Chinese ADAS and Autonomous Driving Tier 1 Suppliers Report, 2021-2022

Autonomous Driving Tier 1 Suppliers Research: the installation rate of L2 and above autonomous driving functions in passenger cars hit over 30% in 2022Q1.

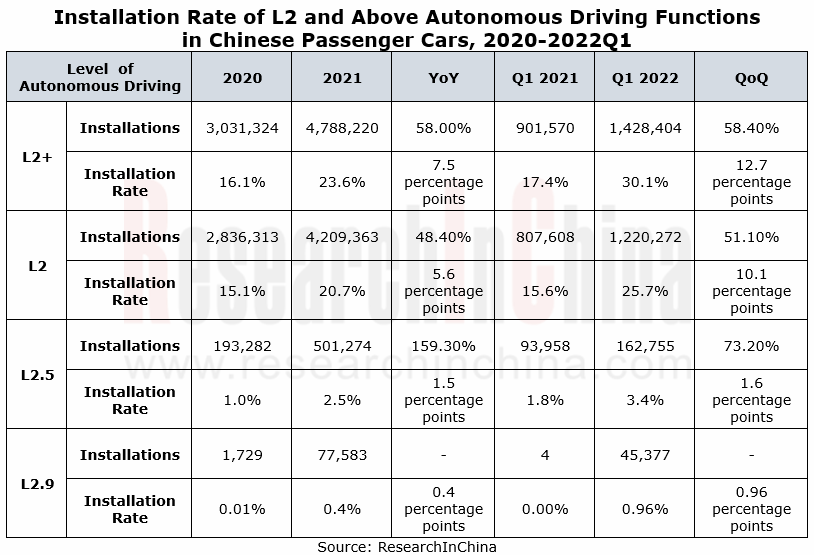

In 2022Q1, the installation rate of L2 and above autonomous driving functions in Chinese passenger cars reached 30.1%, a year-on-year increase of 12.7 percentage points. Specifically, the L2 installation rate went up by 10 percentage points to 25.7%; the L2.5 installation rate rose by 1.6 percentage points to 3.43%; the L2.9 installation rate edged up by 0.95 percentage points to 0.96%.

The boom of ADAS favored a surge in Tier 1 suppliers’ revenue from autonomous driving products.

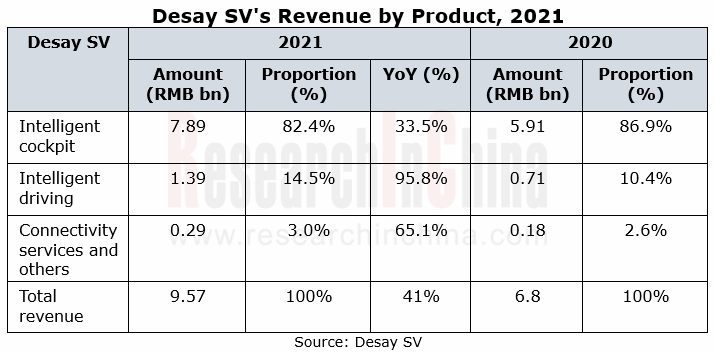

In 2021, Desay SV's revenue from intelligent driving products hit RMB1.39 billion, a year-on-year spike of 95.8%. Desay SV entering the field of autonomous driving in 2016 primarily produces cameras, radars and domain controllers. In the future, it will still focus on perception fusion algorithms and control strategy, and will make further deployments in L3 and L4 autonomous driving solutions. Its domain controller IPU03 was mass-produced for Xpeng P7 in April 2020; the domain controller IPU04 launched in September 2021 is scheduled to be used by Li Auto in 2022; the intelligent computing platform (ICP) "Aurora" became available on market in April 2022.

Neusoft Reach started deploying autonomous driving in 2004. The company works on R&D and commercialization of autonomous driving core technologies, covering autonomous driving systems such as visual perception, embedded high-performance computing, sensor fusion, decision and planning, and vehicle control.

Neusoft Reach provides technologies and solutions for passenger car/commercial vehicle products. Its autonomous driving products include front view smart cameras, driver monitoring systems, domain controllers, and central computing platforms. Its self-developed automotive basic software platform NeuSAR enables effective decoupling of software and hardware. The encapsulation of end-cloud cooperation middleware services helps to connect vehicle-cloud cooperation value data communication links and mobilize cloud platform services to enable the continuous intelligent driving iterations and updates at the vehicle end.

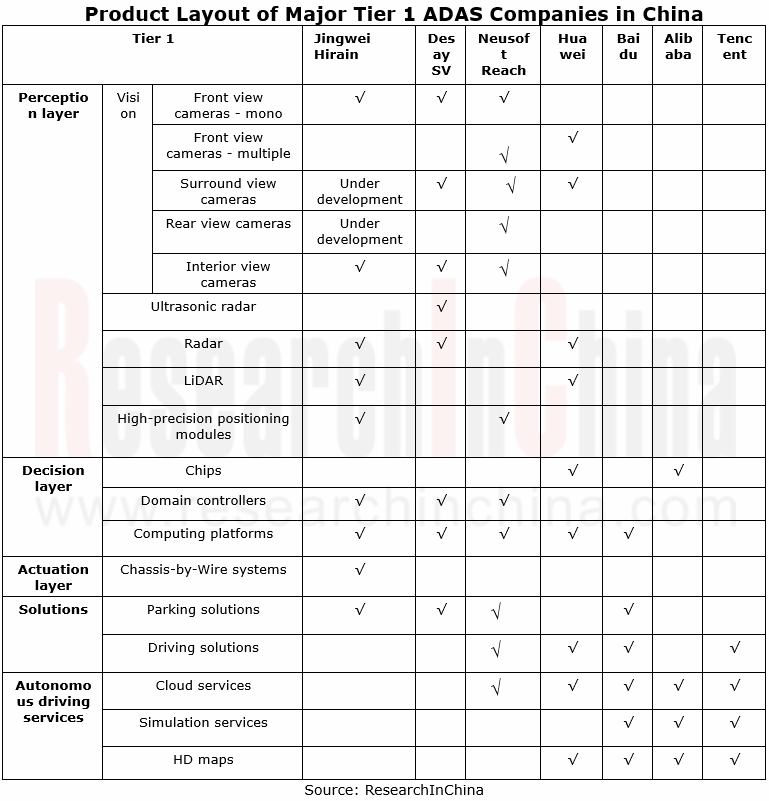

Jingwei Hirain’s revenue from intelligent driving electronics sustained AAGRs of over 100% in recent three years. Jingwei Hirain has begun to deploy autonomous driving in 2015, and established its intelligent driving division in 2017. Its products are led by cameras, radars, domain controllers, computing platforms and chassis-by-wire. The company is working hard to develop system software technology.

Both conventional Tier 1 suppliers and emerging Tier 1 Internet firms are deploying decision layer products

Decision layer products are the bridge between the perception layer and the execution layer. As the core products of high-level autonomous driving, they are responsible for computing, judgment, and decision. At present, Jingwei Hirain, Desay SV, Neusoft Reach, Huawei, and Baidu all have launched their own domain controllers and computing platforms.

Huawei set up the "Internet of Vehicles Division" in 2013. It dabbles in the field of smart cars by starting with the automotive communication module ME909T. Huawei has started developing autonomous driving communication architecture since 2015, and has rolled out the autonomous driving AI chip "Ascend", the Ascend-based intelligent driving computing platform MDC, the intelligent driving cloud service “Octopus”, the intelligent driving operating system AOS, LiDAR, 4D imaging radar, etc.

Huawei keeps enriching its computing platform offerings. In October 2018, Huawei first introduced its intelligent driving computing platforms, MDC600 for L3 autonomous driving and MDC300 for L4. In September 2020, it unveiled MDC210 for L2+ and MDC610 for L3-L4. The vehicle models in which Huawei is negotiating on use of MDC610 include GAC AION LX, Great Wall Salon Mecha Dragon, and GAC Trumpchi. In April 2021 Huawei announced MDC810 an intelligent driving computing platform that supports L4-L5 and will be first seen in BAIC ARCFOX αS Huawei Inside (HI) Edition. The installation of the chip in 2022 Neta TA and GAC Aion is under negotiation. Huawei also plans to launch MDC100 in 2022.

The Institute of Deep Learning Baidu founded in July 2013 has launched an autonomous vehicle project and developed the Apollo autonomous driving open platform. It has introduced autonomous driving service products such as autonomous driving cloud service, simulation service, HD map. In 2021, its products were extended to autonomous driving solutions and decision products. In April 2021, its AVP solution and the corresponding computing platform were first mounted on Weltmeister W6.

Emerging Tier 1 companies are eagerly converting their role in the industry chain.

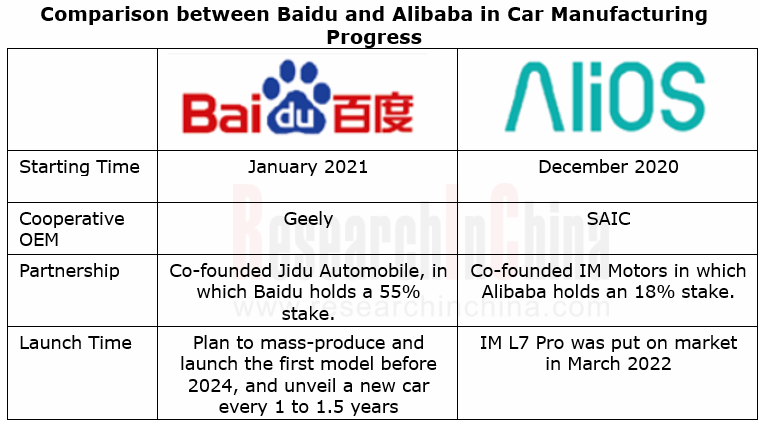

Emerging Tier 1 companies (Baidu, Alibaba, etc.) have made a foray into the automotive field with their superior software technology and data platforms. They are accelerating the development of software-defined vehicles and shortening the development cycle of new automotive products. Meanwhile, they have realized that the Tier 1 market is limited and they need to vigorously change their role in the industry chain into a partner of conventional OEMs to jointly build cars. For example, Alibaba and SAIC together established IM Motors in 2020; Baidu and Geely co-funded Jidu Automobile in 2021.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...