Global and Chinese Automakers’ Modular Platforms and Technology Planning Research Report, 2022

Research on Automakers’ Platforms and Their Planning: the Strategic Layout Directions of 32 Automakers

At present, global automotive industry is in the midst of profound changes unseen in a century. This can be intensively demonstrated through energy, power system, E/E architecture, intelligence and connectivity, application scenarios, user experience, and more. In this context, major automakers are changing their strategic layout. They work hard on key areas from automotive manufacturing platforms, E/E architecture and software platforms to autonomous driving, intelligent cockpit and electrification, and attract consumers and satisfy their needs with differentiated products.

1. Automakers keep upgrading their modular platform architectures.

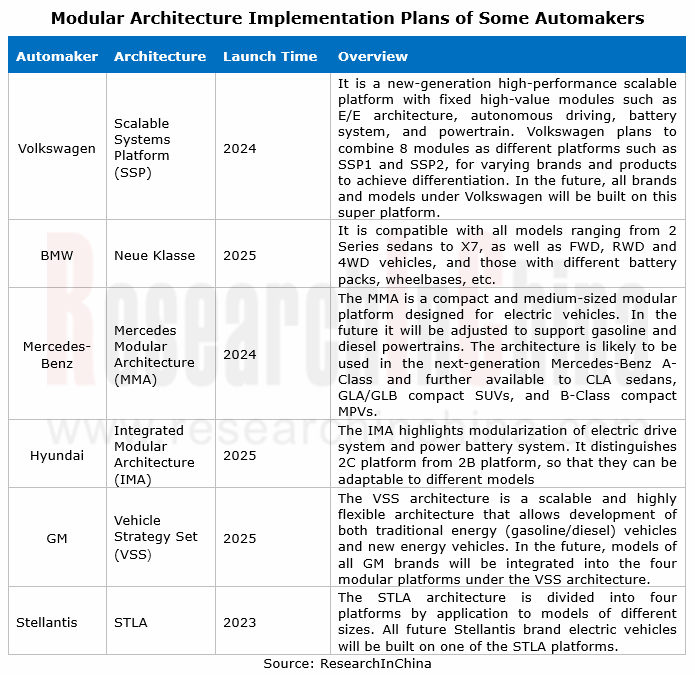

Modular platforms remain superior in increasing the universality of components and lowering R&D and production costs. At present, most automakers have their own modular platforms, or even multiple platforms. Modular architecture outperforms a modular platform. It is an extension and expansion of the platform concept. With higher universality of components and higher scalability, modular architecture is compatible with vehicles of differing classes and power types. Automakers therefore have started gradual transition from modular platform to modular architecture.

Modular architecture favors higher productivity, lower procurement/manufacturing costs, and shorter R&D cycles. In current stage, the generalization rate of components in GAC Global Platform Modular Architecture (GPMA) surpass 60%, compared with 70% in Geely Sustainable Experience Architecture (SEA) and 70%-80% in Toyota New Global Architecture (TNGA).

At present, automakers in China deploy modular architectures relatively early. Among them, BYD, Geely, Chery, and Changan Automobile have launched their own modular architectures. The modular architecture launches of foreign peers are concentrated in the period from 2024 to 2025.

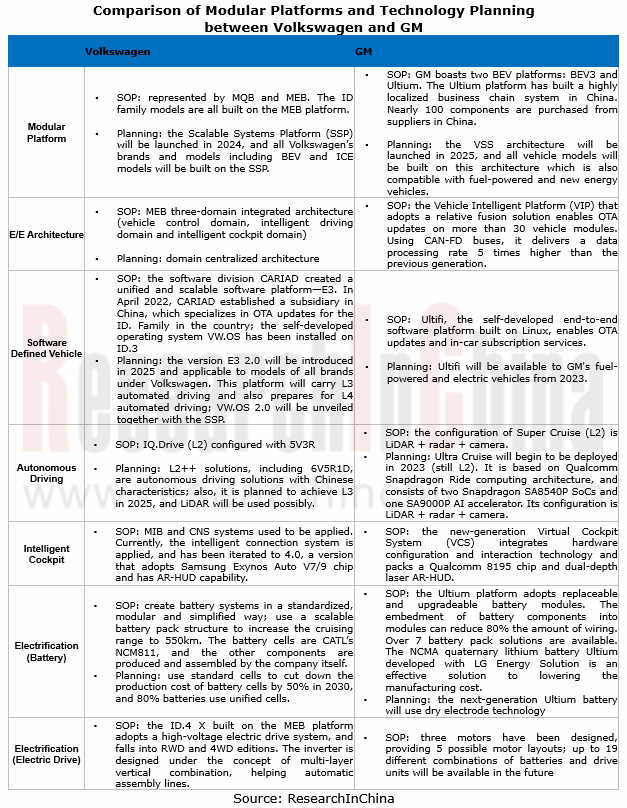

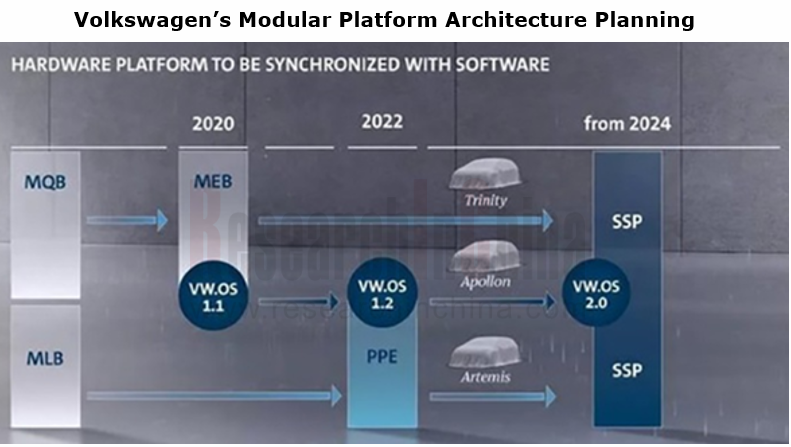

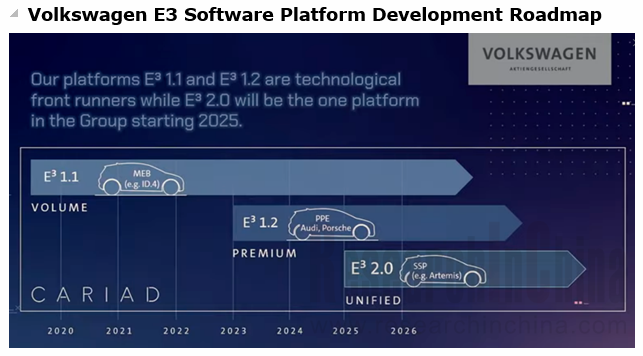

Taking Volkswagen as an example, the company plans to eventually integrate its platforms into SSP, a scalable mechatronics platform architecture applicable to all Volkswagen’s brands and models. In the future, all brands and models at all levels under Volkswagen will be built on this super platform.

2. EEA tends to be centralized.

Through the lens of E/E architecture planning, most automakers plan to deploy centralized vehicle E/E architectures:

GAC projects installation of the centralized E/E architecture "Protoss" in 2023 Aion high-end models;

Hongqi plans launch of its quasi-central architecture FEEA3.0 in 2023;

Great Wall Motor plans to introduce its central computing architecture GEEP 5.0 in 2024;

Changan Automobile is expected to complete the development of its domain centralized architecture in 2025.

For example, GAC has upgraded its E/E architecture in all aspects and has developed the Protoss E/E Architecture, its new vehicle-cloud integrated E/E architecture that enables centralized computing and is about to come out in 2023 at the earliest. This architecture consists of three core computer groups, i.e., central computer, intelligent driving computer and infotainment computer, and four zonal controllers. The intelligent driving domain carries Huawei Ascend 610, a 400TOPS high-performance chip.

3. Automakers transform from independent software platform developers to software service providers.

As autonomous driving and intelligent connectivity boom, large automakers have set off a new round of “software-defined vehicle”-centric transformation and upgrading. Some transform themselves to software service providers by way of establishing software divisions/subsidiaries, independently developing operating systems (OS), and building software platforms.

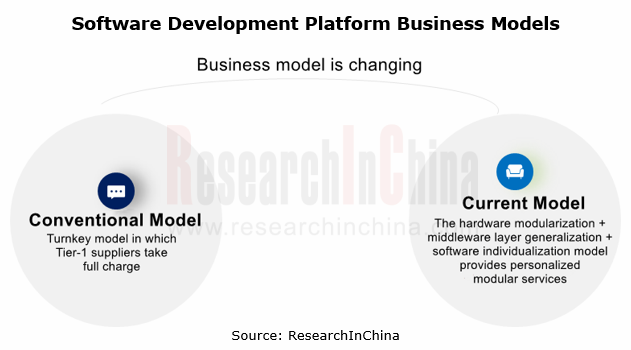

Compared with the turnkey model in which Tier-1 suppliers take full charge in conventional vehicle supply chain, auto brands now take more active part. Joint R&D and flat cooperation gradually blur the boundaries of the supply chain ecosystem, and also diversifies the needs for business models. Modular services thus need providing to meet the individual needs of auto brands with differentiated configurations for different vehicle models. For example, Bosch adopts hardware modularization + middleware layer generalization + software individualization model and adjusts parameters to quickly address the needs of different functions.

Volkswagen is a typical automaker that develops software on its own. In 2019, Volkswagen established a software division and planned to boost the in-house share of car software development from less than 10% to at least 60% in the five years to come. In 2021, Volkswagen changed the software division into CARIAD, a joint-stock company which will be responsible for independently developing the automotive operating system VW.OS and creating the software platform E3. In April 2022, CARIAD announced its China strategy. Its Chinese subsidiary was then established.

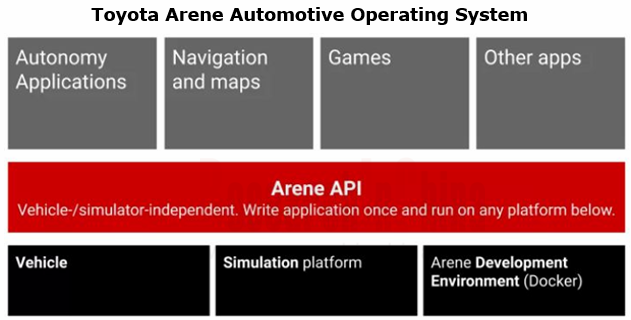

In addition to Volkswagen, GM, Toyota, Mercedes-Benz, Hyundai, SAIC and the like have also begun to self-develop operating systems and deploy their own software platforms, aiming to transform from an automaker to a software service provider. Toyota, which recently acquired the automotive operating system provider Renovo Motors, plans to roll out its own operating system, Arene, in 2025.

4. L3 automated driving of OEMs comes into service.

The mainstream automakers deploy autonomous driving in the following ways:

? Investing in acquiring autonomous driving startups

? Partnering with big tech firms

? Cooperating with other OEMs

? Self-developing, or combining the above ways

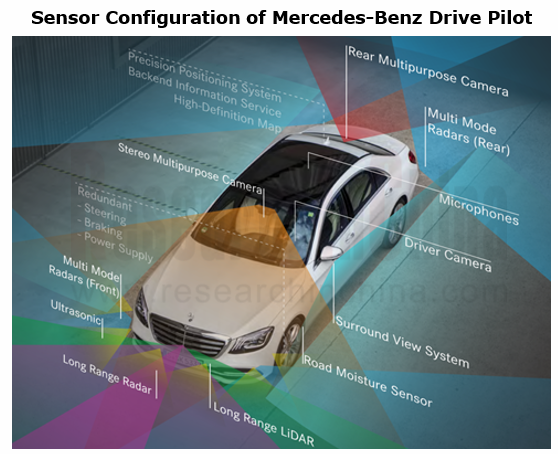

On this basis, these automakers have also introduced their own autonomous driving assistance systems, including Volkswagen IQ.Drive, Toyota Advanced Drive, Mercedes-Benz Drive Pilot, Geely G-Pilot, and GAC ADiGO. Among them, Mercedes-Benz is the world’s first automotive company to meet the United Nations regulation UN-R157. Mercedes-Benz marketed its L3 automated driving system Drive Pilot in Germany in May 2022, and announced that it will be responsible for accidents caused by the system when activated.

Sensor configuration of Mercedes-Benz Drive Pilot:

? 1 LiDAR

? 1 long-range radar

? 4 short-range radars

? 1 stereo camera

? 1 rear view camera

? 1 in-vehicle driver monitoring camera

? 1 differential GPS

Sensor configuration of automated parking:

? 4 surround view cameras

? 12 ultrasonic sensors

5. Intelligent cockpit interconnection platforms connect vehicles, people and everything, playing a more important role.

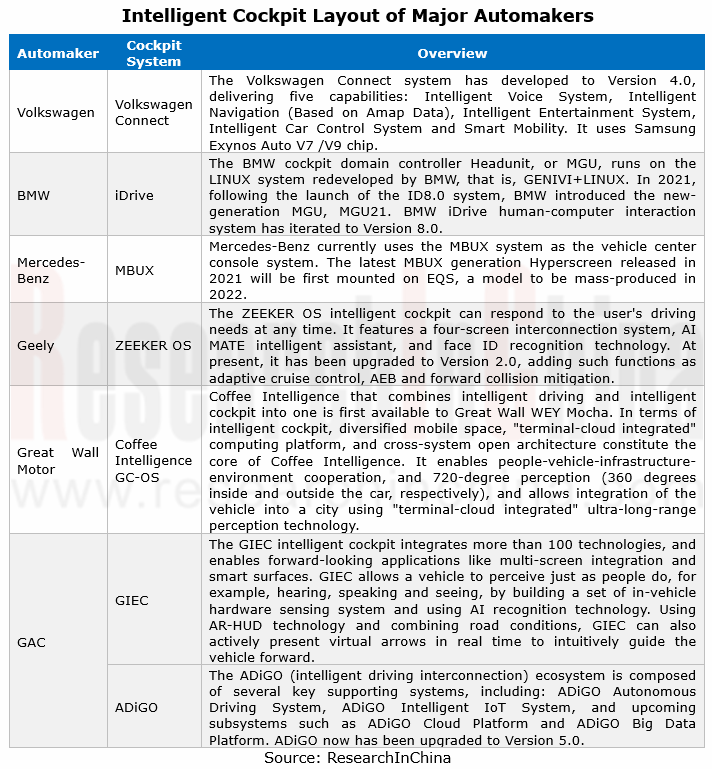

As the Internet thrives, major automakers show much enthusiasm for intelligent cockpits. Almost all of them have rolled out different intelligent cockpit interconnection platforms as selling points, in a bid to attract consumers. Examples include BMW iDrive and Mercedes-Benz MBUX, BYD DiLink and Geely GKUI.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...