Global and China Automotive Emergency Call (eCall) System Market Report, 2022

Automotive eCall system: wait for the release of policies empowering intelligent connected vehicle safety

At the Two Sessions held in March 2022, more than 10 deputies to the National People's Congress (NPC) and members of the Chinese People's Political Consultative Conference (CPPCC) put forward over 30 proposals on the development of the automotive industry, above 80% of which relate to the development of intelligent connected vehicles. The issues about strengthening the safety of intelligent connected vehicles were mentioned many times.

Yin Tongyue, chairman of Chery, suggested that the Ministry of Industry and Information Technology (MIIT) take the lead in promoting the release of eCall (Emergency Call or Accident Emergency Call System) regulations at the earliest possible time, and give some subsidies to companies for a faster progress in promotion and implementation while carrying out the regulations.

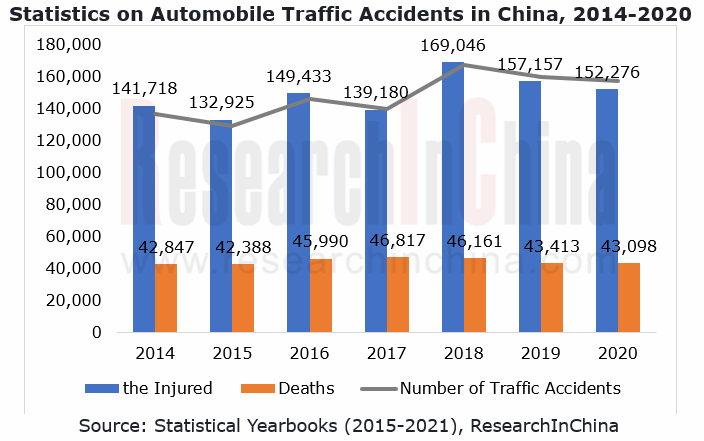

A total of over 30 million people have died in car crashes worldwide since the car made its debut, according to the World Health Organization. The data in statistical yearbooks show that in recent years there are more than 150,000 to 160,000 traffic accidents causing casualties in China annually, with around 40,000 deaths. In traffic accidents, the vast majority (above 90%) of all the dead lost their lives before reaching hospitals. Yet the injured who were successfully delivered to hospitals were very likely to be rescued. In Japan where the timely rescue rate (the rate of rescues within 30 minutes) reaches as high as 98%, the traffic fatality rate is as low as 0.9%, justifying how important it is to introduce mandatory eCall regulations.

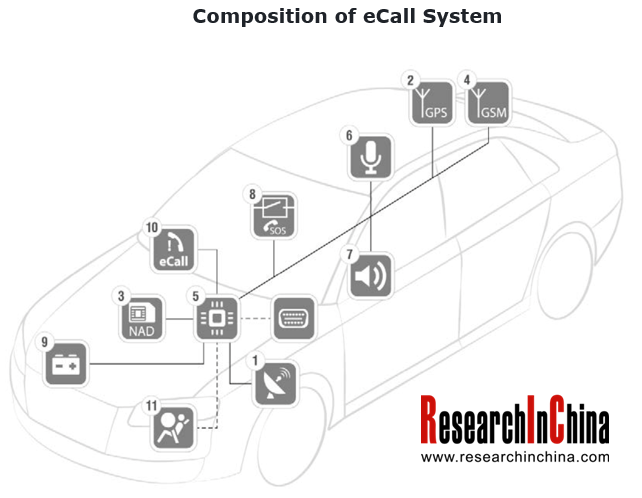

An automotive emergency call system can provide the user with eCall rescue services (GNSS positioning and voice call services) in the event of an emergency, and it can be activated manually and automatically. The manual eCall function is enabled by a physical button; automatic eCall refers to a function in which the eCall system receives the signal and automatically makes an emergency call after a traffic accident happens. After the eCall system dials, the backstage will arrange the responsive rescue services in time according to the location of the vehicle.

A typical eCall system is at least composed of the following: 1. GNSS receiver; 2. GNSS antenna; 3. NAD (Network Access Device, including SIM card); 4. mobile network antenna; 5. ECU/MCU; 6. microphone; 7. speaker/emergency pager; 8. manual button; 9. battery or power supply system; 10. warning or indicating device; 11. collision detection system (sensor).

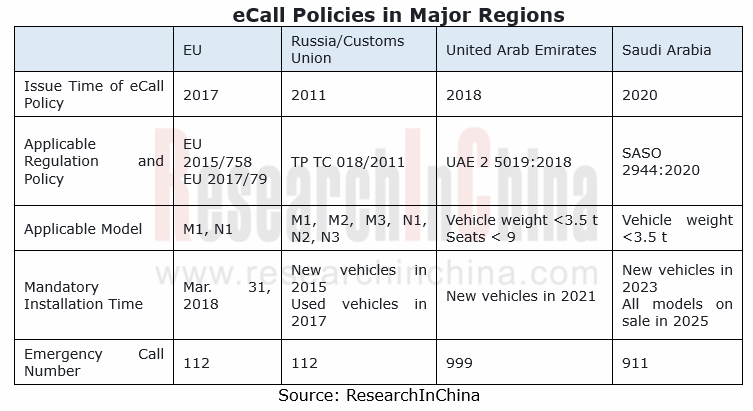

eCall policies have come into force in quite a few Eurasian countries.

In 2005, the European Commission made a request for developing an in-vehicle emergency call (eCall) service, aiming to implement and deploy a unified automotive eCall service system in Europe. To that end, in 2005 the European Commission assigned the technical standard task to ETSI/3GPP (European Telecommunications Standards Institute, ETSI) to develop and build an eCall communication technology standard system.

In 2008, ETSI/3GPP began to release a range of eCall communication module technology standards. In 2011, nine European countries co-founded the HeERO (Pan-European In-Vehicle Emergency Call Service) Consortium. The EU issued the Regulation (EU) 2015/758 in 2015, and introduced the Commission Implementing Regulation (EU) 2017/78 and the Commission Delegated Regulation (EU) 2017/79 in 2017. The EU eCall policies specify the mandatory installation of 112-based in-vehicle eCall systems in all new M1 and N1 vehicles from March 31, 2018.

Besides the EU, the Russia-led Customs Union, the United Arab Emirates and Saudi Arabia have also launched their eCall bills.

Since the introduction of UNECE-R144 in 2018, for new vehicle models, Japan has required mandatory installation of accident emergency call systems (AECS) in M1/N1 vehicles after the transition period of 1.5 years; for vehicles in production, Japan has required mandatory installation of AECS in M1/N1 vehicles after the transition period of 3 years. The AECS will save an average of 4 minutes of rescue time according to Japan’s official statistics. Meanwhile, the D-Cal system, Japan’s advanced rescue service, is expected to save 17 minutes on average.

India has also stipulated that from April 1, 2019, all passenger vehicles such as taxis and buses must be equipped with the device AIS 140 Tracker.

China’s eCall market is awaiting the accompaniment of policies.

In early 2022, we made a one-to-one discussion and communication with several Chinese experts from Tier1 suppliers on the development of eCall systems. We all made an optimistic prediction about the enforcement time of eCall policy, and roughly determined the timeline is between 2023 and 2024.

Automotive safety has always been a major concern of policies. The Telematics Industry Application Alliance (TIAA) announced the TIAA eCall solution in late 2015.

In 2013, the TIAA members, Huawei, HealthLink, Changan Automobile and BYD set up the "eCall Standard Working Group" to research and draft Chinese eCall standards. In June 2014, the key members of the working group including Changan Automobile, HealthLink, BYD, Chery and JAC held a joint demonstration of eCall systems in four places, verifying the stability and practical usability of China’s self-developed eCall system.

In 2016, Huawei and HealthLink led efforts to apply for project approval of the eCall standards researched by the TIAA.

In December 2017, the Automotive Electronics and Electromagnetic Compatibility Sub-Technical Committee of the National Technical Committee of Auto Standardization, organizing major automakers and related technical research institutions, convened the "Technical Seminar on Automotive Emergency Call" in Dali City of Yunnan Province, at which they discussed China's eCall technologies and the plans to advance eCall standards in China.

In January 2018, the MIIT solicited the public opinions on the mandatory national standard plan project—Automotive Accident Emergency Call Systems, on its website. This is the first time that a national authority that administrates the automotive industry has clearly defined eCall standard as a national standard (GB), that is, a mandatory national standard for the automotive industry.

In 2019, China Automotive Technology and Research Center Co., Ltd. led companies to organize several seminars on "Automotive Accident Emergency Call Systems". And in October 2019, it called a preparatory meeting for the drafting of the standard "Automotive Accident Emergency Call Systems", and clarified the main drafting content and schedule.

In 2020, the national standard plan "Automotive Accident Emergency Call Systems" was reported by TC114 (National Technical Committee of Auto Standardization), to the competent authority the MIIT. The main drafters included China Automotive Technology and Research Center Co., Ltd., the Traffic Management Research Institute of the Ministry of Public Security, the SAMR Defective Product Administrative Center, China Academy of Information and Communications Technology, Great Wall Motor Co., Ltd., and Huawei Technologies Co., Ltd. Publicity started on October 29, 2020, and ended on November 28, 2020.

In December 2021, the second meeting on the automotive standard system of the Automotive Accident Emergency Call Systems (AECS) in 2021 was held in Tianjin. The meeting discussed and ascertained the plan for construction of corpus and background noise libraries related to the GB/T "Requirements and Test Methods for Road Vehicle Hands-free Call and Voice Interaction Performance", to foster a well-established automotive accident emergency call system (AECS) standard system, in a bid for a louder voice of China in this field.

In March 2022, the MIIT released the key tasks of automotive standardization in 2022, including accelerating the formulation of standards for hands-free call and voice interaction and starting the filing of the standard Automotive Accident Emergency Call Systems.

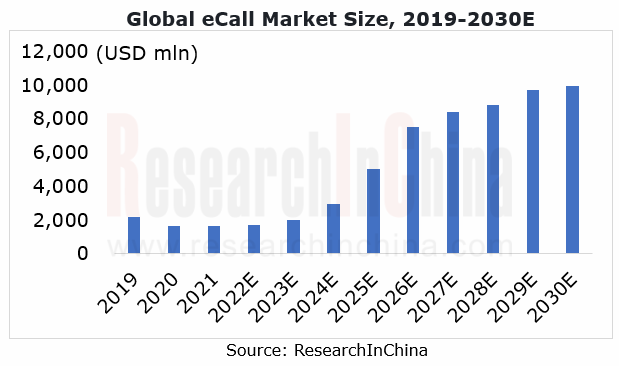

The global eCall market is mainly driven by policies. At present, the market is concentrated in the EU, Russia and other places that have issued eCall policies. Still amid the pandemic in 2021, as the automobile shipments had yet to recover to the level before the COVID-19 and eCall still used 2G/3G modules, the declining average price of the system led to an overall flat market size (by value) in the year, in spite of a slight increase in eCall system shipments. It is conceivable that the global eCall system market will be worth USD1,678 million in 2022, up by 4% versus 2021, and will grow to USD9,931 million in 2030, mainly thanks to the rebound in the automotive market and new eCall markets such as Saudi Arabia and China, a country which will introduce eCall polices on one optimistic estimate.

Supply goes before troops, players makes beforehand deployments in eCall market.

The EU goes earlier in formulation of eCall system standards, with a high demanding on system reliability, but not requiring 4G/5G networks for communications. Currently, European eCall products still mainly use 2G/3G modules, so CAT1 communication modules are fully competent. Some low-end vehicle models are not equipped with products with intelligent connectivity feature, but only eCall products capable of basic communications (Entry Telmatics). Many mid- and high-end models, of course, pack 4G T-Box that integrates eCall function, which is commonplace for intelligent connected vehicles.

In the international market, the key eCall system suppliers are still traditional automotive electronics manufacturers like Continental Automotive, Bosch, Valeo and LG Electronics. In the absence of relevant regulations in China, neither OEMs nor Tier1s have much incentive to promote eCall systems in the country. But we still see the following types of local players active in the eCall system market:

First, companies like Huawei. On the strength of their own experience in communication and automotive electronics, they have partaken in policy formulation, and have developed and applied for technology patents. In 2016, Huawei filed for an eCall patent (application number: CN2016100997921), a method for supporting emergency call (eCall). On October 25, 2021, Desay SV applied for a patent titled "An eCall System Terminal with A Video System and Rescue Method" (application number: CN202111243707.1).

Second, players like Flaircomm Microelectronics. With its expertise in communication modules and T-Box, the company cooperates with local Chinese OEMs to provide eCall systems for products China exports to countries/regions having introduced eCall policies, such as the EU, the Middle East, and Russia. Flaircomm Microelectronics is the first one in China to pass (EU) 2015/758, UNECE R144 and UAE.S 5019:2018 certifications. It provides eCall system solutions for Chinese automakers like SAIC, Geely, GAC, Chery, BYD and Changan Automobile, all of which export vehicles to other countries.

Third, those like Shenzhen Discovery Technology Co., Ltd. They provide eCall security services for car owners, by integrating resources and starting with the aftermarket. Zhuque No. 1, a product jointly launched by Discovery Technology, Silhorse and HealthLink, delivers emergency rescue services for car owners using an AM eCall device and HealthLink’s rescue network.

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...

China Passenger Car HUD Industry Report, 2025

ResearchInChina released the "China Passenger Car HUD Industry Report, 2025", which sorts out the HUD installation situation, the dynamics of upstream, midstream and downstream manufacturers in the HU...

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2025 – Chinese Companies

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2025 – Chinese Companies

Research on Domestic ADAS Tier 1 Suppliers: Seven Development Trends in the Era of Assisted Driving 2.0

In the ...

Automotive ADAS Camera Report, 2025

①In terms of the amount of installed data, installations of side-view cameras maintain a growth rate of over 90%From January to May 2025, ADAS cameras (statistical scope: front-view, side-view, surrou...

Body (Zone) Domain Controller and Chip Industry Research Report,2025

Body (Zone) Domain Research: ZCU Installation Exceeds 2 Million Units, Evolving Towards a "Plug-and-Play" Modular Platform

The body (zone) domain covers BCM (Body Control Module), BDC (Body Dom...

Automotive Cockpit Domain Controller Research Report, 2025

Cockpit domain controller research: three cockpit domain controller architectures for AI Three layout solutions for cockpit domain controllers for deep AI empowerment

As intelligent cockpit tran...

China Passenger Car Electronic Control Suspension Industry Research Report, 2025

Electronic control suspension research: air springs evolve from single chamber to dual chambers, CDC evolves from single valve to dual valves

ResearchInChina released "China Passenger Car Elect...

Automotive XR Industry Report, 2025

Automotive XR industry research: automotive XR application is still in its infancy, and some OEMs have already made forward-looking layout

The Automotive XR Industry Report, 2025, re...

Intelligent Driving Simulation and World Model Research Report, 2025

1. The world model brings innovation to intelligent driving simulation

In the advancement towards L3 and higher-level autonomous driving, the development of end-to-end technology has raised higher re...

Autonomous Driving Map (HD/LD/SD MAP, Online Reconstruction, Real-time Generative Map) Industry Report 2025

Research on Autonomous Driving Maps: Evolve from Recording the Past to Previewing the Future with "Real-time Generative Maps"

"Mapless NOA" has become the mainstream solution for autonomous driving s...