Hybrid Research: China Hybrid EV penetration rate will hit 22% within five years

With the development of automobile energy-saving and new energy technologies and the promotion of low-carbon emission reduction policies worldwide, fuel economy and low-carbon emissions have been in the spotlight of automobile development, and hybrid electric vehicles have become R&D focus of current automobile industry.

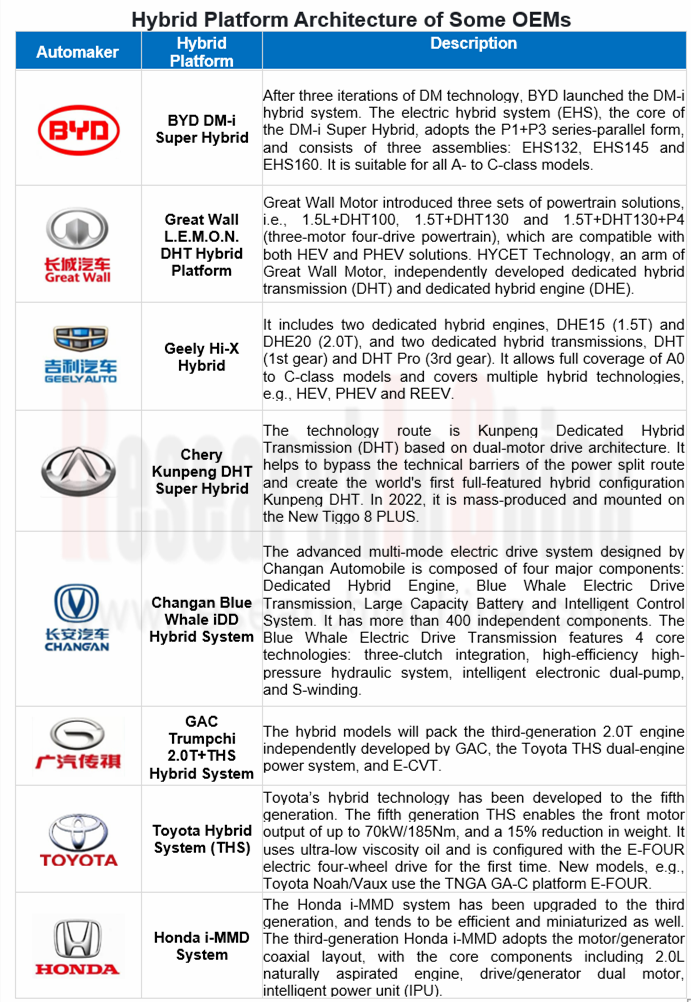

The commercialization of hybrid vehicles has been developing for more than 20 years, with four major markets in the world: Europe, the United States, Japan, and China, which differ in technology, strategy and marketplace. Different automakers are also diversifying their hybrid system architectures. At present, hybrid technologies vary with technology platforms.

Hybrid vehicles are accelerating the pace of replacing fuel vehicles in China

According to statistics, 6.495 million new energy passenger cars (EVs+PHEVs) were sold globally in 2021, up 107.9% year-on-year with the market share hitting a record as high as 9%; wherein, the sales volume of battery-electric passenger cars (EVs) swelled by 110% year-on-year to 4.6 million units, and the sales volume of plug-in hybrid electric passenger cars (PHEVs) increased by 103% year-on-year to approximately 1.9 million units. In 2021, the global sales volume of energy-efficient HEVs jumped by more than 20% year-on-year to approximately 3.5 million units.

Catalyzed by a series of policies such as emission regulations, Measures for the Parallel Management of Corporate Average Fuel Consumption (CAFC) and New Energy Vehicle (NEV) Credits of Passenger Car Companies, Energy-saving and New Energy Vehicle Technology Roadmap 2.0, energy-saving and new energy vehicles are burgeoning. Low fuel consumption and Measures for the Parallel Management of Corporate Average Fuel Consumption (CAFC) and New Energy Vehicle (NEV) Credits of Passenger Car Companies have prompted automakers to accelerate the transformation toward electrification and speed up the deployment of 48V, HEV, REEV, PHEV and other hybrid roadmaps.

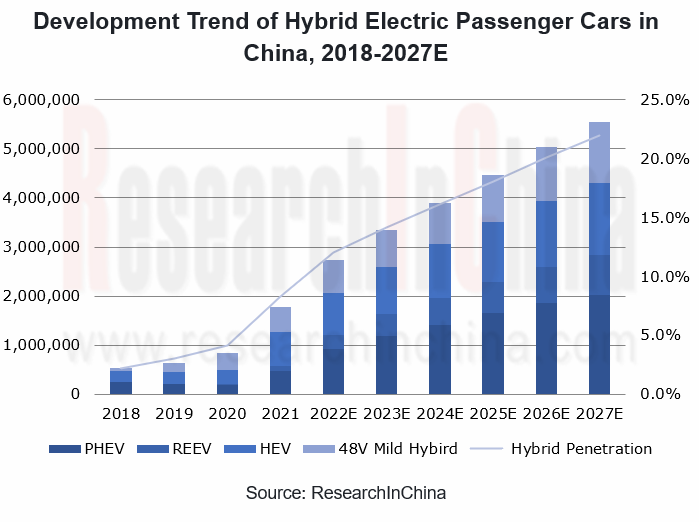

In 2021, the sales volume of hybrid passenger cars in China reached 1.778 million units, including 470,000 PHEVs, 105,000 REEVs, 689,000 HEVs, and 513,000 48V mild hybrids. With the development of hybrid systems of Chinese independent brands, PHEVs will outsell HEVs and 48V mild hybrids by 2022. REEVs have performed well since the launch, and will still grow at a relatively high growth rate from 2022 to 2027.

The penetration rate of hybrid electric passenger cars in China will fetched 8.3% in 2021, and it is expected to hit 22% by 2027 with sales over 5.5 million units.

After several years of development, Chinese independent brand automakers have made significant progress in hybrid vehicle technology, even surpassed Japanese companies such as Toyota and Honda in some aspects of performance. Their models cover weak hybrids, mild hybrids/medium hybrids, strong hybrids and so on:

Micro Hybrid - Start / Stop (12V): The currently available start / stop 12V passenger car models mainly come from European and American brands, while Chinese independent brands account for 19% of the total models;

Mild/Medium Hybrid (48V): Although Chinese independent brand automakers have deployed 48V mild hybrid system technology, they offer few models, and almost only FAW-Hongqi, Geely and Great Wall have sold cars equipped with the technology.

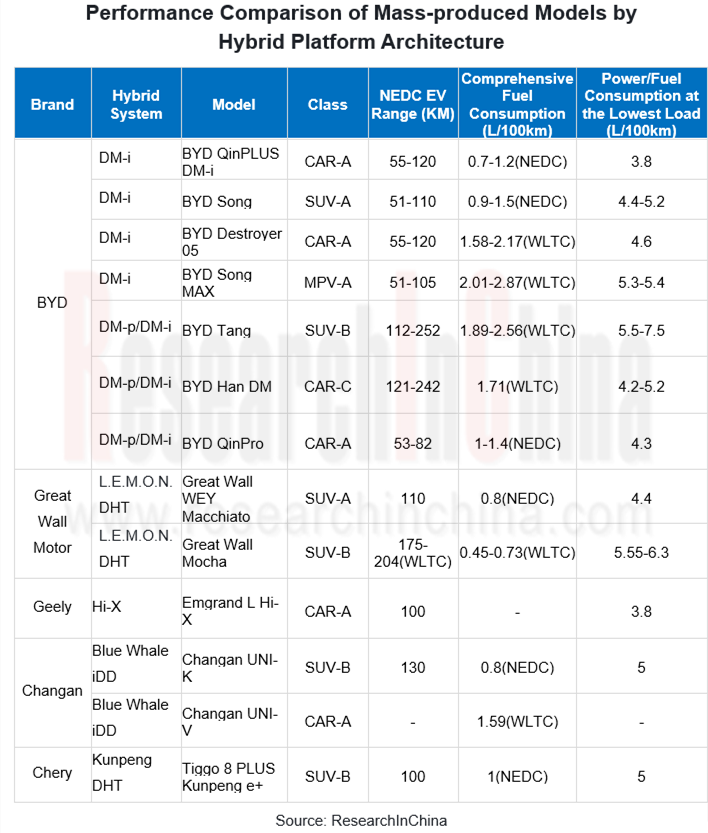

PHEV: BYD DM, DM-i, Great Wall L.E.M.O.N DHT, Geely Thor Hybrid Hi·X, Changan Blue Whale iDD and other hybrid systems have been mass-produced. BYD DM and DM-i have been installed on many of its models; DHT, has been applied to Mocha, Latte, Macchiato and other models of Great Wall; Changan Blue Whale iDD has been applied to UNI-K, UNI-V models;

REEV: The REEVs currently for sale mainly include Seres SF5, AITO M5, Li ONE and Voyah FREE. In June 2022, Li Auto released a full-size SUV - Li L9, and AITO unveiled a medium and large range-extended SUV - AITO M7. Both were so appealing that they received over 20,000 orders upon launch.

OEMs have mass-produced a new generation of DHE + DHT + integrated electric drive hybrid architecture

From the perspective of technical route selection:

48V hybrid technology maintains steady growth by continuously improving motor efficiency and electrification level. At this stage, it is mainly driven by foreign OEMs;

48V hybrid technology maintains steady growth by continuously improving motor efficiency and electrification level. At this stage, it is mainly driven by foreign OEMs;

HEV technology-based models pay more attention to development of energy saving, cost reduction, system simplification, etc.;

HEV technology-based models pay more attention to development of energy saving, cost reduction, system simplification, etc.;

PHEV technology is developing towards low energy consumption and high cost performance, and China has explored an independent development of PHEV technology path;

PHEV technology is developing towards low energy consumption and high cost performance, and China has explored an independent development of PHEV technology path;

REEV technology is complementary to other hybrid technologies due to its simple structure. High battery life and driving experience are welcomed by consumers. Driven by star models such as Li, AITO, and Voyah, it will grow rapidly in the next few years.

REEV technology is complementary to other hybrid technologies due to its simple structure. High battery life and driving experience are welcomed by consumers. Driven by star models such as Li, AITO, and Voyah, it will grow rapidly in the next few years.

From the perspective of hybrid technology platform layout of OEMs, domestic OEMs have independently developed DHE (hybrid special engine) + DHT (hybrid special transmission assembly), and the platform supports multiple hybrid architectures such as HEV, PHEV, and REEV at the same time:

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...