Multi-domain computing and zone controller research: five design ideas advance side-by-side.

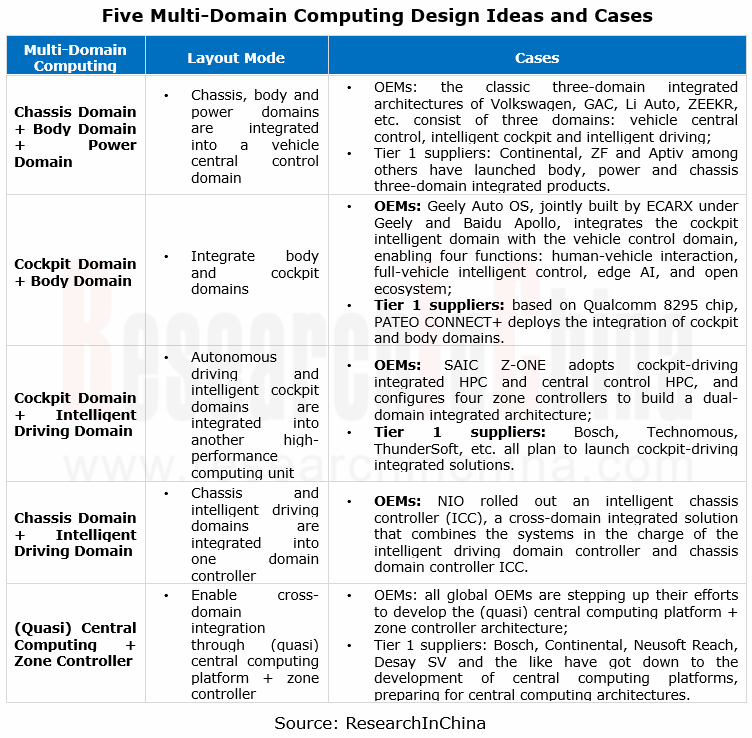

In the trend for higher levels of autonomous driving, intelligent vehicles pose more stringent requirements in the aspects such as computing power, communication bandwidth, software, and security. This trend facilitates the evolution of automotive E/E architectures from domain centralized to multi-domain integrated, and then to the (quasi) central computing architecture. At present, there are primarily following five types of automotive multi-domain computing design ideas:

The driving and parking integration & the cockpit and driving integration are the important directions multi-domain computing heads in.

In terms of driving and parking integration, the low-speed parking function used to be integrated into cockpit domain to constitute a so-called cockpit-parking integrated solution. With the evolution to high computing power platforms, 2022 will be beyond doubt the first year of the development of L2+ driving and parking integration, and more vehicles will support multi-scenario autonomous driving, for example, turn signals for automatic lane change, ramp-to-ramp autonomous driving, home-AVP, and fully automated parking.

Cockpit-driving integration is the direction many OEMs and Tier 1 suppliers work towards. It is expected that mass production and installation of cockpit-driving integrated solutions will be achieved during 2024-2025. From chip vendors, it can be seen that Qualcomm 8795 chip that allows multi-domain integrated computing of cockpit and autonomous driving will be produced in quantities in 2024 at the earliest; Chinese suppliers like ThunderSoft and Haomo.AI have set about research and development; in addition to autonomous driving, NVIDIA Orin X will also fully integrate development of cockpit applications to enable fusion of autonomous driving and in-cabin algorithms through NVIDIA DRIVE IX software stack.

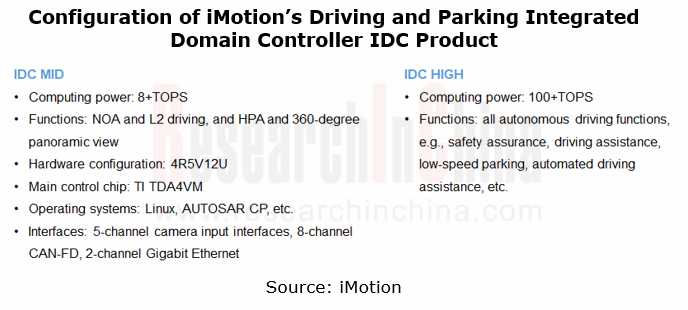

iMotion’s IDC high/low speed driving and parking integrated domain controller solution

iMotion concentrates on developing autonomous driving domain controllers. Following the acquisition of orders for more than 100,000 sets from ZEEKR 001 in October 2021, the company’s high computing power autonomous driving controllers have been designated by multiple first-tier OEMs like Great Wall Motor, Chery, Geely and SMART for a range of their vehicle models.

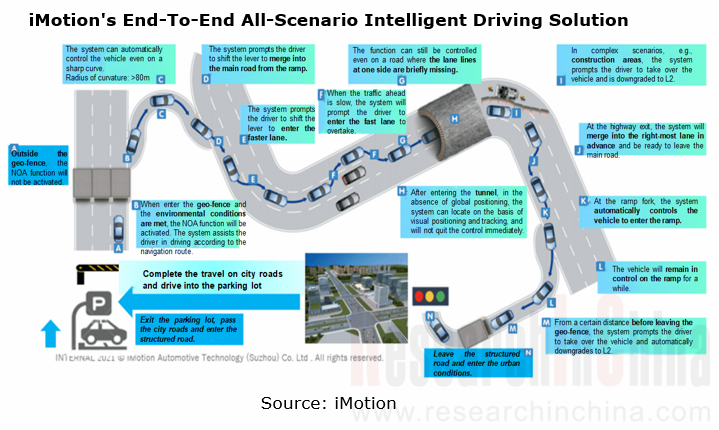

iMotion also launched a domain controller IDC product that integrates driving and parking capabilities like urban NOA and AVP. The IDC product has IDC MID (standard) and IDC HIGH (upgrade) versions, of which the standard version is to be delivered and mounted on new vehicle models of quite a few leading automakers in 2022.

iMotion's end-to-end all-scenario intelligent driving solution takes the driving and parking integrated domain controller as the carrier. Based on L2++ intelligent driving and intelligent parking, this solution collects and trains unknown scene data and updates optimized algorithms by using hardware embedded points and remote software OTA update technology, and optimizing and verifying the big data closed-loop. It constantly improves intelligent driving algorithms in a bid to adapt to more complex scenarios, find application in ever more scenarios and eventually to be available to all scenarios.

In addition to driving and parking integration, the integration of intelligent driving and intelligent cockpit domains is also a megatrend. iMotion is working with its partners to explore multi-domain integrated solutions.

Neusoft Reach's driving and parking integrated domain controllers keep upgrading and iterating.

Neusoft Reach’s fourth-generation autonomous driving domain controller X-Box is a new standard L2+ domain controller product developed according to SDV development model. Based on Horizon Journey 5 Series AI chips, the product offers L2+ driving and parking functions, and supports access of 8M cameras, 4D point cloud radars and LiDAR, with scenarios covering highways, urban expressways, some urban roads and multiple types of parking lots.

X-Box adopts SOA software architecture design scheme, that is, software and algorithms are developed using the modular and service-oriented development model. The product enables cooperative device-cloud autonomous driving under data closed-loop mechanism, and supports new-generation automotive E/E architectures. It enables intra-domain and cross-domain service subscription and discovery, flexible software deployment, and rapid iteration of application layer, and realizes such functions as fully open system architecture, open multi-dimensional full-stack software capability and joint development, allowing partners to quickly develop applications and reuse software. It also provides abundant software development tools for developer partners.

Meanwhile, in terms of safety and security X-Box is developed according to ISO 26262 functional safety and ISO 21434 cybersecurity standards. It implements the minimal risk strategy in typical driving and parking scenarios, and deploys secure boot/storage/upgrade/communication modules in connection systems at the vehicle, cloud and smartphone ends. It helps automakers to provide driving safety and cybersecurity guarantees for consumers. Neusoft Reach offers autonomous driving domain controller solutions for automakers at different tiers through standardized hardware, software platforms, and tool-based services.

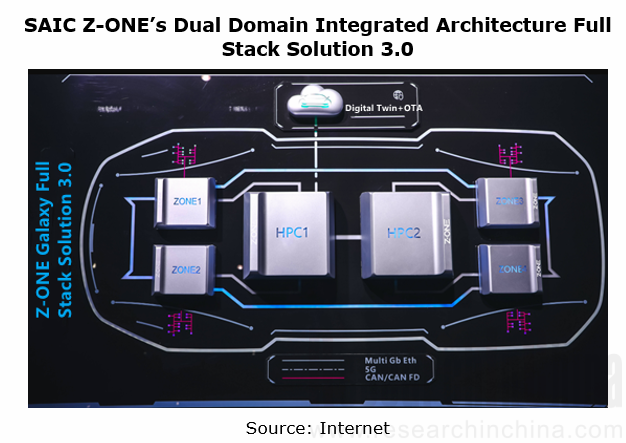

SAIC Z-ONE's cockpit-driving integrated HPC

SAIC Z-ONE plans to spawn a two-domain integrated E/E architecture in 2024, that consists of two high-performance computing units (HPC) and four zone controllers. Thereof, the cockpit-driving integrated HPC will be used to create the modular and scalable software and hardware integrated architecture that combines intelligent cockpit and high-level autonomous driving.

The vehicle central control domain has been the first to be mass-produced.

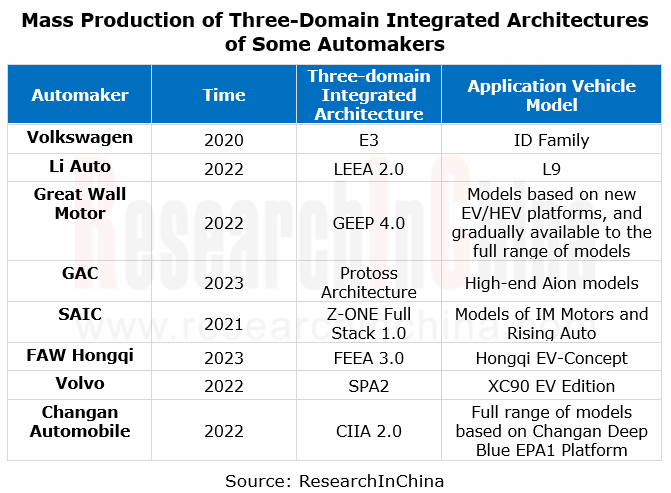

Some OEMs currently make crucial deployments in the integration of vehicle body, chassis and power domains into one central control domain that then combines with intelligent cockpit and intelligent driving domains to form a classic three-domain architecture. From time nodes, it can be seen that multiple vehicle models based on three-domain architectures were mass-produced and marketed during 2021-2022. The three-domain integrated architectures next will further introduce zone controllers for a smooth evolution to zonal architectures.

Li Auto’s three-domain integrated architecture: LEEA 2.0

In June 2022, Li Auto unveiled L9, its newest model that adopts three-domain integrated architecture. The whole car is divided into three domains: central control domain, autonomous driving domain and intelligent cockpit domain. The central control domain controller fuses with power, body and some chassis functions, enabling multi-domain integration.

Aptiv’s Central Vehicle Controller (CVC)

At the CES 2022, Aptiv showed Central Vehicle Controller (CVC), its body, power and chassis three-domain integrated controller. The CVC can serve as a power and body controller, propulsion and chassis controller, data network router, gateway, firewall, zone master and data storage hub all rolled into one – or it can perform a mix of some of those functions. It is applicable to zonal architectures.

Zone controllers are the key component that carries “multi-domain + central computing”.

Zonal Control Unit (ZCU) is the central hub and the zonal data center for different types of sensor collector/actuator drivers in the physical zones of vehicles. It is an effective solution to carry physical interfaces of vehicles, distribute power and balance different input/output controls in the zones, thus supporting cross-domain integration inside smart cars.

The ZCU can cut ECU usage, lower wiring harnesses cost greatly, and reduce weight and communication interfaces, saving space and enabling higher utilization of computing power. At present, most OEMs have planned the use of 2 to 6 ZCUs in their next-generation multi-domain computing architectures.

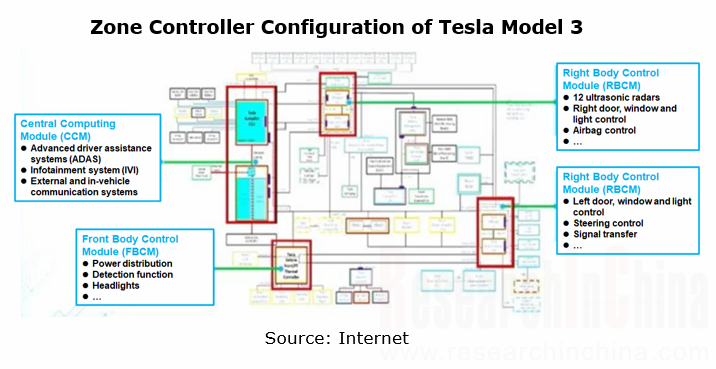

Tesla’s ZCU Configuration

In Tesla’s case, the central computing architecture of Model 3 uses three ZCUs respectively in the front body control module, the left body control module and the right body control module. They take on power distribution, drive and logic control in all physical zones. Tesla Model Y uses fewer ZCUs (2 units), cancels the front body control module, and integrates the function into the left and right body control modules, which means further integration of ZCU functions.

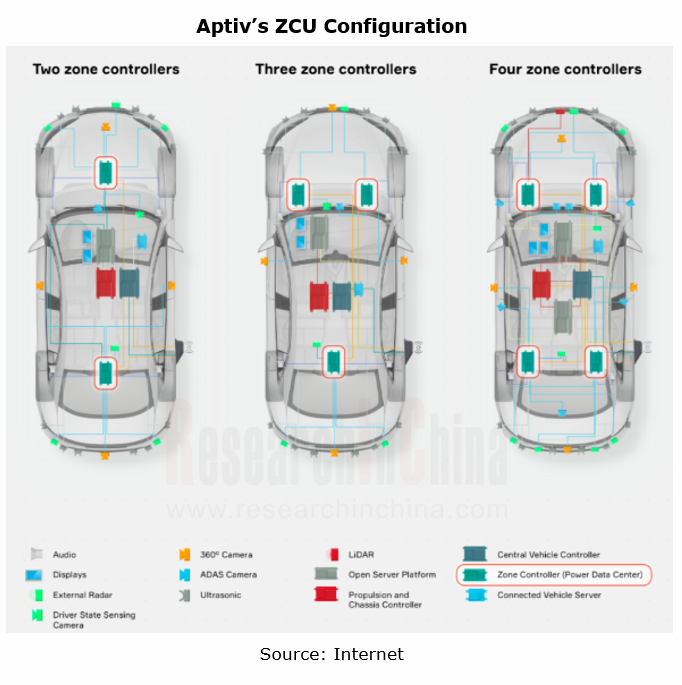

Aptiv’s ZCU Product - Power Data Center (PDC)

In January 2022, Aptiv introduced Power Data Center (PDC), its zone controller product that is installed on the front and rear sides of vehicle body.

Aptiv PDC abstracts the inputs/outputs (I/O) of sensors and actuators around the vehicle from the computing power (OSP, CVC, etc. responsible for processing), and also significantly simplifies hardware interchangeability by eliminating the device layer’s dependence on the computing layer via standardized service-based APIs.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...