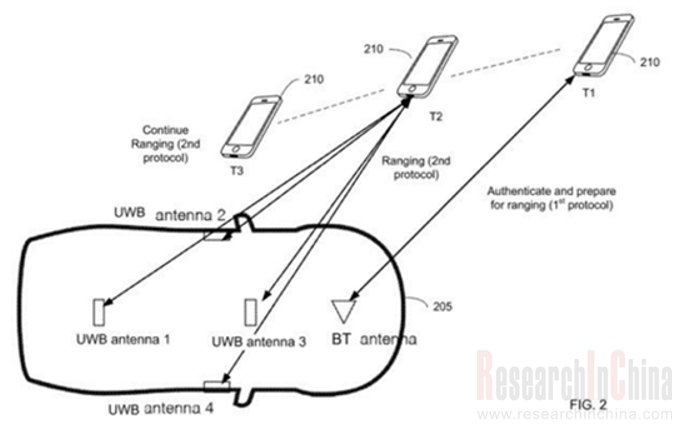

Apple: Beginning in 2020, Apple included the new Car Key feature as an integral of iOS 13.6. When the iPhone holder approaches the car, the signal transmitted by the UWB transmitter on the iPhone will be received by the UWB antenna on the vehicle. The central processing unit then calculates the distance and specific location of the mobile phone around the car according to the signal field strength and direction provided by the UWB antenna, so as to make a targeted response.

Xiaomi: In 2020, a UWB-based garage car-finding solution was released by Xiaomi. When the car is parked in the garage, the UWB anchor interacts with UWB module in the car to be positioned, and the UWB anchor can obtain the distance and location of the car as well as identification information of the car’s UWB module and send the information to UWB server. According to the position of UWB anchor in the garage, the server can obtain the parking position of the car by calculating the distance and position between multiple anchors and the car to be located, and store it in the UWB server.

Also, Xiaomi officially announced its entry into car manufacturing in 2021, and successively established Xiaomi Auto Co., Ltd., Xiaomi Auto Technology Co., Ltd., etc. Expectedly, Xiaomi Auto will use the self-developed UWB technology in the future.

UWB chip vendors: With the development of precise positioning in the Internet of Things, UWB chips usher in a development boom.

Concerning UWB chips, the foreign vendors such as Qorvo, NXP, Apple, and French BeSpoon have taken the lead in launching mass-produced products. Chinese UWB solution providers mostly use UWB chips from Qorvo's Decawave for system research and development. After Apple released iPhone 11, the first mobile phone integrated with UWB technology, UWB chip industry is growing in popularity, and many UWB chip start-ups have been incubated in China, including Chengdu Jingwei Technology, TSINGOAL, Chixin Semiconductor, etc. UWB chips have found large-scale application in precise positioning, consumer electronics, automotive connectivity, etc.

MKSemi: In January 2022, UWB chip design company MKSemi completed the Pre-A+ round of financing, with a total financing of more than RMB80 million in this round. It previously received investments from OPPO and MediaTek. MKSemi's low-power UWB technology can improve the battery life of electronics, making it possible to add UWB positioning functionality to wireless sensors with extremely strict size requirements.

Ultraception: In January 2022, the UWB chip developer Ultraception won strategic investment from Xiaomi. It was also previously invested by Xuxin Investment (Shanghai) Co., Ltd., the main investor of MediaTek in Mainland China. The UWB chip designed by Ultraception enables low power consumption, low cost, and compatibility with multi-band UWB chip solutions, well addressing major pain points of customers, supportive for the long running of button cell batteries to a great extent, and offering miniature, low power consumption, and safety features to meet rigid demand from the consumer market.

NewRadioTech: The Ursa Major UWB series chip independently developed by NewRadioTech is an earlier high-tech forward R&D chip in the UWB field domestically.

TSINGOAL: It mass-produced UWB+BLE5.1 dual-band positioning chip, a full-featured chip that conforms to the 802.15.4z/Bluetooth5.1 technical standard and that is embedded with UWB/Bluetooth 5.1 dual band, coupled with built-in RF unit and processor to form ‘a single chip + antenna’ as a complete positioning terminal. In the field of 5G positioning, China Mobile has completed verification of 5G positioning solution in cooperation with ZTE and TSINGOAL.

Chixin Semiconductor: In December 2021, Changsha Chixin Semiconductor launched CX300, the first commercial UWB chip in China, with a positioning accuracy of ±5cm. It supports the latest 802.15.4z standard, has various low-power modes, supports multi-antenna solutions, and supports FiRa/CCC criteria.

Automotive Ultra Wide Band (UWB) Industry Report, 2022 by ResearchInChina highlights the following:

UWB positioning technology, UWB system features, UWB industry policies and standards as well as UWB application, etc.;

UWB positioning technology, UWB system features, UWB industry policies and standards as well as UWB application, etc.;

UWB industry chain, market size, market pattern, technical trends, etc.;

UWB industry chain, market size, market pattern, technical trends, etc.;

UWB use in varied scenarios (digital key, autonomous driving positioning, indoors parking lot, smart traffic lights);

UWB use in varied scenarios (digital key, autonomous driving positioning, indoors parking lot, smart traffic lights);

Influential automotive UWB chip suppliers and their UWB product lines;

Influential automotive UWB chip suppliers and their UWB product lines;

Influential automotive UWB system solution integrators and their UWB solutions & application.

Influential automotive UWB system solution integrators and their UWB solutions & application.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...