Smart car OTA research: With the arrival of OTA3.0 era, how can OEMs explore payment modes of SAAS?

Driven by the development of smart cars, China's OTA installation rate has been growing. According to ResearchInChina’s data, from January to May 2022, 3.12 million passenger cars in China were equipped with OTA; the installation rate hit 44.6%, a year-on-year increase of 16.2 percentage points. By 2026, the OTA installation rate of Chinese passenger cars is expected to reach 88%, that is, 21.937 million passenger cars will boast OTA.

OTA updates are mainly reflected in infotainment, and will gradually spread to ADAS, body & control, and power.

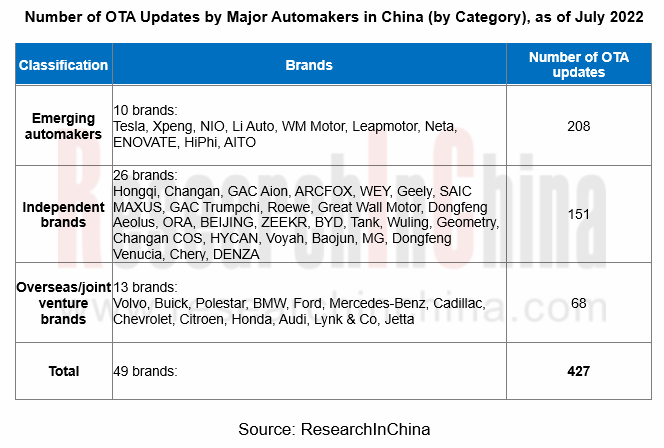

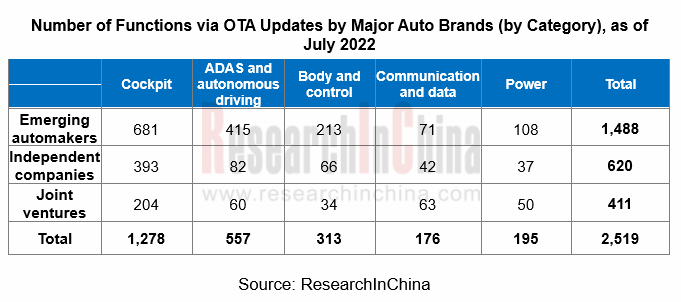

As of July 15, 2022, 49 auto brands (including brands of emerging automakers, independent companies, and joint ventures) had accomplished about 427 OTA updates. Among them, 10 emerging brands had implemented a total of 208 OTA updates, 26 independent brands had completed 151 OTA updates, and 12 joint venture brands had fulfilled 68 OTA updates.

Regardless of emerging automakers, independent companies, or joint ventures, their OTA updates concentrate on cockpits (covering application entertainment, information display, etc.), reaching 1,278 updates; another 557 updates are about ADAS and autonomous driving.

In the era of OTA 3.0, OEMs explore SAAS (Software as a Service)

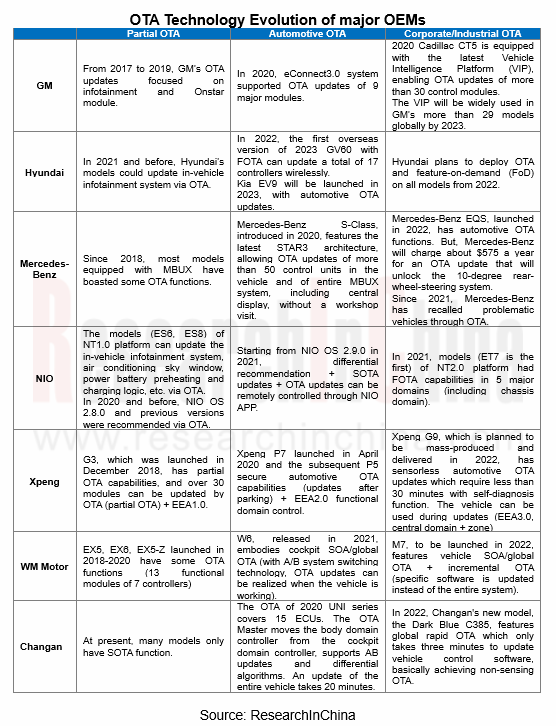

ABUP believes that automotive OTA industry should go through four development stages: component-level OTA, vehicle-level OTA, enterprise-level OTA, and industrial-level OTA. OTA has evolved from the 1.0 era (non-critical safety function updates) and the 2.0 era (automotive OTA) to the current 3.0 era (SAAS).

In the era of OTA 3.0, OTA functional services of OEMs are propelled by demand instead of R&D. OEMs guide users to purchase software OTA services. In the future, SAAS will become an important income source for major OEMs.

With deep involvement of automotive OTA, the business models of automakers are changing. The model of hardware "costization" + software "profit" continues to penetrate in the smart car market. Many automakers have pre-embed hardware in new models, and subsequently open functions through OTA software updates, so as to obtain commercial profits.

In the past two years, both emerging automakers and conventional car companies have been stepping up their exploration of SAAS model. In addition to offering paid OTA for new functions and services, many automakers have announced plans to launch "subscription on demand" services.

In addition to selling cars, Tesla makes money by selling software and services. Its software revenue comes from FSD (Full Self-Driving), OTA updates, and advanced Internet of Vehicles. The price of Tesla's FSD has been rising, hitting as high as $12,000. In addition, Tesla has introduced the Acceleration Boost upgrade for $2,000 that improved the 0-60 mph acceleration of Model 3 Dual Motor (Long Range) from 4.4 seconds to 3.9 seconds.

Hyundai announced to offer OTA and feature-on-demand (FoD) on all models from 2021. Users can not only update software and systems remotely, but also selectively purchase software systems.

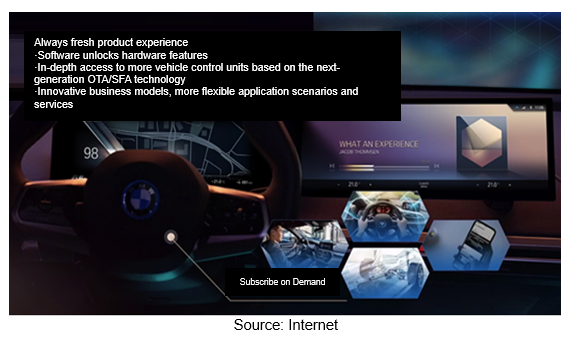

In July 2021, BMW announced about its Functions on Demand system, in which customers can choose to pay monthly subscriptions for certain options. It unlocks the hardware modules pre-installed on the vehicle through software, remotely provides customers with new products and services, and helps customers enjoy the latest products in an innovative way.

In July 2022, BMW launched a number of subscription-based services for drivers in South Korea, including heated seats, a heated steering wheel, high-beam-assist headlights, simulated sound waves, wireless Apple CarPlay and other functions. Heated seats, for example, run for about RMB120 per month. per month or RMB1,180 per year.

At the same time, there have been some changes in the profit models of assisted driving systems of some OEMs. In the past, users had to pay for optional advance assisted driving systems which now tend to be included in the standard configuration, whereas the software cost is included in the car price for the purpose of suppressing the continuous price spike of battery-electric vehicles since 2022 and raising the activation rate of advanced assisted driving systems to collect real road data; in addition, the standard configuration of assisted driving systems improves the cost performance and value preservation rate of vehicles.

On May 6, 2022, Xpeng suddenly made major changes to users' rights and interests. It installed the intelligent assisted driving system software as standard, and canceled the lifetime free charging and free home charging piles. According to the data released by Xpeng in October 2021, the activation rate of XPILOT 3.0 with high-speed NPG is 59.29%, and it will continue to rise thanks to the standard configuration of assisted driving software;

In 2022, Tesla offers free Enhanced Autopilot as standard in China for a limited time, while it still charges FSD as an option;

Li Auto has always adhered to the standard autonomous driving system. The newly launched Li L9 is equipped with the Li AD Max full-stack intelligent driving system and hardware solution as standard;

NIO has altered its business strategy for ET7. It comes standard with LCC and ALC which are ready to use, so that users need not pay additional fees or buy the NIO Pilot Selected Package.

SAAS is paid separately or charged include the car price, and it has become a business strategy that major OEMs should consider and explore.

OTA supervision is becoming strict and standardized

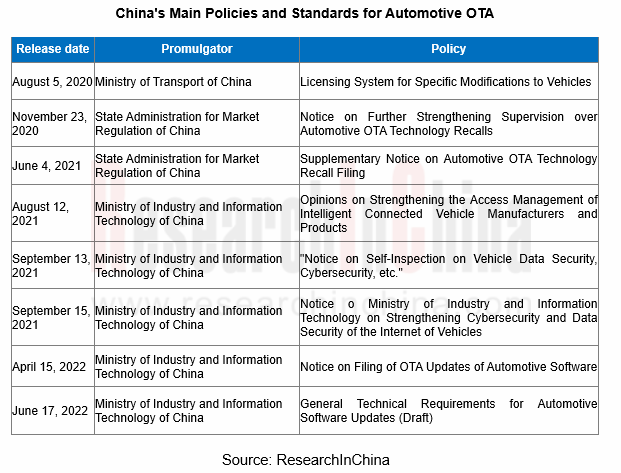

With the rapid growth of automotive OTA technology, China has issued a number of policies and standards about OTA updates in the past two years, clarifying requirements for ICV software updates.

On April 15, 2022, the Ministry of Industry and Information Technology Equipment Industry Development Center issued "Notice on Filing of OTA Updates of Automotive Software", which stipulates that automakers licensed to produce road motor vehicles should file for their vehicles equipped with OTA updates and every OTA update implemented. Authorities have attached great importance to OTA recalls, and have improved relevant procedures and specifications. A strict and effective regulatory mechanism will regulate the software updates of automakers. It will have a positive impact on the development of the entire industry while protecting the rights and interests of consumers.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...