Global and China Electronic Rearview Mirror Industry Report, 2021-2022

Electronic rearview mirror research: the streaming rearview mirror installations soared by 73% in 2021.

This report combs through and summarizes the global and Chinese electronic rearview mirror markets, including status quo (installations and installation rate), function applications, development trends, suppliers’ products and market layout.

1. Overview of electronic rearview mirror

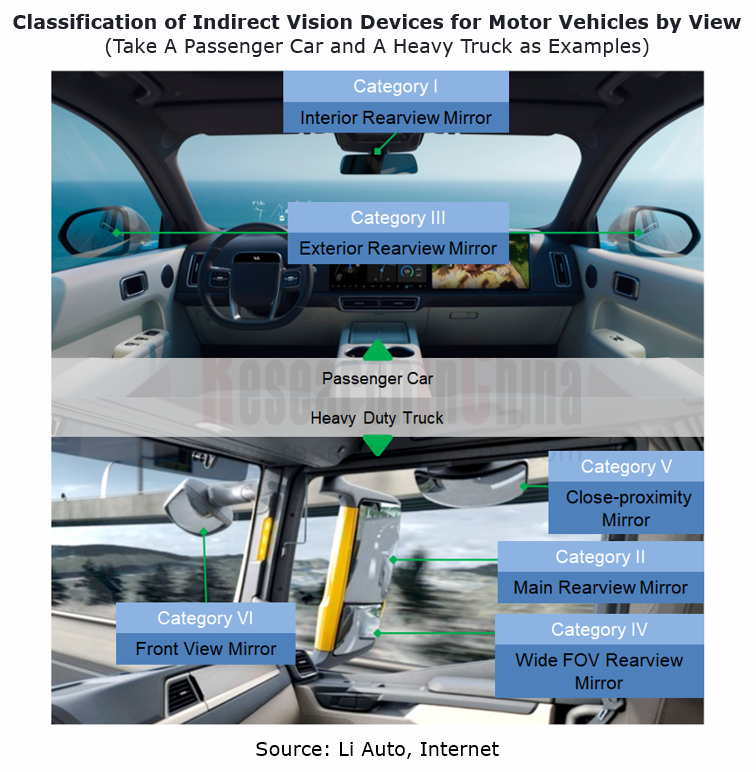

Before talking about electronic rearview mirrors, it first needs to state the classification of automotive indirect vision devices (providing the rear, side or front view of a vehicle). The new version of GB15084 explicitly divides the motor vehicle indirect vision devices into seven categories by view:

I: interior rearview devices

II/III: main exterior rearview devices

IV: wide FOV exterior view devices

V: close-proximity exterior view devices

VI: front view devices

VII: mirrors for Category L motor vehicles with at least a partially enclosed cab

Specifically on a vehicle, the figure below shows the classification of indirect vision devices by view.

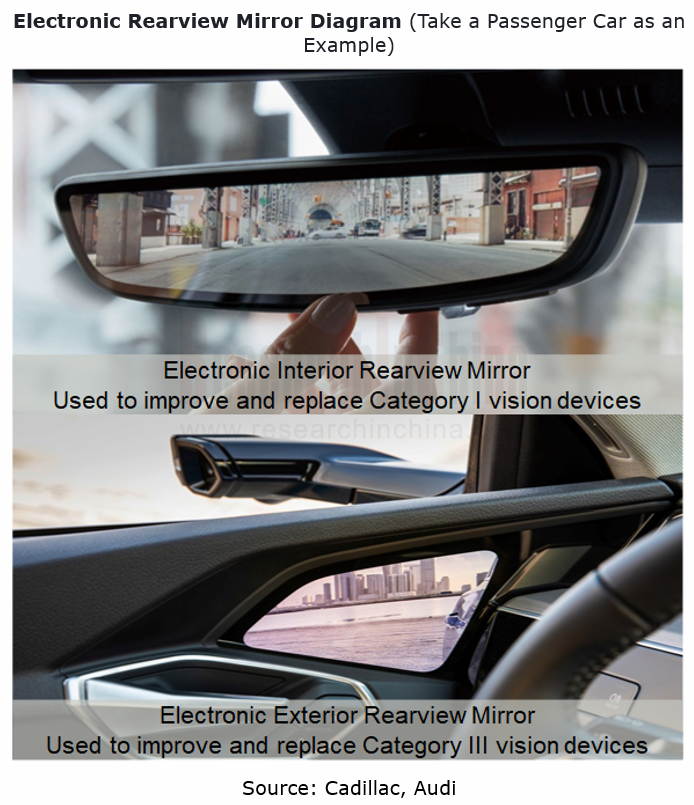

So what is an electronic rearview mirror? The electronic rearview mirror is a new type of indirect vision device. In the new version of GB15084, it is described as a "camera-monitor system" (abbreviated to as CMS), that is, "indirect vision device, a system composed of a camera and a monitor, can clearly see the rear, side or front of the vehicle within the specified field of view”.

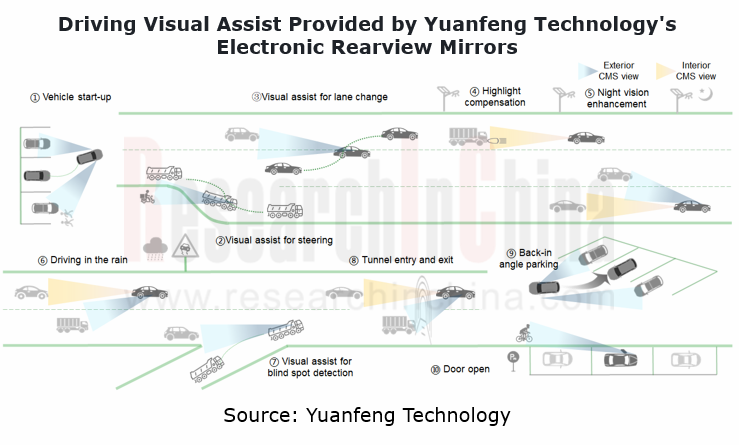

In terms of function, an electronic rearview mirror is roughly similar to a conventional optical mirror, but presents an image on the display instead of glass, bringing in more possibilities of enriching image information. As an improvement on and an alternative to the conventional Category I-VII view devices, CMS can deliver a wider and clearer rear view to the driver, eliminating the obscuring effect of rain, snow and fog on windows and mirrors. Overlaying a variety of driving assistance information, it also allows the driver to know much more about road conditions behind, making driving safer.

By installation position, electronic rearview mirrors are mainly split into interior and exterior types, of which interior electronic rearview mirrors are often called "streaming rearview mirrors".

2. The electronic rearview mirror market is soaring, but still in its infancy.

In April 2016, the 2016 Cadillac XT5 equipped with a streaming rearview mirror was launched on market. It was the first time that an OEM streaming rearview mirror appeared in the Chinese passenger car market. And then, auto brands like WEY, Buick and FAW (Hongqi, Bestune) also unveiled models with streaming rearview mirrors. As of May 2022, a total of 13 auto brands in China have marketed models carrying streaming rearview mirrors and achieved certain sales.

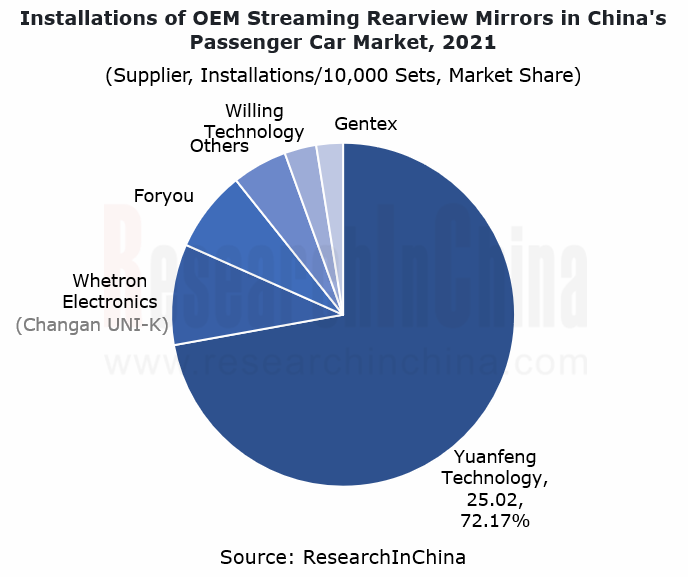

The boom of intelligent cockpits and ADAS has favored the flourish of vehicle cameras in recent years, and streaming rearview mirror cameras are no exception. In 2021, there were 346,700 insured passenger cars (excluding imported ones) packing standard OEM streaming rearview mirrors in China, surging by 73.04% on the previous year. In 2021, the insured passenger cars in China totaled 20.328 million units, which meant the installation rate of streaming rearview mirrors in passenger cars was just 1.71%. The streaming rearview mirror market is still in its infancy.

There are few streaming rearview mirror suppliers participating in the OEM market considering the current size, creating a relatively simple completive landscape. Our data show that Yuanfeng Technology is now the largest supplier of streaming rearview mirrors in the Chinese passenger car market, with an overwhelming market share of 72%.

Having undergone four iterations, Yuanfeng Technology’s streaming rearview mirror products subject to the international standard ECE R46 perform well in video latency, system stability, screen highlighting, lightweight mirror body, heat dissipation and other technical parameters, and have supported car models of Cadillac, Buick, Chevrolet, Great Wall Motor and Toyota, among other auto brands.

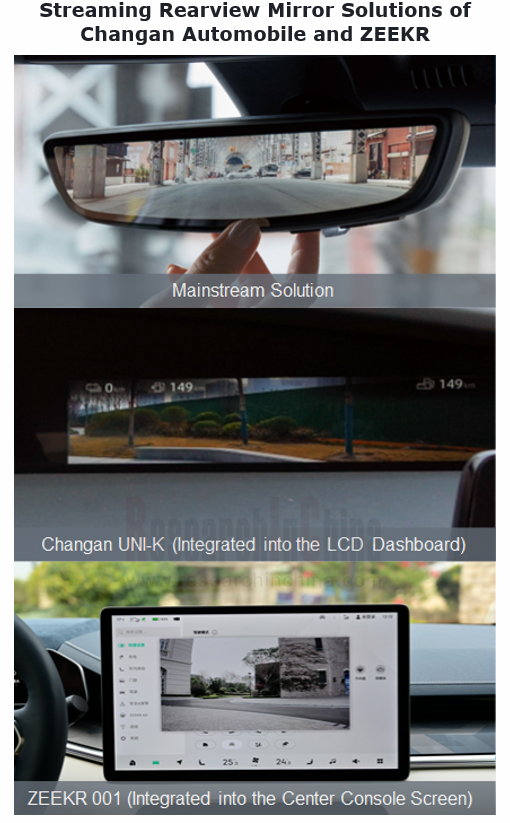

As for solution implementation, mainstream solutions change Category I vision device from a conventional optical mirror to a display, so as to maximally adapt to the driver's habit of seeing the rear view. Some OEMs also carry out a compromise, a solution of separating the Category I vision device from the image, that is, still using the conventional optical mirror to present the image collected by the streaming camera on the cluster screen or the center console screen. Examples include Changan UNI-K and ZEEKR 001.

3. Electronic exterior mirrors: most automakers take a wait-and-see attitude.

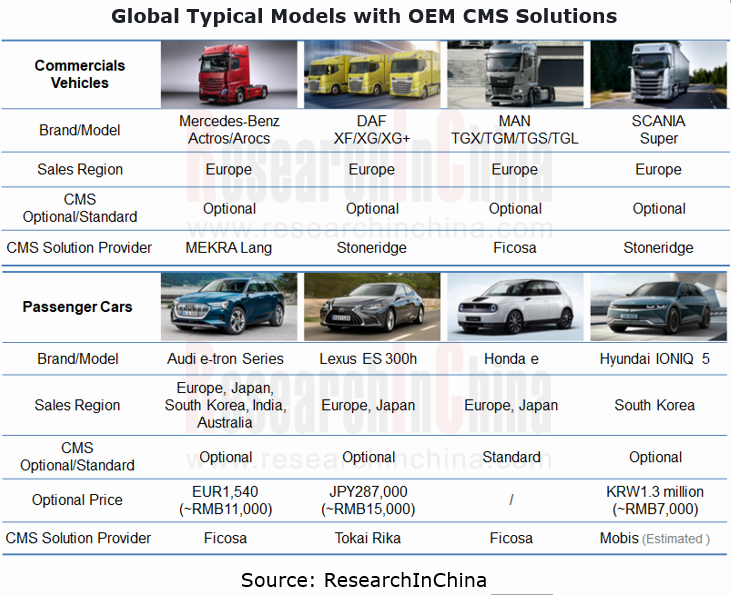

Differing from streaming rearview mirrors, exterior rearview mirrors that play a hugely important role in daily driving safety walk on a bumpy road to electronization. Since the United Nations issued the UN-R6 regulation in June 2016, Europe, Japan, South Korea and India among other regions/countries have started to sell models equipped with electronic exterior mirrors. Today, although policies and regulations have helped to open up the electronic rearview mirror market for 6 years, only a few auto brands and models provide mass-produced OEM electronic exterior mirrors solutions.

Commercial vehicles:

Commercial vehicles:

Take Mercedes-Benz for example. Mercedes-Benz Trucks first introduced MirrorCam, a mass-produced electronic exterior mirror solution that was first applied to the flagship heavy-duty truck Actros. Mercedes-Benz adopts a conservative rearview mirror replacement strategy where only the main rearview mirror (Category II) and wide FOV rearview mirror (Category IV) are electronic, and the front view mirror and close-proximity exterior view mirror are retained. The Mercedes-Benz MirrorCam system is composed of two cameras and two 15.2-inch displays. Above the MirrorCam display are three manually adjustable virtual distance lines (moving left, reversing, and overtaking) to assist the driver in estimating the distance with the rear vehicle. At the same time, the MirrorCam display also integrates the warning information of Mercedes-Benz Sideguard Assist.

Just this past May, Mercedes-Benz Trucks upgraded its electronic rearview mirror MirrorCam to the second generation. Still using the single-camera solution, the second-generation looks more compact than the first-generation for the camera arms on each side have been shortened by 10cm, and displays clearer images.

Passenger cars:

Passenger cars:

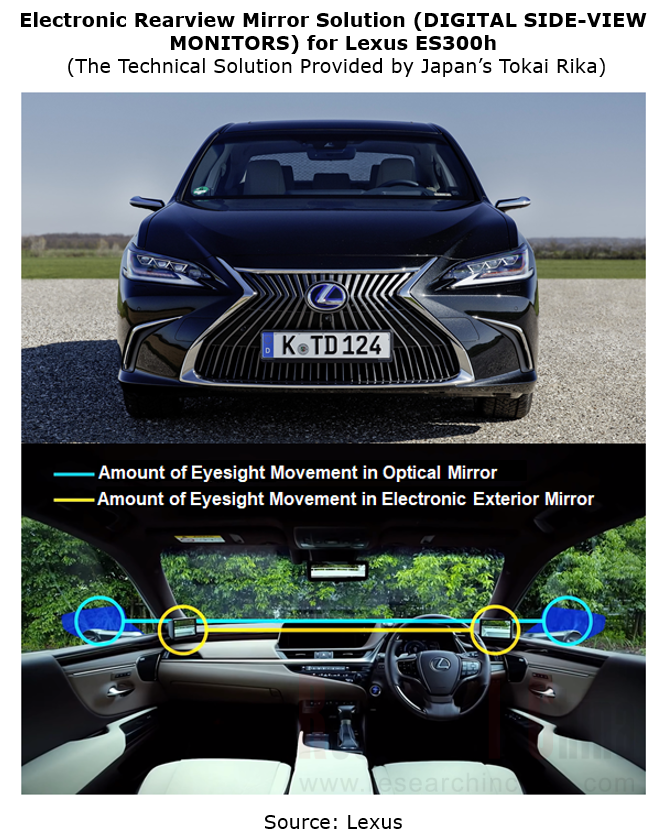

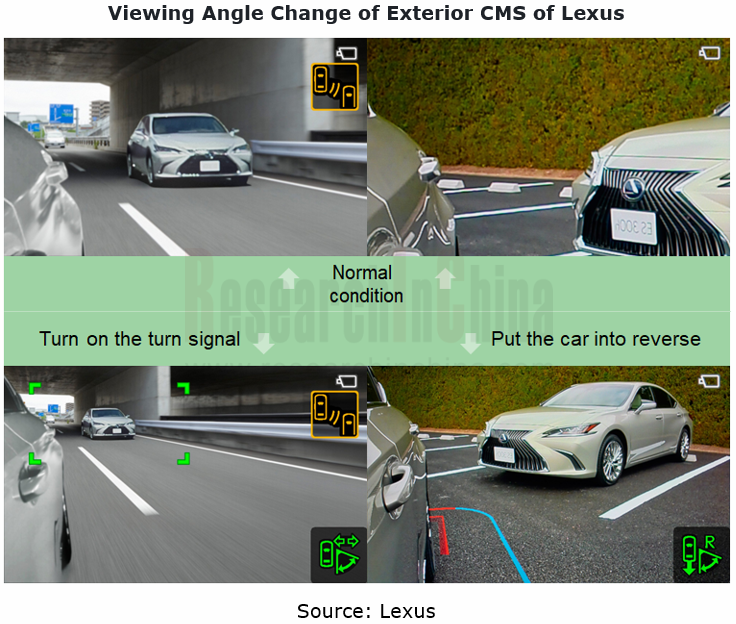

In terms of appearance and structure, the cameras and displays of electronic rearview mirrors for passenger cars are more compact and smaller than those for commercial vehicles. For example, Lexus, a luxury brand, was the first one to mass-produce the passenger car electronic exterior mirror (DIGITAL SIDE-VIEW MONITORS), and applied it to ES300h.

Lexus DIGITAL SIDE-VIEW MONITORS allows real-time switching of viewing angles in different driving conditions. For example, when the turn signal is on or the reverse gear is engaged, the viewing angle will automatically enlarge from an ordinary angle to a wide angle; ADAS warning capabilities, e.g., blind spot detection/blind spot monitoring are also integrated.

From the official configurations automakers released on their websites, it can be seen that electronic exterior mirrors for either commercial vehicles or passenger cars are mostly launched on market as an optional solution for consumers to choose. A set of passenger car electronic exterior mirrors costs RMB70,000-15,000, undoubtedly a prohibitive price for ordinary consumers. The technology research and development also needs lavish spending. At the "2022 OKOKOK Intelligent Cockpit Technology Exchange Online Forum", Fu Hongqiang, the general manager of Shanghai Yuxing Electronic Technology Co., Ltd., admitted that the research and development of electronic exterior mirror cameras alone costs at least RMB50 million.

4. Challenges exist, but the trend is unstoppable.

Electronic rearview mirrors remain far more superior to conventional optical mirrors, but face huge challenges such as high cost, low reliability and the driver's eyesight shift, which need companies to try hard to overcome. Moreover, the focal length of the camera and the depth of field of images make it easy for the driver to misjudge the distance with the rear vehicle.

In the long run, electronic rearview mirrors will act as an integral part of vehicle intelligence, but will not become a megatrend in the short term. Automakers can seize the initiative in capital investment and technology research and development. How to reduce product costs, how to improve stability and users' acceptance of electronic rearview mirror, and how to make them pay for and boldly accept this configuration are the knots companies need to undo.

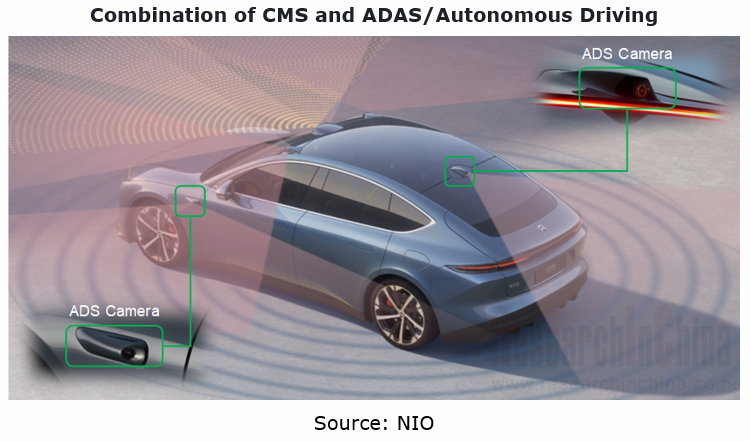

Trend 1: the combination of CMS and ADAS/autonomous driving

The electronic rearview mirror camera is installed near the conventional exterior rearview mirror or at the rear of the vehicle, two positions where the ADS camera is often located. Some functions of CMS overlap the blind spot monitoring/blind spot detection/ADS camera, both of which aim to acquire or detect road traffic conditions at the side rear of the vehicle and provide driving decisions for the driver/vehicle. The two are expected to be integrated considering product cost, function realization and air resistance.

For example, Yuanfeng Technology's electronic rearview mirrors, the exterior/interior CMS for commercial vehicles and passenger cars, detect the rear + side views, enhance the visual perception of the vehicle, and integrate ADAS functions.

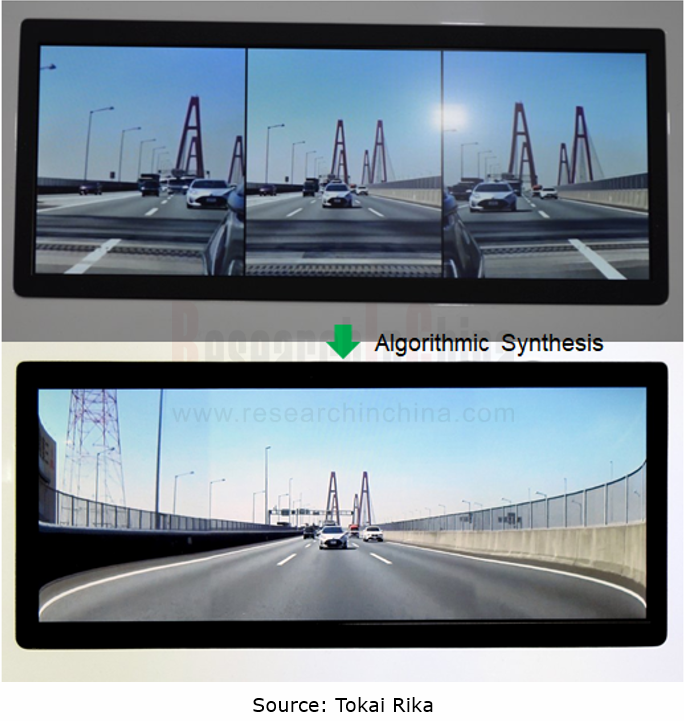

Trend 2: the fusion of CMS interior/exterior rearview mirror images

The way to display the side/rear view of the vehicle currently follows the conventional driving habits. The CMS screens are placed in the left, upper middle, and right in the front of the cockpit, with physical display splits. Technologically on the basis of retaining the traditional optical mirror, the images of the left rear, rear and right rear captured by the electronic exterior view mirror and the electronic interior mirror can be synthesized with algorithms, fused, and displayed on one screen.

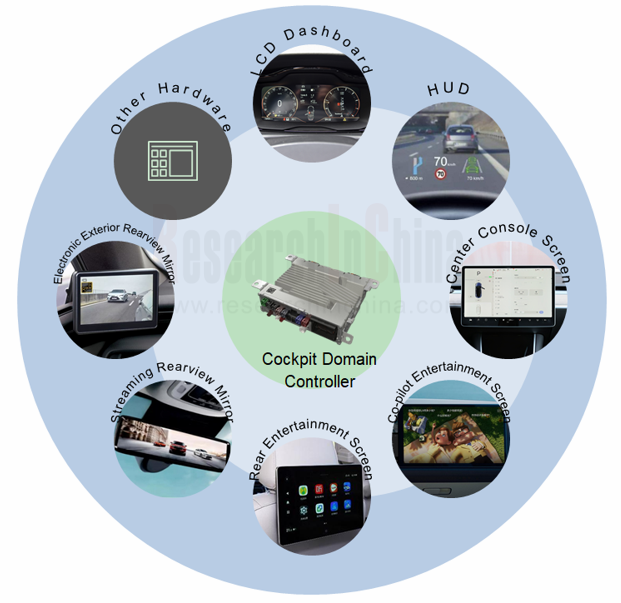

Trend 3: the combination of CMS and cockpit domain controller

As chip computing power improves and E/E architecture evolves, cockpits are integrating display solutions such as LCD cluster, HUD, center console screen, co-pilot entertainment screen and rear entertainment screen into intelligent cockpit domain controllers, in a bid to enable unified management in the same chip. The emergence of electronic rearview mirrors produces more data flows that need processing for the vehicle, and separate ECUs will further drive up the cost of the entire vehicle. Lower cost will be the key driving force to the adoption of cockpit domain controllers. Therefore, streaming interior rearview mirrors and electronic exterior rearview mirrors will also be no exception to such a management way.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...