Overseas ADAS Tier1 Suppliers Research: The gap between suppliers has widened in terms of revenue growth, and many of them plan to launch L4 products by 2025

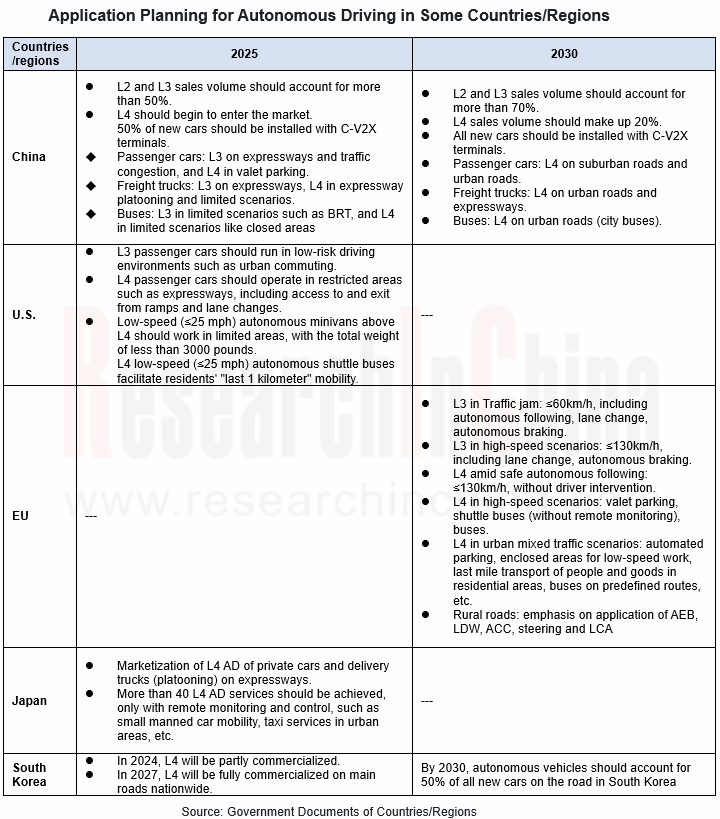

Countries allow L3/L4 vehicles on the road to a limited extent

Germany enacted Autonomous Driving Act in July 2021. Through its new legislation, Germany has become the first country in the world to allow L4 autonomous vehicles onto public roads without requiring a human backup safety driver behind the wheel. Application scenarios include: shuttle buses, short-distance public transport in urban areas, logistics between distribution centers, demand-oriented off-peak passenger transport in rural areas, first/last mile passenger or cargo transport, automated parking of dual-mode vehicles.

Japan's government planned to amend traffic laws to allow L4 autonomous vehicles to drive on some roads and ask lawmakers to approve the change as early as March 2022. Under the revised law, a license system will be introduced for operators of transport services using autonomous vehicles with L4 autonomy. Operators will be required to assign a chief monitor who can supervise the operation by riding a car or through remote control and can command multiple vehicles simultaneously. Japan aims to achieve L4 by 2025, which would allow private cars and delivery trucks (platooning) to operate on expressways, as market-oriented application.

In March 2022, the U.S. Department of Transportation’s National Highway Traffic Safety Administration (NHTSA) issued the "Occupant Protection Regulations for Automated Vehicles", stating that fully autonomous cars no longer need to be equipped with traditional manual control devices such as steering wheels, brakes or accelerator pedals. The United States plans to realize the market-oriented application of L3 passenger cars in low-risk driving environments such as urban commuting, and L4 passenger cars on expressways (like going on/off ramps, autonomous lane change) by 2025.

In July 2022, Shenzhen, China issued "Regulations on Administration of Intelligent Connected Vehicles in Shenzhen Special Economic Zone", allowing L3 autonomous vehicles to be tested and demonstrated on open roads in administrative areas with relatively sound CVIS infrastructure.

The ADAS business of major Tier 1 suppliers maintains rapid growth and they vigorously deploy L3/L4 products

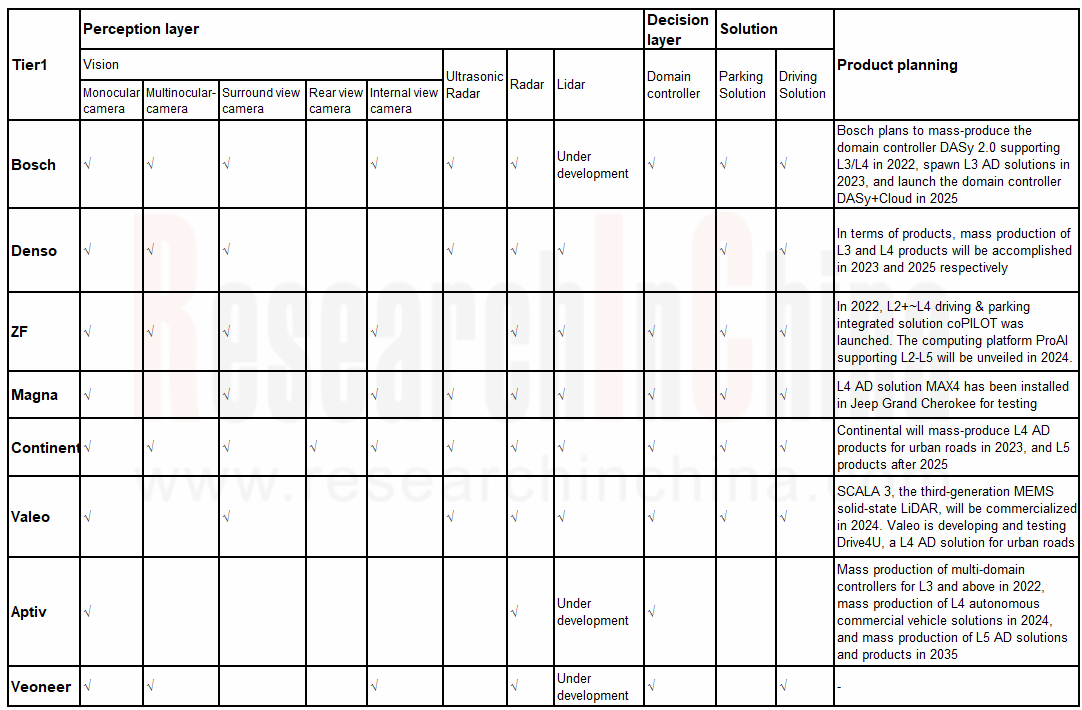

In 2021, a number of Tier 1 suppliers saw the sales related to autonomous driving swell by more than 10% year-on-year. For example, ZF’s Electronics & ADAS Division earned sales of EUR1.84 billion, a year-on-year increase of 17.9%; the sales of Magna's Power & Vision Division jumped 17.0% year-on-year to USD11.34 billion; Veoneer secured sales of USD869 million from active safety, a year-on-year spike of 39.3%.

Source: financial reports of above companies

Bosch plans to mass-produce the domain controller DASy 2.0 supporting L3/L4 in 2022, spawn L3 driving solutions in 2023, and launch the domain controller DASy+Cloud in 2025.

Denso aims to achieve sales of JPY500 billion in ADAS field in 2025. In terms of products, mass production of L3 and L4 products will be accomplished in 2023 and 2025 respectively.

In 2021, Continental recorded EUR 7.559 billion in the revenue of its autonomous driving and safety business, accounting for 23.7% and edging up 0.8% year-on-year which was lower than that of its competitors. Continental will mass-produce L4 autonomous driving products for urban roads in 2023, and L5 products after 2025.

In 2021, Valeo Comfort & Driving Assistance Systems Business Group garnered EUR3.417 billion in revenue with a year-on-year spike of 6%, of which autonomous driving contributed EUR1.9 billion or 56%. The ADAS sales will reach EUR4 billion in 2025, with CAGR of 20.5%. Valeo says SCALA 3, the third-generation MEMS solid-state LiDAR released by Valeo in November 2021, which will be commercialized in 2024, offers 12 times better resolution, three times longer range and a viewing angle that is 2.5 times wider than the second-generation. SCALA 3 supports L3 autonomous driving below 130km/h.

Source: ResearchInChina

1 Global Traffic Regulations and Development Planning for Autonomous Driving

1.1 Global Traffic Regulations on Autonomous Driving

1.1.1 UNECE Automated Lane Keeping System (ALKS) Regulation

1.1.2 Autonomous Driving Development Planning in Some Countries/Regions Worldwide

1.2 China’s Traffic Regulations on Autonomous Driving

1.2.1 China's Management Specifications for Road Tests and Demonstrative Application of Intelligent Connected Vehicles (Trial)

1.2.2 Access Conditions of Open Road Tests in China

1.2.3 China's Autonomous Driving Development Planning

1.2.4 China's Intelligent Connected Vehicle Technology Roadmap: Phased Development Goals and Milestones of Passenger Cars

1.3 EU’s Traffic Regulations on Autonomous Driving

1.3.1 Autonomous Driving Act in Germany

1.3.2 Autonomous Driving Development Planning of EU & Europe

1.3.3 EU’s Autonomous Driving Roadmap and Outlook in 2040

1.4 Traffic Regulations on Autonomous Driving and Planning of the U.S. by State

1.5 Japan’s Traffic Regulations on Autonomous Driving

1.5.1 Japan's Action Plan for Realizing and Popularizing Autonomous Driving 4.0 - Classification of Driving Environments for Autonomous Vehicles

1.5.2 Japan's Autonomous Driving Development Planning

1.5.3 Japan's "RoAD to the L4 Project" - Four Themes

1.6 South Korea’s Traffic Regulations on Autonomous Driving and Planning

1.7 Singapore’s Traffic Regulations on Autonomous Driving

2 Summary and Comparison of Overseas Major Autonomous Driving Tier 1 Suppliers

2.1 Overview of Overseas Major Autonomous Driving Tier 1 Suppliers

2.2 Sales/Revenue of Overseas Major Autonomous Driving Tier 1 Suppliers, 2021

2.3 Products and Customers of Overseas Major Autonomous Driving Tier 1 Suppliers

2.4 Lidar and Customers of Overseas Major Autonomous Driving Tier 1 Suppliers

2.5 Domain Controllers and Customers of Overseas Major Autonomous Driving Tier 1 Suppliers

2.6 Solutions and Customers of Overseas Major Autonomous Driving Tier 1 Suppliers

3 Overseas Major Autonomous Driving Tier 1 Suppliers

3.1 Continental

3.1.1 Profile

3.1.2 Revenue

3.1.3 Management Structure

3.1.4 Autonomous Driving Product Layout

3.1.5 Autonomous Driving Product Lineup

3.1.6 Autonomous Driving Product - Camera

3.1.7 Autonomous Driving Product - Driver Monitoring

3.1.8 Autonomous Driving Product - Cockpit Monitoring

3.1.9 Autonomous Driving Product - Radar

3.1.10 Autonomous Driving Product - LiDAR

3.1.11 Autonomous Driving Product - Domain Controller

3.1.12 Autonomous Driving Product - Ultrasonic Radar

3.1.13 Autonomous Driving Product - Automated Parking Solution

3.1.14 Autonomous Driving Product - Autonomous Driving Solution

3.1.15 Autonomous Driving Product - Autonomous Driving Solution for Passenger Transport

3.1.16 Autonomous Driving Product - 5G& V2X

3.1.17 Autonomous Driving Planning

3.1.18 Autonomous Driving Partners

3.1.19 Market Layout of Main Autonomous Driving Products

3.1.20 Summary

3.2 Bosch

3.2.1 Profile

3.2.2 Sales

3.2.3 Distribution of Human Resources

3.2.4 Presence in China

3.2.5 Intelligent Driving and Control Division

3.2.6 Main Business

3.2.7 Autonomous Driving Product Layout

3.2.8 Autonomous Driving Product Lineup

3.2.9 Autonomous Driving Product - Third-generation Front View Camera

3.2.10 Autonomous Driving Product - Surround View Camera

3.2.11 Autonomous Driving Product - In-vehicle Monitoring System

3.2.12 Autonomous Driving Product - Radar

3.2.13 Autonomous Driving Product - LiDAR Layout

3.2.14 Autonomous Driving Product - Domain Controller

3.2.15 Autonomous Driving Product - Sixth-generation Ultrasonic Radar

3.2.16 Autonomous Driving Product - Automated Parking Solution

3.2.17 Autonomous Driving Product - Autonomous Driving Solution

3.2.18 Autonomous Driving Product - Middleware

3.2.19 Autonomous Driving Product - Redundant Positioning Solution

3.2.20 Autonomous Driving Partners

3.3 Magna

3.3.1 Profile

3.3.2 ADAS Lineup

3.3.3 Autonomous Driving Product - Camera

3.3.4 Autonomous Driving Product - Driver Monitoring & Lidar

3.3.5 Autonomous Driving Product - Radar

3.3.6 Autonomous Driving Product - Domain Controller

3.3.7 Autonomous Driving Product - Ultrasonic Radar

3.3.8 Autonomous Driving Product - Automated Parking Solution

3.3.9 Autonomous Driving Product - Autonomous Driving Solution

3.3.10 Autonomous Driving & Intelligent Connectivity Planning

3.3.11 Summary

3.4 ZF

3.4.1 Profile

3.4.2 Operation

3.4.3 Corporate Structure

3.4.4 Autonomous Driving Product Layout

3.4.5 Autonomous Driving Product Lineup

3.4.6 Autonomous Driving Product - Camera

3.4.7 Autonomous Driving Product - Driver Monitoring System

3.4.8 Autonomous Driving Product - Radar

3.4.9 Autonomous Driving Product - LiDAR & Sound Sensor

3.4.10 Autonomous Driving Product - Domain Controller

3.4.11 Autonomous Driving Product - Domain Controller and Middleware

3.4.12 Autonomous Driving Product - Autonomous Driving & Parking Solution

3.4.13 Autonomous Driving Product - Automated Valet Parking System

3.4.14 Development Trends & Layout

3.4.15 Summary

3.5 Valeo

3.5.1 Profile

3.5.2 Sales

3.5.3 Automotive Product Layout

3.5.4 R&D Bases in China

3.5.5 Autonomous Driving Product Layout

3.5.6 Autonomous Driving Product Lineup

3.5.7 Autonomous Driving Product - Front View Monocular Camera

3.5.8 Autonomous Driving Product - Surround View Camera

3.5.9 Autonomous Driving Product - Radar

3.5.10 Autonomous Driving Product - LiDAR

3.5.11 Autonomous Driving Product - Domain Controller

3.5.12 Autonomous Driving Product - Ultrasonic Radar

3.5.13 Autonomous Driving Product - Parking Solution

3.5.14 Autonomous Driving Product - Autonomous Driving Solution for Expressways

3.5.15 Autonomous Driving Product - eDeliver4U

3.5.16 Autonomous Driving Products - Move Predict.ai

3.5.17 Autonomous Driving Product - 360° Autonomous Emergency Braking System

3.5.18 Autonomous Driving Partners

3.5.19 Dynamics in Autonomous Driving

3.6 Denso

3.6.1 Profile

3.6.2 Operation

3.6.3 Major Customers

3.6.4 Smart Mobile Electronics Division

3.6.5 Autonomous Driving Capability and R&D Layout

3.6.6 Autonomous Driving Product Lineup

3.6.7 Autonomous Driving Product - Development History of Sensor

3.6.8 Autonomous Driving Product - Camera

3.6.9 Autonomous Driving Product - Radar

3.6.10 Autonomous Driving Product - LiDAR

3.6.11 Autonomous Driving Product - Ultrasonic Radar

3.6.12 Autonomous Driving Product - Automated Parking Solution

3.6.13 Autonomous Driving Product - Autonomous Driving Solution

3.6.14 Autonomous Driving Product - 5G V2X

3.6.15 Tests and Dynamics of Autonomous Driving

3.6.16 Development Roadmap of Autonomous Driving

3.7 Hyundai Mobis

3.7.1 Profile

3.7.2 Operation

3.7.3 Autonomous Driving Product Lineup

3.7.4 Autonomous Driving Product - Camera

3.7.5 Autonomous Driving Product - Driver Monitoring

3.7.6 Autonomous Driving Product - Radar

3.7.7 Autonomous Driving Product - LiDAR & Ultrasonic Radar

3.7.8 Autonomous Driving Product - Automated Valet Parking (AVP)

3.7.9 Autonomous Driving Product - Mobis Parking System (MPS) and Smart Cruise Control (SCC)

3.7.10 Autonomous Driving Product - Autonomous Concept Vehicle

3.7.11 Autonomous Driving Development Planning

3.7.12 Summary

3.8 Veoneer

3.8.1 Profile

3.8.2 Revenue

3.8.3 key Managers

3.8.4 Corporate Development Roadmap

3.8.5 Autonomous Driving Product Layout

3.8.6 Autonomous Driving Product Lineup

3.8.7 Autonomous Driving Product - Camera

3.8.8 Autonomous Driving Product - Driver Monitoring

3.8.9 Autonomous Driving Product - Radar

3.8.10 Autonomous Driving Product - LiDAR

3.8.11 Autonomous Driving Product - Domain Controller

3.8.12 Autonomous Driving Product - Positioning System

3.8.13 Autonomous Driving Product - V2X

3.8.14 Autonomous Driving Product - Autonomous Driving Solution

3.8.15 Development History and Planning of Autonomous Driving Solution

3.8.16 Key Partners

3.8.17 Release of ADAS Technology in 2021

3.8.18 ADAS Availability in 2021

3.8.19 Distribution of ADAS Customers in 2021

3.8.20 Summary

3.9 Aptiv

3.9.1 Profile

3.9.2 Sales by Region

3.9.3 Global Presence

3.9.4 Autonomous Driving Product Layout

3.9.5 Autonomous Driving Product Lineup

3.9.6 Autonomous Driving Product - Front View Camera

3.9.7 Autonomous Driving Product - Radar

3.9.8 Autonomous Driving Product - Radar and Monocular Camera Integrated System

3.9.9 Autonomous Driving Product - LiDAR Investment and Layout

3.9.10 Autonomous Driving Product - Domain Controller

3.9.11 Autonomous Driving Product - Satellite-based Sensing and Computing System

3.9.12 Autonomous Driving Product - ADAS Platform

3.9.13 Autonomous Driving Partners

3.9.14 Dynamics in the Field of Autonomous Driving

3.10 Visteon

3.10 Profile

3.10.1 ADAS Lineup

3.10.2 Autonomous Driving Product - Driver Monitoring

3.10.3 Autonomous Driving Product - Domain Controller

3.10.4 Summary

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...