LiDAR research: Chinese passenger cars will carry over 80,000 LiDAR sensors in 2022

1. The mass production of LiDAR is accelerating, and the installations are expected to exceed 80,000 units in 2022

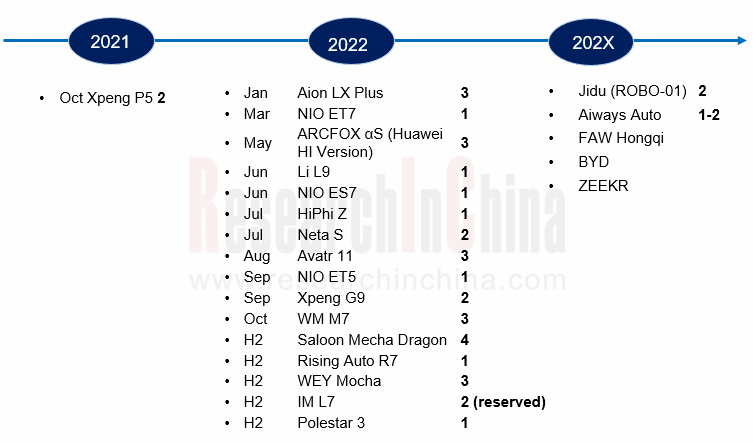

Since 2021, LiDAR industry has entered the stage of commercialization. Local OEMs have taken the lead in mass-producing a number of models, including Xpeng P5, Aion LX PLUS, NIO ET7, and Li L9.

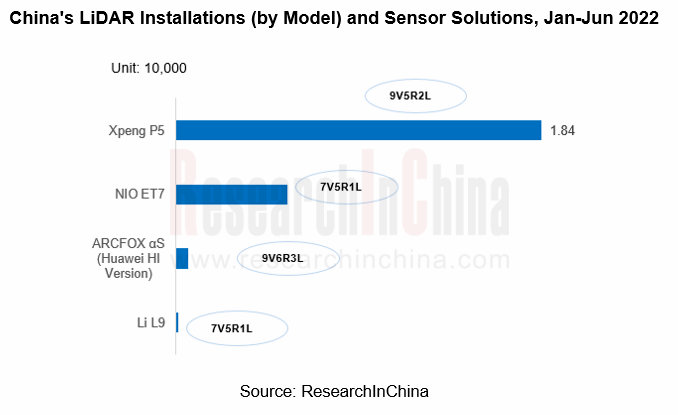

According to the statistics from ResearchInChina, Chinese new passenger cars were equipped with 24,700 LiDAR sensors in the first half of 2022, of which 18,400 units or 74.4% was seen in Xpeng P5.

In the second half of 2022, there will be more than 10 new models featuring LiDAR to be delivered in China, including Xpeng G9 and WM M7, which will spur LiDAR installations to exceed 80,000 units in the full year.

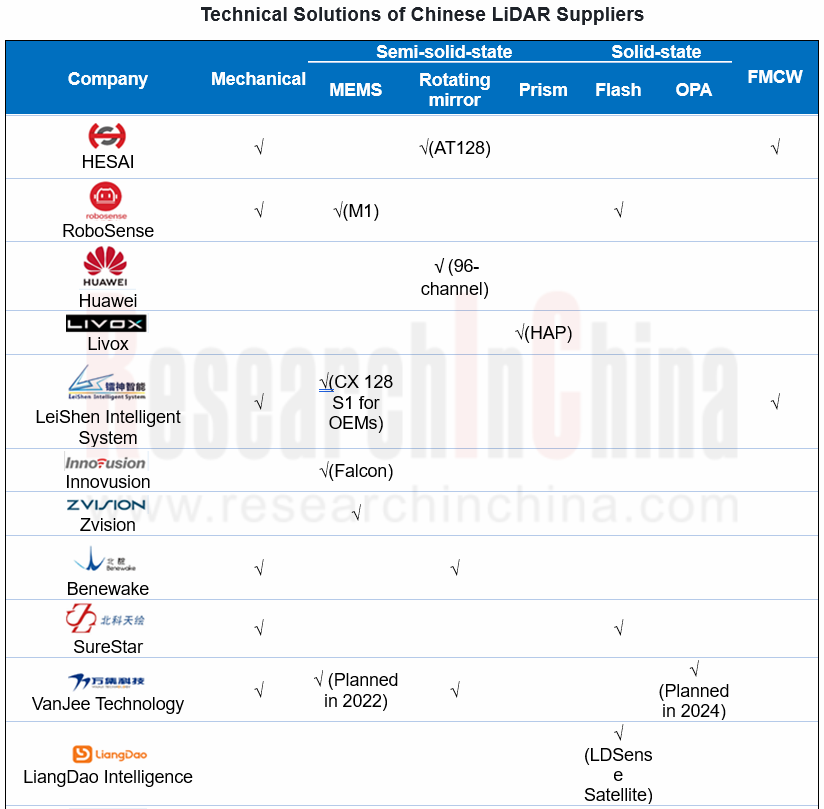

2. The "rotating mirror + MEMS" technical solution is the first choice for mass production

At present, production models mainly adopt "rotating mirror + MEMS" technical solution, such as HESAI AT128, RoboSense M1, Huawei 96-channel LiDAR, Innovusion Falcon, etc...

RoboSense launched it semi-solid-state LiDAR - M1 in June 2021. Based on 2D MEMS smart chip scanning technology, it has “GAZE” function with intelligent zoom and detection distance of 150m for 10% reflectivity targets. So far, it has been designated by 40+ models. In 2022, it served GAC Aion LX Plus, IM L7, WM M7, Xpeng G9, Lotus, etc.

Huawei's 96-channel hybrid solid-state LiDAR adopts a rotating mirror solution, with a field of view of 120?x25? and a maximum detection distance of 150 meters. It has been mass-produced for ARCFOX αS (Huawei HI version), Neta S, and Avatr 11, and will be applied to other models such as Saloon Mecha Dragon which will boast 4 units located at the front, rear, and both sides of the front.

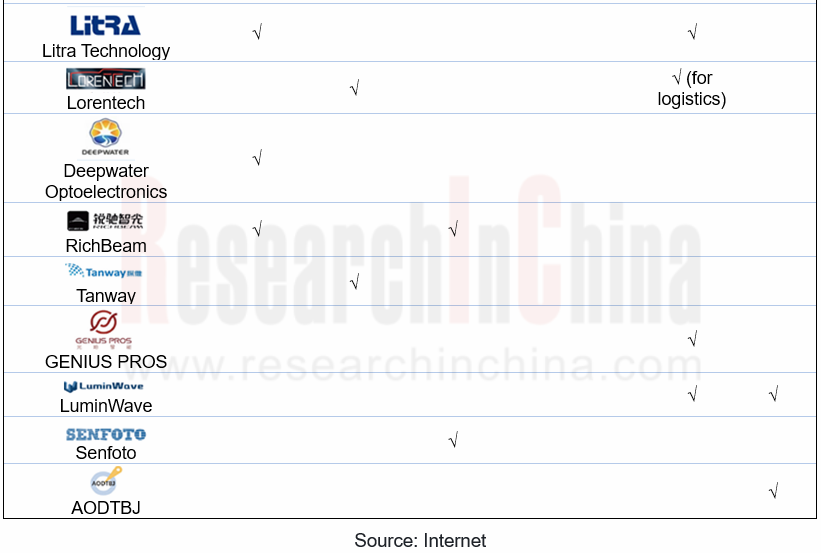

In the short term, the "rotating mirror + MEMS" solution is still the mainstream for local LiDAR installations on vehicles. In the long run, solid-state solutions (flash, OPA) and FMCW LiDAR will be play main roles.

Especially, the flash solution has achieved a breakthrough. In May 2022, LiangDao Intelligence released its first self-developed flash lateral LiDAR - LD Satellite for Chinese market, with a chip-based design and a vertical field of view of 75°-90°. It will be mass-produced in the second half of 2023. In the future, LiangDao Intelligence will combine LD Satellite with its experience in perception development and verification testing to provide LiDAR software and hardware integrated solutions for Chinese market.

A number of enterprises have deployed OPA technology, such as VanJee Technology, Litra Technology, GENIUS PROS, LuminWave, etc. Among them, VanJee Technology plans to release silicon-based OPA LiDAR with a range of 30 meters in August 2022, and automotive silicon-based OPA LiDAR in June 2024.

In addition, Chinese companies such as LeiShen Intelligent System and HESAI are developing FMCW technology. In July 2022, Aeva announced that the first Aeries? II 4D LiDAR had been produced and shipped to customers as the world's first FMCW LiDAR delivered. This will inspire breakthroughs in FMCW technology in China.

3. Mass production and delivery capabilities should be improved comprehensively

Thanks to the definite LiDAR technology route, many Chinese suppliers have improved capacity swiftly through foundries, cooperation and self-built factories.

The "Maxwell" intelligent manufacturing center invested by HESAI with nearly US$200 million is expected to be fully put into operation in 2022, with an annual capacity of more than one million units. Innovusion cooperates with Joyson Electronics. The first automotive-grade LiDAR production line has an annual output of 100,000 units. The second production line located in Xiangcheng District, Suzhou is expected to be put into operation in 2022, with a monthly capacity of 20,000 units.

In addition to large-scale production, suppliers are reducing LiDAR cost and accelerating mass production and applications through hardware integration and chipization. For instance, HESAI AT128 is a long-range semi-solid-state LiDAR based on a VCSEL array (the second-generation chip is provided by Lumentum). The VCSEL array embedded in the chip replaces the traditional discrete light source to significantly slash the manufacturing cost of LiDAR.

The solid-state LiDAR of LiangDao Intelligence leverages the flash technology upgrade solution - VCSEL electric drive scanning and SPAD partition receiving technology to dramatically amplify the detection distance of flash LiDAR. Plus the design of optical lens, it offers a wide field of view.

In general, Chinese LiDAR suppliers mainly focus on cost reduction in laser transceiver module (about 60% of cost). For a long time, the technology of electronic components such as lasers and detectors has been monopolized by foreign companies. However, in recent years, some Chinese enterprises have gradually broken through technical barriers, launched automotive-grade products, and secure orders from automakers.

Vertilite’s VCSEL has been certified by AEC-Q102 and IATF 16949, and won the bid for a major LiDAR customer's OEM mass production project. In March 2022, the company received investment from Huawei, Xiaomi, BYD, DJI, etc.; in August, HESAI and RoboSense became its shareholders.

Fortsense began to develop LiDAR SPAD chips in 2019, successfully taped out in 2021, and received a custom order from a leading automaker in early 2022.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...