Top 10 roadside perception suppliers: quality suppliers come to the front in each market segment.

The growing number of roadside perception players comes with active industrial investment and financing.

The soaring demand for roadside perception is an enticement to ever more entrants. In addition to conventional roadside perception suppliers that make continuous efforts to deploy, technology giants and vehicle perception suppliers among others all have begun to step into the roadside perception field.

The four tech tycoons, Huawei, Baidu, Alibaba and Tencent (HBAT), have all entered the smart-road roadside perception market:

Huawei with the ability to independently develop software and hardware can self-develop full-stack smart roadside perception solutions which have been seen in projects like Beijing–Taipei Expressway, Yanqing-Chongli Expressway and Shenyang Dadong District Smart Bus.

Huawei with the ability to independently develop software and hardware can self-develop full-stack smart roadside perception solutions which have been seen in projects like Beijing–Taipei Expressway, Yanqing-Chongli Expressway and Shenyang Dadong District Smart Bus.

Baidu concentrates on application of vehicle-infrastructure cooperation technology, for example, in Beijing Yizhuang and Yanqing-Chongli Expressway. It provides some perception hardware (cameras), and the rest are customized by its ecosystem partners;

Baidu concentrates on application of vehicle-infrastructure cooperation technology, for example, in Beijing Yizhuang and Yanqing-Chongli Expressway. It provides some perception hardware (cameras), and the rest are customized by its ecosystem partners;

Alibaba has participated in construction of smart highways such as Hangzhou-Shaoxing-Ningbo Expressway in Zhejiang and the Middle Section of Jinan-Qingdao Expressway in Shandong. It provides software platforms and integrated solutions, and roadside perception hardware is offered by its partners;

Alibaba has participated in construction of smart highways such as Hangzhou-Shaoxing-Ningbo Expressway in Zhejiang and the Middle Section of Jinan-Qingdao Expressway in Shandong. It provides software platforms and integrated solutions, and roadside perception hardware is offered by its partners;

Tencent has piloted the digital base map mode of radar + ETC real-time perception on Guangzhou-Qingyuan Expressway.

Tencent has piloted the digital base map mode of radar + ETC real-time perception on Guangzhou-Qingyuan Expressway.

In addition, being optimistic about roadside perception, the capital market places more bets on roadside perception companies:

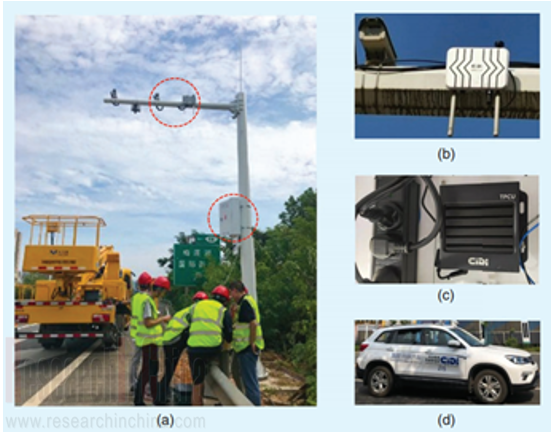

In May 2022, CiDi closed a Series C funding round and raised RMB300 million. This round was led by Chengdu Science and Technology Innovation Investment Group; China Xinxing Asset Investment was the co-investor; old shareholders such as Hunan Ruishi Private Equity Fund Management and Unifortune Investment Fund Management continued to follow up;

In May 2022, CiDi closed a Series C funding round and raised RMB300 million. This round was led by Chengdu Science and Technology Innovation Investment Group; China Xinxing Asset Investment was the co-investor; old shareholders such as Hunan Ruishi Private Equity Fund Management and Unifortune Investment Fund Management continued to follow up;

In April 2022, Raysun Radar raised tens of millions of yuan in a new funding round which was jointly invested by Yongxin Capital and Yijing Capital. The funds will be largely spent on developing roadside sensors for smart roads above C4, expanding existing capacity and enhancing market layout;

In April 2022, Raysun Radar raised tens of millions of yuan in a new funding round which was jointly invested by Yongxin Capital and Yijing Capital. The funds will be largely spent on developing roadside sensors for smart roads above C4, expanding existing capacity and enhancing market layout;

In July 2021, Xiangde Information Technology collected tens of millions of yuan in its Pre-A funding round in which Jianyuan Fund and ZTE Zhongchuang (Xi'an) Investment Management were co-financiers;

In July 2021, Xiangde Information Technology collected tens of millions of yuan in its Pre-A funding round in which Jianyuan Fund and ZTE Zhongchuang (Xi'an) Investment Management were co-financiers;

In April 2021, Hikailink closed a strategic funding round where CCCC Fund and China Merchants Capital both increased their share capital. The raised funds will be used to accelerate the research and development of new-generation intelligent connected roadside devices.

In April 2021, Hikailink closed a strategic funding round where CCCC Fund and China Merchants Capital both increased their share capital. The raised funds will be used to accelerate the research and development of new-generation intelligent connected roadside devices.

Quality suppliers stand out in each of the multiple roadside perception segments.

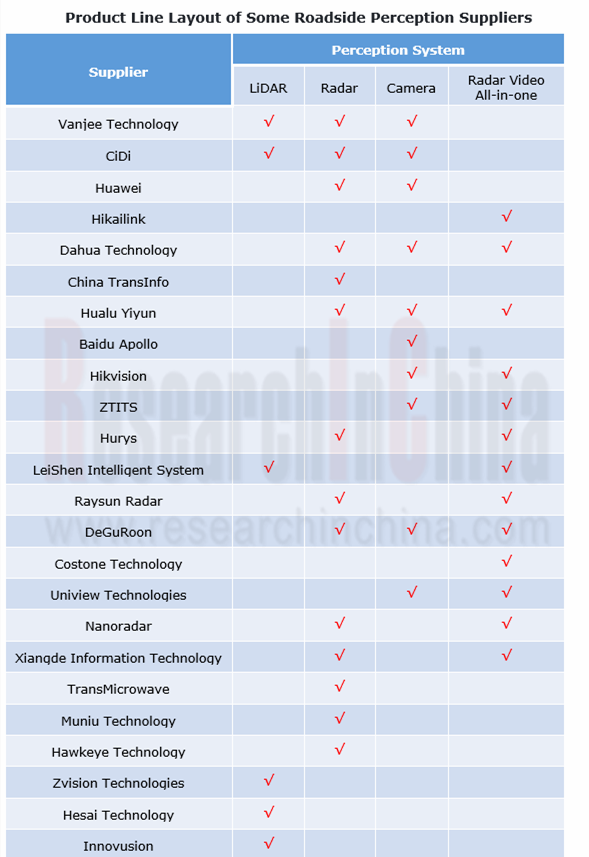

This report summarizes and analyzes the top 12 suppliers of roadside perception integrated solutions, and the top 10 suppliers in roadside camera/radar/LiDAR/radar-video all-in-one segments.

Take the roadside radar-video all-in-one as an example:

Roadside perception technology evolves with market development.

Current roadside perception hardware products include cameras, radars, radar-video all-in-ones, and LiDARs. Cameras are used most widely, with the most mature market and technology; radars have been becoming a standard configuration for communication control systems after their application value was verified, and are more used in vehicle-infrastructure cooperation and smart highways.

(1) Cameras improve resolution and perception in low visibility conditions.

At present, cameras are still the most important perception device that produces the largest amounts of roadside data. The development of smart roads is accompanied by the ever higher requirements for roadside perception hardware. For conventional cameras collect and recognize small amount of information, AI computing power is therefore needed to improve resolution of cameras and add camera functions. Huawei, Dahua Technology, Baidu and Uniview Technologies among others have all introduced their AI cameras.

Furthermore, CiDi proposed a new method for daylight visibility detection and warning using vision + C-V2X technology, and has deployed and promoted it on highways. Utilizing existing surveillance cameras combined with C-V2X technology and roadside edge computing, this method enables roadside devices to response quickly even in low visibility conditions.

(2) The radar frequency band is adjusted according to policies, and 80GHz has become a wide choice.

In December 2021, the Ministry of Industry and Information Technology (MIIT) issued the "Interim Regulations on the Administration of Automotive Radar Radios", indicating that the 76-79GHz frequency band is used for automotive radars, and shall not be applied by other types of ground-based radars unless otherwise specified by the national radio administration. The document came into effect on March 1, 2022. Considering the frequency band limitation of the MIIT, roadside radar suppliers have also adjusted their product lines. Now 80GHz is a wide choice.

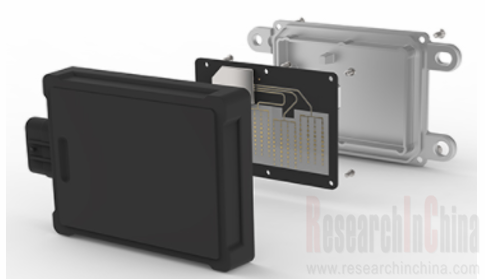

Nanoradar: the MR76S roadside perception radar unveiled in April 2022 staggers the 76-79GHz frequency band for automotive radars and uses 80GHz, effectively preventing interference to 77GHz automotive radars. This radar enables accurate ranging, speed measurement and precise positioning for 128 targets, with the maximum detection range of 300 meters. It is available to holographic intersections.

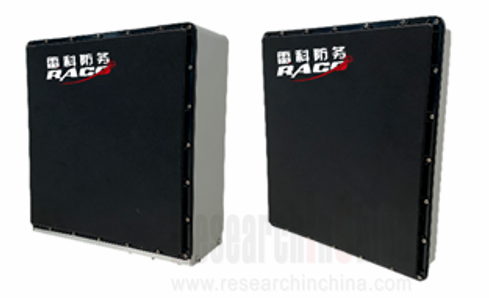

RACO Defense: in December 2021, Beijing Institute of Technology Ruixing Electronic Technology Co., Ltd., a subsidiary of RACO Defense, launched an 80GHz super range radar, which was developed with Hebei Provincial Communications Planning and Design Institute. This product breaks through the detection range of 500-1000 meters delivered by conventional super range radars, and detects as long as 1000-1500 meters at the 80GHz upgrade.

(3) LiDAR starts massive adoption at the roadside.

The mass production and declining price of LiDAR at the vehicle end has laid a solid foundation for its application at the roadside. Among roadside LiDAR suppliers, VanJee Technology, CiDi, LeiShen Intelligent System and Innovusion have developed dedicated roadside LiDAR products; automotive LiDAR vendors like Zvision Technologies, Hesai Technology and RoboSense have set foot in this field as well.

From the completed smart road projects, it can be seen that the adoption of LiDAR has been widespread:

The project of reconstruction and expansion of the Tai'an-Zaozhuang two-way eight-lane section of the Beijing-Taipei Expressway spans 189.483 kilometers, and installs a total of 33 sets of LiDARs;

The project of reconstruction and expansion of the Tai'an-Zaozhuang two-way eight-lane section of the Beijing-Taipei Expressway spans 189.483 kilometers, and installs a total of 33 sets of LiDARs;

The all smart intersections in Yizhuang in Beijing and Jiading District in Shanghai use LiDARs. Yizhuang adopts LiDARs tailored by Baidu with its partners, and Jiading District’s LiDAR products are provided by Zvision Technologies and Hesai Technology;

The all smart intersections in Yizhuang in Beijing and Jiading District in Shanghai use LiDARs. Yizhuang adopts LiDARs tailored by Baidu with its partners, and Jiading District’s LiDAR products are provided by Zvision Technologies and Hesai Technology;

The Xiong’an 5G+ Smart Bus Project deployed RoboSense’s LiDAR RS-LiDAR-M1 at the roadside.

The Xiong’an 5G+ Smart Bus Project deployed RoboSense’s LiDAR RS-LiDAR-M1 at the roadside.

(4) As more radar-video all-in-ones are used, manufacturers’ pace of deploying accelerates.

Through the lens of bidding projects of local governments in the recent two years, the demand for radar-video all-in-one products has surged:

In 2021, the traffic signal control system project in the Intelligent Transportation Project of People’s Government of Puyang City planned to purchase 120 sets of radar-video all-in-ones;

In 2021, the traffic signal control system project in the Intelligent Transportation Project of People’s Government of Puyang City planned to purchase 120 sets of radar-video all-in-ones;

In 2021, the Beijing Signal Renovation Project started to use radars and radar-video all-in-ones as the main perception approach, showing Beijing's acceptation of the radar-video all-in-one technology route. This marks that the radar-video all-in-one product market will enter a new phase of development.

In 2021, the Beijing Signal Renovation Project started to use radars and radar-video all-in-ones as the main perception approach, showing Beijing's acceptation of the radar-video all-in-one technology route. This marks that the radar-video all-in-one product market will enter a new phase of development.

Suppliers are also stepping up their efforts to develop radar-video all-in-one technology and deploy new products:

Raysun Radar: its 4D radar-video all-in-one is applicable to both intelligent transportation management and vehicle-infrastructure cooperation. Compared with the previous-generation products, the device can accurately recognize 9 types of targets within its detection range, effectively filter ground clutters with its height finding capability, and thus distinguish motor vehicles from non-motor vehicles and pedestrians, with the recognition accuracy above 90%.

Uniview Technologies: in September 2021, the company launched RV942, a 4MP low-light radar-video all-in-one that carries an 80GHz radar and integrates a camera with AI algorithms. Supported by video algorithms, the device can track up to 256 targets and offers a detection range as long as 250 meters.

China Smart-Road Roadside Perception Industry Report, 2022 highlights:

Roadside perception industry (development background, formulation of policies and standards, market size, market pattern, demand from autonomous driving, etc.);

Roadside perception industry (development background, formulation of policies and standards, market size, market pattern, demand from autonomous driving, etc.);

Key roadside perception technologies (camera, radar, LiDAR, radar-video all-in-one, etc.) (status quo, development trends, etc.);

Key roadside perception technologies (camera, radar, LiDAR, radar-video all-in-one, etc.) (status quo, development trends, etc.);

Roadside perception application deployment in scenarios, e.g., highways, urban intersections and smart bus routes;

Roadside perception application deployment in scenarios, e.g., highways, urban intersections and smart bus routes;

Key roadside perception system integrators (main integrated solutions, application, etc.);

Key roadside perception system integrators (main integrated solutions, application, etc.);

Key roadside perception hardware suppliers (main product lines, cooperation, product application, etc.).

Key roadside perception hardware suppliers (main product lines, cooperation, product application, etc.).

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...