Electric drive and power domain research: efficient integration becomes a megatrend, and integration with other domains makes power domain stronger.

Electric drive systems have gone through several development phases from independent module, integration of motor and transmission, and partial integration of ECU, motor and transmission, to three-in-one and X-in-one integration. In the trend towards "software defined vehicles", E/E architectures tend to be domain controller centralized and centralized ones. Electric drive systems evolve from conventional "three-in-one integration" at the mechanical level to "X-in-one integration" at the power electronics + "software integration" at the power domain level. Continuous deep FOTA updates favor the better performance of vehicle power systems.

OEMs: accelerate mass production of efficient and intelligent electric drive system solutions.

When selecting electric drive solutions, OEMs will consider five factors - power density, integration level, efficiency, safety and intelligence. These factors are of primary importance whether OEMs choose to self-develop or buy from other components manufacturers. In the next stage, new technologies such as X-in-one integrated electric drive, 800V voltage platform, SiC/GaN power devices and power domain will give a big boost to the electric drive system industry.

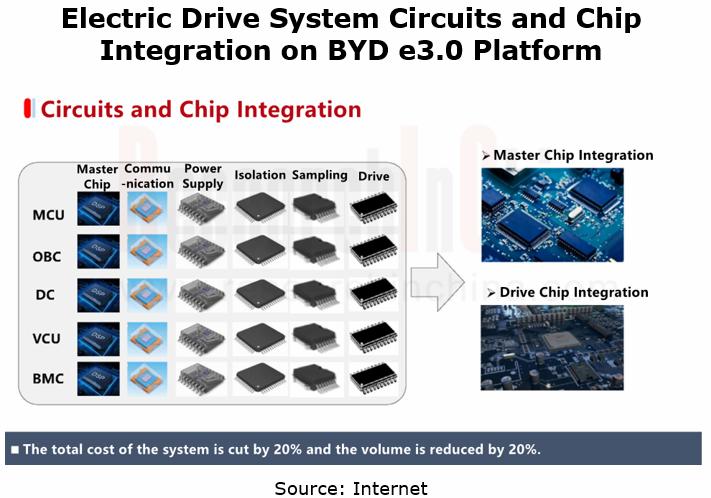

BYD's “eight-in-one” electric powertrain: in 2021, BYD introduced an eight-in-one electric powertrain based on e3.0 platform. The high integration of motor, transmission, motor controller, PDU, DC-DC, OBC, VCU and BMS further decreases the space usage and weight of the system. Compared with the previous generation, the solution features 20% higher power density, 15% lighter weight, 20% smaller size, and overall efficiency up to 89%.

As an automaker, BYD builds 400V medium-voltage and 800V high-voltage vehicles on the same platform. The independent boost device and reusable drive system power devices constitute a boost charging topology that enables modular boost architecture. The high-voltage platform adopts 1200V/840A SiC power modules that enable 60% smaller size, 70% lower switching loss, and electric control system efficiency up to 99.7%, relative to IGBT controllers.

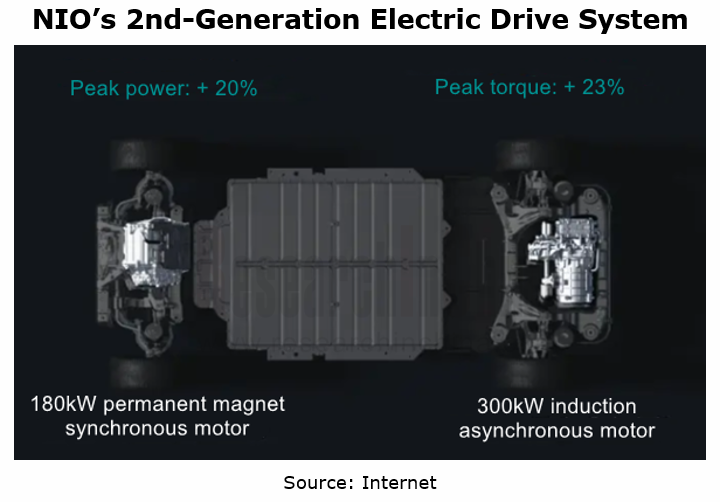

NIO's second-generation electric drive system: NIO has established the route of front permanent magnet synchronous motor and rear induction asynchronous motor. The maximum power of the permanent magnet synchronous motor and the induction asynchronous motor reaches 180KW and 300KW, respectively. NIO chooses ON Semiconductor's latest VE-Trac? Direct SiC power modules for the front permanent magnet synchronous motor of its second-generation electric drive system.

NIO's electric drive systems are provided by its subsidiary Shanghai XPT Technology Limited. XPT has made a one-line, multi-site manufacturing layout in Nanjing, Shanghai and Hefei.

Components manufacturers: deploy new electric drive system products and expedite technological iteration.

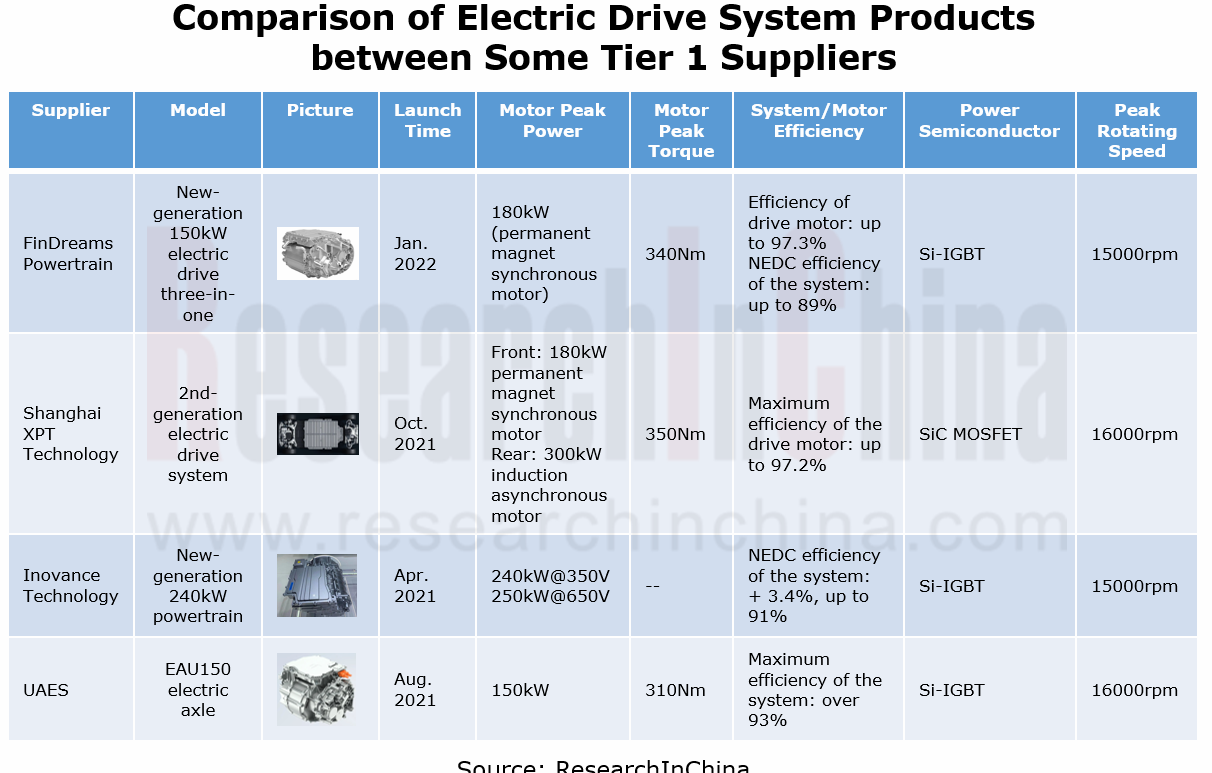

As "three-in-one" integrated electric drive systems mature, the next step will be to achieve "X-in-one integration" at the power electronics level, that is, deep integration of on-board charger (OBC), high-voltage DC/DC converter, inverter and power distribution unit (PDU). Tier 1 suppliers compete to launch new electric drive system products.

Shanghai Edrive’s GaN “three-in-one” electric powertrain: in November 2021, Shanghai Edrive displayed its GaN three-in-one electric powertrain at Nexperia's booth. The sought-after product boasts much higher efficiency than conventional silicon-based IGBT motor controllers in the same working conditions. The maximum efficiency of GaN-based motor controller reaches 99.34%, and the area with efficiency greater than 90% accounts for 93.58%; that of silicon-based IGBT motor controllers is 98.3%, and the area with efficiency greater than 90% makes up is 83.94%.

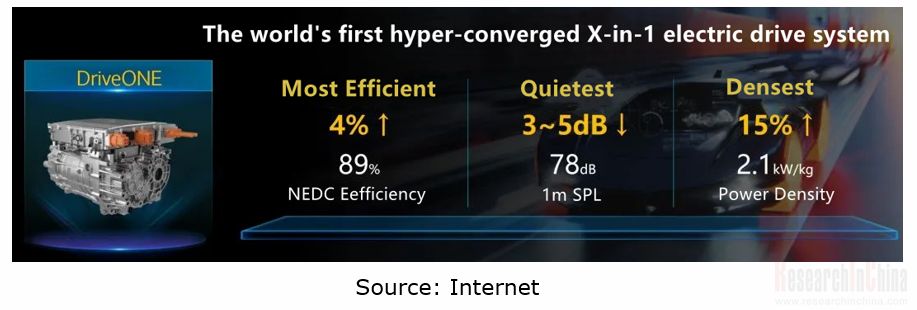

Huawei's “X-in-one” electric drive system DriveONE: it integrates seven major components, i.e., BCU (battery control unit), PDU (power drive unit), DCDC (drive power), MCU (microcontroller unit), OBC (on-board charger), motor, and reducer, enabling the deep integration of mechanical and power components. With its superiority in software, Huawei also brings intelligence into its electric drive systems in a bid for integration of terminal-cloud cooperation and control. This X-in-one electric drive system achieves the goal of reducing volume by 20% and the weight by 15%, lowers development cost and realizes matching of vehicle front and rear wheel drives.

Vitesco Technologies’ fourth-generation electric drive system EMR4: in July 2021, Vitesco Technologies, Continental's former Powertrain Division, unveiled EMR4, its fourth-generation product that offers high power density, compact dimensions, and low weight and covers a power range of 80 kW to 230 kW. Compared with EMR3, EMR4 enables 5% higher efficiency, 30% lower cost and 25% lighter weight, and can carry two high-voltage platforms, 400V and 800V.

Development Trends of Electric Drive System Technology

?“Three-in-one” electric drives keep evolving towards "X-in-one" integrated electric drives.

The conventional "three-in-one" electric drive technology will evolve towards "3+3+X platform", that is, a three-in-one electric drive system (motor, transmission and motor controller) and a three-in-one high-voltage charging and distribution system (DC/DC, OBC and PDU) are combined as a "six-in-one" product, or further integrate with BCU (battery control unit) and VCU (vehicle control unit) among others to constitute a "seven-in-one" or "eight-in-one" product, achieving deep integration of mechanical and power components.

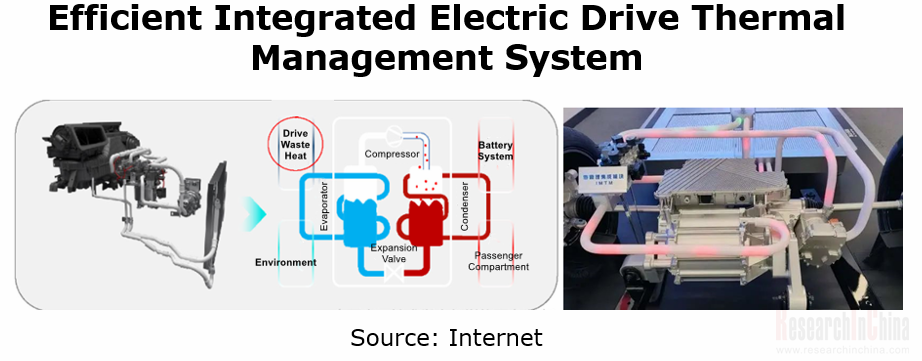

Meanwhile, the electric drive and the vehicle thermal management system are further connected and integrated to form an efficient integrated electric thermal management system. The integration with cooling system composed of motor, electronic control, reducer, DC and power supply, and unified thermal management enable heat source integration, reduce heat exchange and heat loss, and improve heat absorption efficiency of heat pump, so as to extend the cruising range of electric vehicles.

Yet X-in-one systems still face technical challenges (e.g., thermal management, electromagnetic interference and failure rate), and the cost is high. At present, only a few suppliers (Huawei, BYD, etc.) have the systems mass-produced and fit on vehicles. X-in-one systems will still be a R&D priority of OEMs and Tier 1 suppliers in the future.

The penetration rate of flat wire motors surges.

Flat wire motors provide benefits of high power density, low cost, and good temperature performance. Foreign automakers have applied flat wire motor technology early. In 2021, flat wire motors shone in China. Quite a few blockbuster models including Tesla Model 3/Model Y, Volkswagen MEB-based vehicles, NIO ET7, IM L7, ZEEKR 001, and Great Wall ORA Black Cat carried flat wire motors. The overall penetration rate of flat wire motors has approached 20%.

Flat wire motors require high levels of process, manufacturing technology and equipment automation. Chinese suppliers such as Zhejiang Founder Motor, FinDreams Powertrain, HYCET E-Drive and Huayu E-drive have achieved mass production of flat wire motors.

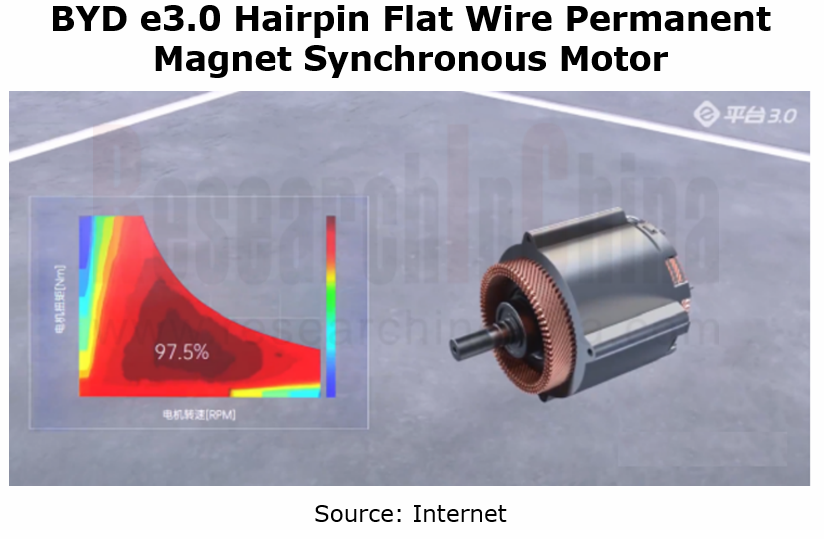

In BYD’s case, compared with previous-generation that uses round wire motors, BYD e3.0 adopts hairpin flat wire permanent magnet synchronous motors with higher copper space factor, lower copper loss, and a power coverage range of 70-270kW. The ultra-thin silicon steel sheet used to inhibit iron loss contributes to a 40% increase in the motor power and the maximum efficiency up to 97.5%. In terms of deceleration mechanism, low-friction bearings and oil guide structure are used to improve lubrication effect and reduce oil churning loss. The fine gear design helps to cut gear sliding loss. Moreover, low-viscosity oil is introduced for the first time, making the transmission efficiency up to 97.6%.

The mass production of 800V SiC high voltage platforms is accelerated.

Chinese automakers race to follow up on 800V high-voltage platform architecture, and achieve mass production and delivery in 2022. Xpeng Motors adopts 800V SiC high-voltage products from Inovance Technology. Xpeng G9 packing XPower 3.0 power system provides two offerings: 2WD single motor (maximum power: 230kW (312HP)) and 4WD dual motor (maximum power: 175kW (238HP) / 230kW (312HP)). The efficiency of the electric drive system can reach as high as over 95%.

Multi-stage gear reducer technology

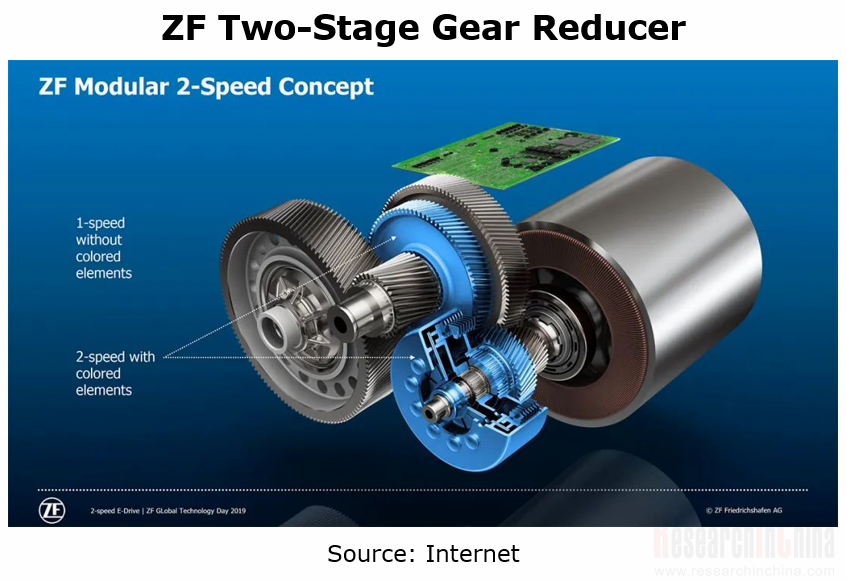

There is a clear trend of high-speed motors, making reducers head in the direction of two-stage gear deceleration. At present, the motors of Tesla Model 3 deliver rotating speed of up to 17900rpm; most automakers in China have reached 16000rpm and plan 18000-20000rpm. High speed motors however require the support of multi-stage gear reducer technology.

Two-stage gear reducers used in hybrid systems at first are now seen in all-electric systems. Compared with the single-stage gear reducers, two-stage gear reducers allow drive motors to run in a more efficient area, thereby improving the efficiency of the drive system. On the other hand, the use of two-stage gear reducers favors higher gear ratio, better vehicle dynamic properties and shorter 0-100km/h acceleration time.

In addition, the use of two gears makes drive motors more miniaturized and run at lower speeds, thus reducing the cost of motors and ECUs. ZF, GKN, Magna and like have rolled out two-stage gear reducer products.

Power domain controllers further evolve towards domain controller centralized and central computing + zonal architectures.

Currently, the three-in-one integrated electric drive has become a mainstream solution in the industry. As "software-defined vehicles" evolve, E/E architectures tend to be domain controller centralized and centralized ones. A number of OEMs and components manufacturers have implemented three-domain architecture, involving: vehicle control domain, intelligent driving domain and intelligent cockpit domain. The vehicle domain controller (VDC) is integrated into the three functional domains: chassis domain, power domain, and body domain.

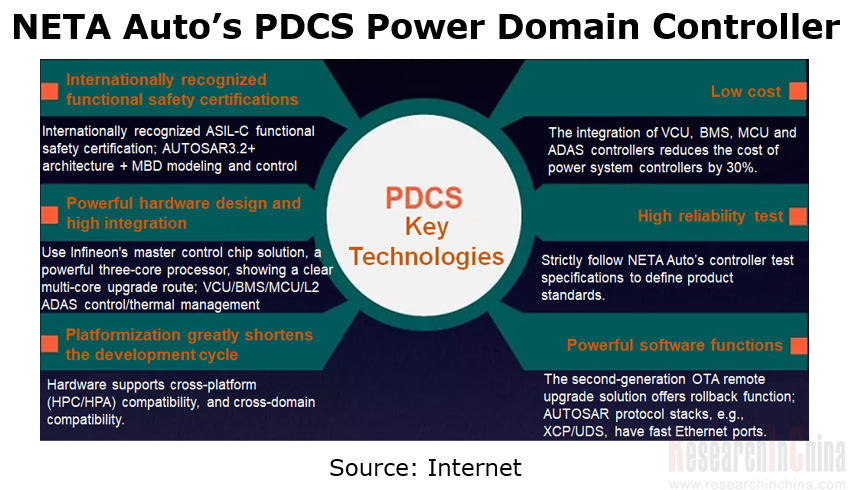

Independent power domain controller: the power domain combines vehicle controller, motor controller, BMS, on-board charger controller, etc. for example, NETA Auto’s power domain control system (PDCS) integrates software and hardware functions and algorithms of VCU (vehicle control unit) and BMS (battery management system), and uses Infineon multi-core CPU/GPU in hardware architecture. The system provides larger code storage space, greater and securer computing power, and an abundance of input and output communication ports, and supports various forms of composite applications and OTA update capabilities. In the software architecture, the AUTOSAR architecture + MBD modeling application makes software much more reliable and portable.

Cross-domain fusion central domain centralized architecture: in Li Auto’s case, LEEA2.0, the domain controller architecture used in Li L9, features three vehicle control domains, of which the central control domain (including power, body and some chassis functions) enables the integration of the body control module (BCM) and the central gateway.

Li L9’s central domain controller uses NXP's latest S32G automotive-grade chip. All of the hardware, systems and software for the controller are self-developed by Li Auto. The functions such as range-extended electric system, air conditioning system, chassis system and seat control system are also independently developed by the automaker, which better ensures the scope and timeliness of OTA updates on Li L9 in the future.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...